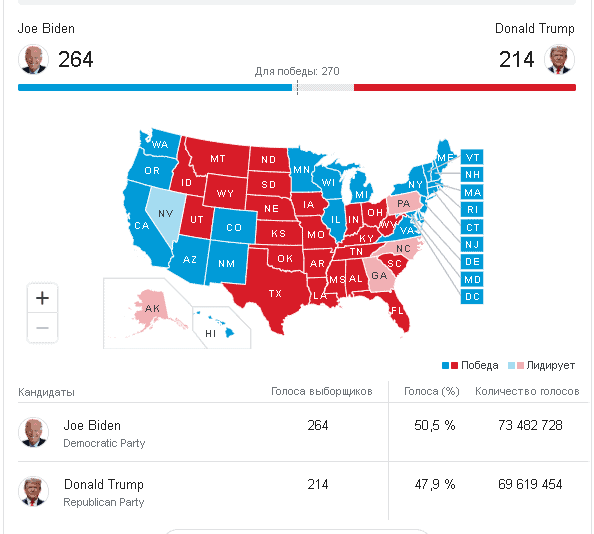

The US Presidential election results.

The US Presidential election outmatched all other events of the past week. Let’s talk about prospects while markets ‘salute’ the probable victory of 77-year old Joe Biden by strong growth. What does a probable election of a Democrat mean for the stock market and dollar exchange rate? We will also discuss why Jeff Bezos disposes of the Amazon stock and who was the owner of the mysterious cryptocurrency wallet, from which bitcoins for the amount of USD 1 billion were transferred.

Calendar of economic statistics

What the US Presidential election results mean for the stock market

The dollar devaluation continues: Britain and Australia respond

Jeff Bezos disposes of the Amazon stock

The mystery of the wallet with bitcoins for the amount of USD 1 billion was revealed

Date, Time (GMT+3:00) | Event | Impact, forecast |

From Monday until Friday, November 9-13 | Counting results of the Presidential election in the US. | All markets. |

Tuesday, November 10 10:00 | Great Britain. U.K. Claimant Count Change. | GBP. FTSE. Forecast – 78.8K, previous value – 28K. |

| 13:00 | Germany. ZEW Economic Sentiment Indicator. | EUR. DAX. Forecast – 50.8, previous value – 56.1. |

| 15:00 | United States. Job Openings and Labor Turnover Survey (JOLTS). | USD. S&P 500. Previous value – 6.493M. |

Wednesday, November 11 10:00 | Great Britain. GDP for the third quarter (quarter-over-quarter). | GBP. FTSE. Forecast -20.5%, previous value -19,8%. |

Thursday, November 12 16:30 | United States. Consumer Price Index (CPI). | USD. Forecast – 0.2%, previous value – 0.2%. |

Friday, November 12 13:00 | Eurozone. GDP for the third quarter (quarter-over-quarter). | EUR. DAX. Forecast – 12.7%, previous value – 12.7%. |

From Monday until Friday, November 9-13 |

Counting results of the Presidential election in the US. |

All markets. |

Tuesday, November 10 10:00 |

Great Britain. U.K. Claimant Count Change. |

GBP. FTSE. Forecast – 78.8K, previous value – 28K. |

| 13:00 |

Germany. ZEW Economic Sentiment Indicator. |

EUR. DAX. Forecast – 50.8, previous value – 56.1. |

| 15:00 |

United States. Job Openings and Labor Turnover Survey (JOLTS). |

USD. S&P 500. Previous value – 6.493M. |

Wednesday, November 11 10:00 |

Great Britain. GDP for the third quarter (quarter-over-quarter). |

GBP. FTSE. Forecast -20.5%, previous value -19,8%. |

Thursday, November 12 16:30 |

United States. Consumer Price Index (CPI). |

Friday, November 12 13:00 |

Eurozone. GDP for the third quarter (quarter-over-quarter). |

EUR. DAX. Forecast – 12.7%, previous value – 12.7%. |

Counting results of the US Presidential and Parliamentary elections will be the focus of investors’ interest during the next week. Significant splashes of volatility are possible in the event of court action against the election results or important statements of Joe Biden, which would help to better understand his priorities in the economic policy. Economic statistics would have a moderate influence.

What the US Presidential election results mean for the stock market

First, we should note that our conclusions are preliminary and there’s a probability of the political setup adjustment. The votes of the US Presidential election and elections into both Congress Chambers are still being calculated.

The process is prolonged due to a big number of those who voted by mail. However, as of the Friday morning, November 6, the market players placed the stake that the 77-year old Democrat Joe Biden would be the next US President.

Biden takes the lead and he just needs to win in 1 of the 4 key states, where the results are still unknown. The Congress, most probably, would preserve the status quo: the Senate will have the Republican majority and the House of Representatives will have more Democrats.

If Biden wins, a new distribution of power in the US will be favourable for markets. On the one hand, the Government, headed by Democrats, means that the anti-crisis budget economic stimulus measures will be significantly bigger. And here we speak not about USD 1.6 trillion but USD 2.1-3 trillion.

The money will be spent on support of the unemployed in the form of bigger unemployment benefits and on various social programs. The dollar inflow in the amount of 10% of GDP is very favourable for stocks, since it significantly increases the effective demand.

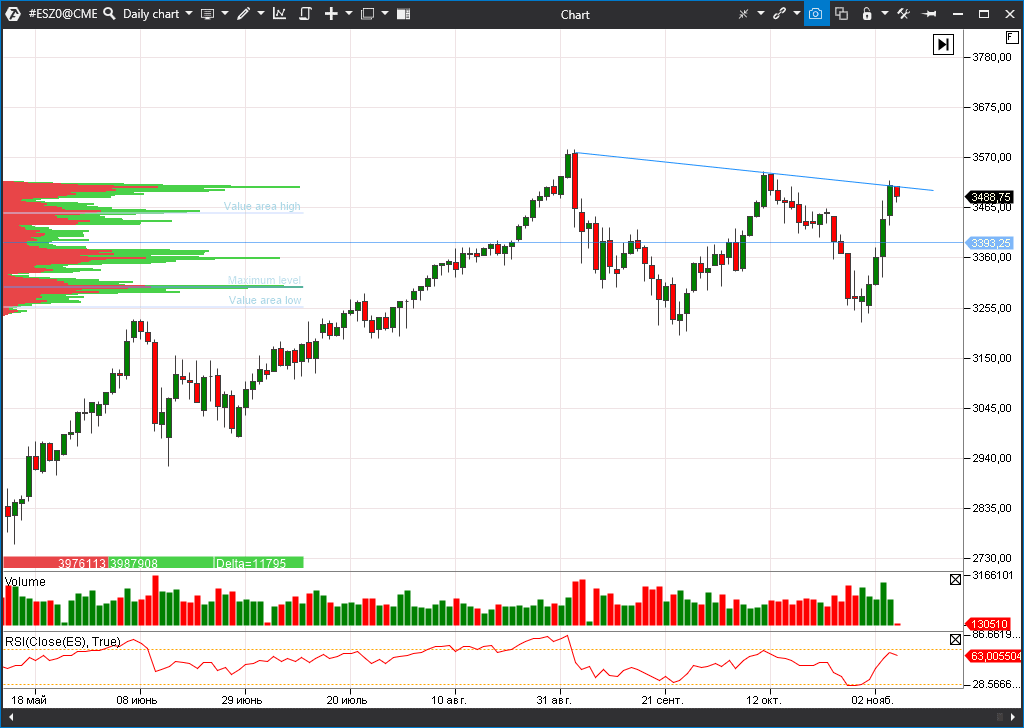

As a result, the S&P 500 index futures (ESZ0) already gained 7%, practically winning back the preliminary retracement results.

On the other hand, the Republican Senate will slow down Democrat appetites with respect to increasing spendings and the inevitable tax boost.

Dollar devaluation continues: Britain and Australia respond

Other markets would indirectly win from the new configuration of power in the United States. Perhaps, activation of the printing press would increase the dollar (DXZ0) devaluation trend. Losses of the American currency already exceeded 1.5% from the beginning of the week.

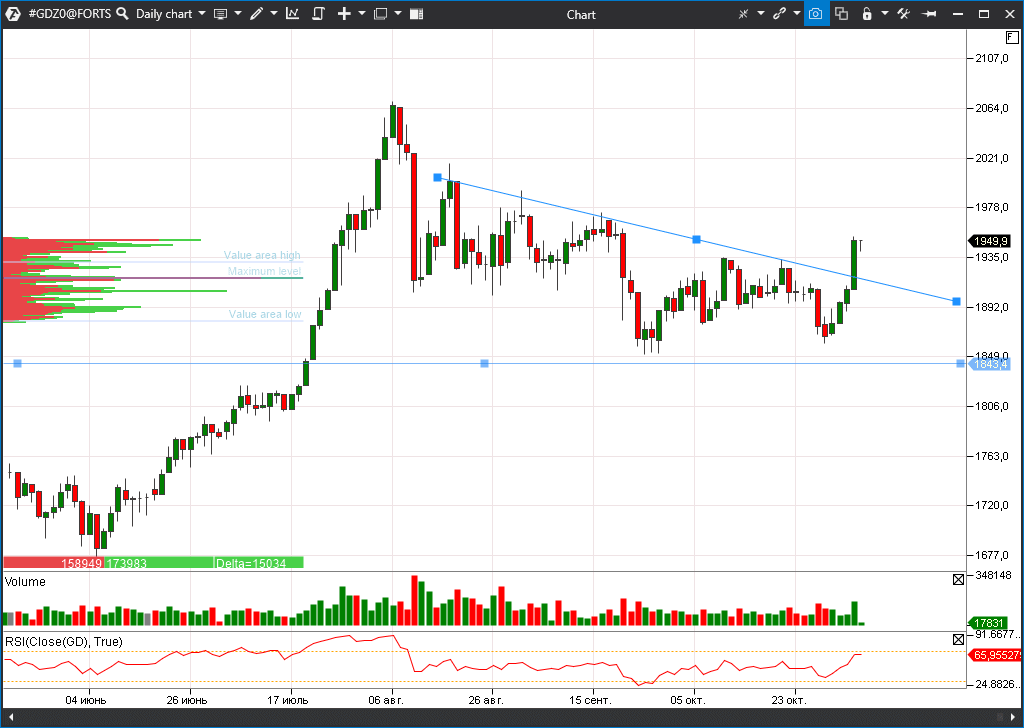

And this is a favourable factor for the raw material markets (and their major exporters), bonds of developing countries, gold, bitcoin and other risk assets. It is not of surprise that all these assets positively responded to the probable Biden’s victory.

Some leading central banks are not happy with this development – if their currencies become cheaper with respect to the dollar, it would undermine exports. Central Banks of Australia and Great Britain made a decision past week about increasing their Quantitative Easing programs by AUD 100 billion and GBP 150 billion respectively. The markets wait for a similar step from ECB by the end of the year.

Further escalation of currency wars will weaken the pressure on the dollar but will be favourable for the stock and bond markets. We speak here about what is called asset inflation. This happens when financial assets have outstripping growth rates compared to the consumer inflation due to a redundant and practically free liquidity from central banks.

Jeff Bezos disposes of the Amazon stock

The richest man on Earth, CEO and biggest Amazon (AMZN) stockholder Jeff Bezos makes use of the favourable market situation for selling big stock packages. According to CNBC, as quoted by the Securities and Exchange Commission (SEC), he sold, last week, a package of Amazon stock in the amount of 1 million shares for USD 3 billion.

According to OpenInsider, Bezos sold one share within the corridor between USD 2,950 and USD 3,075. The businessman still has a package of 53 million of shares of the total value around USD 170 billion.

Earlier this year, the businessman already sold packages for USD 3 billion and USD 4 billion. The billionaire explained these steps by a necessity to finance his space industry startup – Blue Origin and also a big charity fund in the sphere of fighting global warming.

We want to remind you that Amazon showed impressive results in the third quarter of 2020. The company increases its earnings and profits with record-breaking rates. As a result, the Amazon stock value has grown by 80% already since the beginning of the year.

However, the price-earnings ratio of the online trade giant has reached 124. Which is significantly worse than Apple (35) and Facebook (34) stocks and stocks of other largest US companies, which could mean that expectations of investors are too optimistic.

The mystery of the wallet with bitcoins for USD 1 billion has been revealed

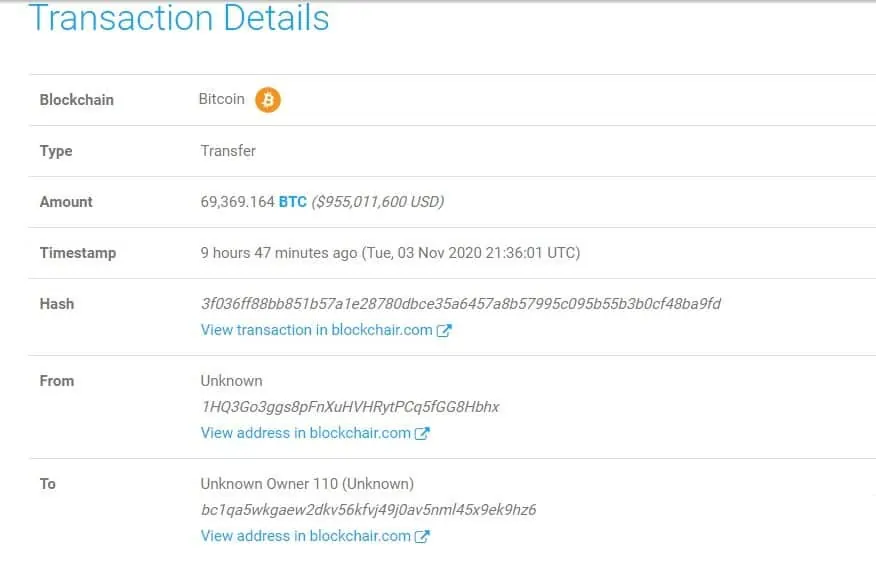

While BTC renewed multi-year price highs, the cryptocurrency community took a lively interest in the mysterious transaction in its network. We speak about the fourth biggest wallet, which stayed inactive for many years.

A mysterious ‘John Doe’ got access to it and performed one transaction in the amount of BTC 69,369 with a general value of nearly USD 1 billion. Crypto-experts immediately became suspicious that the wallet belonged to the Silk Road darknet founder Ross Ulbricht, who got life in a US prison. Hackers tried to break the wallet for years.

Their suspicions were confirmed two days later. It turned out that the US authorities seized bitcoins from the hacker, who managed to break the mysterious wallet. This cryptocurrency seizure became the biggest one in history.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.