What you should know about financial centres

Simply speaking, a Financial Centres (FC) are places (a city or a business district of a city), where a big number of major financial market participants are physically concentrated. These participants are:

- banks;

- exchanges and clearing companies;

- brokerage companies;

- capital management companies and proprietary trading companies;

- institutional market participants, for example, hedge funds and major pension funds;

- taxation and finance consultants;

- law firms that operate in the financial sphere;

- rating agencies;

- insurance companies;

- financial state regulatory bodies, infrastructure organisations and firms that render other services, directly or indirectly connected with finance.

Sometimes, financial centres are called Financial Hubs. Examples of FC are City in London and Manhattan in New York.

Financial Centre categories

There are 3 categories of FC as classified by the International Monetary Fund (IMF):

- International or IFC. They include such cities as New York, London, etc.

- Regional or RFC. Hong Kong, Singapore, Toronto, Mumbai, Sidney, Luxemburg, etc.

- Offshore or OFC. Island states, such as Saint Vincent, Vanuatu, British Virgin Islands, Ireland, etc.

Moreover, the above mentioned three categories do not have a strict division. For example, according to the IMF, Hong Kong, Singapore and some other centres could be simultaneously classified to the 2nd and 3rd categories.

Let’s consider these categories in more detail

International Financial Centres are full range FC. International FC have:

- direct channels to the markets with maximum liquidity;

- highly developed payment systems, which connect IFC with major banks of developed countries;

- a balanced legislation, which maintains reliability of financial enterprises and regulatory body activity.

Regional Financial Centres also perform the function of development of financial markets and respective infrastructure. At the same time, their national economies are inferior to such countries as the United States, Great Britain and China.

Offshore Financial Centres, according to the IMF, have small sizes and focus on rendering specific services. They are described as jurisdictions, where non-residents receive financial services in amounts, which are not proportional to the national economies’ indicators.

Financial Centre ratings

Various ratings are used to rank Financial Centres by significance. Perhaps, the Global FC Index is the most popular among them.

It is calculated every half a year with participation of 2 analytical centres:

- Z/Yen (London);

- China Development Institute (Shenzhen).

As of the second half of 2020, New York takes the leading place being a little bit ahead of London:

It is interesting that the traditional pair of leaders is aggressively ‘pressed’ by a group of Asian Financial Centres. In our opinion, it is rather strange to see that 6 out of 10 places in the rating belong to Asian FC and there is no Chicago among them. However, it is quite possible that these are new realities, caused, among other things, by the world coronavirus pandemic.

New York. The main financial centre of the world

According to multiple FC ratings, New York has taken the leading position for many decades.

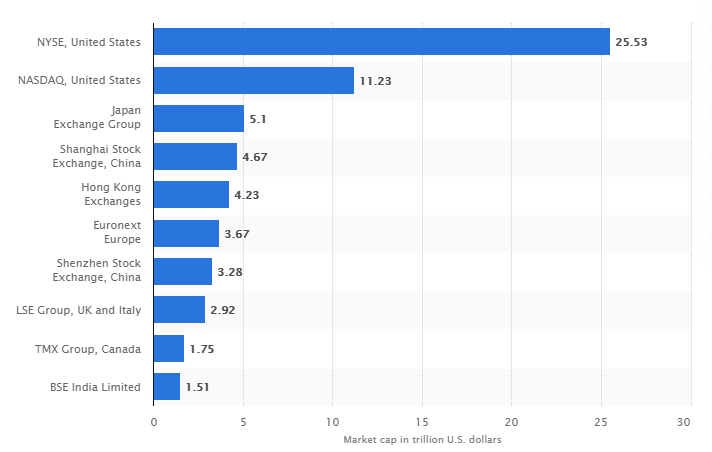

Two world biggest exchanges are located in Manhattan:

- NYSE (New York Stock Exchange);

- NASDAQ (National Association of Securities Dealers Automated Quotations).

For comparison, assess the sizes of stock exchanges by capitalization in the picture below (Statista data as of the end of 2020).

Apart from stock exchanges (more than 2 of them), headquarters of Standard & Poor’s, Moody’s Investors Service and Fitch Ratings are located in New York. These are three main agencies, which ratings exert influence on global investors.

The New York Federal Reserve Bank is also located in Manhattan. It is the largest subdivision in the Federal Reserve System structure, which regulates the United States monetary policy and, therefore, influences the whole world economy.

New York takes the leading place by concentration of the hedge fund capitals and volumes of Treasury Note trading. However, despite all its significance in the financial world, this Capital of Capital (as it is called in one Cambridge University study) is gradually losing its breakaway from the other Financial Centres.

The Asian influence is growing year after year and, according to analysis from McKinsey & Company, namely, Asia will become the centre of the new world growth. And history knows many cases when the world financial centre moved from one country to another.

History of Financial Centres

The 11th century. It is believed that primary financial centres were formed during annual fairs in Europe. For example, St. Giles’ Fair near Oxford or the Autumn Fair in Frankfurt.

So, where was the very first international financial center formed? It is accepted in the economic literature that it was the city-state of Venice, which reached the peak of its development in the 14th century. Namely in Venice (and also in Genoa) such securities as bonds, which are widely used in the modern world, were introduced into circulation.

The 17th century. Amsterdam becomes the main financial centre of the world. It held leadership for more than 100 years (this period is known as the Dutch Golden Age). Three extremely important novelties, which predetermined the whole financial development, were introduced in Amsterdam:

- The first world public company – United East India Company (VOC) – was founded in 1602. The VOC foundation is considered to be the official start of globalization, because the East India Company was the first one, which used the transnational corporation form.

- The first stock exchange in Amsterdam was founded at the beginning of the 1600s. The capital market started to function on its basis.

- The Bank of Amsterdam (Amsterdamsche Wisselbank) was founded in 1609. It is rightly considered to be the first example of the State Central Bank.

London replaced Amsterdam by the beginning of the 1800s. The British capital became the world centre of lending and investing. Not only the capture of colonies facilitated it but also the English contractual law, which was widely disseminated in the sphere of international finance. London law and finance institutions provided services at the international level (for example, Lloyd’s of London, which was founded in 1686 and which functions until now).

London continues to play the leading role as the International Financial Centre at the beginning of the 21st century. It is interesting that namely the capital of Great Britain has the highest positive trading balance in the sphere of financial services. The London Stock Exchange, the global gold market and bond market are located here. The national FCA (Financial Conduct Authority) regulator controls operation of about 58 thousand financial firms, which:

- provide working places for 2.2 million specialists;

- pay about GBP 65.6 billion as taxes.

Specific features of Offshore Financial Centres

Financial market traders, who closely work with brokers, should know that many Forex brokers are registered in offshore harbours. We wrote about it in the article for beginner Forex traders. Besides, the geography is rather wide.

As of the beginning of the 21st century, the IMF distinguished 46 Offshore Financial Centres.

They vary:

- from those that are loyally regulated, strongly depend on tax proceeds and have restrictions;

- to those that have a relatively strong economy, authoritative regulations and are attractive for major financial institutions.

The International Monetary Fund underlines that Offshore FC could be established:

- for legal purposes;

- for the so-called doubtful purposes (including tax evasion and money laundering).

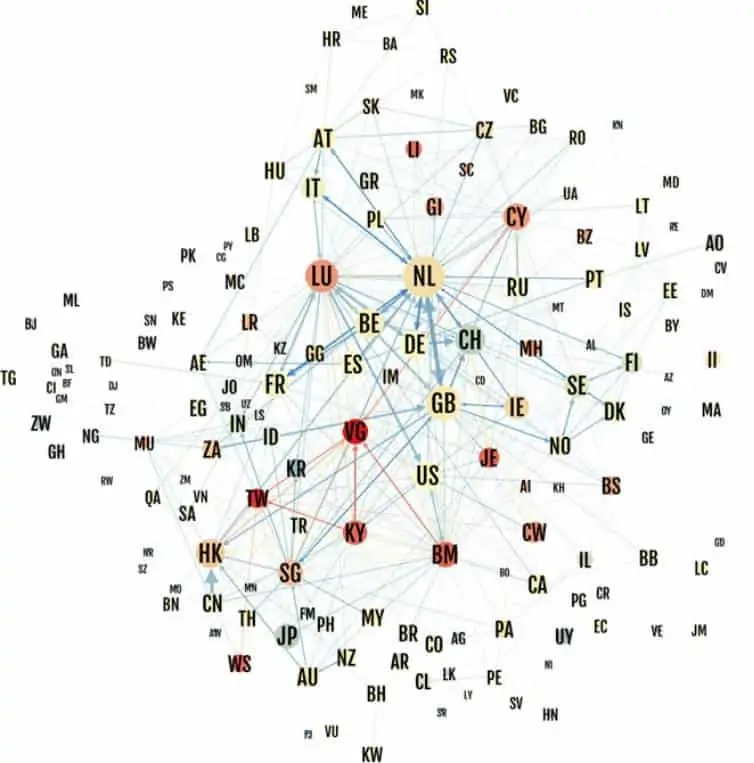

In 2013, the Cornell University Press published the ‘Tax Havens: How Globalization Really Works’ article (authors: Palan R., Murphy R. and Chavagneux C.).

According to the authors, 50% of the world trans-border assets and liabilities (USD 21-32 trillion a year) pass through Offshore Financial Centres.

The article contains visualization of links between Financial Centres (mainly European ones).

Starting from 2000, the IMF, Organisation for Economic Co-operation and Development and Financial Action Task Force (FATF) have dealt with implementation of initiatives for increasing offshore transparency. This resulted in a decrease of regulatory attractiveness of OFC. Nevertheless, they are still rather active.

What do FC do?

The world Financial Centres are influential regulators of the world financial flows. However, this is not the only function of such centres. The following functions could also be underlined:

- Analytics and information processing. Financial Centres usually interact with well-known consultants, such as the McKinsey firm, and financial experts, which allows them to conduct a high-quality market analysis and forecast markets rather accurately.

- Strengthening the world financial system. The International Financial Centres deal, in cooperation with the leading market players, with planning and development of the world financial system regulation strategy and its management.

- Restructuring state debts. International Financial Centres manage international debts and restructure state debts in such a way, so that their payment doesn’t strike a blow at national economies. It is yet another method of ensuring stability of the world financial system.

Conclusions

Financial Centres are, as a rule, cities, where banking organizations and financial institutions are concentrated. However, it is not necessary to stay close to a FC in order to be an active participant of the financial markets. Due to the modern technologies, you can speculate and invest from any place in the world where the Internet is available.

Download the ATAS software for professional exchange trading. Its advanced functionality will help you to compete in modern trading.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.