Order types. Their advantages and disadvantages

This article is for beginner traders and it explains what types of exchange orders exist. We will also briefly show you how to use the ATAS platform for working with exchange orders.

Read in the article:

- What Bids and Asks are. Basics of order matching in the financial market.

- Market orders.

- Limit and stop orders.

- Other order types.

What Bids and Asks are. Basics of order matching in the financial market

Exchange, whether it is a platform for trading cryptocurrencies or CME, is a place where financial commodities and money are exchanged between buyers and sellers. In general, it is like a regular marketplace.

However, modern financial exchanges have specific features and a beginner trader can get confused easily. Let’s start with history to try to help them.

The picture below shows the NYSE hall in 1924. Trades were executed by voice in those times.

For example, one participant of trades shouted: “I will sell 100 shares at USD 25!” It was a selling offer or Ask. Another participant shouted: “I will buy 200 shares at USD 24!”. It was a buying offer or Bid.

You can find more examples with explanations in our article about What Bid, Ask and Spread are.

The process, during which limit and market orders ‘meet each other’, is called order matching. We have several articles on order matching and exchange trading mechanics. We recommend that you read them. These articles discuss various order types from various points of view:

- What a novice should know about order matching.

- ’Good and bad’ order types.

- Order path from creation to execution.

- How to place an order.

- Depth of Market indicator.

- Algorithms of order matching on the CME.

Let’s start with a more detailed description of exchange order types. While explaining their essence, we will show how to send them to an exchange with the help of the Chart Trader panel (and other tools) in the ATAS platform

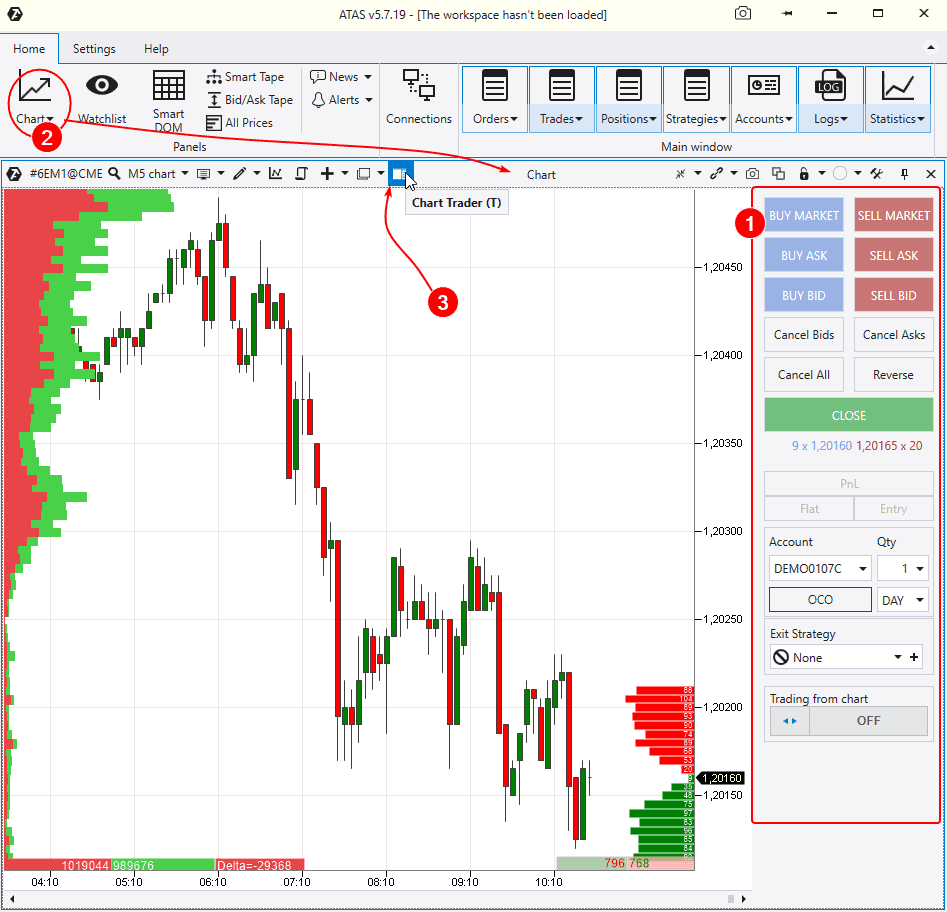

The Chart Trader panel is on the right side of the chart (1). The Chart Trader panel is hidden by default. In order to enable it, open the chart (2) and press the corresponding icon (3) in the upper menu or use the ‘T’ hotkey.

There is one more setting. When you send an order to an exchange, the ATAS platform (as many other platforms do) can ask you for an additional confirmation or send the order without confirmation (with one click). We will not mention this setting any more in order to focus on the article subject.

Market orders

What are they? As we have already mentioned, market orders are placed for accepting an available exchange asset buying or selling offer.

For example:

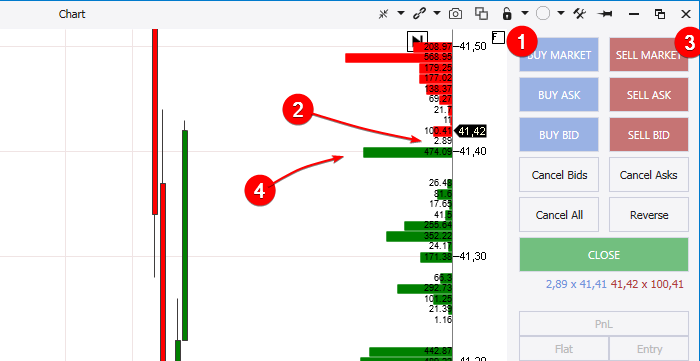

- You send a market order to an exchange for buying an exchange instrument at the best Ask price if you press the Buy Market button (1). Your order will be matched with the lower limit order from the red Best Ask row (2).

- You send a market order to an exchange for selling an exchange instrument at the best Bid price if you press the Sell Market button (3). Your order will be matched with the upper limit order from the green Best Bid row (4).

Besides, there is an important nuance. Let’s assume you place a buy market order. There is no guarantee that you will receive your order execution at the price you hope for. For example, you want to buy at 41.41 (see the picture above) but receive execution at 41.42 or even higher. Why?

Here are possible variants (which can be realized in combinations):

- the seller cancelled the limit order, which was at the Best Ask price;

- several other market orders from other buyers were placed together with your buy market order and your order was executed after them on the first-come first-served basis;

- the volume in your order was too big and all sell offers at the price of 41.41 and then 41.42 and then even higher were used for executing your order.

Taking into account high intensity of online exchange trading and also technical nuances, those traders who place market orders should be ready for the situation when not all their orders are executed as supposed. It is called ‘slippage’ in the trader language.

Pros and cons of market orders. It is practically guaranteed that you execute a trade and this is a pro. However, the price, at which the trade will be executed, can be a con.

When to use market orders? You can use them when you need to enter a position quickly and for sure. It is believed that the traders, who place market orders, act more aggressively as if pushing the price in a certain direction. This knowledge is important when analysing exchange volumes.

Limit orders

What are they? In simple words, these are orders for declaring your intentions. For example, you want to buy an exchange asset but the current price is too high, that is why you place a buy limit order at the price, which suits you.

Pros and cons. A pro is that you receive the price you want. A con is that your order may not be executed if the exchange asset doesn’t come back to the price at which you placed your buy order. There can even be a variant when the quotation reaches the level at which you placed the limit order, but you do not enter a trade because there is no offsetting market order for your limit order.

When to use limit orders? There is no single answer. Everything depends on your circumstances and specific situation. Let’s consider 4 examples.

Example 1. You trade according to the false breakout strategy. It often occurs due to the fact that the cunning market ‘peeps’ into those areas, where multiple stop losses are accumulated. One specific feature of this penetration beyond the local extreme point with the goal to activate stop losses is its short duration. Trying to enter in a position with a market order, you can just miss the point when you can do it, that is why using a limit order will be a more justified decision.

Example 2. Placing a take-profit.

Example 3. You want to enter the market at a certain price and are ready to stay outside the market if the price doesn’t come back to your order.

Example 4. You trade on cryptocurrency exchanges. Commission fees in their systems are usually calculated by taking into account types of orders, which traders use. In terms of cryptocurrency exchange terminology, a maker (who adds his limit order in the general order book) and taker (who withdraws a limit order from the order book using his market order) take part in every trade. So, makers receive a bonus. Exchanges stimulate increase of liquidity on their platforms by reducing maker commission fees.

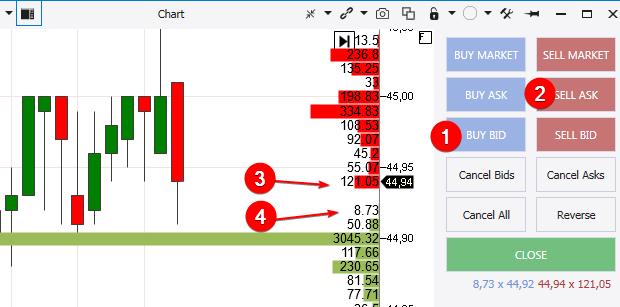

The Buy Bid and Sell Ask buttons (1 and 2) in the Chart Trader panel will serve cryptocurrency traders under such circumstances.

For example, if you press the Buy Bid button (1), the ATAS platform will send a buy limit order at the best Bid price, which is the upper green row (4) with the price 44.92 in the picture above. Consequently, if you press the Sell Ask button (2), the ATAS platform will send a sell limit order at the best Ask price – this is the red row (3), which is the closest to the price 44.94. In such a way, you receive a high probability of fast trade entry execution at a reduced commission.

How to place a limit order at a random level?

There are 2 ways to do it:

- If you press the required level in the chart with the right mouse button, you will open a context menu, which contains an item about placing a buy limit order at the price below the current one and about placing a sell limit order at the price above the current one.

- If you press and hold the spacebar, you will activate the menu for placing a limit order at the required level with the help of the left and right mouse buttons.

Use the Depth of Market indicator (or the so-called order book) to view all placed limit orders.

Stop orders

What are they? They are similar to limit orders because you declare your intention to buy or sell when the price reaches a certain level. The table below lists differences.

| Below the current price | Above the current price | |

| Buy | Limit | Stop order |

| Sell | Stop order | Limit |

One more difference is that limit orders are shown to everyone while stop orders are hidden.

When to use stop orders? The most frequent reason for using stop orders is to limit losses. They are also called stop losses.

One more popular application of stop orders is trading by the ‘breakout’ strategy, when a trader, for example, buys an exchange asset at a bit higher price than the previous high hoping for impulse continuation.

Pros and cons of stop orders. A market order is sent to the exchange when the current price reaches the level at which a stop order is placed (the condition is met). There are pros and cons in it. Your order will be executed (it is a pro), but the price can be worse than expected (it is a con).

How to post a stop order at a random level? It is done the same way as with limit orders (see 2 ways above).

What other orders exist

Pending orders. It is a common name for limit and stop orders. The term ‘pending’ means that sending orders to the exchange is pending until the conditions are met.

OCO orders. OCO means One Cancels the Other. It is a combination of two orders. For example, you place a stop loss and take profit when you are in a position. The other order is cancelled after one is activated. Find more details about this combination in the video about protective strategies on our YouTube channel. Do not forget to subscribe!

Iceberg orders. These are big orders of professional market participants, which can be split into several small ones. Other market participants may not see them or they can see only parts of them. A trader will have to pay an additional commission fee for using iceberg orders, but it can be justified since iceberg orders allow to hide his intentions.

If you still have questions about order types, you can ask them in the comments.

Conclusions

What orders to trade? What orders are better and what are worse? There is no simple answer. You need to select orders individually depending on your strategy, market context and other circumstances. Each order type serves its purpose, that is why understanding of specific features of each type allows you to implement your trading ideas in the best way possible.

We recommend that you read the Getting acquainted with ATAS. Trading opportunities article to get acquainted with all opportunities for trading from the ATAS platform. It contains a video, which shows various ways of placing orders.

Perhaps, the Market auction theory article can be interesting for you if you study order types to understand the exchange trading process mechanics.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.