How to protect a deposit from large losses: 5 steps

- First steps in trading. How to avoid mistakes with your deposit?

- 5 steps, which will protect your deposit.

- Conclusions. What to make in practice?

First steps in trading. How to avoid mistakes?

Beginner traders are very enthusiastic about trading on the exchange and ready to jump into the battle immediately. Success stories may inspire them but every success story is the result of hard work, that is why you shouldn’t hurry. The market has existed for hundreds of years already and will continue to exist. It is important to study necessary things step by step.

A good trader spends 10% of his time for trading and 90% – for studying and analysing the market. Why is it necessary? The market is the product of human society and the scientific and technological progress is constantly developing. Society changes and the market changes. Trading systems become outdated and, due to this, something that worked in the market yesterday will not work today. That is why, a good trader is a good researcher who constantly looks for new inefficiencies in the market and opportunities to make money.

Since it is true for an experienced trader, it is true for a beginner trader even to a larger extent. How can a beginner trader avoid mistakes and save his first deposit?

Do not hurry to trade and allocate sufficient time for the study!

5 steps to protect your deposit

Let’s discuss simple actions, which will help a beginner trader to save his deposit:

- Do not add funds to your account until you make the following steps. A beginner trader is in a hurry to replenish his first deposit and start making money. This is wrong. You mustn’t hurry in trading. At least one year should pass from the moment you get interested in trading for the first time until you open your first real trading deposit. It is doubtful that you could do it faster. You should spend the first year on studying and training and you’d better invest your funds into:

- training courses;

- good books on trading;

- professional software for analysing financial markets, for example, the trading and analytical ATAS platform;

- exchange quotations in order to study real-life exchange market data, and this information costs money;

- visiting various events for traders.

Such investments will bring much more benefit during the first year of studying trading.

- A simple trading system.

Your training should result in a trading system. It includes an algorithm – a set of rules by which you want to trade. The following should be clearly described in your trading system:

- when and where you will enter the market;

- when and where you will exit from the market;

- with what volume you will enter the market;

- what the risk in every trade and on the whole account would be.

For example, your trading system should describe an entry point where you post a stop loss, limit your risks and post take profit for exiting from the market.

- A test on 1 year history. Whatever boring and not interesting it might seem to test on historical data, it is important to do it. After your trading system has been completely formed, you should start testing rather than real trading. Advantages of testing on historical data:

- Saves money. Testing will save thousands of dollars. If you find out during testing that your trading system doesn’t work, you will not use it and, consequently, will not lose money on your deposit. It is better to lose virtual money during testing than real money during trading.

- Saves time. If you start trading by your trading system at once, you might have profitable periods and loss-making periods. Months could pass until you understand that, in the long run, your trading system loses more money than makes. Testing helps to understand it in several hours.

- Gives experience. Having analysed 100 and more trades, you acquire valuable experience of trading by your trading system. You may require months to acquire it in real-life trading.

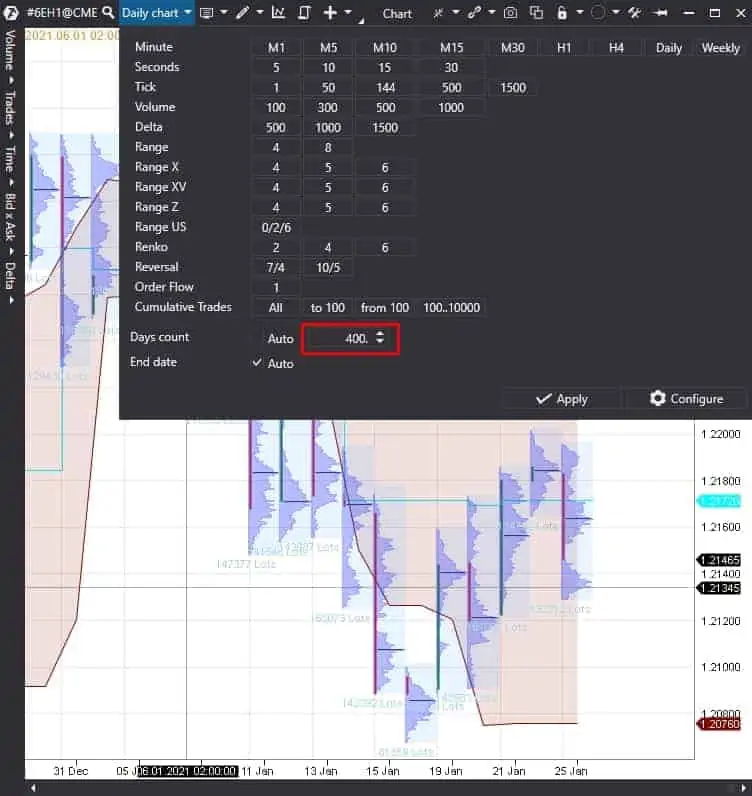

That is why testing is very important. Namely, disregard of quality testing often becomes the reason for beginner trader losses. How to conduct testing in the trading and analytical ATAS platform? Select the instrument you want to test.

Load the required amount of historical data in the time-frame selection window, selecting the number of days you need.

The minimum period of time you need to test is 1 year, because it is important to test your trading system under various market conditions:

- flat,

- trend,

- winter – spring – summer – autumn,

- periods of holidays.

In this event, your testing will be objective.

How to conduct testing in practice:

- Without seeing the ‘future’. It is important to conduct testing on historical data without seeing the ‘future’. It means that you shouldn’t see the future developments in the instrument chart when you make a decision about a trade. Your mind may deceive you and you will not execute a trade if you see that it will be loss-making. It means that testing should be very close to real-life trading.

- Put all the results into an Excel table. Testing makes sense only if its results are saved for analysis. That is why try to spend enough time to note down all details of a trade. Entry points, exit points, results in ticks, result in dollars and the trade volume.

- Analyse the testing results. Based on the received data, calculate how your deposit was changing and build the capital curve. What was the maximum drawdown of your system during the test? How much did the profit exceed the risk? Take into account that results of your trading system could be twice as worse in real-life trading. It means that your trading system should show a big margin of safety during testing. Reality will be different, since testing has ideal conditions for trading.

- Conduct a test one more time. It is desirable to conduct one more test of the same historical period in one month’s time, when you forget the results of the first test. Then check how different the results of both tests are. It is important that the results are only slightly different and trading by your system was unambiguous. If your trading system is too complex and the test results are very different, then it is better to simplify and elaborate it.

A high-quality test will take some time, but it is worth it.

- Trading on the demo account for 6 months. After you have completed testing on historical data, you would feel an urge to start making money at once. But you shouldn’t hurry. Testing on historical data is the most favourable variant of trading. You feel no distress, you take your time and you trade with demo money in the Excel file, you do not take risks and are not nervous. Real-life trading is much different. You should gradually approach real-life trading and start from the demo account.

It is like a sportsman who gradually increases the lifted weight during training in order not to injure himself.

The same is true for a trader who needs to start from the demo account in order not to injure his state of mind due to a money loss. You can register demo accounts in the trading and analytical ATAS platform: Crypto Sim (for cryptocurrencies) and ATAS Sim (for futures and stocks). There are no time limits for working on these demo accounts.

How long should you trade on the demo account? The same principle works here as for the testing: the longer the better. Six months could be enough since namely this period allows covering various market states. One or two months are definitely not enough.

Having traded for six months, conduct analysis, build the capital curve, calculate the maximum drawdown and compare the results with the historical data testing. If the results are identical and the capital curve gradually moves up, everything is fine, your system is stable and you can move further. If the capital curve is not smooth and has significant valleys and peaks and doesn’t coincide with the historical data testing, you should look for the reasons, correct mistakes and continue to trade on the demo account.

Trading on the demo account is already very close to real-life trading. The only thing, which is not in the process yet, is the psychological factor. The following step will help to train psychology.

- Trading with a minimum volume. If the historical data testing and demo account trading were stable, you can start trading with real money. However, there is an important rule:

DO NOT HURRY!!!

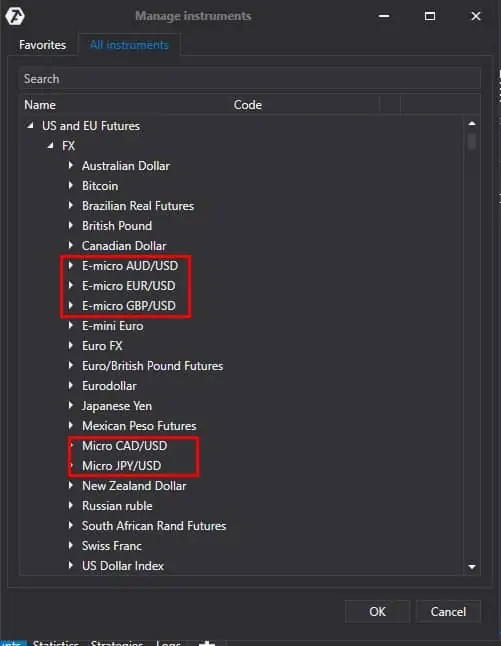

If you start trading with big volumes and risks, you will hurt yourself as a weight lifter by a heavy weight. You should do everything step by step. Select instruments with a minimum tick price and start training on them. Namely these instruments should be selected for the historical data testing and demo account trading, since every instrument has its movement character and your trading system may work good on one instrument and bad on another.

For example, currency micro futures from the CME could be good for this stage:

It could be some other ‘cheap instruments’. Start trading one contract and collect trading statistics. You shouldn’t hurry to increase the volume. It is better to do it gradually – once a quarter if the statistics is good. You may ask why is it so slow? Because, if you trade using real money, the psychology, emotions, fear and greed are involved. You should learn to control these emotions, which requires time. You may absolutely calmly trade one contract and start to feel nervousness and irritation when you increase your trading volume to three contracts. If it happens, it means that your state of mind is not ready yet and you should decrease the volume. Trading shouldn’t cause strong emotions. You should trade calmly, then your decisions will be well considered.

It may take a year to reach the working volume, but this gradual movement will save your deposit. If you start to hurry you will start to lose!

Conclusions. What to do in practice?

Is it possible not to lose your first deposit? It is possible if you follow these simple recommendations:

- Do not trade on the real account until you make the first steps.

- Develop a simple and easily tested trading system.

- Test your trading system on at least 1 year historical data.

- Trade on the demo account in real time for at least 6 months.

- Start trading on the real account with a minimum possible volume and increase the volume no more than once a quarter.

- DO NOT HURRY. At least two years should pass from the moment when you get interested in trading until you start trading on the real account with the full volume.

These simple recommendations will protect your money from losses. Follow them!

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.