This article is written in order to help beginner traders to avoid sad consequences of the lack of knowledge of the margin trading basics. The original source of information is materials from the SEC web-site.

You will learn in this article:

- What margin trading is.

- Legal issues of the subject.

- What trader responsibilities are when working with margin.

- Margin types.

- What Margin Call means.

- Whether margin requirements may change.

Trading stocks with margin. What is it?

Margin trading (or trading with margin or trading with leverage) in the stock market is a method to buy stocks, which involves borrowing funds from the broker by the investor in order to pay for the stocks (what brokers are). Investors borrow funds more rarely to open a short position.The broker charges some interest for the money lending service (7-8% annual are considered to be the standard practice).

Traders and investors usually use margin (or leverage) for increasing their buying capacity in order to have a possibility to possess a big number of stocks without paying for them in full.

The benefit is that, when using margin, the market participants may increase reward for their correct forecast. However, margin exposes investors to the risk of bigger losses. This is the negative side of the issue.

Let’s consider one example.

Variant 1. Favourable

Let’s assume you buy a stock for USD 50 and later its price increases to USD 75.

- If you bought the stock without borrowing money and paid for it in full, you get 50% profit from your investment. In this case your leverage is 1:1.

- However, if you bought the stock with margin, paying USD 25 in cash and borrowing USD 25 from your broker, you get 100% profit on the invested funds. In this case your leverage is 1:2 (one dollar of yours accounts for the stock value of two dollars).

Variant 2. Unfavourable

The other side of margin using is that if the stock price goes down, a trader could suffer significant losses. Let’s assume the value of stock you bought for USD 50 fell to USD 25.

- If you paid for the stock in full, you lose 50% of your money.

- However, if you bought with margin, you lose 200%. Moreover, you will have to pay the interest, which you owe him for the borrowed funds, to the broker in any case.

Some beginner traders might be shocked by knowing that their broker has the right to sell securities, which were previously bought with margin, from their accounts even without any notification and, potentially, with significant losses for an investor!

This is tough – both psychologically and from the point of view of efforts for compensation of losses, since, if the broker sells your stocks out of necessity after a sharp price fall, you not only register a loss, but also lose a possibility to compensate losses if the market comes back to its normal state.

Legal issues of the subject

Is it all legal? Yes, it is. Margin trading is allowed all over the world and is strictly regulated.Brokers have the right (it is called Margin Call) to:

- require from the customer to replenish his account so that its margin is sufficient to cover the position;

- close customer positions immediately without notification if the margin doesn’t cover his position.

Margin trading is carried out on the basis of the current legislation. Authorised financial monitoring bodies (regulators) supervise fulfilment of the rules by market participants and ensure fair and transparent trading.

For example, the following bodies regulate trading in the financial markets of the United States:

- SEC (The United States Securities and Exchange Commission was founded in 1934 when Roosevelt was the President) — agency of the US Government – main body, which supervises and regulates the American securities market.

- FINRA (Financial Industry Regulatory Authority) – financial service regulation body — private American corporation which controls fulfilment of the trading rules in the over-the-counter (OTC) market. It was founded by a US Congress decision in 1939.

- CFTC (Commodity Futures Trading Commission) – commission on trading commodity futures. The central body of the state control of the United States, which controls fulfilment of the Commodity Exchange Act.

- NFA – National Futures Association was founded in 1984. It regulates the derivative markets, including the market of exchange index futures. NFA is financed by means of membership fees and assessment fees and membership is mandatory for many market participants.

- FED (Federal Reserve System) – it is not a classical regulator, however, respective rules, approved by the Federal Reserve should be fulfilled by the financial market participants.

- SIPC – Securities Investor Protection Corporation. It was founded in accordance with the Securities Investor Protection Act (SIPA) in 1970. It is also not quite a regulator. It is controlled by the US Securities and Exchange Commission (SEC). The SIPC goal is to accelerate restoration and return of lacking customer assets in the process of liquidation of a bankrupt investment company.

Admission of responsibility

Before opening the margin account, you should clearly understand that:- the amount of losses may surpass the amount of investments;

- perhaps, you would need to deposit additional money (or securities) to your account immediately in order to sufficiently secure your position;

- you might be forced to sell a part of your position (or even the whole position) if the prices fall down;

- your brokerage firm has full power to sell a part of your position (or even the whole position) without prior consultation with you in respect of repayment of the funds, which were borrowed to you.

In order to open the margin account for trading US stocks, a customer needs to confirm that he has a sufficient qualification and financial reserve. Also, your broker should have respective agreements signed by you.

This is not the forex of an offshore broker, where you can have USD 100 and trade with 1:500 leverage after quick registration.

- Board of Governors of the Federal Reserve System;

- New York Stock Exchange (and other exchanges);

- National Association of Securities Dealers;

- brokerage firm, in which you opened your margin account.

You should read the agreement attentively before signing it. Be as attentive as if you take out a mortgage.

Similarly to a majority of situations with borrowings, the agreement explains conditions of the margin account. The agreement describes:

- how the loan interests are calculated;

- how you are responsible for repaying the loan;

- how the acquired securities serve as the loan collateral.

Margin types

The Federal Reserve System Board and many Self-Regulating Organisations (SRO), such as NYSE and FINRA, developed a system of rules that regulate margin trading. Brokerage firms may establish their own requirements if they are in concordance with the rules of the Federal Reserve System Board and SRO.Here’s what you need to know about margin types:

Minimum Margin

Before you start trading with margin, FINRA, for example, requires you to deposit minimum USD 2,000 to your brokerage firm or 100% of the buying price, depending on what is less. It is known as ‘minimum margin’. Some brokers may ask you to deposit more than USD 2,000.

Initial Margin

According to Regulation T, approved by the Federal Reserve System Council, you have the right to borrow up to 50% of the buying price of the securities, which could be acquired on margin. It is known as ‘initial margin’. Some firms would ask you to deposit more than 50% of the buying price. You should also take into account that not all securities could be acquired on margin.

If a market is unstable, investors, who deposit initial margin for the stock, could, at times, be asked to provide additional money funds.

Maintenance Margin

FINRA requires an investor, who bought the stock with margin, to have a certain amount of funds at any time.

According to the Rules, it should be not less than 25% of the total market value of the securities. These 25% are called the ‘position maintenance requirement’. In fact, many brokerage companies set even higher requirements to the maintenance margin amount – usually from 30% to 40%. Sometimes even higher – depending on what stocks the customer buys.

Let’s consider an example of how maintenance margin requirements act.

Let’s assume you acquired AAPL stock for the amount of USD 16,000, having borrowed USD 8,000 from your firm and paid USD 8,000 from your own funds.

Later, to your regret, AAPL rate falls. The market value of the stock you own goes down to USD 12,000. Your account balance will fall to USD 4,000 (USD 12,000 – USD 8,000 = USD 4,000).

- If your broker asks for 25% margin, you need to have USD 3,000 of your own funds (25% of USD 12,000 is USD 3,000). In this event, your funds are sufficient, since the available USD 4,000 is more than USD 3,000, which are required for servicing.

- However, if your maintenance margin brokerage requirements are 40%, you have problems. The broker needs your capital to be at least USD 4,800 (40% of USD 12,000 is USD 4,800). Your USD 4,000 capital is less than the minimum for maintaining your position in the amount of USD 4,800. In the result, a ‘Margin Call’ occurs, since the own capital on the account is USD 800 less than required.

What Margin Call is

In the event your account doesn’t meet the maintenance margin brokerage requirements, the broker usually makes a Margin Call in order to ask you to deposit more money funds or securities to your account. If you are not able to meet the margin requirements, your firm will sell your securities in order to increase the own capital on your account up to the level required for servicing, set by the firm or higher.Always remember that your broker is not always obliged to ask you to deposit additional funds or inform you in any other way that your account doesn’t correspond with the margin requirements. Your broker may have the right to sell your securities at any time without prior consultation with you and, most probably, he will do it this way. According to a majority of brokerage servicing agreements, even if your firm offers you some time for replenishing your account, it has the right to send an order for selling all your securities without waiting for replenishment of your account.

Specific features of margin trading depending on a country

An important feature of stock trading is that, comparing margin trading requirements of various brokers in various markets, you find an endless number of variants.It depends on:

- the broker’s jurisdiction,

- what types of accounts the broker can open,

- on what exchanges you buy stocks,

- stock of what issuer you buy,

- the position type – long or short.

Moreover, servicing conditions may change in view of personal qualities of the customer. Your knowledge, savings and trading experience you have – everything may influence your conditions of margin stock trading.

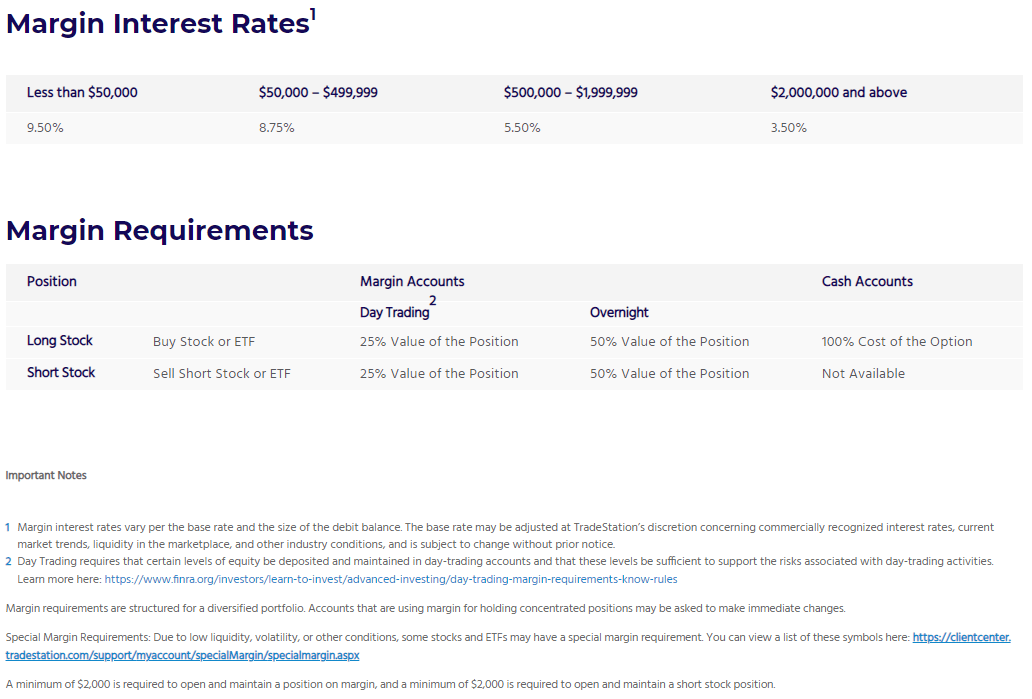

For example, below are the margin stock trading requirements of a certain broker No. 1, who acts under the US state regulators. Leverage here is up to 1:4 for intraday trading and up to 1:2 for rolling overnight.

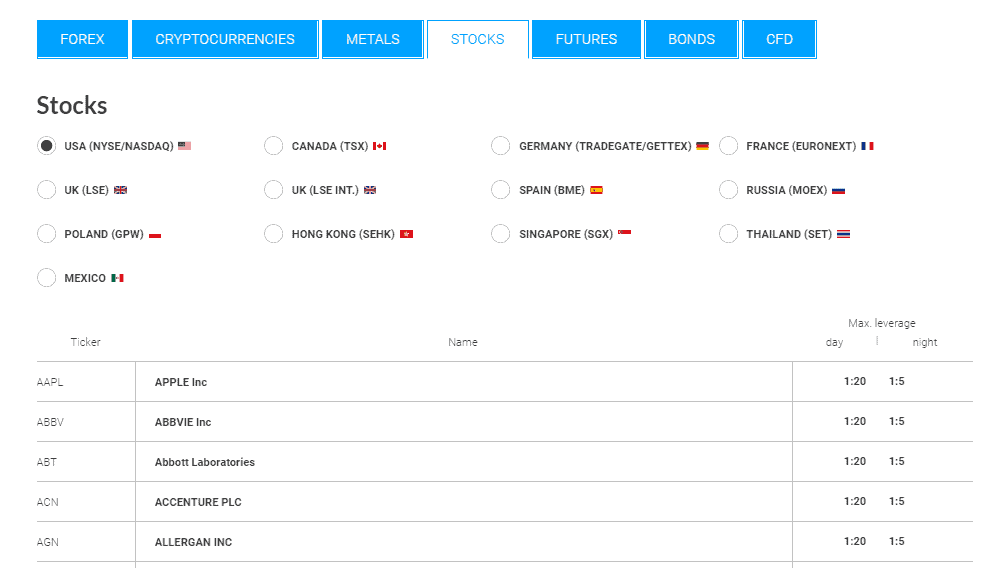

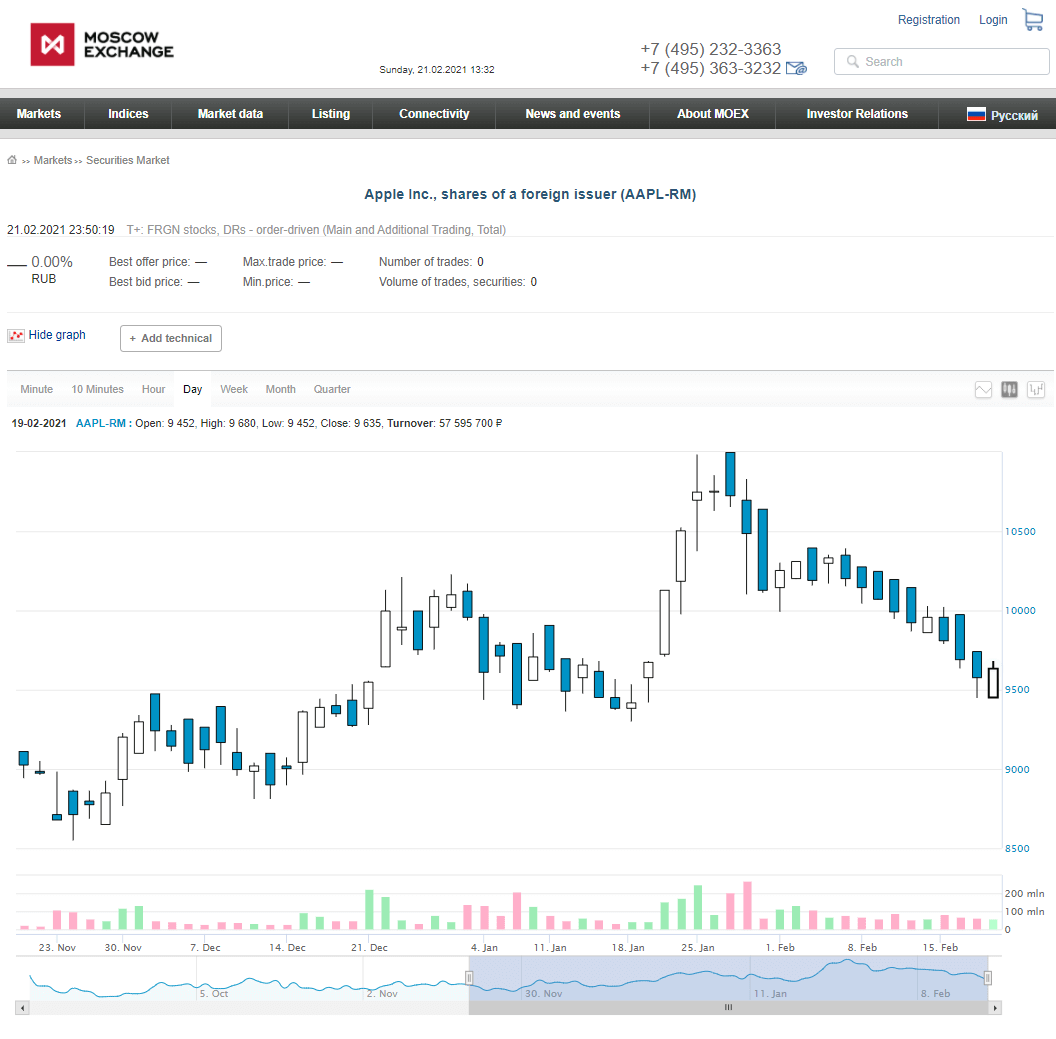

Moreover, AAPL stock could be bought not only on NASDAQ, but also, for example, on the Moscow Exchange.

The force-majeur factor

Let’s assume you are persistent and compared margin trading conditions of various brokers in various markets. It doesn’t mean they cannot change.It may happen at the broker’s discretion or under the influence of regulators in force-majeure conditions.

Example 1. Hype with GameStop stock, which took place at the beginning of January-February 2021, when the stock was bought out by a group of traders who had laid plans beforehand in the Reddit social network. Responding to the inadequate price growth, the authorities forced brokers to change servicing rules.

Example 2. The story of the effort to seize the silver market in 1980 when the metal price skyrocketed from USD 6 to USD 50, but later the exchange increased margin requirements and the manipulators went bankrupt. You can find more details in the article about silver futures.

Conclusions

Margin requirements is a very changeable story. If you consider trading with leverage, you should know well what stocks you want to trade, what your strategy is and how margin trading would bring you benefit (and not otherwise).Theoretically, margin trading is profitable for all parties:

- the investor gets an opportunity to increase the profit twice or even more;

- the broker doesn’t risk much, because, in real life, the stock of well-established companies cannot fall critically down. Instead, the broker makes money on interest (usually 5-10% annual) providing funds to the customers for buying stocks. The broker also increases his income through commissions (the bigger the customer trade, the higher the commission is);

- the exchange also makes money on commissions;

- the state GDP grows;

- the issuer is also glad, since the sold stock brings him investments for developing his business.

The reverse side of trading with leverage is risk. Perhaps, the most important thing you should know about margin requirements is that you may lose your money in an eye’s wink without notice.

The main protection is knowledge and understanding how the margin account works and what would happen if the stock price, which you bought with margin, moves down.

Do you want to trade US stocks? Study conditions of brokerage servicing attentively when you open the brokerage account.

List of key issues:

- Do you know that margin accounts are connected with a much higher risk than cash accounts, on which you pay for securities in full?

- Do you know that when buying with margin you can lose more than initially invested? Can you afford to lose more than you invested?

- Did you read the margin agreement? In the event you had questions after reading – did your broker explain the margin agreement conditions?

- Did you ask your broker about how the margin account works and whether margin trading is suited for you?

- Do you know about the interest, which will be charged from the money you borrowed from your brokerage firm, and about how these interests would influence your total profit?

- Do you know in detail how your broker would manage your stocks if you have insufficient funds on your margin account?

Don’t hesitate to ask your broker whether it makes sense to trade with margin taking into account your financial resources, investment goals and risk tolerance.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.