Forecast for 2021 on stocks, currencies and raw material prices

Financial markets never live in the present. It is always a complex and non-stop effort to predict the future. If you do not understand what investors expect, it is just impossible to understand why prices are such at the moment and not two times lower or higher.

The goal of this article is analysis of expectations of the largest investment banks and analysts from Wall Street for the year 2021. What to expect from the global economy, what stocks would grow better than others would and what risks should be taken into account. Of course, nobody knows for sure what the future would be but the trends are forming today based on the picture described below.

Brief description:

- Beginning of 2021: believing in vaccination

- Post-covid economy: how it looks like in Wall Street forecasts

- Central banks continue to flood the world with trillions

- Dollar and not only: why the world currencies will decrease in value

- The main trend in the stock market – buy what has become cheaper

- Main risks of the year 2021

Beginning of 2021: believing in vaccination

Looking at new historic records of the key American stock indices, many observers have doubts regarding whether the markets are running ahead of the train, since the COVID-19 incidence and death rate are still horrifying.

Yes, the virus continues to rage, however, very few on Wall Street have doubts that massive vaccination in the United States, European Union, Great Britain and other largest financial centers would break the negative trend of incidence as early as in the 1st quarter 2021.

The main problem of the vaccine distribution is logistical, since the medications turned out to be extremely sensitive to the storage mode and require down to -70° C for safe storage. However, the majority of the Wall Street major investors proceed from the assumption that solutions would be found.

Post-covid economy: how it looks like in Wall Street forecasts

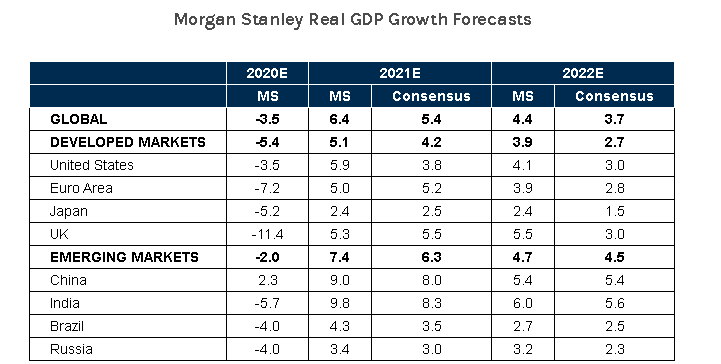

Meanwhile, the leading world investment banks and rating agencies, one after another, set a significant improvement of the situation in their forecasts for the world economy for the year 2021. We will present to you one opinion, which, actually, reflects the general mood.

The Global Economic Outlook for 2021 says that Morgan Stanley (MS) expects a synchronous exit of developed and developing countries from the crisis. The World GDP would grow by 6.4% with 5.1% growth in developed and 7.4% growth in developing countries.

Experts believe that the current crisis develops according to the V-shaped scenario. It means that the world economy growth in 2021 would be as strong as the fall in 2020 was.

The most active stage of recovery starts in April 2021. They believe in the bank that major Asian countries, such as China, India and South Korea, would be drivers of the growth.

Moreover, the world economy in general would benefit from low interest rates in the US – the dollar lending would be affordable, which would stimulate both the real sector and financial market rise.

Central banks continue to flood the world with trillions

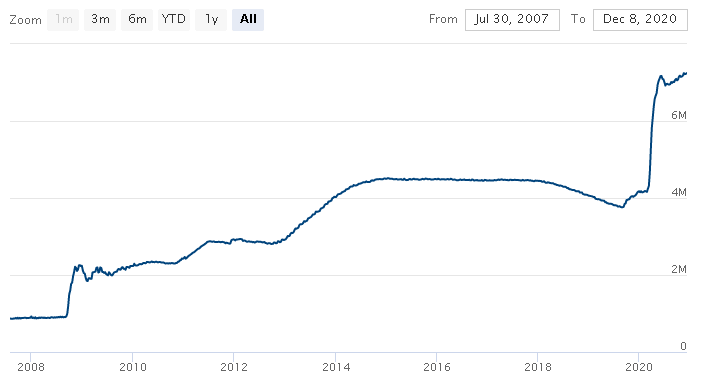

JPMorgan Chase (JPM) and Bank of America (BOA) economists set, in their forecasts and recommendations to investors for 2021, preservation of the ultra-soft monetary policy of the FRS, ECB and other key central banks practically as a fact.

Interest rates will be kept at the zero or even negative level for, at least, several more years. Thus, they assure in the FRS that there are no plans to increase interest rates before 2023.

They are nearly sure on Wall Street that large scale quantitative easing programs would be continued and some more trillion dollars of liquidity would be poured into the world economy through them. The balance of FRS only may increase by USD 2-3 trillion.

All these circumstances, as well as good prospects of corporate profit recovery, suggest high chances of the ‘bulge’ of prices on the key asset types – from stocks to raw materials. Consensus forecast of Wall Street analysts suggests the growth prospects of the key stock market indicator – the average earning per share – by 38%.

It would not be boring as well in the capital raising market. A series of the largest IPO in history took place in the second half of 2020 and the overvalued estimates resemble the history of the dotcom bubble more and more. However, under conditions of excessive capital, we may see more than one fantastic growth story similar to Airbnb and DoorDash, stocks of which added in value during the first day of trading by nearly 100%.

Dollar and not only: why the key currencies will decrease in value

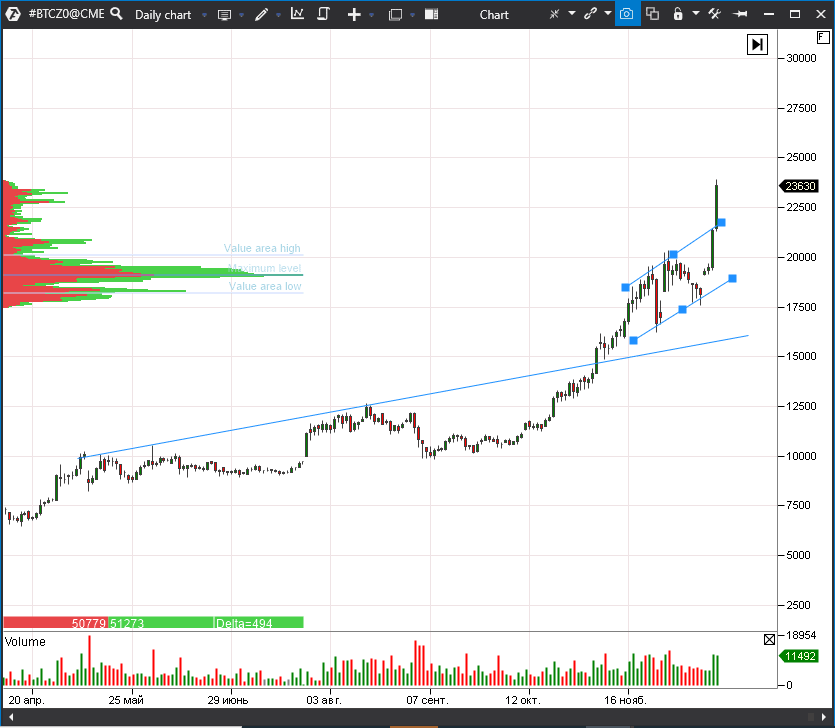

Many on Wall Street expect now that the dollar index trend on weakening would continue. What floats the stock market, cryptocurrency and raw materials sinks the dollar.

They believe that the American currency would continue to lose its positions due to the growing risk appetites in the world markets and increasing confidence in the developing country economies. The FRS and US Treasury policy on large-scale monetary (through emission) and fiscal (through budget) pumping of markets with liquidity will leave their marks on the dollar.

There are different forecasts for the dollar index (DXH1) fall – from humble 4% to impressive 20-30%. However, one should understand that other central banks of the world, from ECB to the Bank of Japan, would print money with at least equal speed, which might ensure some devaluation parity for all currencies.

It is not the best idea to keep money in cash when currencies fall synchronously. Professional investors recommend buying assets in such a situation.

If there are no new disasters in 2021, the asset inflation would continue, which means that the prices on real estate, stocks and other real values would grow faster than the food prices. At least, such a position is popular among analysts today.

Prospective assets of 2021

Apart from investing into bitcoin (we have a separate article about cryptocurrency forecasts), some investors move their capitals into gold, since the precious metal market also doesn’t look like a bad alternative to the weakening world currencies. And although gold rarely shows growth by more than 20% annual, it is less volatile and more liquid. This is the main argument for many funds.

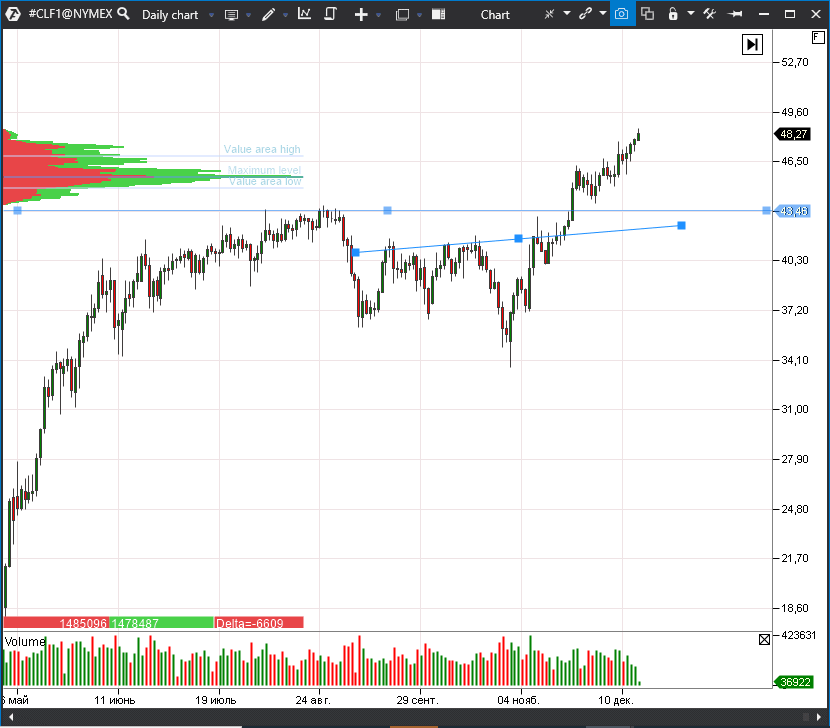

Major bank experts take notice, among other prospective assets of 2021, of oil and raw material assets, connected with it. Expected successes in fighting coronavirus will help prices to recover. According to Goldman Sachs, the average annual WTI oil (CLF1) price would reach USD 65 in 2021.

However, most probably, the stock market will continue to be the main beneficiary of money pumping into the economy.

The main stock market trend in 2021

Many leading investment companies have a similar view on another next year’s basic tendency – relocation of the capital from the so-called growth companies into value companies. We will briefly explain the difference between them.

Investors buy growth companies mainly hoping for a fast growth of basic economic indicators by means of creation of new markets or blistering expansion of the old ones. As a rule, such companies either do not pay dividends in principle or their size is so small that it doesn’t influence the stock attractiveness. That is why, investors usually buy them for the sake of the stock value growth.

The main ratio, when assessing stock, is P/E (Price to Earnings) ratio. It is usually much higher than average with growth companies and some of such companies have this ratio at astronomical levels (it may reach 100 or even more than 1,000, as it is with Tesla, while the average value is 20).

A majority of technology companies from various sectors, from retail to software development and automobile manufacture, belong to growth companies. These are Amazon (AMZN), Apple (APPLE), Google (GOOG), Netflix (NFLX), Tesla (TSLA), Salesforce (CRM), Zoom (ZM) and so on. The ‘smartest’ growth stocks increased their companies capitalization twice despite all crises.

In contrast to them, value companies are attractive due to creation of a stable value for stockholders. As a rule, they pay dividends above the index average level, have generated stable profits during the past few years and their activity is focused on the ‘classical’ sectors of the economy.

These are leading banks, food producers, fast-food restaurants, oil companies and so on. Classical examples are Bank of America (BAC), Coca-Cola (KO), McDonald’s (MCD) and Exxon Mobil (XOM). They have, as a rule, the brightest red colour in the infochart above, because they suffered much more from coronavirus than others did.

Forecast on the capital relocation is mainly caused not by the factor that many value companies turned out to be significantly overbought against the agiotage background in 2020 and their income growth doesn’t keep pace with the stock price. Some of them even manifest the signs of a bubble (Tesla and Zoom). The stock prices of value companies, on the opposite, fell during the previous year and fast recovery of the world economy and lockdown removal would create a potential for their financial indicator growth.

Main risks of 2021

Forecasts for the financial markets for 2021 would have been incomplete without consideration of threats, which are always waiting for their time to come. Investors should keep in mind the risk of the black swan event, which could change the situation dramatically.

Coronavirus became the black swan in 2020. Nobody knows what would happen in 2021. We can only make assumptions.

They believe in Fitch Ratings that there could be problems in the first half of the year, which are connected with the vaccine distribution. This might interfere with fighting coronavirus rather fast.

Growth of geopolitical tension between the US and China is also on the surface. Both individual private companies and whole sectors of the world economy could become victims of the sanction wars.

The US internal political opposition should also be remembered. If the Republicans win a majority in the Senate, the newly elected US President Joe Biden may forget about implementation of his large-scale economic proposals.

The limited resources of the central bank monetary policy raise serious concerns. In fact, all possible instruments were thrown into the ‘furnace’ of the 2020 crisis and there is no potential left for active actions in the event of deterioration of the situation.

And what if inflation starts to grow. Increasing the interest rate is not the answer, since the still weak economy will just totally stop. The only way out would be to continue printing money and devalue currencies. Evil tongues say that inflation devaluation of enormous debts of the leading countries is exactly the primary goal of the current monetary policy.

They point, in the Bank of America, at the growth of structural disbalances in the economies of developed countries (among other risks). The matter is that the policy of saving those who are drowning by means of filling the swimming pool up with bags full of dollars is a dangerous game. Inefficient ‘zombie companies’ with high debt loads and good for nothing business models breed like rabbits all over the world. And inefficiency is always bad, especially in the times of crises, the mission of which is to clean the economy from weak links and facilitate progress.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.