How volume analysis indicators help to find the end of a correction

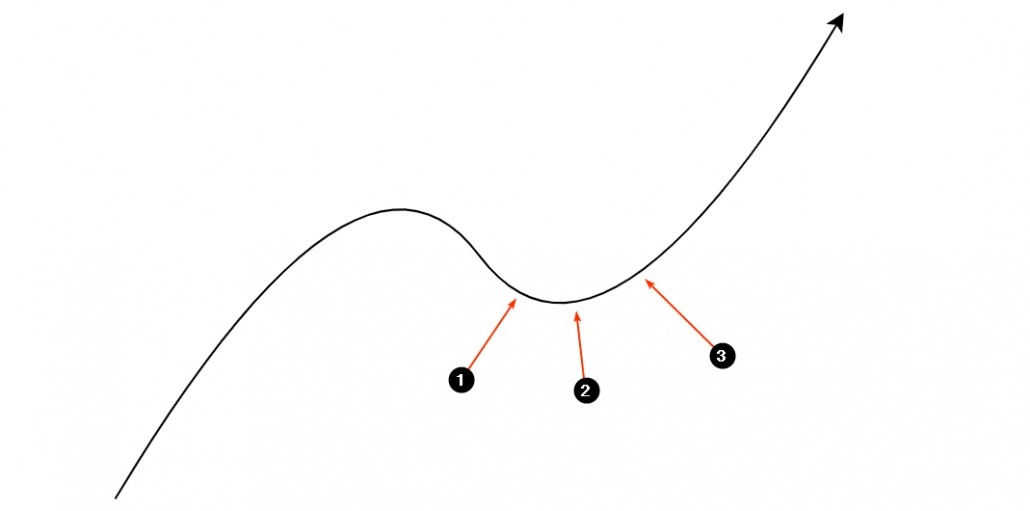

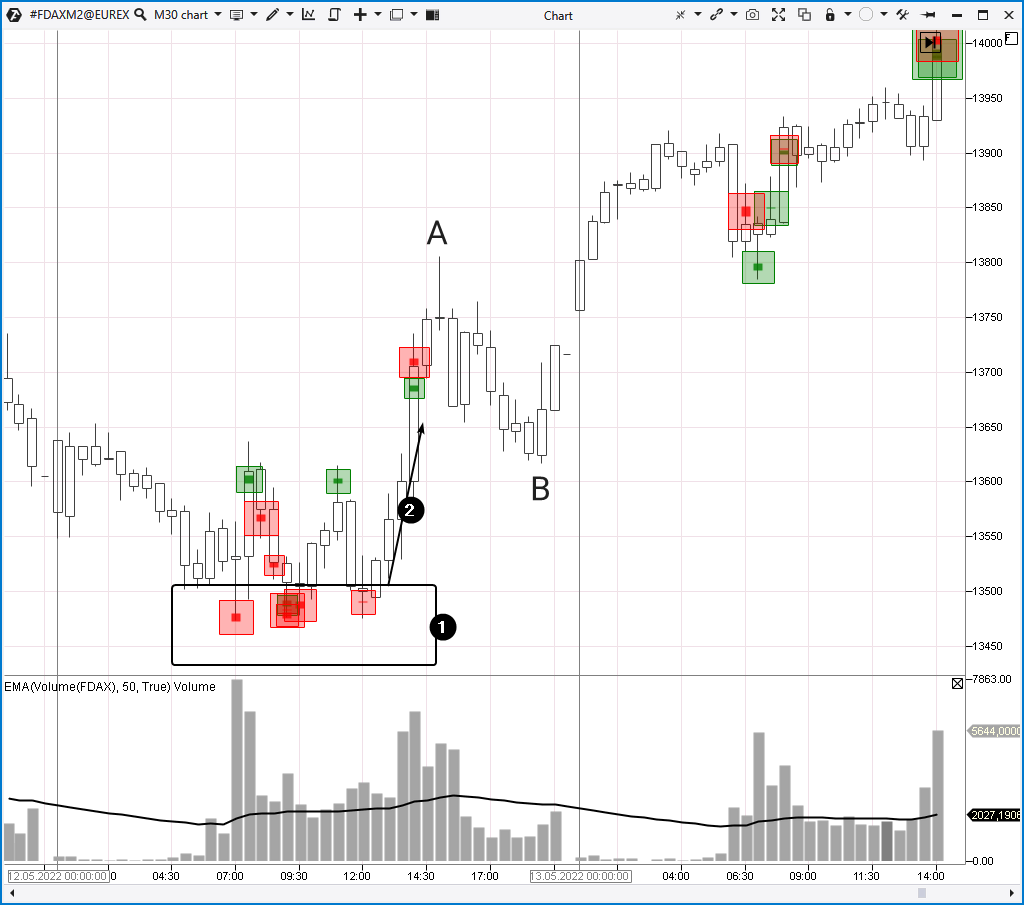

The end of a correction is very important because at this moment traders have an opportunity to enter a position with a potentially high reward (in case of a trend resumption) and reduce risks at the same time.

Read in this article: