Trading books you must read

“A book is a great thing while a man is able to use it” Alexander Blok.

Traders and investors come to the market to make fast and easy money. They read books searching for a magic trading system, try various software and methods. 90% of traders lose their deposits and faith in themselves. Why does it happen and how to avoid it? There is no a clear-cut answer, since every loser has his own individual story. But all these stories have one undertone – insufficient level of knowledge about the exchange game, which follows from a small number of good trading books, which traders read.

The books, we will speak about today, do not have a magical advice how to make fast money. And those trading systems that brought millions to their authors, most probably, will not work for you.

However, experience of successful traders, understanding of how the market works and thinking by probability categories will prepare you for solving possible problems and will save some of your nerve cells and a part of your deposit.

In this article – a short list of top books that take pride of place in our library:

- encyclopedias of technical analysis;

- books in trading psychology;

- books in trading techniques.

Encyclopedias of technical analysis

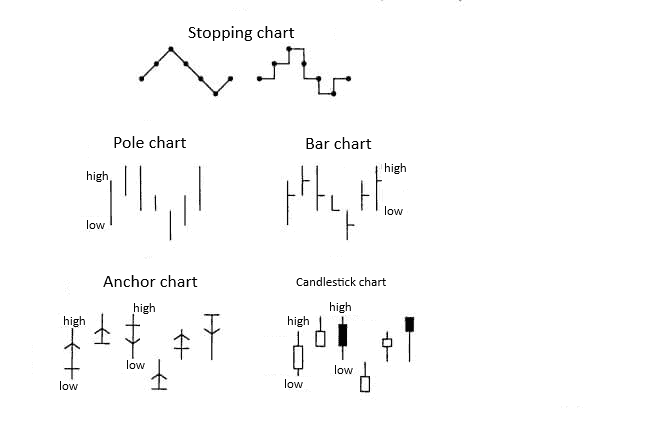

This category contains books with a multitude of charts, terminology and formulas. These are reference books, which you can open from time to time during (or after) trading sessions.

Number 1. “Technical Analysis of the Futures Markets” by John J. Murphy takes the first place in this category.

Just like preschool children view pictures in the “I Study the World” encyclopedia, beginner traders study “Technical Analysis of the Futures Markets”. Anyone involved in trading will recommend you to read this book. It is a thick book and quite boring, full of charts, specific terminology, theories and patterns. Murphy speaks about everything – indicators, oscillators, waves, point-and-figure charts, capital management and many other things. If you manage to read this book, the other technical analysis books would seem you familiar and clear. It is more efficient to study this book not before going to bed or on your way to the office, but in front of a trading terminal, when you can check immediately whether the S&P 500 index broke the 200-day moving average or whether the RTS index is in the upward trend. Murphy writes in the foreword that this book will be useful both for beginner and professional traders.

Brief summary – not easy but useful reading.

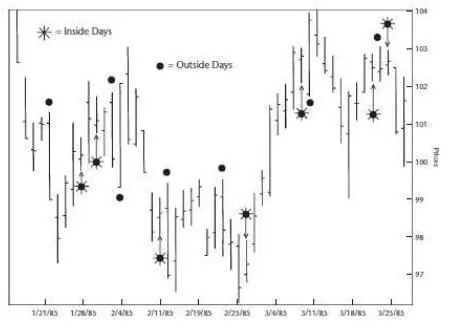

Number 2. The second place belongs to Larry R. Williams and his “How I Made One Million Dollars Last Year Trading Commodities” or “Long-term Secrets to Short-term trading”. Larry Williams is the only person who increased his capital from USD 10,000 to USD 1,147,000 during one year. It happened in 1987, when the general mood in the market was dull and gloomy. Larry Williams developed several indicators and traded mainly in the futures markets. Larry Williams gives examples of trades and speaks about his own experience of using various instruments of technical analysis. For example, he actively used outside and inside days.

Brief summary – practical and worth trying reading.

Number 3. The third place belongs to Alexander Elder and his “Trading for a Living. Psychology. Trading Tactics. Money Management.” It is a theoretical and practical textbook where you will find both technical analysis and the Triple Screen trading system used by Elder himself. He writes in one of his books: “Trading attracts us with its promise of money and freedom”. Alas, to become free from routine and get early pension you will need many years of trading experience apart from reading smart books. Alexander Elder lives and works in the US but he is a native of Saint-Petersburg. Reading his books you will find trading quizzes, which would help you to assess your level of the market understanding. You will learn importance of 3M – Mind, Method, Market (psychology, trading tactics and money management) – and understand why it is important to keep a trader’s diary.

Brief summary – interesting and informative reading.

Trading psychology

This category contains books, which are closer to fine literature, without charts but with specific terminology. On the one hand, it is easier to read these books than the books on technical analysis. On the other hand, it is difficult not just to read but to control your emotions and actions in the process o trading.

Number 1. Mark Douglas and his “Trading in the Zone” takes the first place. You will learn from this book that it is not necessary to know what happens the next moment in order to make money. Your competitive advantage is just a big probability of price movement in a certain direction. If you accept the thought that anything can happen, then it is easier to follow the trading strategy even when it does not bring profit. Mark Douglas writes that discipline and faith in yourself are more important than a trading system. Do not break rules and use your competitive advantage – then you will be a stably successful trader.

Brief resume – positive attitude and discipline.

Number 2. The second place belongs to “What I Learned Losing a Million Dollars” by Jim Paul. The book is written in the belles-lettres style without charts and terminology and only with two pictures. It is a story of life and work of a trader on CME from his first unsure trades to the stardom disease when “I command the market”. The author speaks about own experience of mistakes, holding loss-making positions, averaging, predicting, gambling and greed. “There are many ways to make money on the exchange and very few ways to lose. Why we are not rich yet while there are many books, which tell us about how to make money, on our bookshelves.” You will learn how not to become a gambler or predictor, at what stage of loss suffering you are and how not to take losses too close to your heart.

Brief summary – easy and pleasant reading.

Number 3. The third place is for Brett N. Steenbarger and his “Enhancing Trader Performance”. Steenbarger keeps own blog, where you can find a trading diary, notes and articles. The book will help you to structure your training and focus on unobvious issues, such as selection of a niche depending on specific features of a character or differences between professionals and amateurs. The book contains Internet resources, which would help a beginner trader – resources for improving efficiency. You will also learn how to develop your competence and your skills and how to set correct goals.

- Short-term trader

- Thinking process

- Learning process

- Trading style

- Source of trading advantage

- Duration of training

- Short-term trader

- Implicit

- Repeated sessions

- Intuitive, based on intuition

- Experience

- Accelerated

- Long-term trader

- Explicit

- Market research

- Analytical, by rules

- Knowledge

- Long-term

Brief resume – selection of a correct niche and gradual improvement of trading skills.

Trading techniques

This category contains books, which would help you to analyze individual trading directions deeper. They are even more complex than the technical analysis books, but they are worth reading, since trading techniques create your competitive advantage.

David Weis said during a webinar in 2015 that beginner traders make losses because they change trading strategies too often. Those traders become successful who master one trading strategy.

It is rather difficult to give a brief summary of these books, so, we just offer you to read what matches your trading style.

- Demand and supply, tape reading and Wyckoff method – “The Day Trader’s Bible” by Richard D. Wyckoff. Richard Wyckoff was the first who started to analyze interrelation of the price and volume. He did not use indicators, instead he worked with demand and supply. His method is based on analysis of actions of big players or managed money. He called them Composite Operators. If you understand what big players do, accumulate or distribute positions, you will be able to go with the market and not against it. The times of pre-computer trading passed away and the number of trades on tape is many thousand times bigger than in Wyckoff times, but the nature of demand and supply operation didn’t change.

- Volume Spread Analysis (VSA) – “Master the Markets” by Tom Williams. We wrote about Tom Williams and VSA several times. He adapted the Wyckoff method, developed own software and successfully traded on the exchange until 2016. The volume gives the price a possibility to move. The Tom Williams’ patterns will show reversals, exhaustion of demand/supply or culmination of sells/buys. Check signs of the market strength or weakness, marked by Tom Williams, before making a trading decision.

- Chart patterns – “Encyclopedia of Chart Patterns” Thomas N. Bulkowski. We wrote about chart patterns and Thomas Bulkowski recently. He studied 38 thousand chart patterns using historical data of 1,000 companies for the period of 10 years. He both found patterns in the charts and studied a number of pullbacks and price change percentage. You come across a chart pattern – ask Bulkowski for advice. He will tell you whether it is worth trading and what the probability of success is.

- Japanese candles – “Japanese Candlestick Charting Techniques” by Steve Nison. We also spoke about Steve Nison and Japanese Candles quite recently. He was the first person who got acquainted the American and European markets with Japanese Candles and Renko Charts. If you want to trade candlestick patterns, this book is a must for your library.

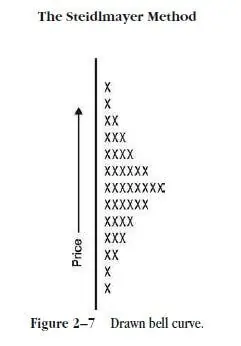

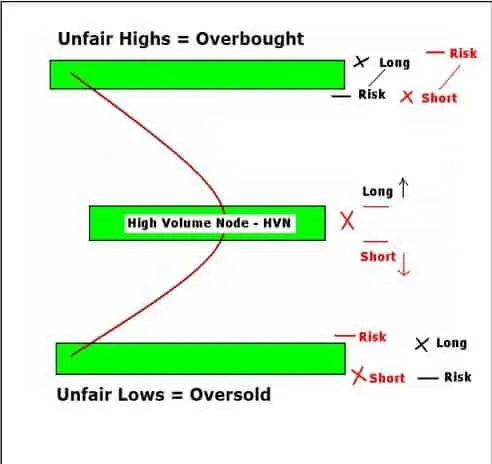

Market profile – “Steidlmayer On Markets: Trading with Market Profile” by J. Peter Steidlmayer, “Mind Over Markets” by James F. Dalton, Eric T. Jones and Robert B. Dalton and “Trading Without Crutches” by Tom Alexander.

Peter Steidlmayer showed the CME traders in 1984 the Market Profile or visual reflection of the market movement at different price levels during a day. While studying the price movement, Steidlmayer realized that the market tends to achieve a balance, expressed in the form of a bell-shape line or standard distributions. As soon as the market reaches equilibrium, it is ready for a focused trend movement in search for a new equilibrium. In order to understand the market profile better, it is also useful to read the Steidlmayer followers. James Dalton, Tom Alexander and Donald Jones developed the Market Profile further and changed it. Tom Alexander, for example, offers a readymade trading system of proactive and responsive trades. You can easily implement this system with 4 Market Profile variants available in the ATAS platform.

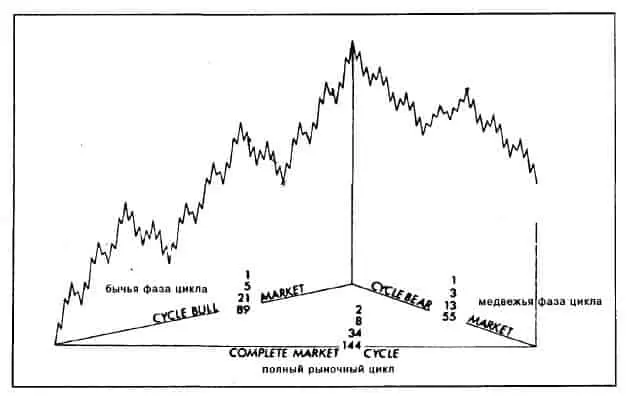

Wave analysis – “The Wave Principle” by Ralph Nelson Elliott and “Trades About to Happen” by David H. Weis. Ralph Elliott wrote in 1920 that the price does not change chaotically, but in cycles and waves. Each price movement causes an equal and opposite counteraction. The price, which has grown today, will fall tomorrow and vice versa. Elliott developed wave patterns and rules of working with them.

David Weis is a Wyckoff follower. He published several articles on how to apply the Elliott Wave Theory. Then he realized his “Weis waves” indicator, based on calculation of the volumes of buying and selling waves. One indicator and understanding of how the market works are sufficient for the Weis successful trading.

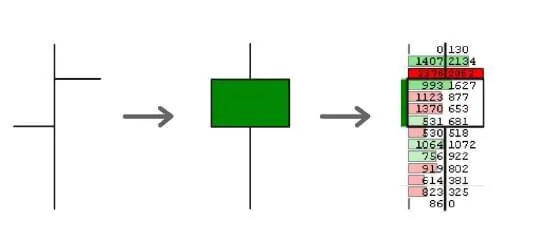

- Footprint – is the most modern reflection of movement of the price and order flow inside each bar. Footprint allows monitoring how buyers and sellers struggle for each price tick. We see an accurate number of asks and bids and also can mark price levels, at which one significantly exceeds the other. It is an unbelievable competitive advantage for intraday traders and scalpers.

Footprint exists for a little bit more than 15 years. Unfortunately, there is not a single book on footprint as of now. Everything we can find now are – instructions, articles. But the future belongs to the progress and technologies, that is cluster analysis and footprint.

Summary

If you want to become a successful trader, you need to find your competitive advantage and realize it step by step, gradually increasing the level of your professionalism. Books, modern software and your determination will help you to achieve your goal. Money trees grow overnight only in the Field of Miracles in the Land of Fools. Hard work is the key to success.