Footprint analysis: patterns and practice

This article is a practical instruction for those who studies the market analysis with the help of such concepts as volume, clusters, footprint and delta. This method of analysis focuses on real powers that influence the price – efforts of buyers and sellers.

For our today footprint reading (how to read footprint for beginners) we take the forward market, namely, a EUR futures (what is EUR futures). The aim of this analysis is to understand how really the buyers and sellers act and who of them controls the market at each point of time.

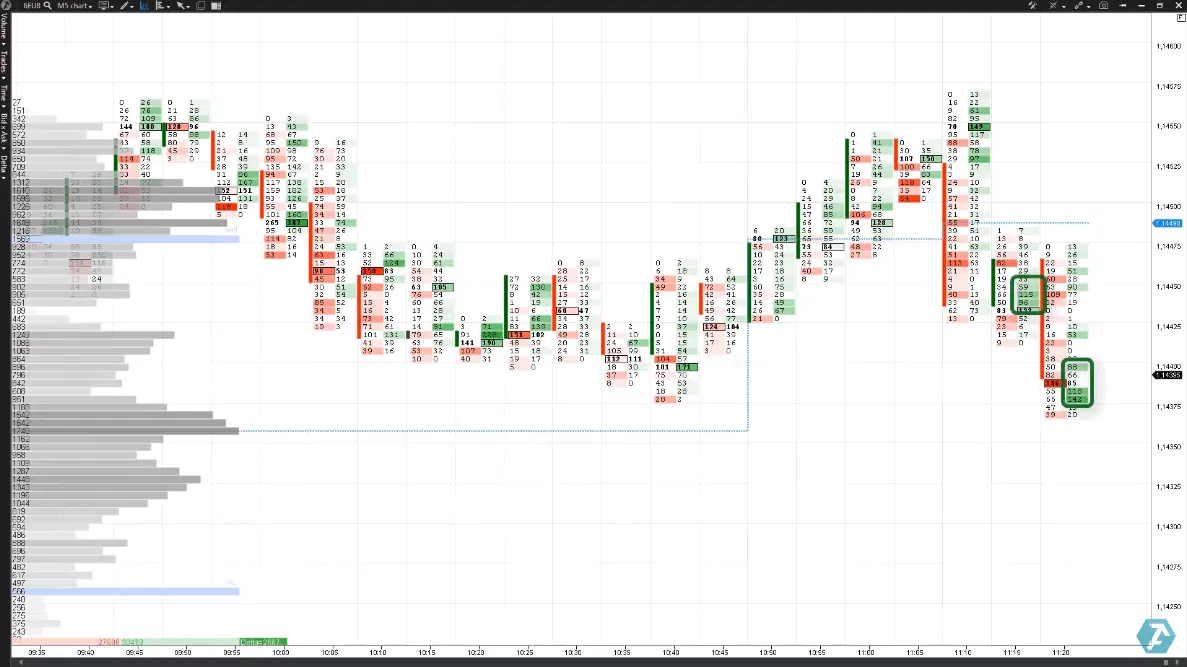

Bid-Ask footprint type

Let us use a 5-minute chart and bid-ask footprint type. It means that every candle, displaying 5-minute period of trading, is divided into 2 columns. Activity of sellers is shown in red color in the left column (the numbers register a number of sold contracts at each level), activity of buyers is shown in the right column. The brighter the color, the higher activity is.

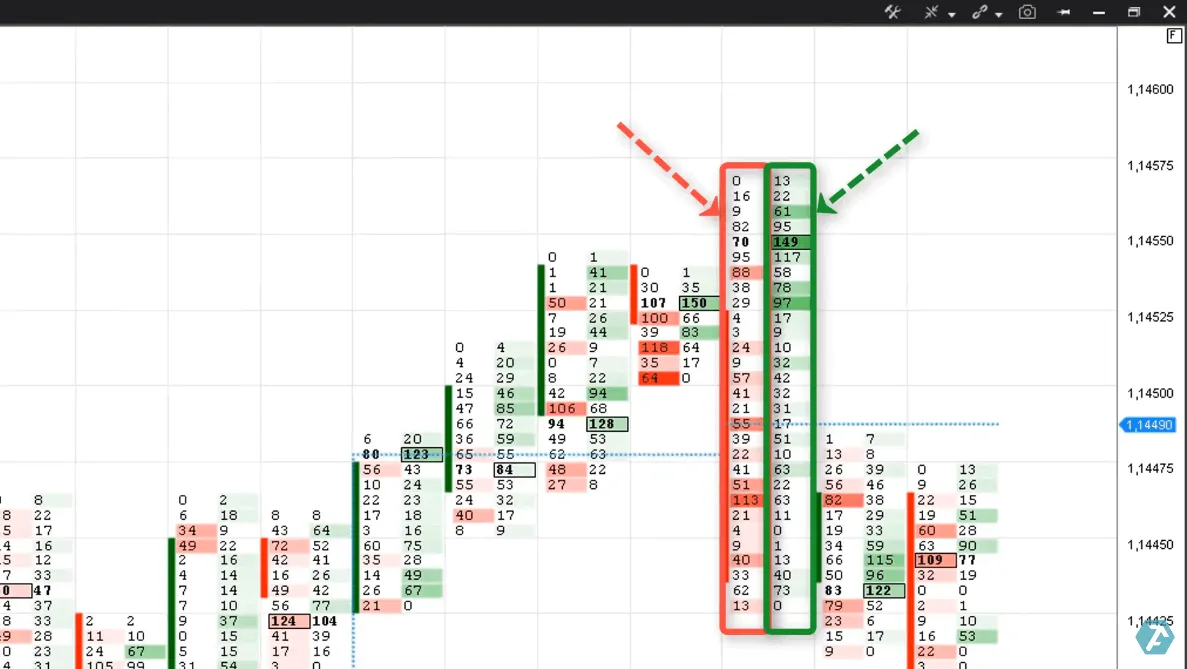

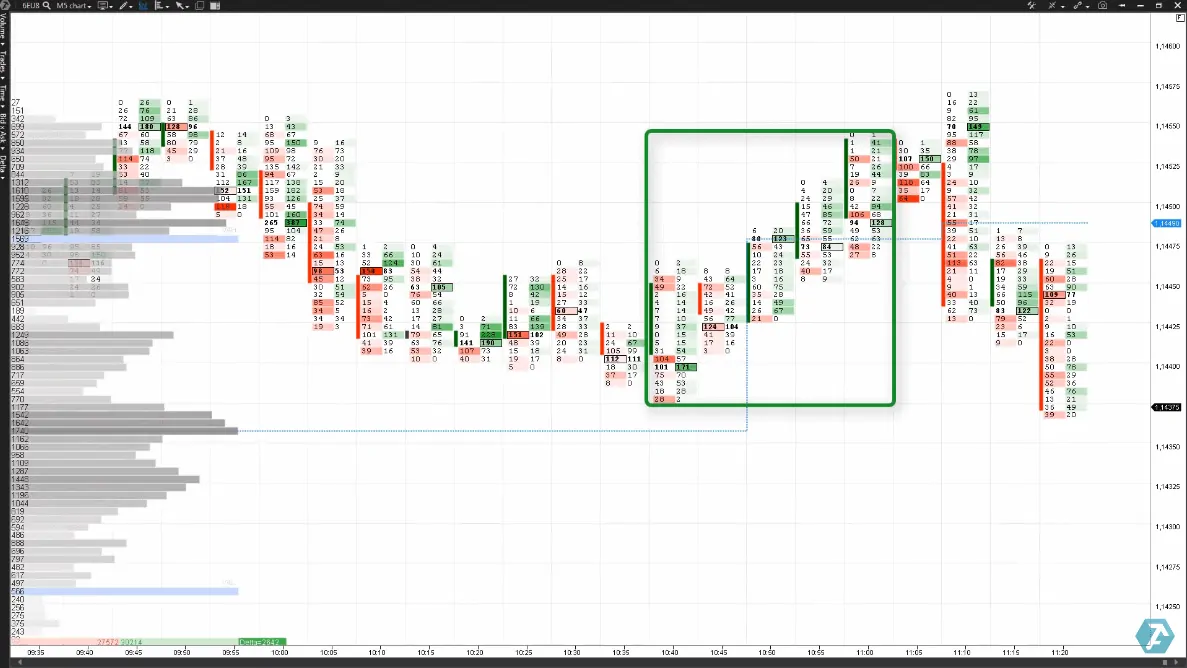

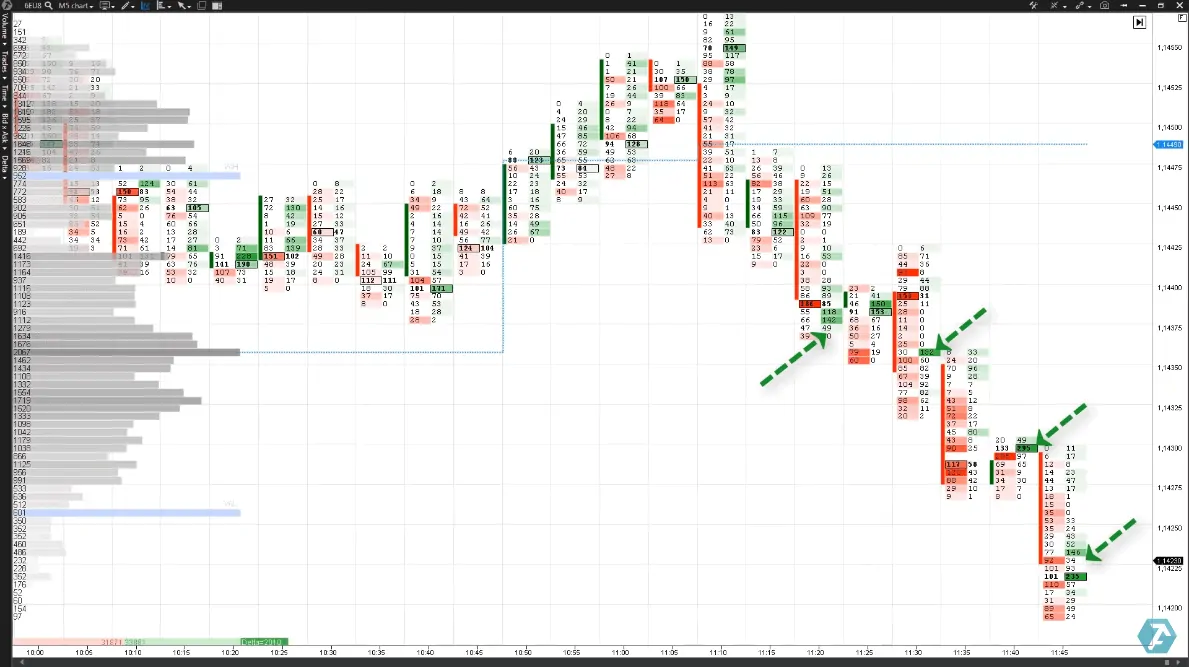

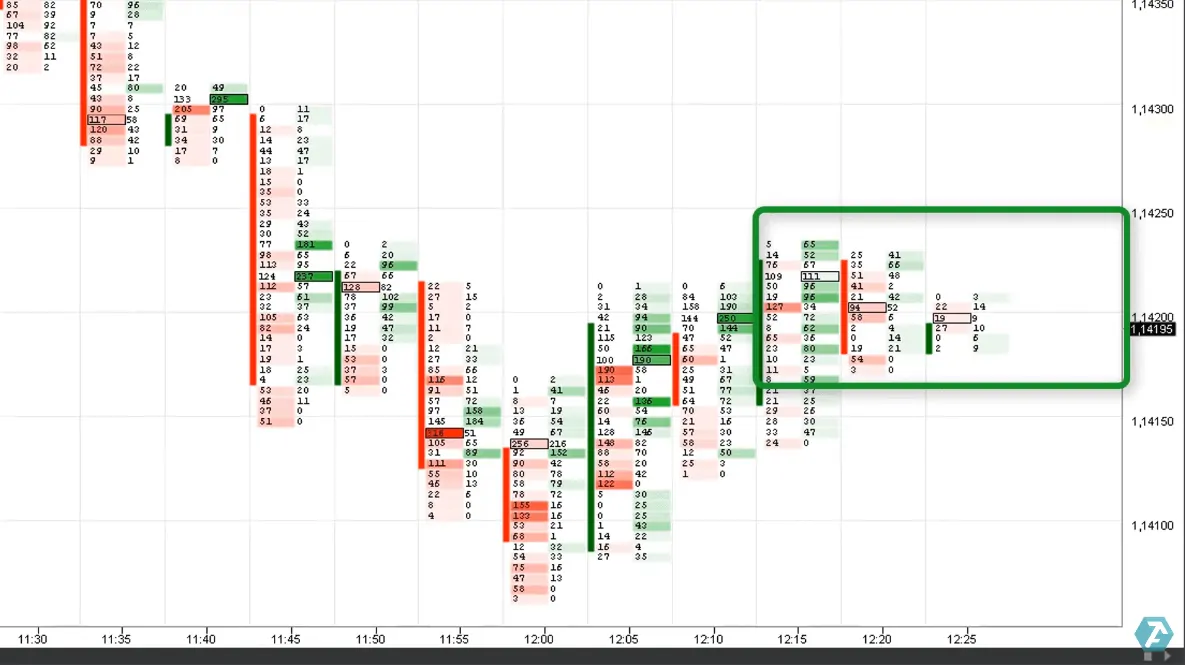

Let us analyze a short backstory before reading a footprint. In the example above you can see how the buyer temporarily controlled the price quote (marked with a green square). But what happened next?

The red rectangle draws attention to the moment when big sell clusters (bright red “bricks”) appear in the footprint. The market tries to go up after that, which means that market buyers push the price, attracting the followers.

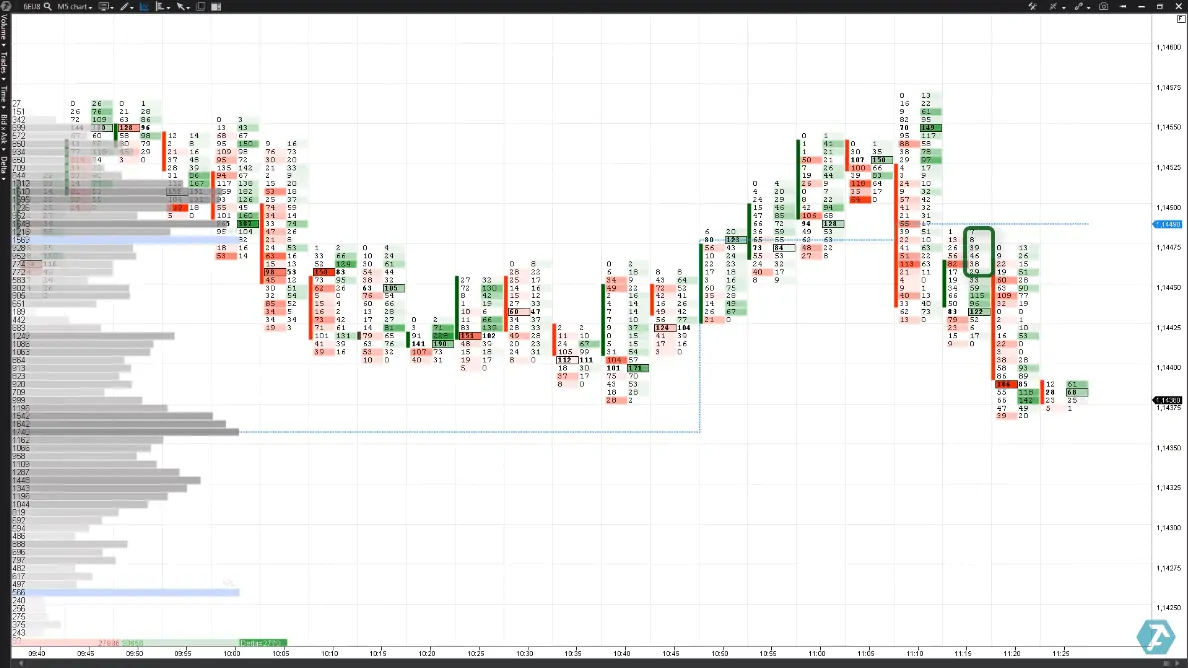

Formation of a powerful bearish reversal.

Green big clusters confirm this effort of the buyers (marked with a green arrow). But the efforts to continue the upward movement fail (a trap for bulls), and the candle is closed under the seller’s control (marked with a red arrow in the chart below).

Let us consider this maneuver as a formation of a powerful bearish reversal. Let us try to analyze the market by bars starting from this moment. We will try to analyze what takes place in each 5-minute candle while it emerges in the chart.

- So, what did happen after a wide bearish reversal bar was formed with stuck buyers at its high around 1.1455? We have two candles:

- The buyers try to move the market upwards in the first candle, but …

- … fail, since the next candle closes at lows under the seller’s pressure.

Taking into account the downward context and reversal bearish bar, the buyers could be stuck in the positions against the trend in these two bars (marked in the picture below). The limit seller engulfs them.

Aggressive sellers.

One more sign of the buyer’s weakness is exhaustion of initiative at the candle high, which is marked with a green rectangle in the chart below. You can see that major buyers do not support the movement, when an effort to increase the price is made.

The next candle. Aggressive sellers emerge. We can see their emergence in the column in the top left section – 2 bright red clusters. Thus, the sellers try to aggressively push the price further down.

After which the chain of sell orders is triggered and it looks very much like triggering stop orders, which initiate a chain reaction. One of the signs of triggering stop losses is absence of trades in one of the footprint columns, which is marked in the next picture.

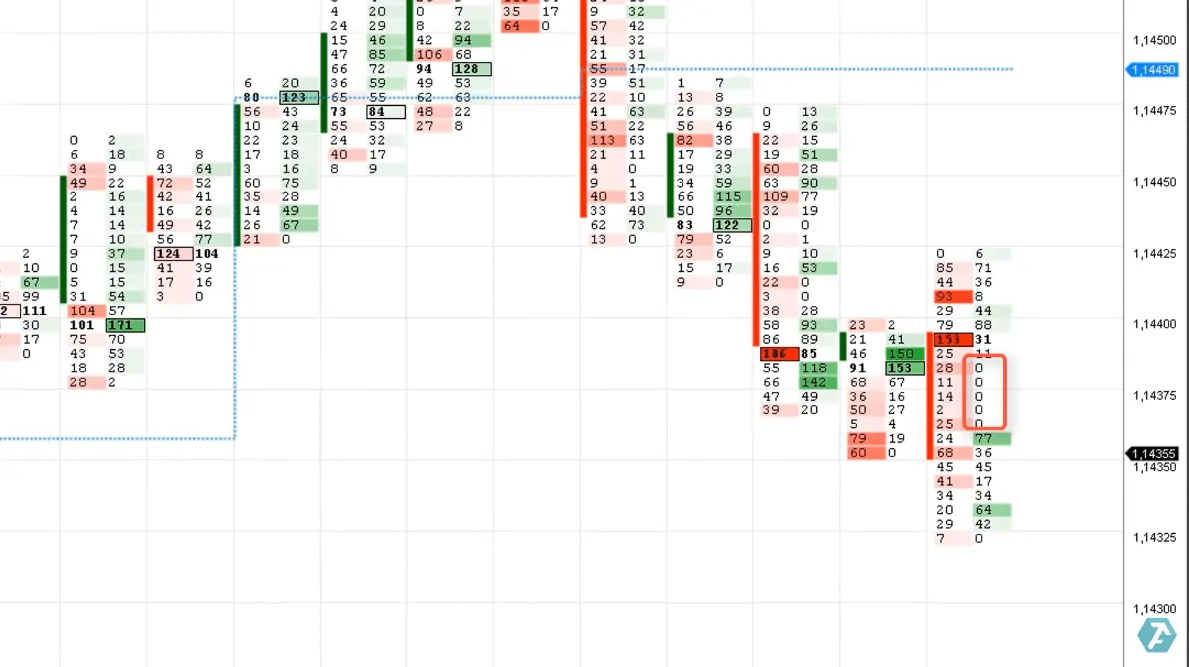

When we look at the general downward movement and the most recent candle in particular, we state that the sellers dominate over the buyers according to the footprint.

We can see in the next candle that the seller continues to push downward. Red cells dominate in the footprint and the candle again closes in the bottom, which means that the seller controls the market.

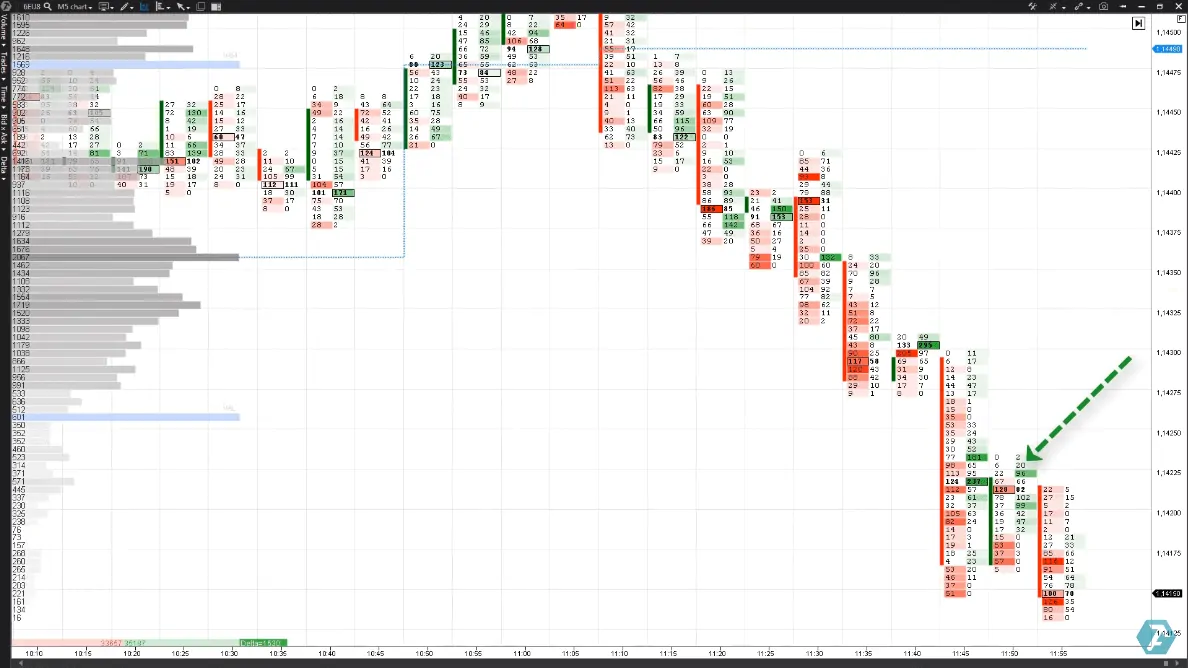

A specific feature of the downward movement is that all efforts of the buyers to reverse the momentum (executed buys are marked with green arrows in the picture below) fail.

An intraday downward trend continues. The arrow in the chart below shows how one more growth effort dries out, since there is a lack of initiative buyers to support the price growth.

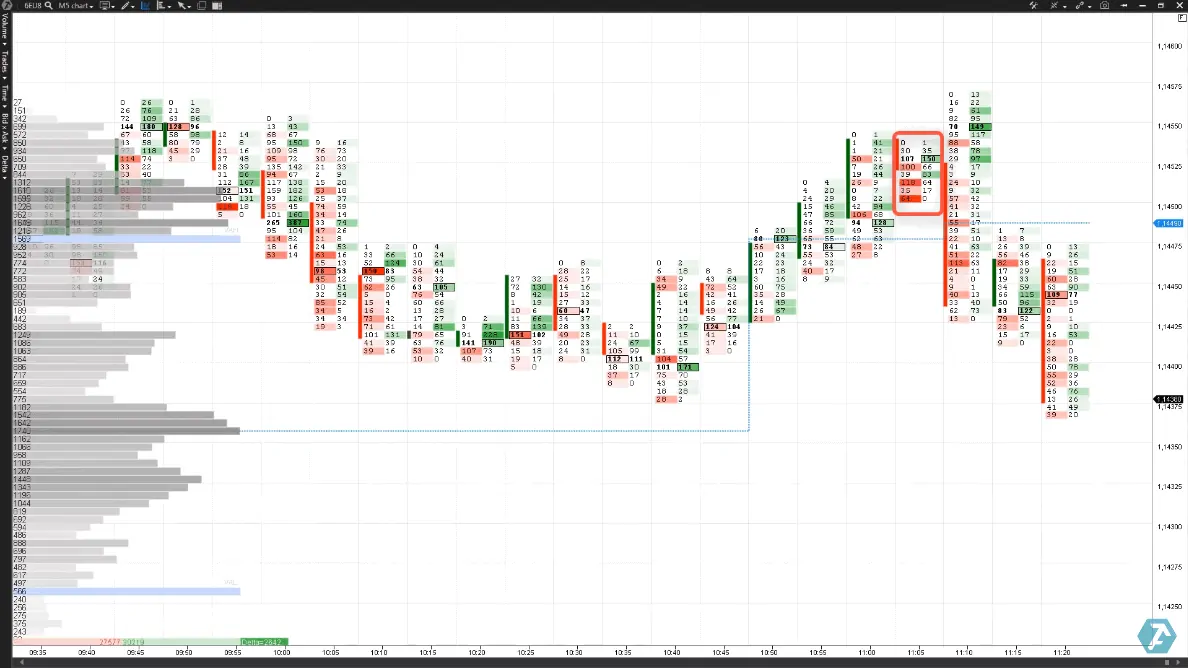

Big sell cluster.

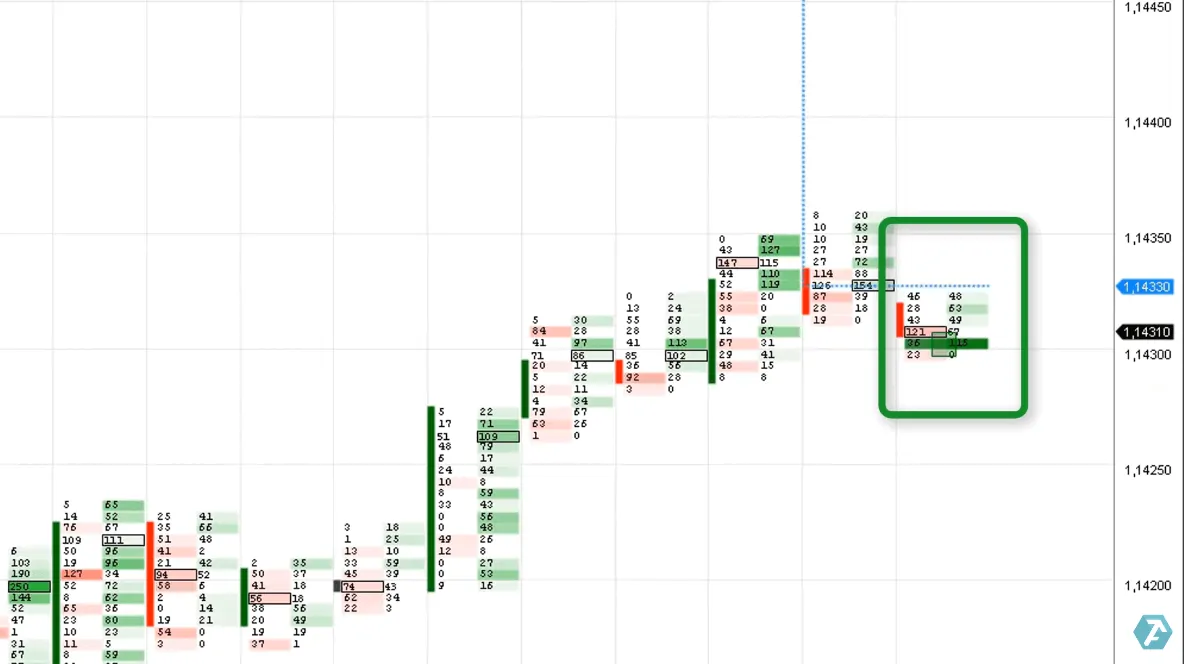

Something special takes place in the next candle. We can see in the footprint that a big sell cluster emerged for the first time during the whole downtrend and this cluster was engulfed by limit buy orders (marked with a red arrow).

Such a behavior may testify to the fact that the seller starts to fix his open sells with profit. It is an early sign of a reversal.

A breaking point takes place in 10 minutes.

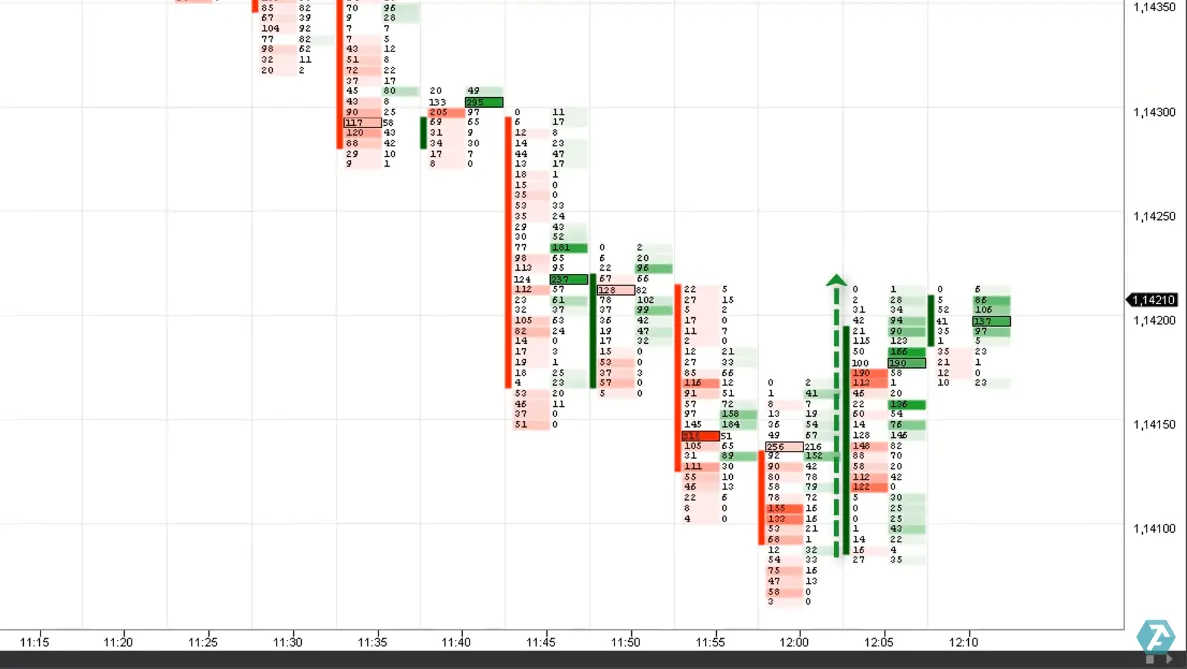

We can see very big aggressive buy clusters (in the left column). What’s interesting – the buyers manage to push the price up through these red clusters. A 5-minute candle is closed under control of buyers and we have ground to state a change of mood in the market.

The buyer starts to dominate in the footprint again (marked with a green rectangle in the picture below), there is a lack of sellers. Individual big sells are engulfed by limit buy orders.

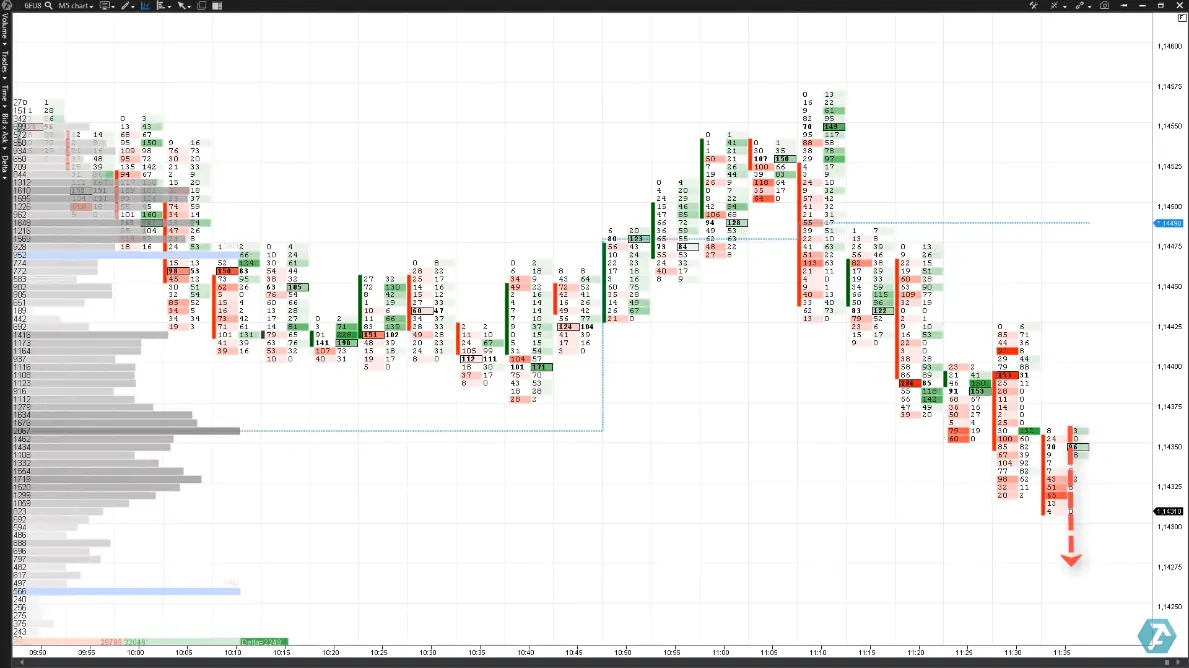

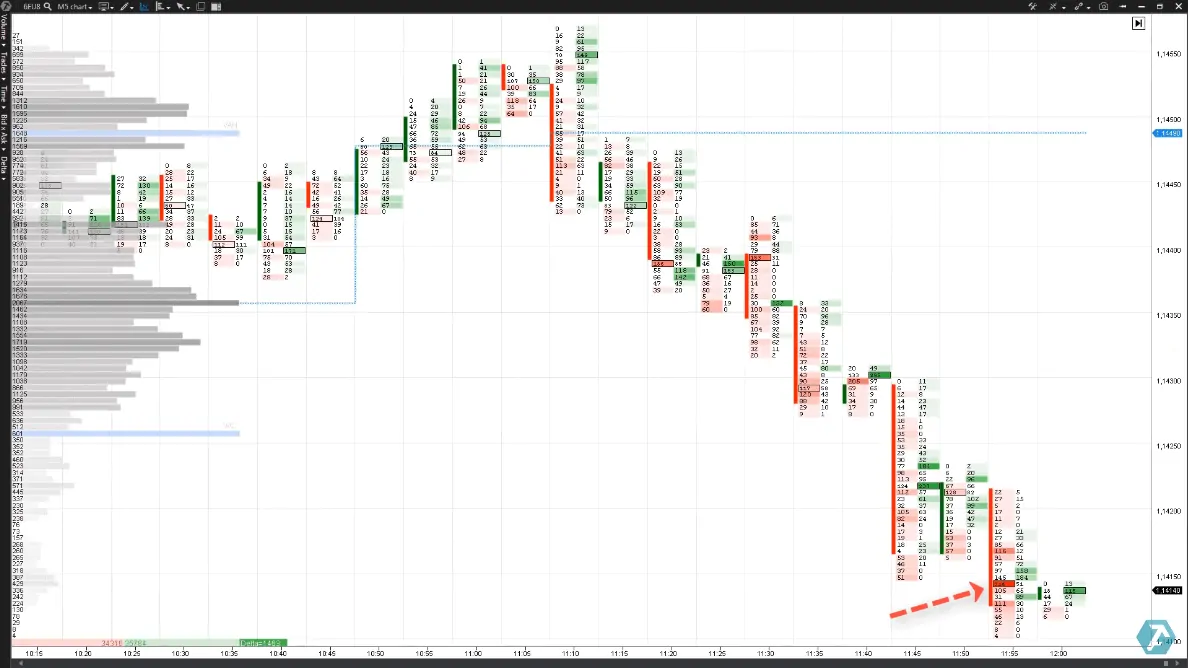

Now the price moves towards the sellers’ stops.

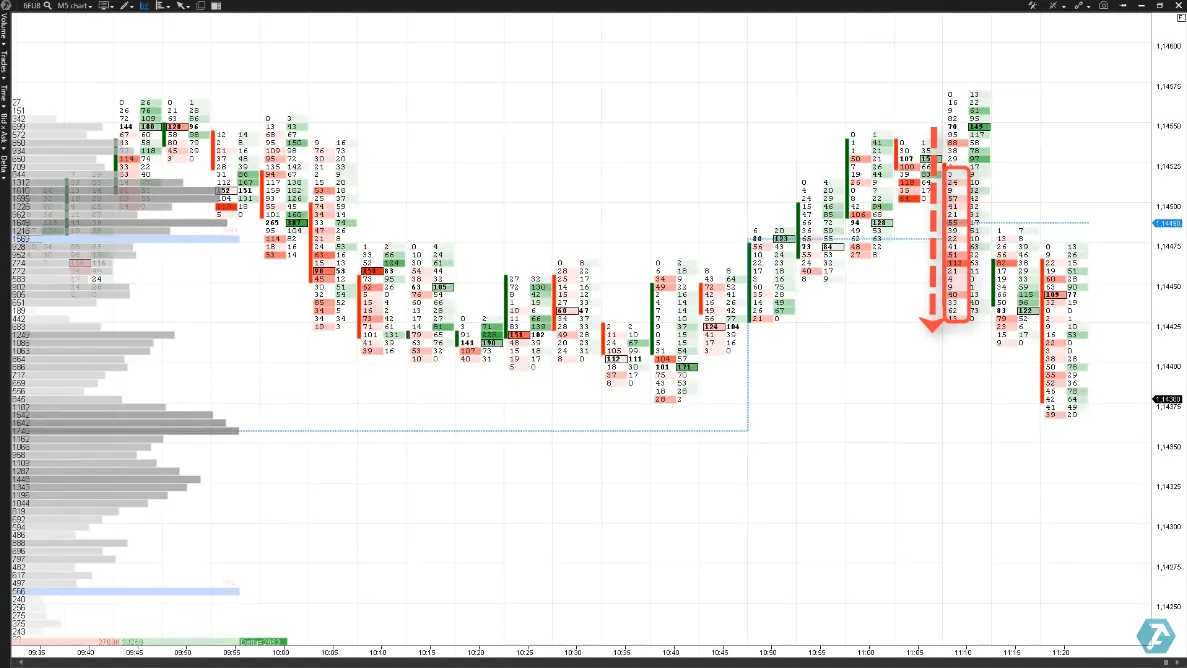

There is a tough struggle between sellers and buyers during the several next candles, but the price moves neither up nor down.

Trading in a narrow range does not detect a major seller, who has pushed the price quote down very aggressively before that.

It is not a surprise that this small flat is finalized by the buyers’ victory (upward breakout of the 1.1425 level). We can see a familiar picture, but in the opposite direction. Buys dominate in the footprint and there is a lack of sells in order to prevent the bulls from pushing the price upward.

A blue rectangle points at the POC in the profile (learn about POC). When the price increases up to this maximum volume profile level, the buyer prevents the price quote from going down.

It can be seen on a 5-minute candle in the lower part in the form of a big green cluster (marked with a green rectangle in the picture above).

Let us make a mini-summary. The seller failed to settle in the bottom and there are still no big red sell clusters in order to renew the intraday downtrend. And the buyer still pushes the price further up.

As well as it was with the downward movement we need to see the buyers’ exit from the market. The footprint will definitely show it in the form of big green clusters, after which a major seller, who would be ready to reverse the momentum, should appear.

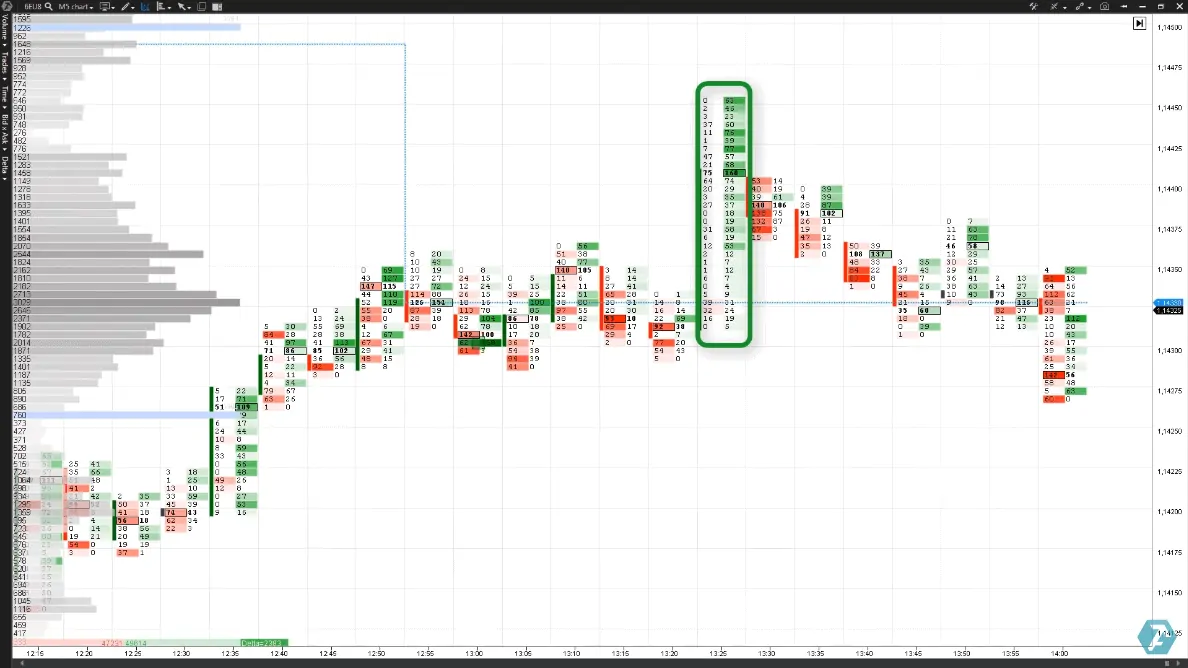

Namely these events are shown in the picture below.

A powerful upward impulse took place. We can assume that a major buyer left the market judging by the character of the movement and big buys in the upper part of the 5-minute candle (marked green). After which clusters with aggressive sellers (marked with a red square in the picture below) appeared immediately and the market started the downward movement.

Note that a seller, who pushes the price quote down, dominates practically in each 5-minute candle. Further on, the downtrend continued, moving the price quote below the previous low.

Summary

Footprint reading is detection of activity of buyers and sellers in order to identify who dominates. The above example shows in practice why it is worth to use footprint for analyzing the market in real time.

With the help of this powerful instrument of the volume analysis you will be able to:

- see the dominance of one of the parties without distortion;

- understand when the buyer or seller loses control;

- see the familiar candle patterns in more detail;

- analyze the nodal points with volume;

- assume where the profit fixation takes place.

Try footprint from ATAS right now. Check for yourself what advantage the footprint brings to your market vision.