3 years on the way to a dream. The story of a real trader.

Hello. My name is Julia. I am from Saint-Petersburg. My trading experience is 3 years. I do the positional and intraday trading on the Moscow Exchange.

In this autobiographical article I will tell you how I became a trader. I will split my story into:

- failures – a description of mistakes. Each failure contains a saving prescription of how not to fall into my traps;

- successes – a story of achievements. What I recommend.

But first, a bit of background before we start speaking about failures and successes.

Why I decided to reverse my life

Three years ago I decided to resign from a well-paid office job to start doing what was interesting for me – investment and trading.

I chose exchange trading, because:

- I had economic education;

- I was fed up with my job;

- I had free money and I was ready to take a risk;

- I wanted to run away from the office routine;

- I wanted to make millions.

How I planned to change my profession.

I calculated my monthly expenditures/income and built a plan of changing a profession. The plan envisaged that I could trade without income for some time.

From the very beginning I got qualification certificates of the Federal Financial Markets Service 1.0, 5.0 and 7.0, so that brokers would recognize me as a qualified investor.

Theoretically, qualified investors could buy any financial instruments of the Moscow and American Exchanges through Russian brokers. Practically, they are just beautiful pieces of paper hanging on the wall.

Preparation for exams and getting qualification certificates took about half a year. At the same time, I studied portfolio investment, bonds and stock at https://www.coursera.org/ and financial consulting in the Ministry of Finance of the RF.

I should admit that it was a doubtful decision. If I had a time machine, I would have missed this long stage of training and certification and started to trade on a real account much faster.

Having received all certificates I started to count the days until I make millions and set off for an ocean cruise around the world. However, the reality of first trades on the exchange turned out to be less radiant.

And now we come to my failures.

Failure No. 1. Mistakes when executing a brokerage contract.

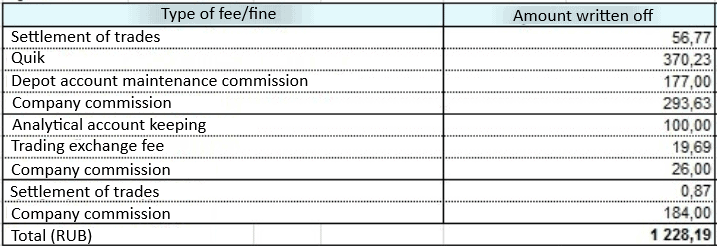

I took my time to select a broker. I compared conditions, studied trading platforms, commissions and cash withdrawal methods. But when I arrived to execute a contract, I made a lot of mistakes.

There is a popular term – a noob. A noob is a newcomer, incompetent person and inexperienced user. Well, when I opened a broker’s account I behaved like a dumb noob and happily agreed to everything the broker offered.

- “NYSE? Sure!” I didn’t know that I would have to pay for the access to NYSE more than RUB 300 a month and that commissions are accrued in USD.

- “LSE? Sure!” I had no idea at that time what LSE was. Additional payment for the access is another RUB 300 a month.

- “FORTS? Of course!” I also didn’t know what forward contracts were. Additional monthly commission was RUB 100.

- “Currency market? Of course!” I didn’t know that the minimum lot was USD 1,000. And there was an additional commission for trading less than 50 lots.

I think you’ve already got the main idea – I was connected to everything and mandatory payments were written off immediately. After I got acquainted with details and realized that what I need is FORTS (Futures and Options on Russian Trading System) and nothing else, I found out that I made a present to my broker in the amount of RUB 1,300. And, by the way, the tariffs of my first broker, from the point of view of trading on FORTS, were not the best possible ones, which I started to realize only a year later.

How to avoid failure No. 1:

- Read contract and tariff conditions, despite the fact that there is a lot of text there and it’s boring;

- Execute a contract online – this would help you to avoid additional offers and possible psychological pressure;

- Compare conditions and tariffs of different brokers;

- Make your decision what and where you trade beforehand. Learn everything about tariffs in this market. Stay focused and select only one market to start with. One cannot embrace the boundless.

Failure No. 2. Absence of important knowledge and trading system. Experiments on a real trading account.

It’s funny – I studied the theory for half a year but had no idea about the basics of price movement. I didn’t know:

- how orders are reduced;

- what bid/ask is;

- what the ATAS order flow is…

… and so on. I only had a very ordinary Quik as a trading platform.

I still remember my first trade – I bought Aeroflot stock in the middle of a falling trend. I behaved like a joke – I buy it because it falls.

I marked the week when I bought the stock with number 1. Unfortunately, it wasn’t the last time when I did it.

For about half a year I tried to buy and sell everything I saw and considered acceptable – commodity futures on gold, oil and platinum, futures on indices and stocks and currency futures. It resulted in the loss of 20% of my account.

Of course, there were accidental achievements, when I managed to catch up with a developing trend and make some money. For example, I opened a long position in a Lokoil stock futures on the eve of New Year during two years. Both times I made a relatively big profit: about RUB 15 thousand in 2018 and a bit less in 2019 (closed too early).

Do you think I conducted a thorough technical or fundamental analysis before buying? No. I bought these futures hoping for a New Year rally. The trading system during the first year on the exchange had the proud name – ‘maybe’.

Trading without a system is a cause of many mistakes:

- trading from sheer boredom. “I cannot just sit and watch the screen. I need to do something during a trading day”.

- trading in big lots.I wanted to make a lot of money immediately. I watched a broker’s webinar where a trader made RUB 17 thousand during a day and I badly wanted to reach that number.

- trading in several markets and instruments simultaneously. For example, I bought a Moscow Exchange index futures, RTS index futures and Sberbank stock futures. If I would have done it along a trend, perhaps, I could have reached the desired 17 thousand. But I managed to do it against the main trend, increasing my losses, because the correlation between the Moscow Exchange index and Sberbank stock achieves 80% and higher. (By the way, I traded by correlation too).

- trading by an unclear plan. On the one hand, you have a trading plan, on the other hand, it has unclear statements, which allow several variants of trading by this trading plan.

- absolute misunderstanding of what takes place in momentum. I saw in the Quik platform that prices go up and down and constantly tried to understand why this happens.

Now I think that it is not important why the price moves. It is important how it moves. Let’s assume that the price does not grow and the positive delta grows on the day’s local high. Perhaps, the market buy orders are engulfed by limit sell orders. The key word is ‘engulfed’, that is, the limit sell orders do not let market buy orders move further. Quite often this engulfing forecasts a downward reversal.

How could I see engulfing and reversal in Quik at that moment? I still don’t know. That is why I started to look for the required software with rich functionality for analysis of buyers and sellers actions. And the ATAS footprint shows it immediately.

I will give an example in the range chart (10) of a WTI oil futures. I like charts that are not connected with time, since they show the market situation from a different angle and the existing trading platforms do not have them.

I marked engulfing with a rectangle and the horizontal red line shows the level, above which the buyers failed to break through.

- Number 1 marks the bar with the biggest volume for the previous upward movement.

- Number 2 marks neighbouring bars, in which the buyers obviously tried to push the price up. After that, the delta becomes stably negative, buyers move into the shadow and sellers become more active. Big volumes and small delta show a fight between buyers and sellers. And a big number of red footprint cells shows that sellers win.

- Numbers 3 and 4 mark bars in the breakout area, where there is an obvious overweight of sellers.

This is how I see engulfing and reversal in a footprint. This footprint type is called the Bid Ask Ladder. I traded by candle charts in Quik.

How to avoid failure No. 2:

- Watch videos on the ATAS channel. Start from the basics of the market movement of prices, clusters, volumes and order flow.

- Look inside each bar to understand who exerts a bigger pressure – buyers or sellers.

- If you want to be an intraday trader, pay attention to what takes place in momentum, in other words, right now in front of you on the screen.

Failure No. 3. Rushing around between trading systems.

I have tried more than 40 techniques, indicator sets and magic Grails during my short trading life.

Unfortunately, I cannot even call them appropriate trading systems. I didn’t use a single technique for more than a month. Most often, I became disappointed after several loss-making trades. I used to abandon yet another failed strategy and continued to look for the magic wand.

David Weiss calls this mistake the most significant mistake of beginner traders. I skated across the surface hoping to get an immediate result without efforts and risks instead of improving one strategy.

These are some things that I tried:

- Alexander Elder’s triple screen trading system. I read all of his books, but it is difficult to apply his techniques for intraday trading.

- Candles, triangles, channels, technical indicators MACD, RSI, Momentum, OBV, Ichimoku, etc.

- COT (Commitment Of Traders) reports. I manually calculated indicators, which Larry Williams described in his books, for oil and gold futures and tried them on the Moscow Exchange. I also read Larry Williams books and again came to a conclusion that these methods are not good for intraday trading.

- Spreads and correlation. I even bought a hard copy book named ‘Futures Spreads’, since I hadn’t found anything of interest in soft copy. The book speaks about positional trades, for which many contracts should be opened quite often. For example, you need to buy/sell 11 contracts (5 against 6) in order to work with the spread of ordinary and preferred Sberbank stock. It is believed that spread trades have low risk, however, losses could be significant due to a large number of contracts. I wanted to try the Brent-WTI spread very much, but my broker didn’t allow me to trade WTI futures.

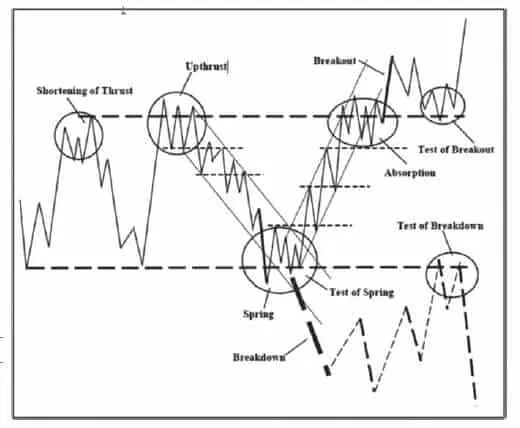

- Springs and upthrusts of David Weiss. David Weiss is one of my favourite teachers. I read his ‘Trades About To Happen’ book twice and a picture from this book still hangs over my table. It is called ‘Where to Find Trades’.

By the way, Alexander Elder brought me to the book and technique of David Weiss. I like to read what authors, whom I like, recommend me. I think that I didn’t achieve positive results because the Quik lacked important things – instruments for analysis of waves and charts, which are not connected with time. All of this I found in ATAS later and got to like David Weiss even more.

How to avoid failure No. 3:

Your trading system should be simple and clear, and you should trade ALL its setups at least 4-8 weeks and gather the statistics of results. Loss-making trades are a part of the trading system rather than a reason to look for another system

Systematic trade differs from the chaotic one with the rules of entry, exit and stop. Preliminary, the trading system should show the positive yield on historical data:

- Payoff ratio = average profit/average loss > 1;

- Hitrate ratio = number of profitable trades/total number of trades > 0.6.

There is an article about trading strategies in the ATAS blog.

Failure No. 4. Disregard of the capital management rules and absence of discipline.

Ever since reading Elder books I tried to observe the rule of 2% and 6%. Losses in any trade should not exceed 2% of the capital and total losses during a month should not exceed 6%. But I didn’t limit myself to a number of loss-making trades during a day and didn’t stop trading even in the event of significant monthly losses. My relations with stops are still very difficult – a bit later in more detail about it.

How to avoid failure No. 4:

- Identify a number of loss-making trades per day beforehand;

- Identify acceptable daily/weekly/monthly losses;

- Do not violate the rules of the capital management.

Failure No. 5. Holding loss-making positions.

Losses cause a great discomfort and psychological trauma to me. I am in a bad mood and go off on my family and do not sleep well. Sometimes, it was so difficult for me to withstand the pressure of losses that I put more money into my broker’s account. Not because the original capital was exhausted, but because it reduced to important psychological levels. I stopped to add money to my account when I realized destructiveness of these actions.

However, in 90% of loss-making trades I was waiting for the breakeven for several days and even weeks. The idea that loss-making trades become profit-making trades stuck in my mind. Every time I hope that sooner or later I start making a profit. This is the biggest problem in my trading, which I have not managed to overcome until now.

The biggest loss I made was RUB 7.5 thousand. I held my position for a week. It was closed automatically when the contract was changed. A question arises why I didn’t close it earlier. It was a conscious shock therapy. Maybe I needed to make a big loss to make a change. Maybe that was necessary for subconsciousness to realize that losses should be cut off quickly and always use stops. I didn’t know how else to make myself post protective orders in all trades.

How to avoid failure No. 5:

Use stops – not mental but real ones. Try protective strategies. If you are ‘pushed out’ by a stop, it means that your losses are minimized and you can continue trading. A stop is good. Otherwise, you would stay, as I did, in a loss-making position and wait. Do not let the situation degenerate to big unfortunate losses.

Five failures. Resume

I lost about 30% of my original capital during the first year of active trading. It was painful, I started to doubt my abilities, didn’t make money and didn’t understand why it happened. Something had to be changed.

I decided to find a high quality software, which would have given me at least some competitive advantage. There were just a few specific requirements:

- access to the Moscow Exchange forward market;

- reasonable cost;

- many unique indicators;

- a long free testing period.

I came across ATAS accidentally. Perhaps, it is my trading destiny and affection for the rest of my life, like the first teacher or first love.

That was where my success story started.

Success No. 1. Meeting ATAS and changing the broker.

I came across ATAS when was looking for information about the delta. It seemed to me that the delta would change my trading career for sure. The delta has a direct relation to the order flow and shows the difference between the market buys and sells.

When I tried the test ATAS version for the first time, I was struck by the multitude of information, which I didn’t know and didn’t understand. The testing period of 14 days was insufficient to get acquainted with all indicators. I read the blog and watched videos on the channel and tested something immediately, for example, range charts. And I decided to start everything from the beginning after the testing period: I changed the broker, paid for ATAS, renewed trading reports and put up with losses.

Success No. 2. Studying basics of the cluster analysis and order flow.

I wanted to understand how prices move in the market. And only ATAS helped me to see how orders are reduced in the order book and how trades on the tape look like. Only in ATAS I found such a big number of charts that were not connected with time. It was a magic for me and I felt myself like Aladdin in the Cave of Wonders. Now I cannot imagine trading without ATAS, I just do not understand how I traded in another platform.

Cluster charts bring me to the state of aesthetic delight. Let me give you an example of an RTS index futures chart of the delta (1000) type. Charts of this type are not connected with time and a new bar is formed as soon as the delta reaches +1000 or -1000 contracts.

- I marked the first local high, from which the price rolled back, with point 1. POC (Point Of Control) of two neighbouring bars stays nearly at the same level – it is resistance. The maximum volume levels in the next three bars move down and I marked this movement with a red arrow.

- Point 2 is VPOC (Virgin Point Of Control) or the highest level of the maximum volume for a trading session. The price often reverses from such levels, which we observe in the chart. I marked the coinciding POC levels, which form resistance, with the upper black horizontal line. The price rolls back again, but note where the rollback stops – it is the very first bar of the day, that is, a test of the first POC.

Can you ever compare this beauty with a common candle chart? I do not know how to read this situation in a candle chart. I agree that we analyze the past, that is, already formed setups, but you will not be able to see even the past in a candle chart.

Just for comparison, below is a 15-minute RTS index futures candle chart for the same trading day.

The chart is less informative on common candles, while I can see what happens inside each bar on ATAS clusters. And even if I do not always correctly interpret the market situation, I can observe, analyze, make important conclusions and accumulate my experience.

Success No. 3. Writing articles, reading books and testing trading strategies. Discipline training.

Writing articles for the ATAS blog helped me a lot in trading because I analyzed each topic in detail and tested it on my trading account. I continue to lose money from time to time and I still have nervous breakdowns, which are connected with stops.

But my trading strategies became more detailed and clearer than before. And, what’s most important, I didn’t discharge them after each loss. I even considered a variant of trading by different strategies on different week days, since I couldn’t realize for a long time what brings me more profit and satisfaction.

- Weiss Waves. When I saw this indicator in ATAS for the first time, I decided that my destiny waves me with its hands again. It is a wonderful instrument and, when the second article on this topic appeared, I also learnt how to use the ruler. It is not a strategy, it is an art.

- Market Profile. I had never known about the market profile so much before. A profile is everywhere – in the order book, in the chart and on individual chart bars. Responsive and initiative trades really work, you just need to find your time period and instrument.

- Delta and Footprint. I’ve already given many examples here.

- Strategies on the basis of the stacked imbalance, big trades and cluster search indicators – there are examples in the blog.

- DOM and Tape. This is my most recent interest. I will write about it in detail a bit later.

The question arises: if these strategies work, why am I still not on an ocean cruise?

The answer is: I am still looking for the golden mean = profit + emotional satisfaction + a brief working day + entertainment. And I move closer and closer towards this goal.

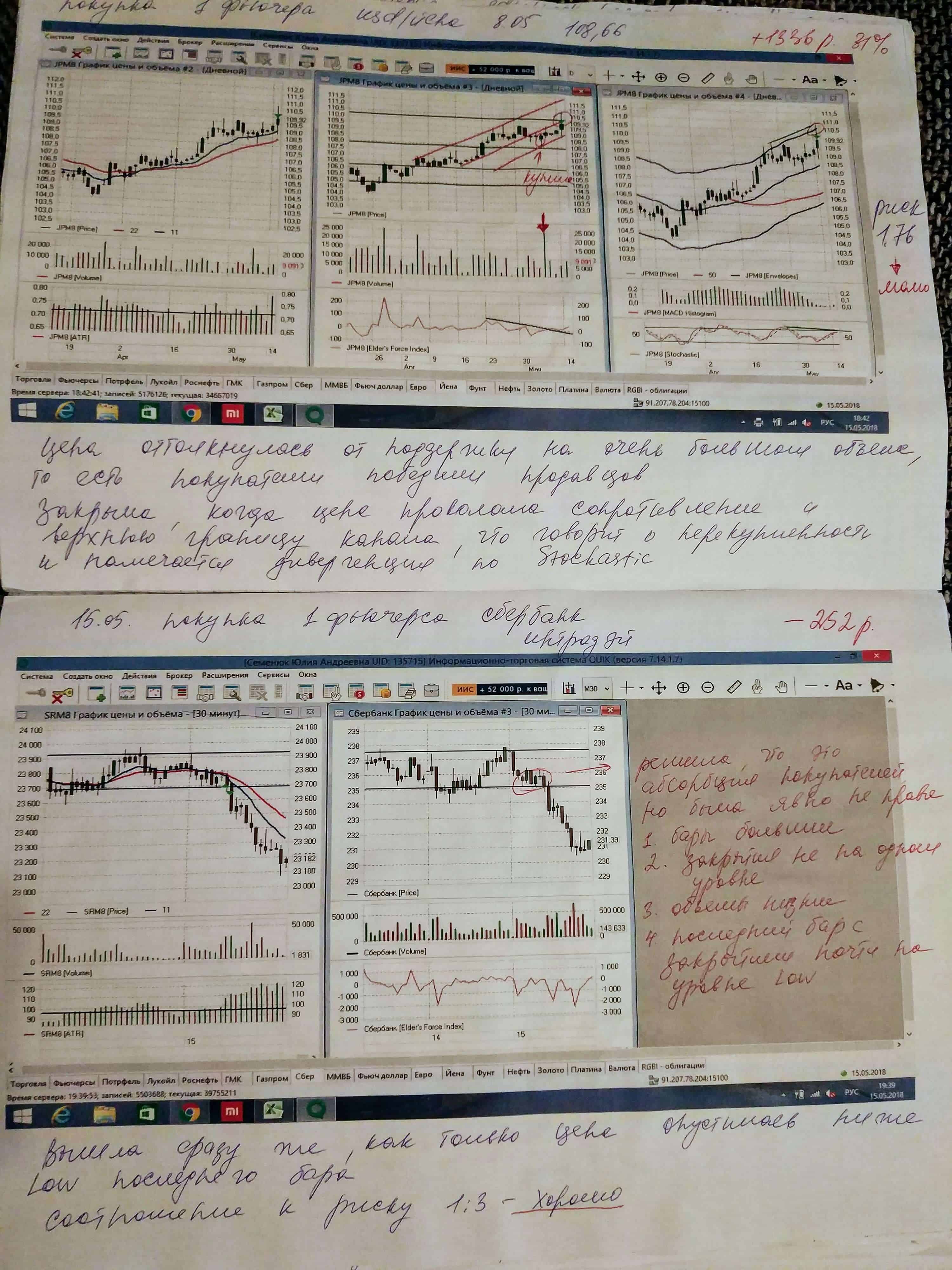

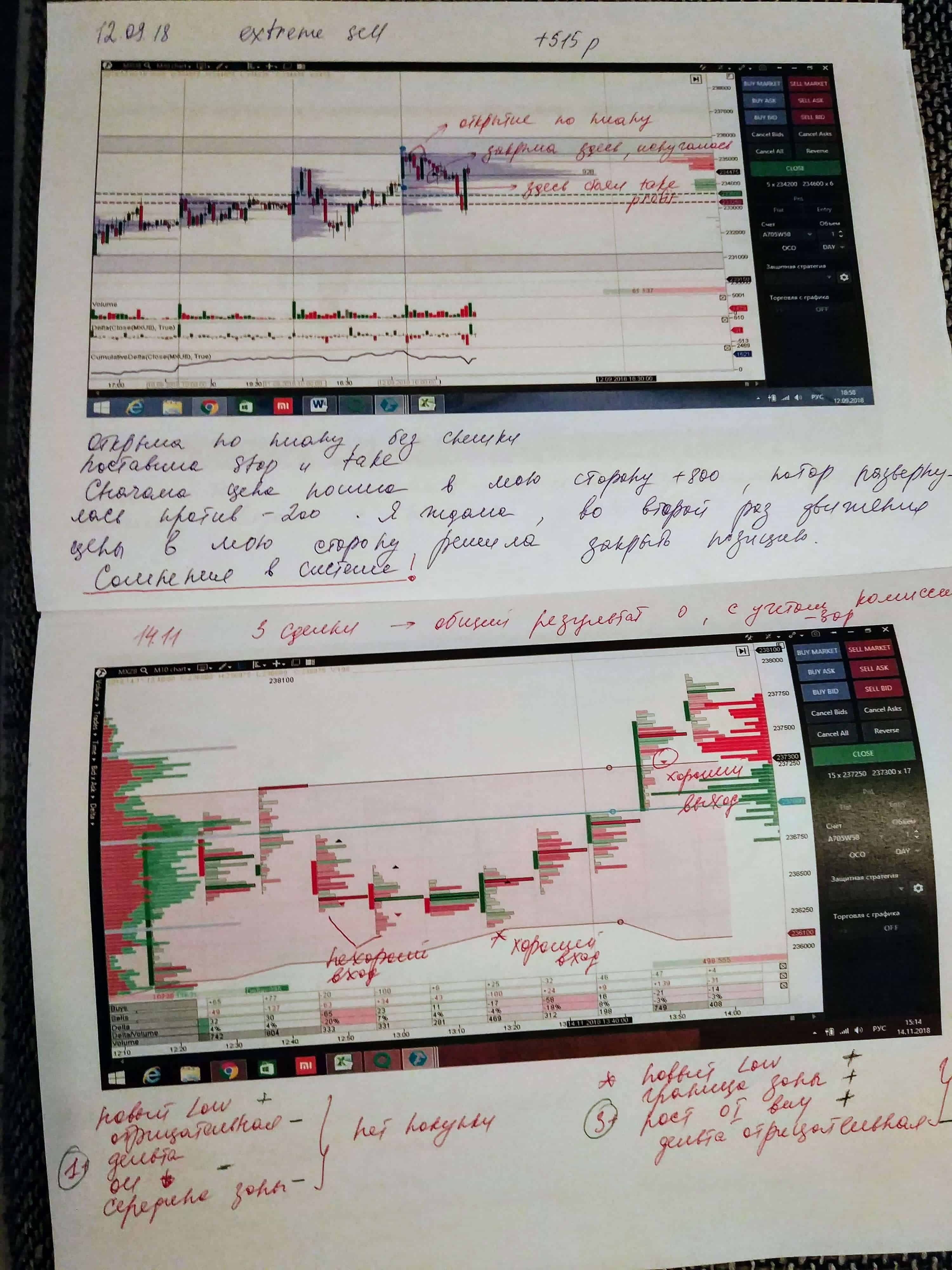

My trading log developed together with me. This is how it looked like before:

This is how it looks like now.

I do not print out all my trades now because I trade during a day quite often, but I register my actions and analyze them. I want to introduce screen recording during trading, so that I could reproduce my activity and analyze mistakes in more detail.

Success No. 4. Improving my English and broadening my outlook.

I studied a lot of information in the English language. So, indirectly, ATAS improved my spoken and written English.

The markets are global. Traders all over the world communicate mostly in English. That is why, English is a must for search for important knowledge about footprint, delta and profiles. I read more than 45 books on trading and psychology during these 3 years of free floating.

Success No. 5. Acquiring my own trading style.

I remember one phrase from the webinar about OI Analyzer with Denis Sotnikov: “if you do not see what took place in the book and on the tape, you will never understand …”.

The order book always seemed to me as something very complex – a lot of numbers, they are constantly changing, the cells flash, some limits, positions traded apart from limit orders and what not. The tape scared me even more. Especially after I read Wyckoff.

But I wanted to try to study the issue in detail. Do you know what the feeling of the flow is? It is an emotional uplift during some activity, when you do everything correctly. The time stopped, you do not want to eat/drink, you are submerged and focused. You are filled with energy as a glass with water and the energy runs over.

These are those feelings, which I experienced trading in DOM:

- I feel myself comfortable and easy – ATAS has a wonderful DOM;

- losses are small, that is why not painful. I limited the number of loss-making trades during a day to 3. Got 3 losses – closed the terminal;

- immediate feedback in the form of a profit or loss. Profit stimulates, loss makes you analyze your actions and mistakes;

- I trade several hours a day, so I have time for sports, family and other activities. Moreover, I nearly ceased to stare at the screen and look for trades;

- I watch English-language webinars and analysis of real-life trades – it is interesting and useful for training;

- I see certain regularities in the price movements. For example, if there is a gradual expansion of the upper or lower boundary of the day’s range without powerful back rolls, the price, most probably, would grow. Or, if the price sharply broke the upper boundary and set a new high, but then bounced back under the first boundary and cannot cross it, the price, most probably, would fall.

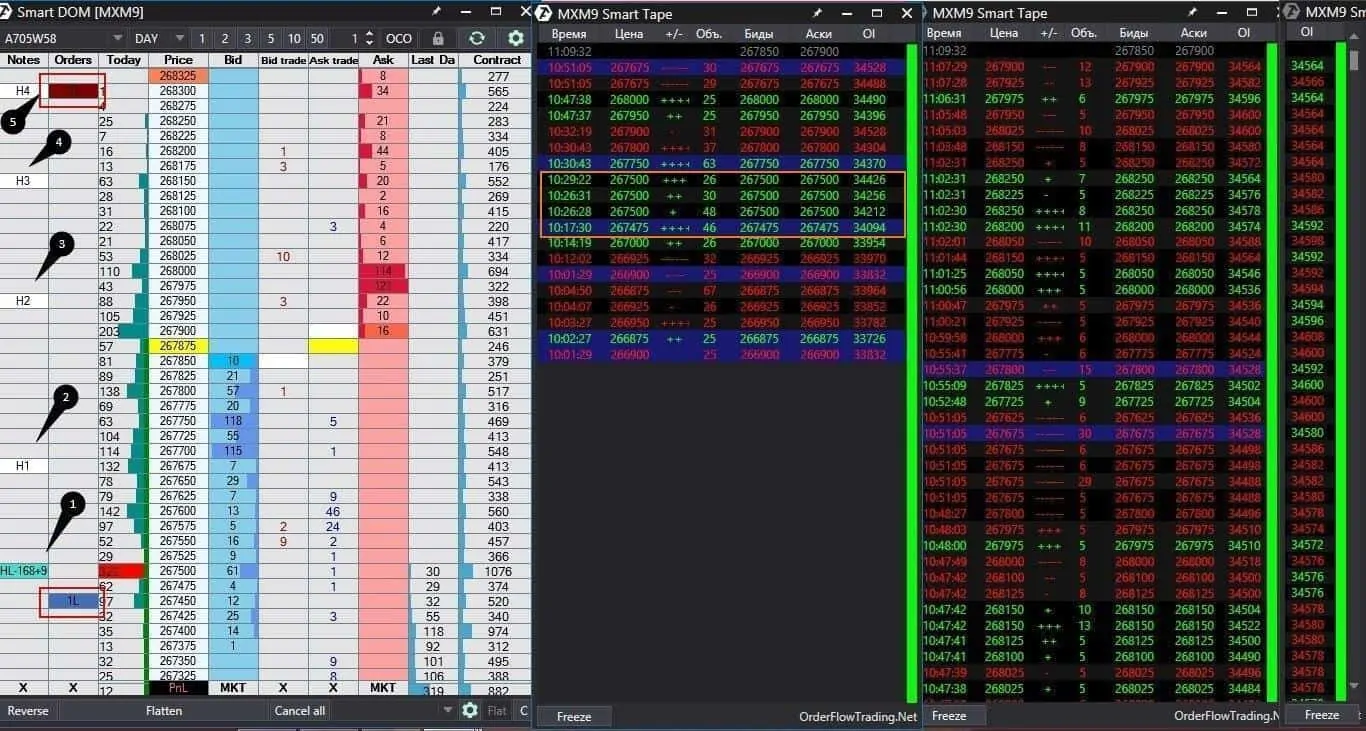

Here’s a real-life example of trading a Moscow Exchange index futures contract in the order book. It is the beginning of a trading session. I like to trade in the morning when the activity is high and, sometimes, the price is in focused movement – as it is in this example.

I marked the previous day’s high (HighLast) with number 1. I mark important levels of the previous day (POC, High and Low) before a trading session and mark levels of the current day during a trading session.

168 new contracts were bought in point 1 – this activity is marked with a yellow rectangle in point 1. Trades from 25 contracts are filtered out on the middle tape. Then the price gradually extended local day’s highs (points 2-5), but these extensions narrowed down or took a smaller number of ticks, which means that the pressure of buyers reduced. You can see from the contracting profile that the number of buys decreases. I wanted to buy from point 1 or sell from point 5 and posted limit orders there, marked with red rectangles.

I bought at RUB 267,500 and closed at RUB 267,825.

Results of the year 2018.

I always post a stop now and do not trade after 3 consecutive loss-making trades. In addition, I limit my monthly losses to 6% of the total size of my trading account (which I, fortunately, haven’t reached for a long time already).

During the year with ATAS, I mastered a multitude of instruments, acquired a holistic comprehension of the market and invested a lot of effort in polishing my ‘ideal’ strategy. The result of these changes are completely controlled drawdowns, which were less than 10% in 2018. Unlike the previous period, profitable months alternate with loss-making ones. Sometimes, there are several profitable months in a row.

The main problem, as well as during the previous year, was the absence of stops and waiting for the breakeven. I managed to cope with it through the shock therapy or major losses, caused by my wrong behaviour.

Summary.

A journey of a thousand miles begins with a single step. Lao Tzu

I’ve developed as a trader for one thousand days already and do not plan to stop.

At the previous year end I developed a plan of improvement for the nearest months:

- I identified problematic behaviour – nonobservance of the trading plan rules. Trading without stops and sticking to wrong psychological habits.

- I set a specific goal – bring back the original capital until the end of 2019.

- I decided what and how I will trade – DOM, 2 hours a day.

- I drew up a setup list and a checklist of rules, which I should observe. What setup is, what rules are observed, at what level I could enter and where the stop is.

- I keep a weekly trading log and register dynamics.

It would be interesting to reread this article in a year’s time and compare dynamics.

I am not a wizard, I am just studying. I haven’t made millions yet and didn’t set off for an ocean cruise around the world. I sincerely hope that the southern wind will blow one day and my hopes will come true.

Perhaps, my experience will help you to avoid major falls and achieve success faster. Thank you for reading. Share this article if you found it useful.