How to trade with the Smart DOM in ATAS

Do you agree that you can endlessly watch three things: how the fire burns, how the water runs and how another person works? Do not believe in restrictions: you also can endlessly watch how orders are changed in the order book.

In this article we will focus on methods of making profit with the help of DOM. Read now:

- What the DOM is and why it is useful to know how to work in it;

- Review of Smart DOM in ATAS;

- Why it is difficult to trade in DOM and what markets are good for trading in DOM;

- Trading setups and basic rules;

- Scalping in the book or levels, which we see in DOM;

- One trader’s experience.

What the DOM is and why it is useful to know how to work in it.

DOM stands for Depth Of Market and is the order book. In fact, it is a list of orders, posted for buying or selling. The higher the price is, the more the sell orders are, the lower the price is, the more the buy orders are. Some traders prefer to work with the book only, without looking into charts. They believe that the book reflects the real balance of demand and supply. And they judge about the market strength or weakness by behaviour of orders and prices.

We will explain you, using a table, what the Depth Of Market is. Let’s assume that there are two traders in the market only – John and Peter. John has much more money than Peter.

| Price | John’s bids | Peter’s asks |

| 1225 | 250 | |

| 1200 | 200 | |

| 1175 | 440 | 75 |

| 1150 | 365 | 150 |

| 1125 – Peter’s losses and John’s profit start from this | 215 | 115 |

| 1100 – Peter’s breakeven | 100 | 50 |

| 1075 | 50 | |

| 1050 | 100 | |

| 1025 | 200 | |

| 1000 | 150 |

One of the two traders should start buying with market orders in order to move the price. Let’s assume that John buys 50 contracts from Peter at 1,100 and moves his bid higher (what bids and asks are). Since he has more money, he continues to buy contracts from Peter and moves his bids and price higher and higher. Peter starts getting nervous at 1,150 and feeling sharp pain at 1,200 due to a loss.

So, Peter cannot bear losses any more and immediately starts closing contracts, selling them to John, since there are only two players in the market. As a result, John gained profit, while Peter gained losses and psychological trauma. This is how the market operates, however, there are much more players in it. And the smart money are concentrated, as a rule, in hands of a few Johns. The task of traders is to aggressively push the opponents and make them close their positions. The situation we described takes place in various variations in various markets. The smart money, first, pushes and then registers profit. That is why the price moves up and down.

Review of DOM in ATAS.

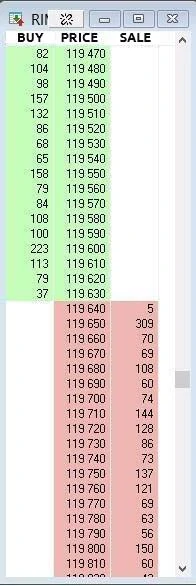

You can find DOM in its simplest form in QUIK. Only the price and limit orders are presented there.

DOM in ATAS is called Smart DOM with good reason – it is very smart indeed.

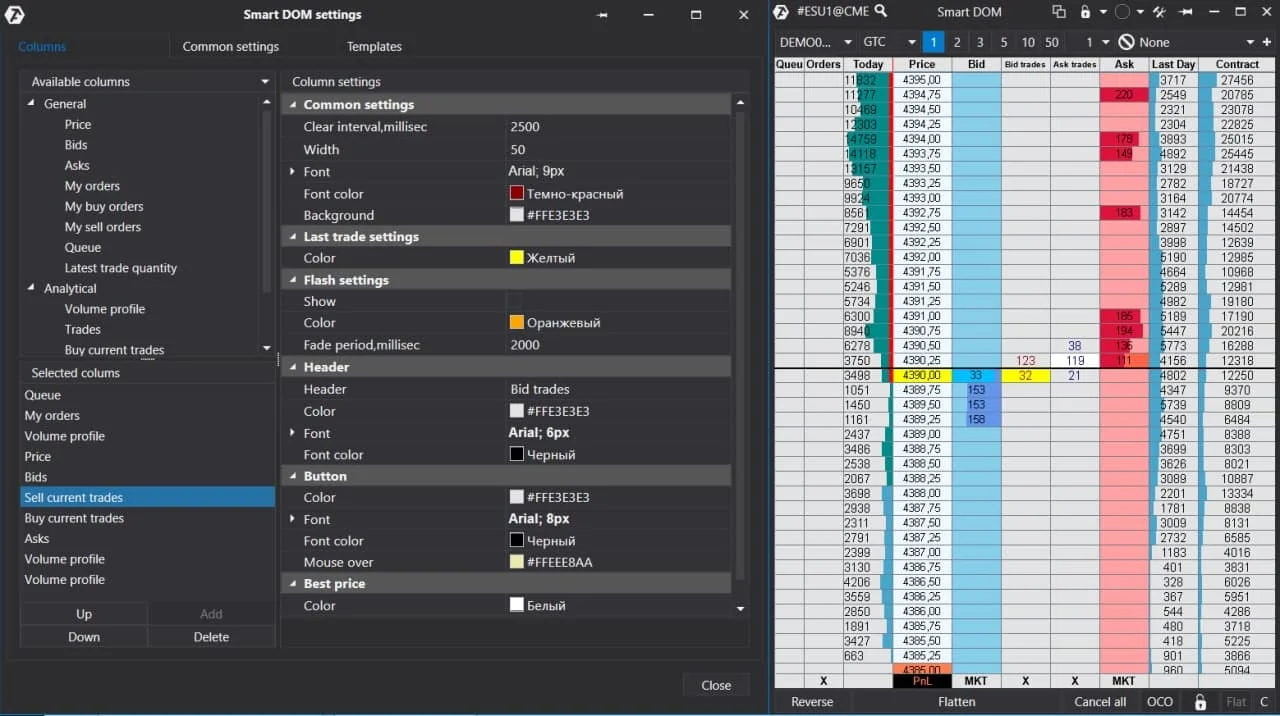

A brief overview of basic functions:

- you can see the actually traded volume at each price level – bid trades and ask trades;

- you can see the market profile of the current day, previous day and the whole contract – today, last day and contract;

- you can see changes of limit orders at each price level – last two coloured columns;

- there is a field for notes (you can’t see it in the picture since we didn’t activate it in settings);

- you can trade directly from the book in one click;

- all fields, font sizes and colours are adjustable;

- you can develop and store templates of your books.

It is really a convenient Smart DOM with a complete set of functions. It’s quite awkward to compare it with the QUIK book.

What markets are good for trading in DOM.

Trading in DOM is attractive but not easy.

Here are the reasons:

- Trades are executed very fast since more than a half of trades in the modern exchanges are executed by robots. In our article about spoofing we analyzed a situation, which occured in 350 milliseconds.

- Orders do not reflect facts, they reflect traders’ intentions instead. That is why the book is a field for manipulating and misleading. Limit orders are cancelled, removed, moved and reduced.

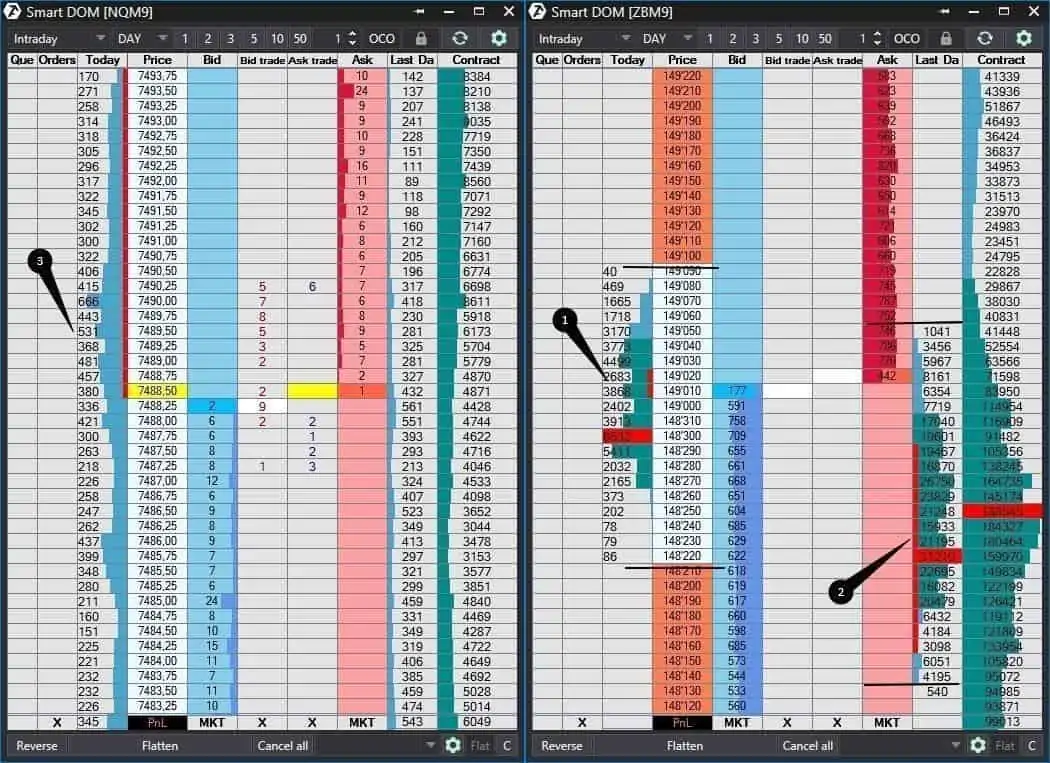

- Not all instruments are good for trading in DOM. There are ‘thin’ markets, where there are many sharp and strong movements or ‘hairpins’. The profile of such markets is long and extended. These are, for example, Nasdaq or Dax and oil. There are also ‘thick’ markets, which do not have sharp movements and the profile is shorter and wider. For example, Treasury Bonds. The picture below shows examples of DOM of such markets – Nasdaq NQM9 to the left and 30-years Treasury Bonds ZBM9 to the right. Numbers 1 and 2 mark Treasury Bonds profiles. They are compact and their boundaries easily fit into one screen. The profile expands closer to the middle. Number 3 marks the Nasdaq profile. It is very long. The day’s high and low do not fit into one screen. The profile expands and narrows several times during a trading session.

Trading setups in DOM and main rules.

There are several trading techniques with the use of DOM:

- trading of impulses;

- trading of sharp movements with the growth of volume;

- level breakout;

- bounces;

- ‘attractions’.

In general, these techniques relate to such a trading type as scalping. Positions are usually held from several seconds to minutes. The reason is that you need to analyze context in the charts for opening longer positions, while assessment by DOM is a search for situational trades ‘here and now’. Let’s consider each of the listed techniques in more detail.

Impulse.

The main idea of trading impulses is to follow the smart money movement. What happens at one price might identify direction for the next hour or even longer period of time. If some traders are caught in a trap, they would prefer to exit. Other traders would wish to jump on board – it is a chain reaction.

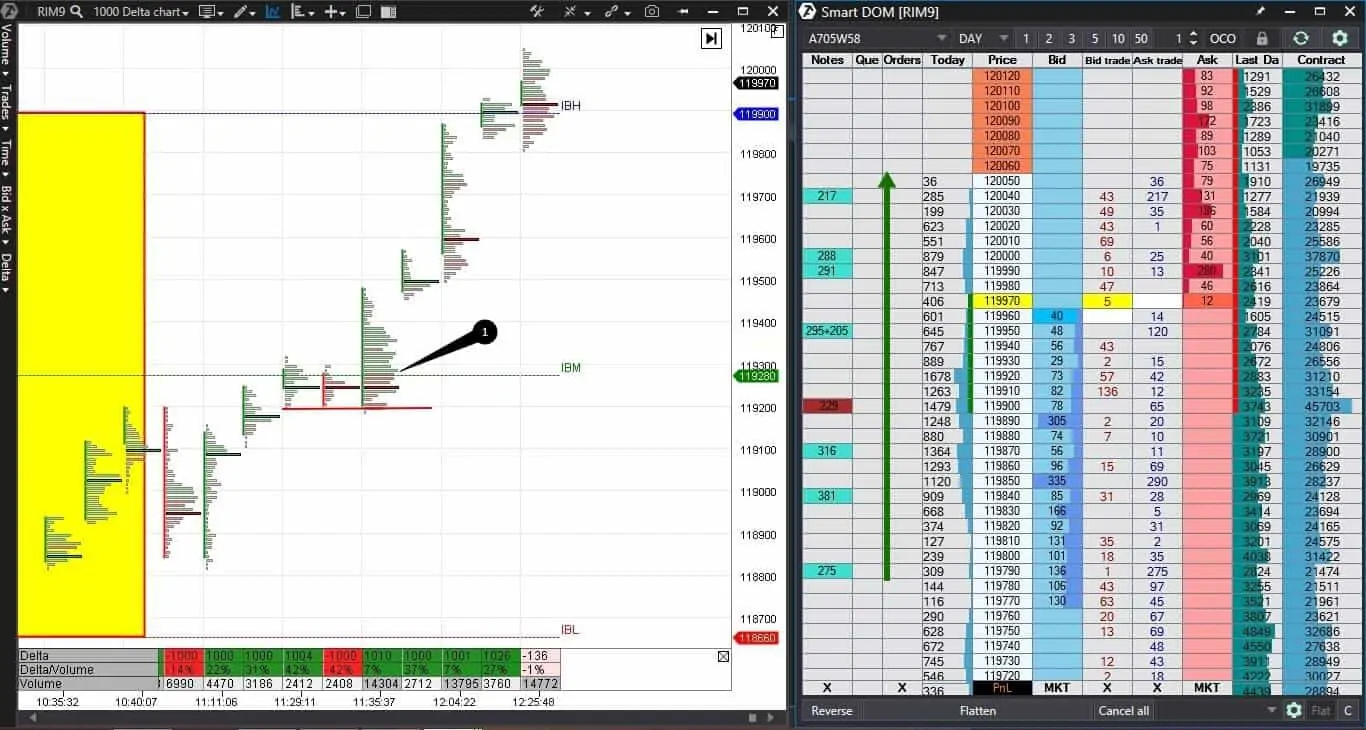

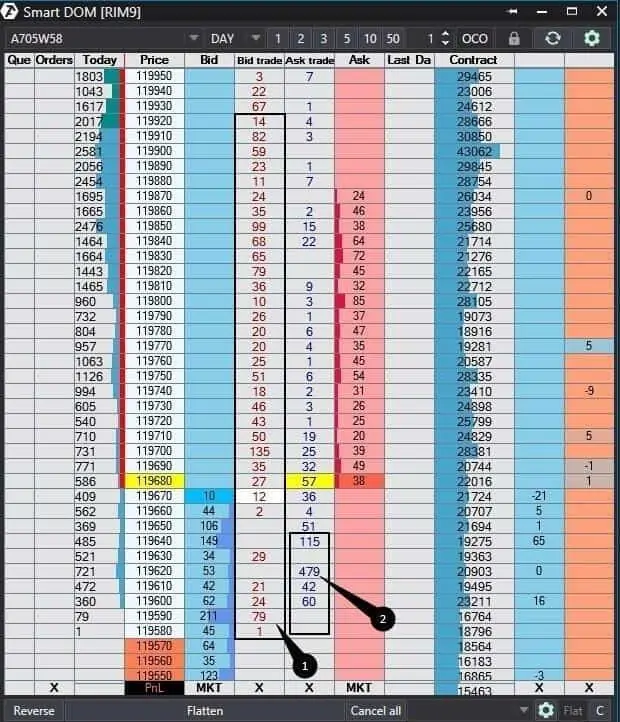

For example, if the market falls by 15 points, there will be few buyers. Bigger volumes and, consequently, bigger money are required to stop or reverse the market for, at least, a couple of ticks. Less money is required to move the falling market by 4-6 ticks more down, because resistance against downward movement reduces. The closing loss-making positions make the already existing impulse even stronger. It works very good at the day’s high/low levels. If the market made a significant move and does not pull back, the probability of a deep pullback sharply decreases. Let’s consider an impulse on a RTS index futures (RIM9) example.

We marked the level of the middle of the initial day’s range, which we identified automatically with the help of the Initial Balance indicator, with number 1. A local support, marked with a red line, from which the price sharply moved upward, was formed at this level. We can see significant market buys, marked with blue numbers in the first column, in the book – this is the impulse, following which has high chances of making profit. We noted these levels in the ‘notes’ column, since ‘bid/ask trades’ columns are renewed when the price comes back to this level, if you didn’t change automatic settings.

Sharp movement on higher volumes – the market sharply passes several ticks in one direction on a significantly higher, than usual, volume – this is the impulse beginning. Join this movement, since those who stand in the opposite direction would close their positions and, by doing so, would push the price further. Level breakout – we look for a breakout of the day’s high/low or other significant levels and watch movements around this level. The faster the market comes back to this level after a pullback, the higher the probability is that this level would not withstand. The context and levels, in which buyers and sellers are interested, are very important. These could be the levels, at which sells or buys, higher volume levels, tails and previous days’ highs and lows stop. Professionals prefer to enter before a breakout if they think that the price would pass this level. Regular traders get into traps at breakouts when they try to trade against an impulse. Always pay attention to what volume moved the price. The bigger the number of contracts is, the higher the probability of a breakout is. If you trade against an impulse, do not buy immediately at lows and do not sell immediately at highs. Wait until the avalanche of stops will stop pushing the price further. You can check whether these are new contracts or stops, but only on the Moscow Exchange, which shows the open interest in real time. We will show you how to work with the open interest below. Pullback from the level – the price touches the level and pulls back, touches again and pulls back again, however, by a smaller number of ticks. Pullbacks become smaller and the probability of a breakout becomes higher. The levels might not coincide with classical support and resistance levels. Downward bounce – the market grows on a good volume but the volume of buys at the very top goes down, there are offers (asks) of big volume and reduction of the bullish progress. Traders would not continue to buy in such a situation, they would sit waiting and the price would pull back down. You should be very careful with this setup, since this is a trade against an impulse. Similarly, you can consider the upward bounce. However, as a rule, you need to undertake a bit more efforts for buying than for selling. Again we use an RTS index futures (RIM9) example.

The price fell sharply. We marked market sells with point 1, but the sells fell down to 1 at the day’s low. And big buys, marked with point 2, emerged at these levels. Perhaps, these are not new long positions but registration of the short positions’ profit – we do not know for sure. But we can see that the price fall stopped and a bounce started. Using DOM we do not forecast, we just see what happens at the moment. Attraction or deception – the price does not move on a huge volume or moves insignificantly. Most probably, the smart money have the opposite movement in mind. We will show you this setup further in detail. Whatever DOM technique you would use – there are general recommendations for each DOM trader. Basic rules:

- Losses should not be more than 2-4 ticks depending on an instrument. We already mentioned above that sharp movements could ruin the deposit, especially if you trade in big lots. Carefully select an instrument.

- Fast profit of 3-6 ticks. Most probably, you will not get significantly more, since it is not scalping any more. If the impulse continues, you, probably, could enter the trade again.

- If the volume ‘dries out’ or the market is traded for a long period in a range, turn off your computer.

- If the market goes against you, immediately exit the trade.

- Register profit when the impulse is exhausted and pullback starts.

- Do not trade from share boredom or because ‘maybe the price would grow after the yesterday’s fall’.

- Trade only those setups that are familiar and tested by you.

- Trade only one instrument or several connected instruments – for example, bonds of various maturity. Do not get distracted by several instruments. ‘Jack of all trades is a master of none’.

- Trade several hours a day only, since you will not be able to keep attention and concentration during a whole day.

- Do not get distracted from DOM when trading.

- Remember that limit orders could decrease and increase, while the market orders could only increase, because it is a really traded volume.

Scalping in the book or the levels, which we see in DOM.

Now, let’s consider trading setups using a specific example.

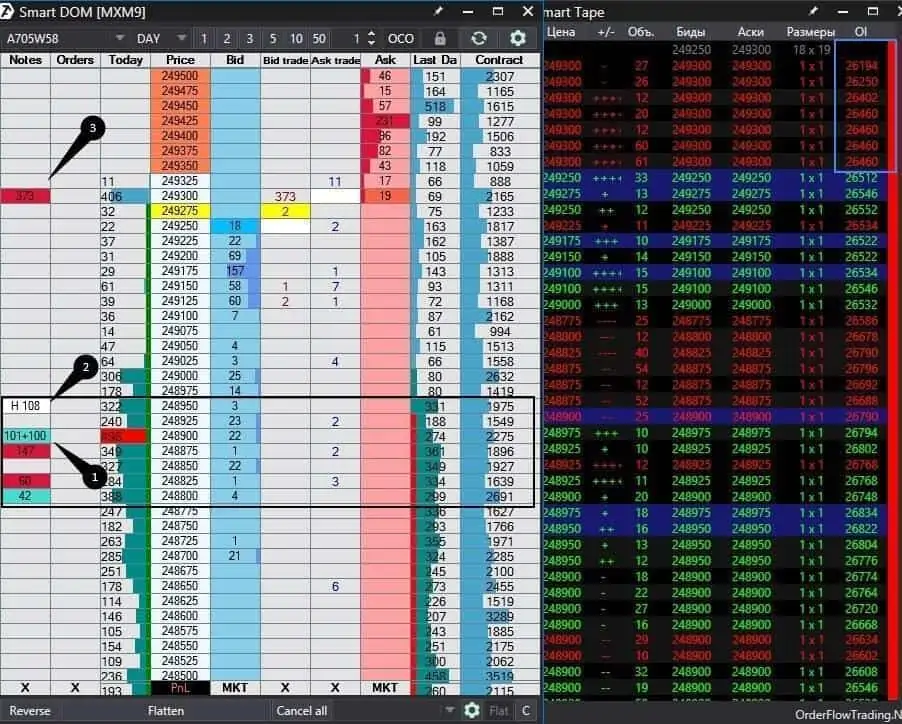

May 14, 2019. This day became an unexpectedly impulse day for a Moscow Exchange index futures (MXM9). The reason was a sharp growth of the Gazprom stock, which takes about 13% of the Moscow Exchange index, price. The situation with a potential growth of the price was evident from the book even without news. Of course, the movement strength could not have been forecasted accurately, since the investors who buy Gazprom stock on the dividend growth news unexplainably ignore news about possible American sanctions with respect to the Nord Stream. However, this is just a step aside into ‘fundamentals’, which has nothing to do with DOM trading.

A Moscow Exchange index futures (MXM9) was traded in a narrow range for two hours from 13:30 until 15:30. It is marked with a black rectangle in the picture. This rectangle marks significant buy and sell volumes – buys are marked blue and sells are red in the farthest column. 100 contracts were bought at the day’s high. Both buys and sells failed to move the price significantly. However, since the price was close to the day’s high, it made sense to monitor attentively and wait for an upward breakout or significant pullback – both scenarios provided a chance to make money. The price broke the day’s high at about 15:00. And those, who bought in points 1 and 2, made profit in point 3. We can see reduction of the open interest, marked with a blue rectangle in the tape – it means that these are not new short positions, but namely a profit registration. The price slightly pulled back after profit registration and ‘laid up’ itself again within a narrow range.

Sellers emerged in point 2. The tape shows growth of the open interest – this fact is marked with a blue rectangle. We have two tapes – the middle one with the filter of ‘10 up’ contracts, the right one is without filters. Despite massive sells, the price didn’t move down. So, we make a conclusion that someone’s limit order absorbed all these sells. Moreover, it was an iceberg. That is, only a portion of the quantity, which someone very smart wanted to buy cheap, was visible in the book. It was the second level, where the price practically didn’t move down under a powerful pressure of sellers. It became clear at this stage already that something is wrong with sells. Perhaps, the smart money had some important information, which was beyond of reach of regular folks.

If you could have read this information in time, you would not have been surprised with the upcoming powerful upward impulse. You can see its result in the following chart.

A narrow range is marked in point 1. Unfortunate shortists, which suffered a lot in absence of stops, are shown in point 2. Point 3 marks an impulse, which was connected with a sharp Gazprom stock price growth.

Of course, the described situation does not occur every day. It’s a rather non-standard situation. However, while monitoring the order flow movement in DOM, we noticed the trading setup before the news broadcast. And managed to enter into long positions both at the level 1 and level 2.

One trader’s experience.

There are many educational videos in the Internet devoted to DOM trading. We will list here some phrases from an interview with a 25 year old trader, who has traded in DOM for 5 years:

- I watched the order flow for a month to understand how important it is.

- I found my pattern, which works – breakouts. Started to trade breakouts.

- I traded from time to time for 6 months, but mostly watched and registered the market behaviour.

- There was no profit for the first year.

- The profit wasn’t stable during the second year. Then I gradually moved into positive territory.

- I execute 6-20 trades in active days.

- I trade 10-year Treasury Bonds only.

- I trade from 8:30 to 11:30, because it is difficult to concentrate for a longer period. Besides, I want to eat at lunch time and prefer to have rest afterwards.

- When trading, I turn off my mobile and do not get distracted by anything.

- The most significant discovery: it is more efficient to align with the traded volumes than with limit orders.

Summary.

DOM trading is one of the forms of making money on the exchange. It is not good for everyone, but you should try your chances.Try it. Maybe it is exactly what you looked for. Download the free ATAS version right now. Smart DOM is developed in this advanced trading and analytical platform in such a way, so that you can achieve positive results in the maximum convenient way.