The Bitcoin forecast for 2022 – should we expect growth?

We wrote a year ago that the year 2021 had all chances to become successful for the cryptocurrency market. We can state that our optimism was completely verified. Let’s briefly sum up the results of the year 2021 and try to look into the year 2022 in order to make an effort to assess the prospects of further growth. We will analyse main economic drivers, get acquainted with expert forecasts and take a look at key levels in the Bitcoin chart.

Read in the article:

- What caused the Bitcoin rate growth in 2021

- What will influence the Bitcoin price in 2022

- Bitcoin rate expert forecasts

- Support and resistance levels

- Strategy of operation in the cryptocurrency market

What influenced the Bitcoin rate in 2021

The year 2021 was a year of abundance for the digital asset market. His Majesty Bitcoin grew from USD 29 thousand to USD 69 thousand at the year’s high. Don’t even ask about its ‘junior brethren’ altcoins, the growth of some of which amounted to dozens of thousands percent. The general market capitalization increased from USD 759 billion to USD 3 trillion at the 2021 year’s high.

Let’s analyse how the market operated and developed.

An important growth drive was represented by an inflow of money in BTC from institutional investors, who accumulated their cryptocurrency balances during the whole year.

- We should also note Elon Musk’s adventures. One day he provoked a powerful increase by his tweets about buying Bitcoins for USD 1.5 billion by Tesla, another day he caused a collapse by the news about stopping to accept Bitcoin as a means of payment for new Tesla cars and yet another day he played with his declaration of love for the meme Dogecoin. However, the fact remains – even after selling a part of the held cryptocurrency, Tesla is a major Bitcoin holder and Musk himself holds some of his personal funds in Bitcoin and Ether.

Bitcoin also continued to actively develop at the infrastructural level.

- The news about the launch of the first regulated Bitcoin futures ETF in the United States significantly supported the market. Now it has become easier for institutional and regular investors to make money on Bitcoin.

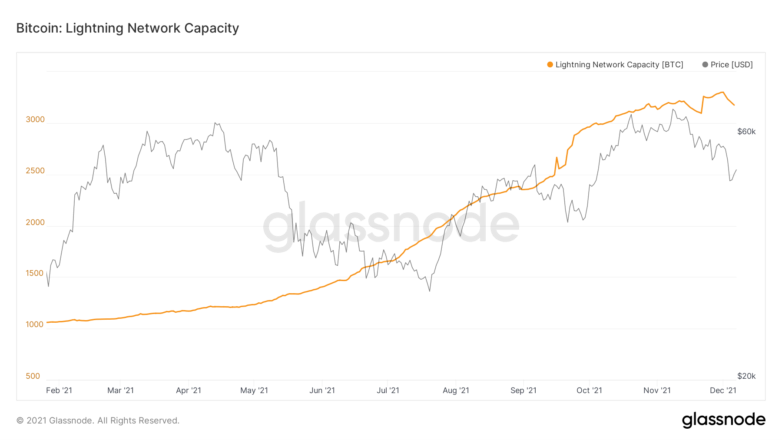

- The Lightning Network payment system achieved unprecedented growth rates. It allows solving the Bitcoin network scaling problem in a fundamental way by reducing commission fees and increasing transaction speed. The number of Bitcoins passing through Lightning during a day, as well as the number of payment channels, increased threefold.

It goes without saying that the main sensation of the year was the Bitcoin acceptance as an official means of payment at a state level. As of now, only El Salvador, a small developing country in Central America, took this leap of faith. However, its move turned out to be inspiring and several other states announced that they considered Bitcoin as an alternative means of payment.

However, the key Bitcoin rate growth driver in 2021 was macroeconomics – all key central banks continued to print money fiercely, their currencies devalued and the inflation grew to the highest values of the decade. Demand on non-inflation assets, such as Bitcoin, was very high in this context.

What will influence the Bitcoin price in 2022

We will discuss those exchange rate influence factors, which are widely expected by the community and experts. We should note that nobody knows the future, that is why some absolutely unpredictable circumstances can interfere with the matter.

Positive side. Analysis of the information environment allows to expect the following:

- Active Bitcoin adaptation by the world of classical finance will, probably, continue. Approval by authorities and launch of new ETFs, although with real crypto-assets on balances rather than futures, are expected soon. It will improve the access of classical investors to the cryptocurrency.

- The Lightning Network will continue to actively develop, which will make Bitcoin an even more affordable means of payment.

- Major financial companies and banks will continue to develop the crypto-trend.

- Australia declares its wish to become the first Western country, which will launch its digital currency and completely formalize Bitcoin at the legislative level. News from this country can support the rate in 2022.

- There is a good chance that a couple of other developing countries will follow the El Salvador example and accept Bitcoin as an official means of payment.

Negative side:

- The US Federal System will, probably, completely exit from the Quantitative Easing program (QE) and will launch the interest rate growth cycle. It is required for fighting the accelerating inflation and, most probably, will result in the dollar strengthening trend continuation. The dollar growth and global decrease of liquidity are key negative factors for the cryptocurrency market in 2022.

- A stock index correction is possible. According to a legendary investor Charlie Munger (the partner of Warren Buffett in Berkshire Hathaway), there is a bubble in stocks, which exceeds even dotcoms in the 2000s. In case the stock market shows strong turbulence, investors will have things other than cryptocurrency to worry about and it may behave even more volatile.

- They discuss plans of digital asset market regulation tightening in the United States. On the one hand, it is good that the market will be more transparent, on the other hand, the crypto-community traditionally has a negative attitude to such news.

As you can see, both positive and negative news are expected in great numbers. If the main expectations come true, it will result in a significant growth of market volatility. However, crypto-investors already got used to the price turbulence, the most important thing is to have growth after fall.

Bitcoin rate expert forecasts for the year 2022

Despite a rough correction at the end of 2021, bullish expectations for the year 2022 still prevail in the expert environment. Thus, Bloomberg Intelligence forecasts that the Bitcoin rate will grow up to USD 100,000 in 2022. Actually, you can see this round number quite often in analytical forecasts.

“I believe that Bitcoin will continue to be volatile, however, the long-term tendency is upward and the general market capitalization will grow twice, on the average”, – forecasted the Director General of a Norwegian mining company Kjetil Hove Pettersen.

Many expert expectations for the year 2022 are connected with the Lightning Network success development and approval at the state level and in the major investment company environment. Experts also pay attention to the fact that Bitcoin hasn’t experienced the parabolic growth stage yet, which usually foretells a reversal. Thus, eToro broker analysts reminded that the bullish market was completed with a sharp rise both in 2017 and 2013. And Bitcoin grew in 2021 only with strong corrections and pauses.

Expectations with respect to the Bitcoin rate in 2022 are more restrained outside the crypto-community environment. Wall Street major bank experts mainly abstain from specific goals stating that the market volatility will persist. The Federal System policy tightening and rate growth are key risks, which can be seen in a majority of forecasts.

We should also add that Bitcoin rate forecasts are a thankless job and often reminiscent of ‘hit or miss’. The rate can be either significantly lower or significantly higher than forecasts. There is also a historical regularity that Bitcoin grows through the years, however its repetition in 2022 is not a must.

Key support and resistance levels

The market entered boundaries of a wide flat at the end of 2021 within the range of USD 30 thousand to USD 60 thousand after a strong correction from the historical high near USD 69 thousand. It is extremely important for bulls to hold the USD 30-40 thousand as the support and then to close one of the weeks above USD 60 thousand in order to renew the Bitcoin rate growth. In such a case, the price target of USD 100 thousand and higher will become more realistic.

As regards the working strategy for 2022, we will underline the following factors:

It is always logical to buy near lows (support) within a range. It means that USD 30-40 thousand will be a good area for buying.

The size of longs can be increased only after a breakout of USD 60 thousand and after testing this level as the support.

In the event the price moves below USD 30 thousand, prospects of renewal of bullish moods in 2022 will become rather vague.

Strategy of working in the crypto-market

Some experts believe that Bitcoin can still show a powerful growth in 2022. Such a scenario is possible, however, it is always more advantageous to maintain a grain of healthy skepticism in the cryptocurrency market. You should also remember that the Bitcoin price moved into a long-term bearish market for 2 years after sharp rises in 2017 and 2018.

Behavior of a reasonable investor in the crypto-market should go along with facts rather than emotions and depend on goals. Let’s state some points about how to invest in Bitcoin using common sense in order not to lose big money in this market and increase chances for making money:

- You should always remember about risk management and diversification rules. Do not invest into cryptocurrency more than you are ready to lose. Cryptocurrency can become a cherry on the cake of your portfolio, however, you shouldn’t rely on this market completely.

- If you are an investor, buy in installments during corrections. Efforts to guess the price bottom are usually counterproductive.

- You can take into account Bitcoin rate expert forecasts for the year 2022, however, you shouldn’t accept them as the monopoly on the truth. Nobody has learnt yet how to forecast the Bitcoin price more or less accurately.

- It will be useful for traders to learn volumes using the ATAS platform. This skill will help you to identify support and resistance levels more accurately and follow behavior of major players that form the main part of volumes in the cryptocurrency market.

Observance of these rules will help you to preserve your capital during strong corrections and boost it in the event of renewal of long-term growth.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.