FRS is afraid of the future. Where’s the logic?

The previous week wasn’t boring for investors. On the one hand, the S&P 500 index finally completed the shortest bearish stage in its history. On the other, the eternal optimist in respect of the US economy Warren Buffett placed a major and absolutely unexpected stake against it and the US FRS bewildered bulls with doubts regarding the future. Read about these and other important events of the week in our review.

content:

- Calendar of economic events

- S&P 500 index renewed its historic high

- FRS minutes brought bulls down

- Buffet stakes on gold

Calendar of economic events

| Date, Time GMT +3:00 | Events | Impact and forecast |

| Tuesday, August 25 11:00 | Germany. Ifo Business Climate Index in August. | EUR. DAX. Forecast – 89.3, previous value – 90.5. |

| 17:00 | United States. CB Consumer Confidence Index in August. | USD. S&P 500. Forecast – 93.6, previous value – 92.6. |

| Wednesday, August 26 15:30 | United States. Durable Goods Orders in July. | USD. S&P 500. Forecast – 2%, previous value – 3.6%. |

| Thursday, August 27 15:30 | United States. GDP for the second quarter (quarter to quarter). | USD. S&P 500. Forecast -32.5, previous value -32.9. |

| Friday, August 28 15:30 | United States. Trade balance for July. | USD. Previous value -70.99B. |

| 15:30 | United States. Personal private spendings in July. | USD. S&P 500. Forecast – 1.5%, previous value – 5.6%. |

| 15:30 | Canada. GDP for June (month to month). | CAD. Forecast – 3.5%, previous value – 4.5%. |

| Tuesday, August 25 11:00 |

| Germany. Ifo Business Climate Index in August. |

| EUR. DAX. Forecast – 89.3, previous value – 90.5. |

| 17:00 |

| United States. CB Consumer Confidence Index in August. |

| USD. S&P 500. Forecast – 93.6, previous value – 92.6. |

| Wednesday, August 26 15:30 |

| United States. Durable Goods Orders in July. |

| USD. S&P 500. Forecast – 2%, previous value – 3.6%. |

| Thursday, August 27 15:30 |

| United States. GDP for the second quarter (quarter to quarter). |

| USD. S&P 500. Forecast -32.5, previous value -32.9. |

| Friday, August 28 15:30 |

| United States. Trade balance for July. |

| USD. Previous value -70.99B. |

| 15:30 |

| United States. Personal private spendings in July. |

| USD. S&P 500. Forecast – 1.5%, previous value – 5.6%. |

| 15:30 |

| Canada. GDP for June (month to month). |

| CAD. Forecast – 3.5%, previous value – 4.5%. |

It makes sense to pay attention on Tuesday, August 25, to business expectations in Germany and consumer confidence in the US. The August data will help to establish how fast the economies of these countries come out of the recession. Investors will learn about dynamics of private incomes and spendings on Friday, August 28.

S&P 500 index renewed its historic high

The positive mood in the US stock market was supported by the real estate market statistics on Tuesday, August 18. The number of construction permissions grew in July significantly higher than forecasted – up to 1.495M instead of 1.320M, which is a consequence of extremely low mortgage rates. Many Americans are in a hurry to take advantage of the situation, which stimulates economic growth in general.

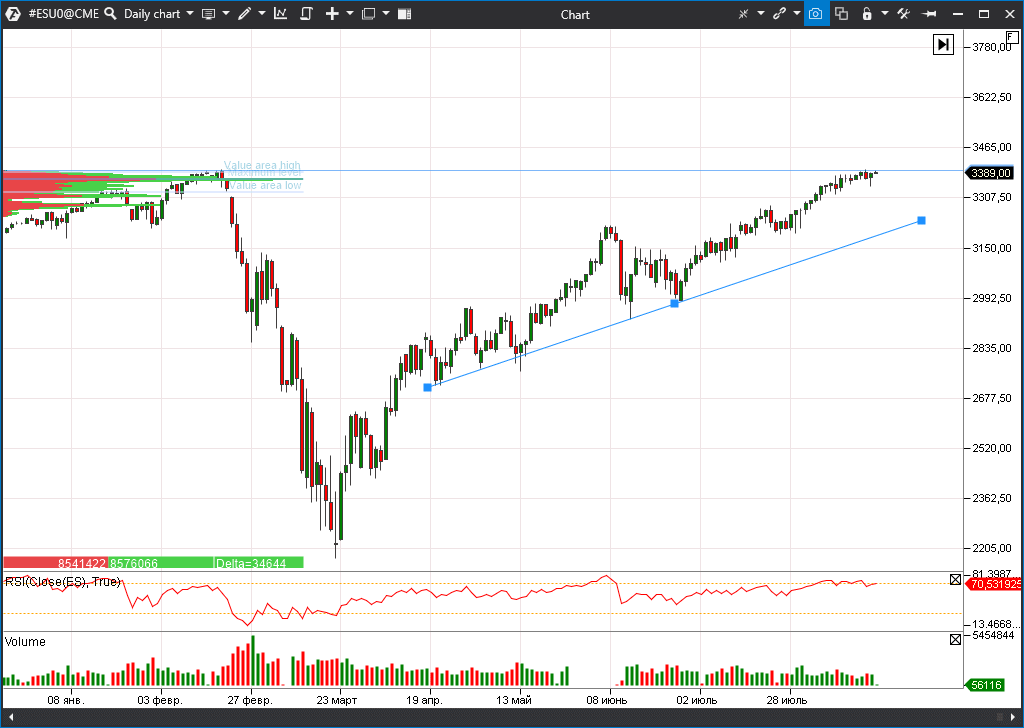

S&P 500 index responded with renewal of its historic high, which marked completion of the shortest bearish market in history. The new record is just several points above the previous one – 3399 points. This area serves as a rather strong resistance, for breaking which serious reasons are required. The S&P 500 futures (ESU0) freezed just in half a step from its historic achievement.

The technology company stocks again were in the front line of growth, which allowed setting a number of personal and corporate records. Thus, Apple (AAPL) became the first US corporation, which capitalization reached USD 2 trillion.

Amazon stock also moved up, which allowed its founder and CEO Jeff Bezos to reach new heights in the Forbes rating of billionaires. His capital reached USD 197.8 billion, which is the absolute record for the whole history of wealth calculation.

FRS minutes brought bulls down

However, the S&P 500 index didn’t stay at new heights for a long time. The reason for a small rollback was the unsettling statement of the US FRS by results of the meeting on Wednesday, August 19. The managers predictably voted for preserving the key interest rate at the level around ‘0’. Moreover, they assured again that the rates would stay ultra-low until the economy recovers after the recession.

However, the tone of the minutes was far from being optimistic. Thus, the FRS managers are seriously concerned about the future economic growth due to the long-running coronavirus epidemic.

Further deterioration of the situation would suppress the economic activity and employment and, in the long run, it may even undermine stability of the banking system. Moreover, FRS officials expressed their concern over the sharp growth of the US state debt.

Buffett stakes on gold

Actions of the legendary billionaire and investor Warren Buffett always attract close attention of the financial markets. The news that his Berkshire Hathaway holding acquired 21 million stocks of the Barrick Gold gold-mining company for USD 562 million was widely discussed during the past week.

The news attracted keen interest because earlier Buffett often spoke against investments in gold. He maintained that gold ‘doesn’t produce anything’, consequently, it doesn’t generate added value and cannot be an investment asset.

In technical sense, Buffett bought stock with a good promise of dividends. However, there is a direct correlation between the metal value and growth of the gold-mining company stock. The profit and dividends in this business depend on the raw material price practically in full. Actually, Berkshire Hathaway put a stake against the US Dollar and American economy, since gold, in fact, is a quasi-currency and an alternative to the dollar.

Moreover, the precious metal is of high demand in times of economic turbulence. It is interesting that the Buffett fund makes its purchase of the gold-mining company against the background of sales of stocks of major American banks, which are the pillars of the economy.

The gold futures value was rather volatile this week and the main fight of bulls and bears broke out in the area of the uptrend line.