How bitcoin reacts to this year’s events

Many financiers take bitcoin as a purely speculative instrument. It is not a surprise taking into account its volatility. However, the opposite tendency – long-term investments into bitcoin – becomes more and more popular. Investors buy cryptocurrency not in order to resell it in a couple of months 20-30% more expensive. Their goals are hundreds of percent and years of hold.

So, let’s see why investors are ready to buy bitcoins and hold them for years, what influences the bitcoin price and what speaks in favour of the coin growth after the bitcoin halving in the middle of May 2020.

Content:

- Investing into bitcoin is a new global trend.

- Approaches to the bitcoin fundamental analysis through the network value.

- What actually makes investors buy?

- Bitcoin as the digital gold.

- What the bitcoin halving would result in.

- What should be taken into account in long-term investing in bitcoin.

Investing into bitcoin is a new global trend

‘Hold’ is not a new concept in the cryptocurrency market. The category of buyers, who declared their readiness to hold their ‘crypts’ to the last, emerged as early as in 2017. The majority of owners of ICO tokens and even rather major cryptocurrencies, such as NEO and NEM, paid a heavy price for such tactics. Their losses by the beginning of 2019 sometimes were above 90% of the amount of initial investments. It is not a surprise that the number of those who wanted to hold altcoins against all odds decreased dramatically.

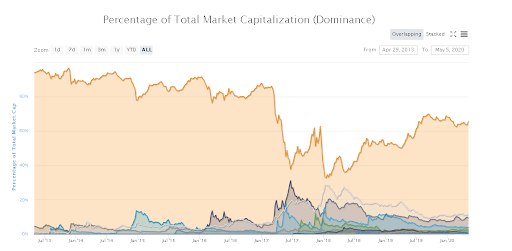

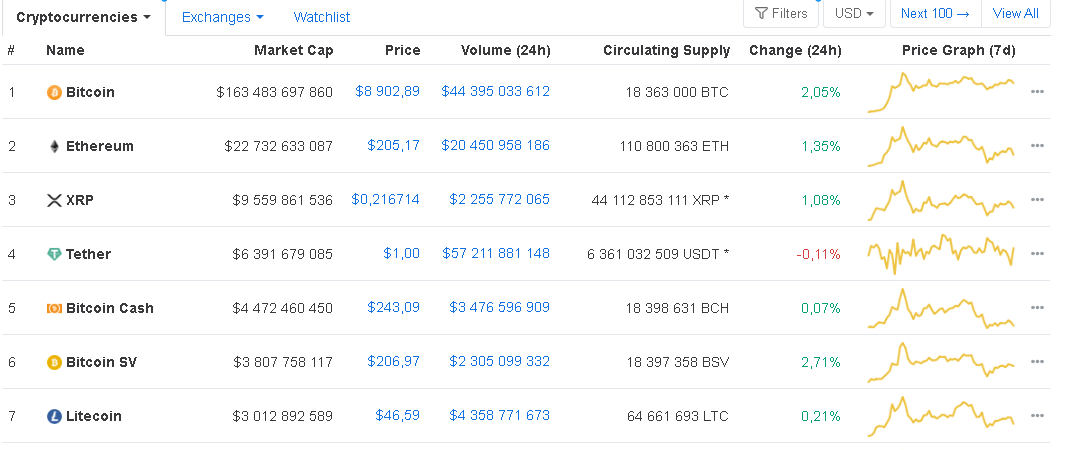

Bitcoin is a different thing. It strengthened its status of the undisputed cryptocurrency leader during the past 2 years even more and managed to preserve the majority of its ardent supporters. Thus, the bitcoin share in the general capitalization of the cryptocurrency market (bitcoin dominance) increased from 35% at the beginning of 2018 to 67% at the beginning of 2020.

The second biggest (by capitalization) cryptocurrency (Ethereum) is 8 times cheaper, while the third biggest one (XRP) is more than 17 times cheaper.

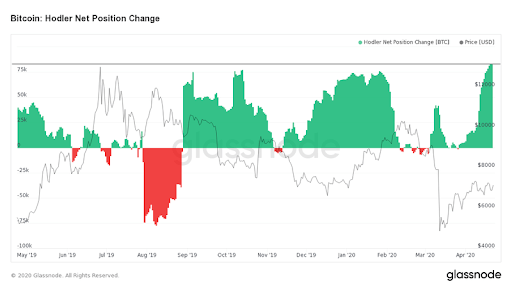

Besides, a new category of bitcoin owners – long-term investors – is actively formed. They do not get rid of bitcoins during powerful retracements, on the contrary, they accumulate their positions.

“42.83% of all BTC in circulation didn’t move during the two years minimum. This indicator increased by 10.4% during the past year and despite the fact that one of the biggest market crashes in history took place in March, the bitcoin price fall practically didn’t influence the confidence of long-term holders”, – this conclusion was made by the Glassnodes company analysts.

Moreover, the volume of cryptocurrencies on accounts of long-term investors increased to a new high in the second half of April 2020.

But what does instill holders’ confidence in good bitcoin prospects? Let’s see whether there are grounds for fundamental analysis of the bitcoin value.

Approaches to the bitcoin analysis through the network value

Some crypto-analysts offer models based on the estimate of the fair value premised on the degree of the network usage. Such approaches are reasonable in respect of bitcoin, since they take into account its decentralized and network nature.

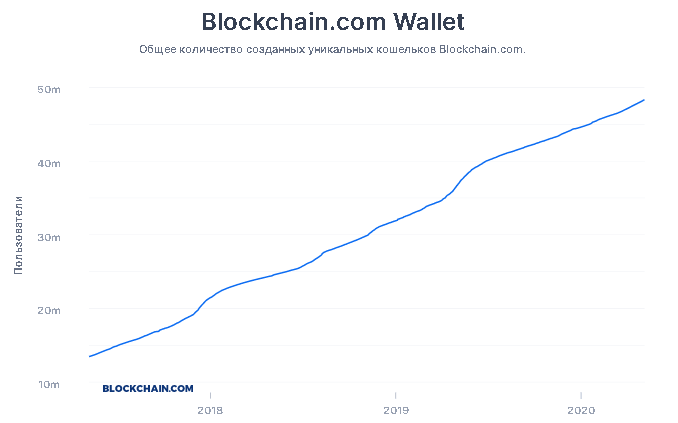

For example, there is a proposal to use Metcalfe’s law, which identifies the network value by the squared number of its unique users. Theoretically, the more users install a cryptocurrency wallet, the more unique connections are created in its network and the higher its practical value is.

Thus, the growth of cryptography capitalization in 2017 was justified, since the number of installed wallets also sharply increased.

It was also proposed to link the network value to the number of operations.

However, those hypotheses didn’t withstand the test of time. The number of wallets continues to increase exponentially but it doesn’t result in the similarly fast increase of the bitcoin value.

The data of the growth of the number of users of the popular blockchain.com bitcoin wallet could be used as an example. The number of downloads has increased not less than in 5 times, the same can’t be said for the price.

Of course, as the practice shows, the network development influences the bitcoin price but not as much as other factors do.

What actually makes investors buy bitcoins?

To a large extent, several global trends facilitate phenomenal bitcoin growth from the outset until now. The biggest holders, such as Roger Ver, Tyler and Cameron Winklevoss and Michael Novogratz, note the following reasons for buying cryptocurrency:

- limited emission;

- high reliability;

- digital asset in the spirit of the time;

- protective asset;

- and other factors.

Let’s consider them in more detail.

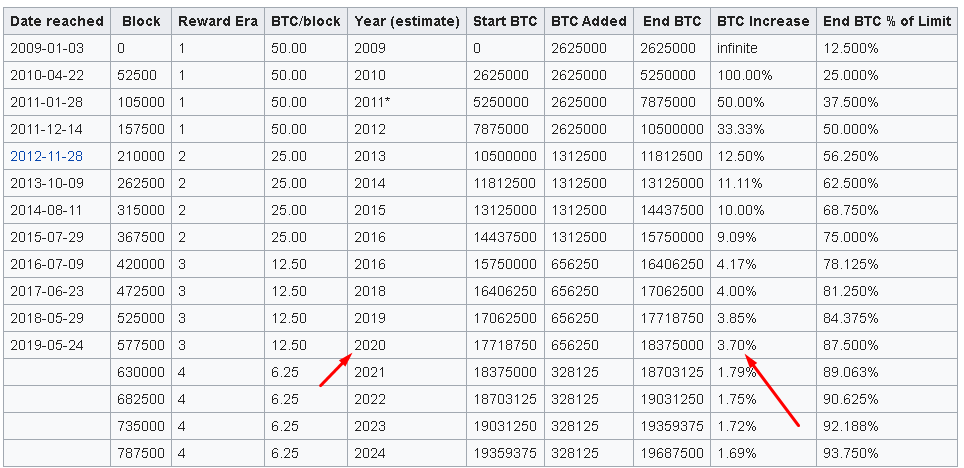

Limited bitcoin emission. Multi-trillion emission of fiat money in the US, EU, Japan and Great Britain hasn’t practically stopped after the 2008-2009 crisis. It undermines confidence in the currencies, which are subject to hidden devaluation. Bitcoin is deprived of this shortcoming since its emission is restricted by a computer algorithm. BTC 21 million will be issued during the whole time of its existence and 87% of them are already in circulation. You can see in the table below that the supply would increase only by 3.7% in 2020 and by 1.79% in 2021. This fact plus the growth of demand from long-term investors would maintain the price.

High reliability. The bitcoin network has never been broken. A complex algorithm and high decentralization secured bitcoin with the reputation of the most reliable cryptocurrency.

Market forms the bitcoin price. States redistribute resources inefficiently. As a result, the financial elite receives a disproportionate amount of benefits compared to the absolute majority of the population. Only market mechanisms influence the bitcoin price.

The digital epoch needs a digital asset. There are more and more young people, who grew up in the digital epoch, among global wealthy men. People of the digital epoch need digital assets. Authors of the Facebook idea and first crypto-billionaires brothers Winklevoss, who are the biggest bitcoin holders, are illustrative examples of this generation. The twins repeatedly stated that they do not plan to sell their cryptocurrency for any reason whatsoever.

Protection from the crisis. Crisis phenomena in the world economy started to manifest themselves still in 2019. The coronavirus crisis just turned out to be a trigger for the beginning of the economic crash. The gold and bitcoin prices started to increase along with the growth of anxiety of investors with respect to stock prices and financial market stability. Thus, gold moved from the multi-year flat trend and bitcoin passed the price bottom and grew up to the levels of the second half of 2017.

Bitcoin as the digital gold

The model of fundamental analysis of bitcoin as a digital commodity and analogue of physical gold is justified as of today. It means that in terms of investing bitcoin is not a classical digital currency, but a protective asset. From this point of view, such indicators as the quantity of transactions in the network are not important, since the value is determined by completely different criteria.

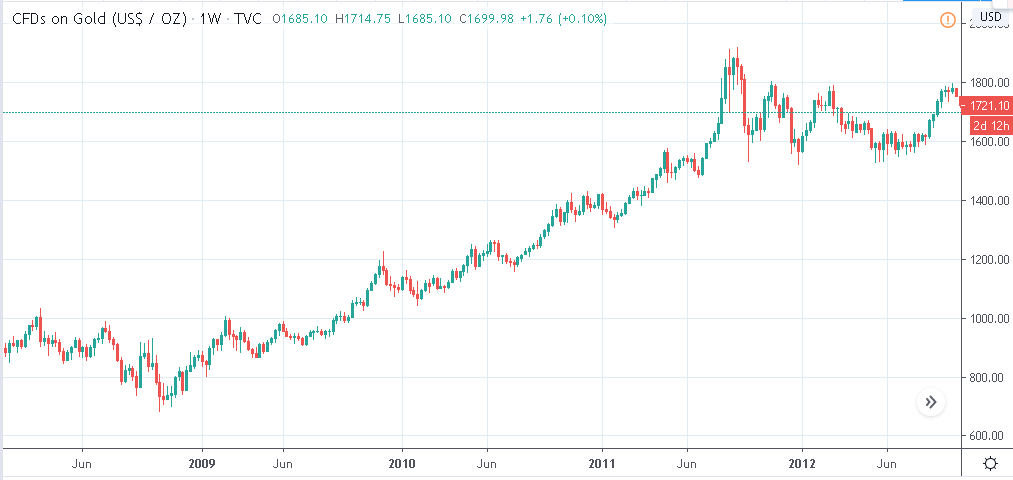

The price of gold traditionally grows during crises when central banks start emission and undermine confidence in fiat (traditional) currencies. Thus, in order to overcome the 2008-2009 crisis the US FRS initiated programs of quantitative easing (actual emission) for the amount of more than USD 5 trillion. And the gold price increased twice during the same period.

Bitcoin was created in 2009 as a response to the crisis of the classical money and immediately started to gain popularity. The cryptocurrency price has grown since then by dozens of thousands percent from several cents to several thousands of dollars. Crisis phenomena in the world economy started to accumulate and the bitcoin price started to grow again.

What speaks in favour of the bitcoin growth in 2020

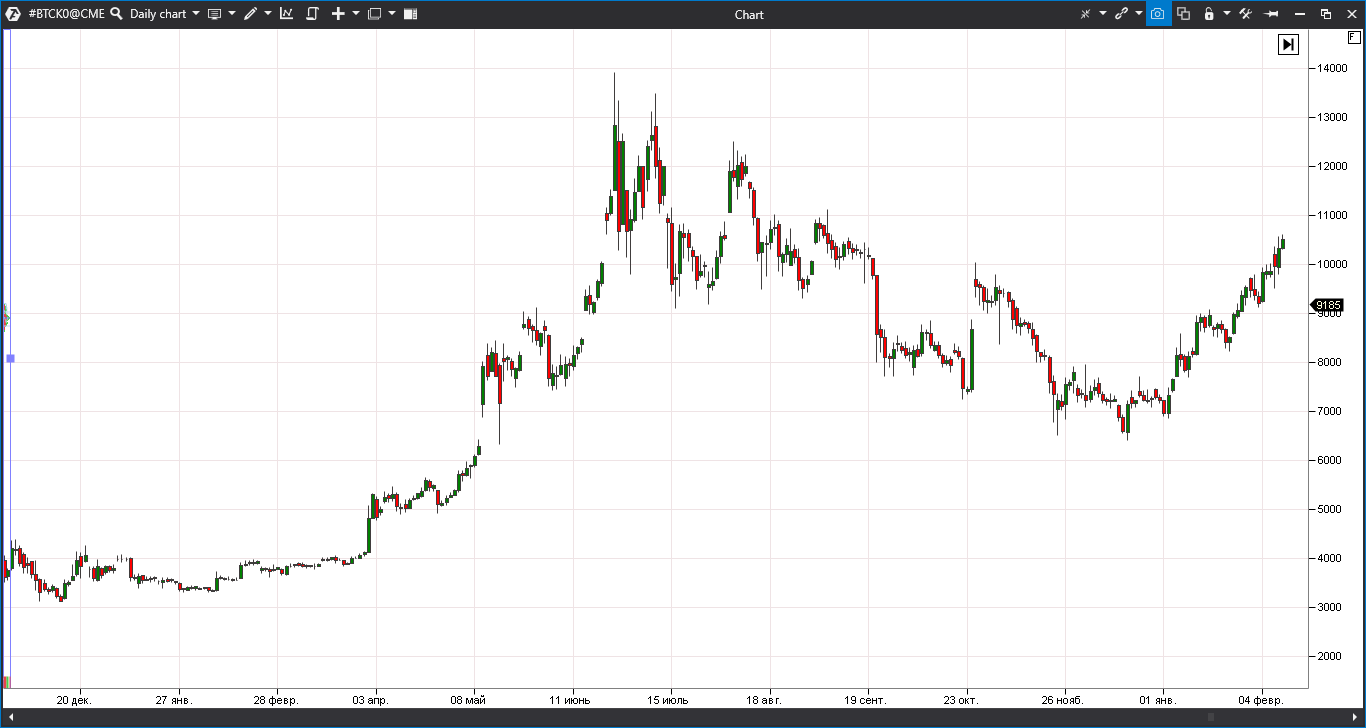

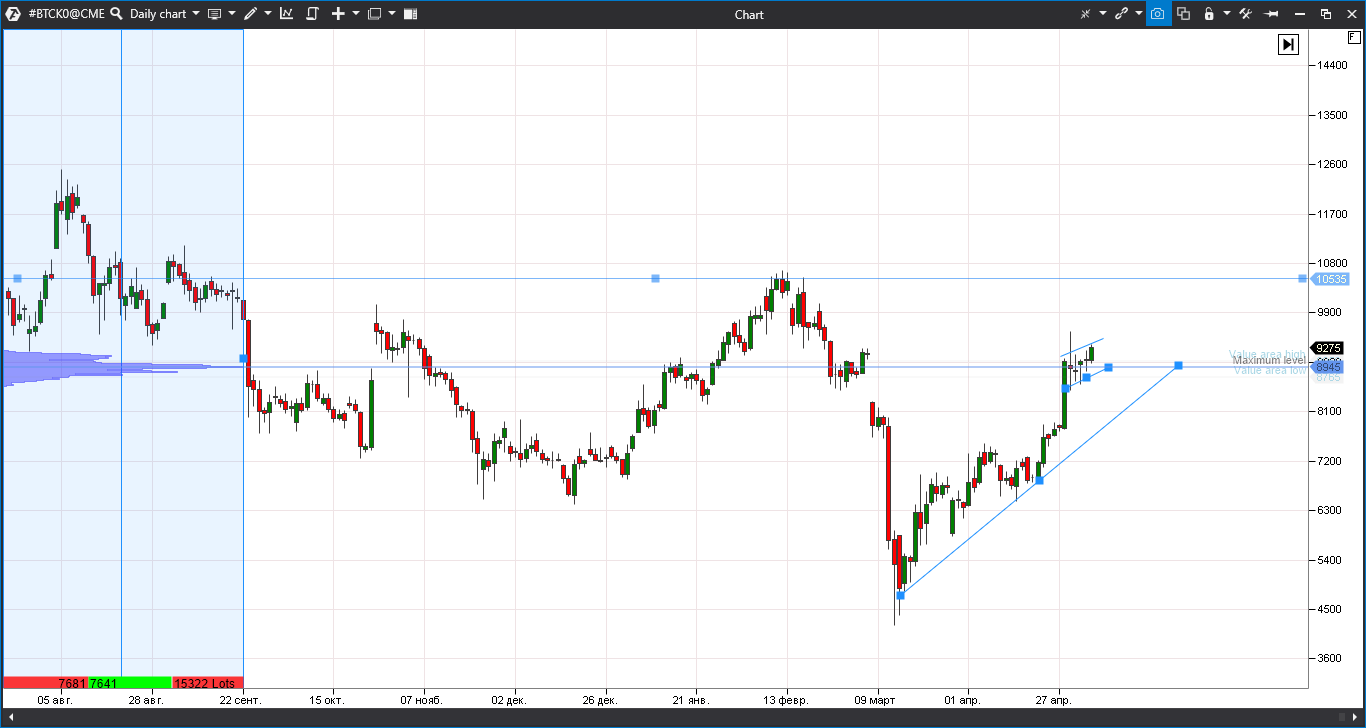

Some experts are sure that the price may grow again in 2020 with the potential above the 2019 year highs (USD 12 thousand). The bitcoin price fastly moves to the year high after the market fall in March 2020.

What is the basis of the assumption that the growth would continue? If we conduct the fundamental analysis of bitcoin as a digital commodity (like gold), we can mark a series of factors that facilitate growth:

Emission of fiat currencies. Central banks started emission of fiat money, which would become the biggest one in history and, presumably, would reach USD 10 trillion. Such a gigantic amount may finally undermine confidence in USD. It is beneficial for bitcoin and gold since they may become the only ‘hard’ assets.

Growth of long-term investments. As we already mentioned above, about 43% of all bitcoins are in the hands of long-term holders, who only accumulate the volume of cryptocurrency in their portfolios. This factor puts pressure on the supply and bitcoin becomes a more scarce resource, which facilitates the long-term growth of the price. The record-breaking purchase of gold by central banks in 2019 had a similar impact on the value of the precious metal.

Market infrastructure. The boom of bitcoin adaptation by classical financial markets has been observed in the world since 2017. The CME and Cboe exchanges initiated trading bitcoin derivatives and such investment monsters as Black Rock and Fidelity are developing an infrastructure for storing and selling cryptocurrency to customers. The launch of the first regulated ETF is possible in the course of the forthcoming year. All these things create grounds for investing not only private but also major capitals from Wall Street into cryptocurrency.

What the bitcoin halving would result in

One more important factor – bitcoin halving – should be considered individually. While fiat money is printed in bigger and bigger volumes, the third halving is expected in the bitcoin network on May 12. It means that the block reward of miners would drop twice from BTC 12.5 to BTC 6.25. It means a double reduction of emission in terms of classical finance.

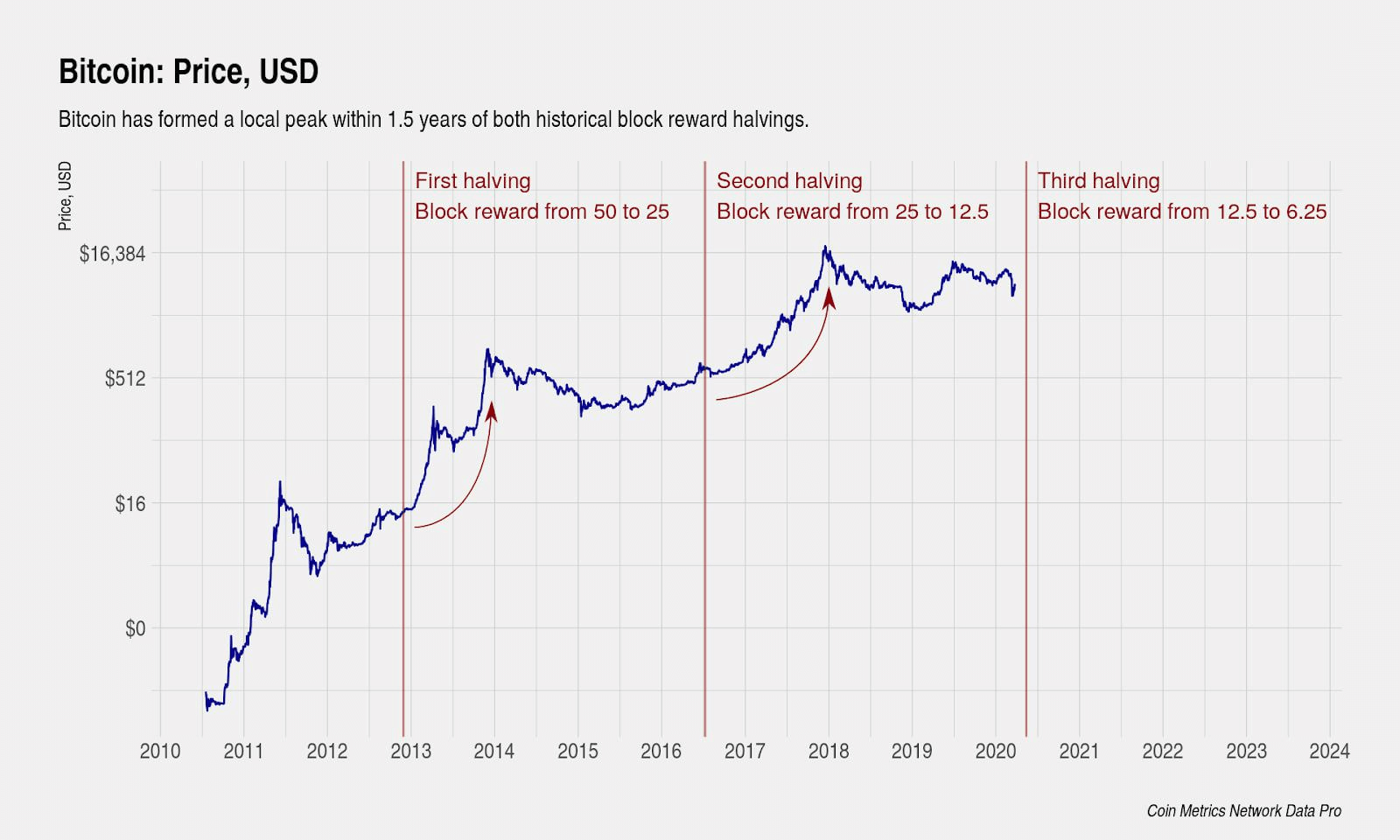

The Bloomberg Agency stated that historically the bitcoin halving is followed by a sharp growth, which may last for more than a year. This already happened after the 2012 and 2016 halvings. If the pattern is repeated, we may expect the new bitcoin price peak in August 2021.

The questioned Bloomberg experts noted that bitcoin was created for overcoming the crisis. And now we face a situation, which promises good prospects to the cryptocurrency. The venture capital investor Tim Draper believes that the price may increase more than 10 times during the coming years. ‘Bitcoin will gain popularity because this currency is just better than any traditional currency, which is linked with governments and political whims’, he said.

What should be taken into account when investing in bitcoin

Prospects look attractive, however, it is critically important to take into account risks when analyzing bitcoin and making decisions about buying it.

- First, bitcoin is not yet a classical investment instrument. Its volatility is too high to include it into classical portfolios.

- Second, the future is full of surprises. For example, nobody could predict the total sellout in the world financial markets in March 2020 under the influence of the coronavirus pandemic.

Due to this, long-term cryptocurrency investors should not invest into bitcoin more than they can put at risk. It goes without saying that you shouldn’t invest the money, which you need for important purchases or medical servicing and also borrowed funds. You may perceive bitcoin as a venture investment, since you have good chances to increase the invested amount significantly. However, if something goes wrong, losses could also be significant.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.