Tag Archive for: Trading patterns theory and practice

Profitable trading on news: everything you need to know

/in Fundamental AnalysisWe have many useful articles in our blog on different subjects connected with trading: Earlier, we published articles about indicators: Big Trades, Speed of Tape, Cluster Search, CCI, RSI, MACD, Imbalances and Fibonacci Levels. Articles about trading strategies: How to trade by VSA, Top 5 strategies of trading by volume, Forex strategies against ATAS instruments, […]

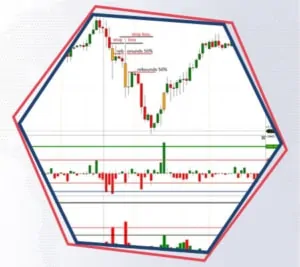

What a Short Squeeze and how shortists lose money.

/in Strategies and PatternsShort Squeeze is not a very popular phrase in the trader’s glossary, it is mostly used by more experienced market participants. We will speak in this article about: what a Short Squeeze is; how to identify it; why a Short Squeeze is important; how to use it in making trading decisions. We will also provide […]

The truth and myths about trading signals of traders

/in Market TheoryIf you have to do something with trading on MICEX or any other exchange, you have come across the trading signal services one way or another. Different messengers and social networks are full of groups and chats, where signals of successful traders are published. Most probably, you received invitations to join them. How does it […]

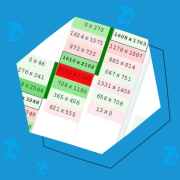

How to learn how to read footprints from scratch

/in Basics of Volume AnalysisThis article is mostly for those traders who have just started to study trading by cluster charts. A beginner should develop own understanding of how to read footprint correctly. We speak here both about training of visual perception, that is, how to find necessary information in the chart, and about training of analytical skills in […]