It’s highly unlikely that there are many people in the world who got up in the morning and, all of a sudden, decided to start trading. As a rule, such a decision is made on the basis of the brokers’ ads, economic knowledge or sharp desire to make ‘easy money’.

Well, let’s assume you decided to become a trader and make a living by trading in the financial markets. But what market will you trade in?

What stock market to select? Where do traders trade? What is the exchange commission in the forward market? What are the types of trading exchange platforms?

We will try to answer the above questions in this article and tell you how to select a market for trading. Read in this article:

- Forward market, stock market or Forex.

- How commission influences the market selection.

- How to take into account liquidity and start-up capital.

- Why competitive advantage is important.

Forex, stock market and forward market - what to select

The majority of quick enrichment ads on the Internet are connected with the Over The Counter (OTC) Forex market. However, be careful. Forex is not very transparent and brokers post spreads. You do not see volumes during trading and, as a rule, you open trades not against another trader but against a broker. The trading volume indicator doesn’t show real volumes, it shows the tick volumes. That is why the chances to make money on Forex decrease.

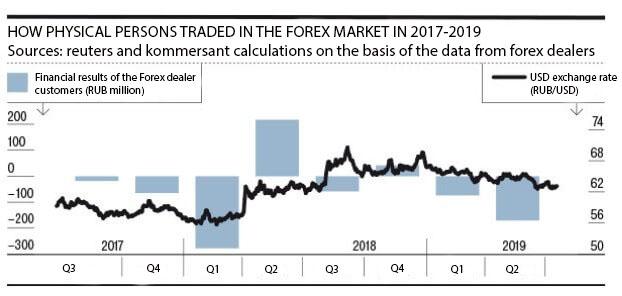

Sometimes you can see splashy headlines in mass media.

Or the following information appears in the news (the picture below is a screenshot from the Kommersant newspaper dated July 23, 2019).

Stock and forward markets are exchange sections. The exchange activity is regulated by legislation and everything is transparent here. It doesn’t mean that you will not lose money. It means that your chances to lose money decrease.

- The stock section trades stocks, bonds and shares – in other words something tangible. The stocks, which are bought here, are stored in the depositary. The stock market is suited both to investors and speculators.

- The forward section trades liabilities, which means that a trader doesn’t have anything tangible even when a trade is open. He has the right or liability to deliver the underlying asset at a specified price. The forward market is not suited to investors. It is suited to speculators or manufacturers, who insure against a sharp price change, for example, on raw materials.

Where is the most profitable place to trade? It depends on commissions, liquidity, start-up capital and competitive advantages.

Commission, guarantee collateral and price step

A commission for a trade in the stock market is an important factor.

Let’s assume two traders trade similar volumes and each tick is USD 100. Let’s calculate how different commissions influence the final profit.

| First trader | Second trader | |

| Tick cost | USD 100 | USD 100 |

| Number of trades | 10 | 10 |

| Number of lots | 10 | 10 |

| Commission for half a trade, that is for the trade opening or closing | USD 1.14 | USD 3.64 |

| General cost of the commission | USD 228 (10*10*2*USD 1.14) | USD 728 (10*10*2*USD 3.64) |

| Number of profitable trades | 5 | 6 |

| Amount of profit in ticks | 10 | 12 |

| Number of loss-making trades | 5 | 4 |

| Amount of losses in ticks | 5 | 4 |

| Gross profit | USD 500 ((10-5)*USD 100) | USD 800 ((12-4)*USD 100 |

| Net profit | USD 272 (USD 500 – USD 228) | USD 72 (USD 800 – USD 728) |

The second trader executes 60% of profitable trades while the first one 50% only. However, the financial result of the second trader is much worse than that of the first one. It happens because commissions ‘eat up’ his profit.

Make approximate calculations of how much you will spend on commissions when you select a market for trading. In some cases it makes sense to stop trading after 1-2 successful trades a day in order to save on commissions.

Check how much money your broker wants to take and how much the exchange. Brokers are often greedy and increase commissions adding payment for ‘analytical account management’ or for trading through an application.

Number of instruments and their liquidity

Liquidity of financial instruments is a possibility to convert the exchange commodity or contract into money. Liquid instruments are traded with a minimum spread between the demand and supply. And many trades will take place at each price level.

It is important for traders to select liquid markets, because:

- the price slippage will be minimal. Slippage is an order execution at a less profitable price due to its sharp movement. Slippage also decreases profit that is why it is important to select liquid markets and instruments;

- an order will be definitely executed. If an instrument is not liquid, an order could wait for execution for a long time or even might not be executed because there will be no offsetting order.

It’s good if there are many liquid instruments in the selected market, because then you can trade several good-quality setups rather than looking for risky trades on one instrument.

Start-up capital

Perhaps, in our case, the start-up capital criterion will be more important than liquidity and number of instruments. Since, unfortunately, even such a liquid instrument as an E-mini S&P 500 futures is not suited to a trader who has only USD 450 of a start-up capital.

Let’s assume you have more money but you are not ready to put it at risk at the beginning. This decision makes sense. Preserve your financial stability and select markets with affordable prices. For example:

- You can trade contracts from RUB 1,000 in the forward section of the Moscow Exchange.

CME has micro contracts, the guarantee collateral of which starts with USD 100.

Russian brokers recommend to trade on CME or NYSE if the start-up capital is not less than USD 20-25 thousand. You can start trading on the Moscow Exchange even if you have RUB 10,000.

Read more about trading on the Moscow Exchange in the following articles: Advantages and disadvantages of trading on the Moscow Exchange and How to select instruments for trading on the Moscow Exchange.

What competitive advantages the selected market provides?

For example, the forward market provides leverage to everybody because only a guarantee collateral is required for buying a contract and not the whole cost of the contract.

There are Open Interest (OI) data here apart from the margin trading. The Moscow Exchange shows the futures contracts OI data online.

We already discussed this topic in the How to use Open Interest in trading article. Let’s describe one more example in brief. Look how the use of the OI analyzer indicator in the forward market of the Moscow Exchange provides valuable information for analysis.

We added 2 OI analyzer sell and OI analyzer buy indicators to a 5-minute RTS index futures chart.

- Red-and-white growing candles show that sellers open new short positions.

- Green-and-white growing candles show that buyers open new long positions.

- New positions feed the price movement since it is an inflow of new money.

- Candle reducing is a closure of old positions. When there is little money and little movement in the market, it becomes unattractive for intraday traders.

OI Analyzer is available on the Moscow Exchange only. CME provides a bit different information. CME shows the Open Interest data with a breakdown into different participants – major manufacturers, hedgers and small speculators. But this information is also could be used to advantage. For example, a successful trader Larry Williams built indicators using the OI data from CME.

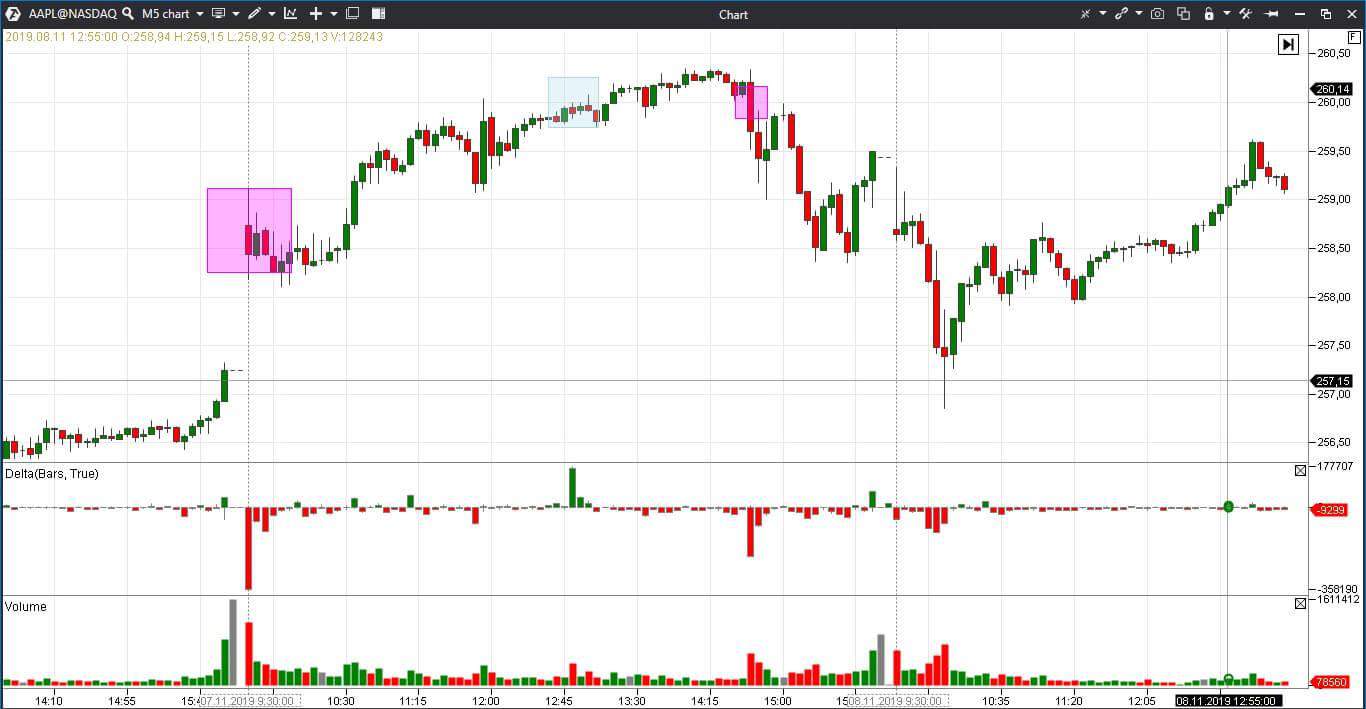

Let’s note that the Open Interest analysis is not the only way to get an advantage. The Delta and Cluster Search indicators are similarly good for the stock and forward markets. And they also could be used for improving performance. Please, see the example below.

We added two Cluster Search indicators to the 5-minute chart of the Apple stock prices. The first one looks for bids from 70,000 items and marks them lilac and the second one looks for asks from 70,000 items and marks them bright-green (what bids and asks are). Thus, traders can see what price levels attracted major buys or sells.

If you selected a forward market for intraday trading, pay attention to the guarantee collateral and price step. All these (unremarkable but important) details are stated in the contract specifications.

Conclusions

Every trader needs to find his own niche and trading strategy for profitable trading. The fundamental and cluster analysis, as well as the technical analysis instruments, will help you in it.

Whatever market and instrument you select – your knowledge, experience and modern software will help you to become successful.

Trading is a complex money-making process. You will have to learn to accept losses and work under stress and uncertainty conditions. Successful traders should be able to control their emotions and protect their capitals, while the trading and analytical ATAS platform will help to get valuable information in the form convenient for analysis. The platform provides comprehensible instruments of the technical and cluster analysis. And our blog and video channel contain valuable ideas on how to use them.