When should you stop? Closing the trade

The modern futures market is a dynamic environment, which is characterized by significant and fast fluctuations of futures contract prices. Being under conditions of an unstable market situation, traders often have to make decisions about closing profitable trades very fast. Ability to systematically make immediate trading decisions makes a difference between successful traders and the rest.

Despite the fact that traders use a wide spectrum of approaches to closing profitable trades, there are only two reasons why they do it:

- achievement of the trade’s goal at which the profit is registered;

- confirmation of the fact of changing market conditions.

In this article we will tell you about a number of factors which traders take into account in their trading for identifying goals at which they register profit in the earlier opened trades.

In this article:

- Goals of profit registration.

- Changing market conditions.

- Decision to close a trade.

Goals of profit registration

The goal of the profit registration is the earlier set price level, at which the potential size of the profit justifies the size of the acceptable risk, which the trader undertakes when executing a trade. The goal, achieving which the profit is registered, is a popular method of closing a trade with profit.

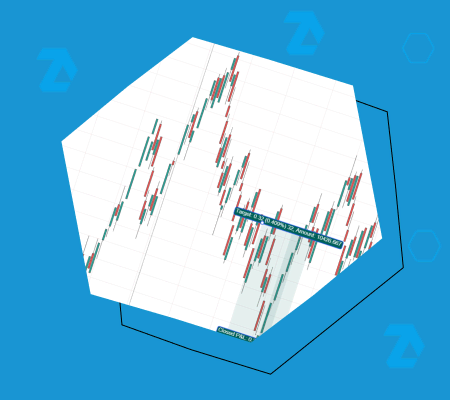

o accomplish it, traders use a take-profit order, which is set beforehand at a certain price level, achieving which the trade is automatically closed. Identification of optimum goals for making profit in each opened trade is a serious task and a trader needs to take into account a number of factors to do that:

- Risk-reward ratio: finding an acceptable risk-reward ratio is an integral part of identification of goals for profit registration. The size of an acceptable risk in the futures market depends on the futures contract specification and degree of the market volatility. Traders use the risk-reward ratio for identification of the size of the capital allocated for each trade. To do it, they often apply the risk-reward ratio higher than 1:1. Although application of the risk-reward ratio in trading is often the subject of heated discussions among traders, it is still a popular method of identification of goals, achieving which a profitable trade is closed.

- Trading methods: the trading style is an important part of identification of goals for making profit. If a trader scalps liquid futures contracts, opening trades within the boundaries of a short time horizon, the goals he uses for profit registration will be less profitable compared to those used by long-term or positional traders. Finally, a decision about closing a trade depends on the trading style and trading methods used by a trader.

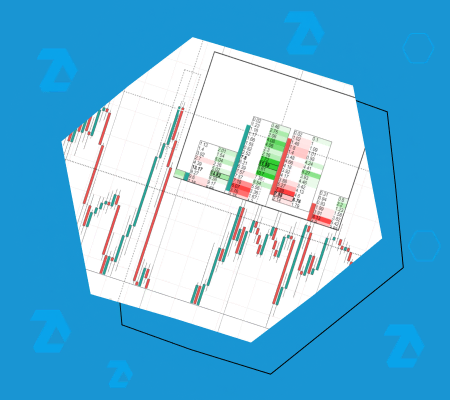

- Support and resistance levels: traders could use volume, technical or fundamental market analysis and also combine these types of analysis for identifying goals to make a profit. Traders that apply technical and volume analysis in trading could use the Fibonacci Retracement Levels, Bollinger Bands indicator, Moving Averages and also Maximum Levels, which reflects levels with maximum volume, and Market Profiles Indicator for finding support and resistance areas. These and many other indicators are accessible to traders in the advanced trading and analytical ATAS platform.

Changing market conditions

Unlike setting specific goals of profit registration, a fast assessment of the market behaviour is a more subjective process. A multitude of factors make their contribution into a possibility of shortening and prolongation of one or another price movement and, consequently, influence the resulting profitability of each trade:

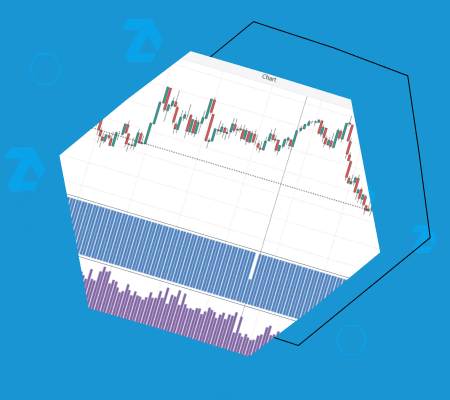

- Momentum: traders use technical indicators and volume market analysis indicators that measure strength and sustainability of price moves. Some of the most popular technical indicators are RSI (Relative Strength Index), Stochastics, MACD (Moving Average Convergence/Divergence) and CCI (Commodity Channel Index). Some of the most popular market volume analysis indicators are Market Profiles and Volume. Methods of application of different indicators in trading are different, however, the main goal of their use is identification of the overbought or oversold state of the market.

- Market state: the character of the price behaviour in the futures market will help to understand when it makes sense to close a profitable trade. For example, if the market is in focused movement in profitable direction, the decision about refusal from the earlier set goal of the profit registration could be justified. However, if the price behaviour character tells us about the market transition to the stage of compression or consolidation, an immediate profit registration would probably be the best decision.

- Time of day: depending on your traded market and trading style, time of day could be an important factor which influences a decision to close a trade. Volatility of many futures markets and contract types is usually increased at certain periods of the trading session. For example, WTI (West Texas Intermediate) oil futures contracts (ticker: CL) are actively traded from 9:00 until 14:30 EST (Eastern Standard Time). If your trade is on the positive side it makes sense to close it before the trading activity starts to go down.

Decision to close a trade

Perhaps, the most difficult aspect of futures trading is closing a profitable trade. Every trader, from time to time, makes a decision not to register the accumulated profit but instead allows a profitable trade to continue ‘working’ further. Independent of whether a trader sets specific goals for profit registration or analyzes signals of the volume or technical analysis of the market when closing trades, stability of his income is of crucial significance. Achievement of a long-term success in the futures market requires a trader to make well-considered decisions and also avoid making the same mistakes.