The same is in trading. If you select the trading type which doesn’t fit you, you can lose a lot of time and strength. In the end, you will not get the required result.

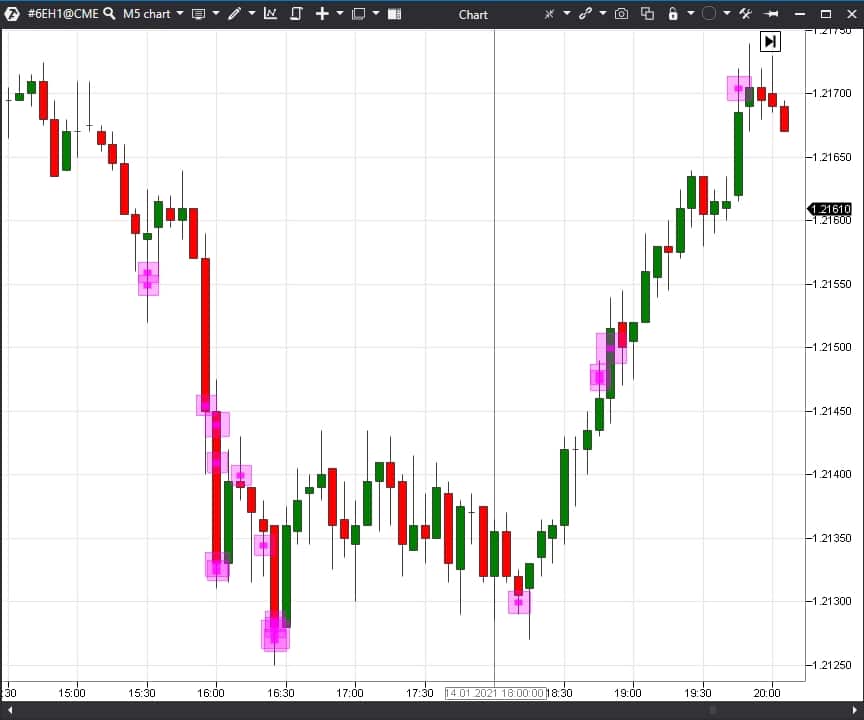

Beginner traders prefer to trade on small time-frames – 1 minute (M1) or 5 minutes (M5), since the price moves fast here and it seems that you can make money fast.

However, you shouldn’t hurry. You should analyse pros and cons of all trading types and understand what time period fits you best of all and is in correspondence with your style of life and daily schedule. Only after that you should go deeper into studying trading systems and market analysis methods.

The present article will help you to do it. In this article, we compare pros and cons for three trading types:

- short-term (intraday);

- middle-term;

- long-term (close to investing).

Short-term trading Pros and cons

Short-term trading is intraday trading on the exchange. The following time-frames are used for this type of trading:- M1 and M5 are good for scalping, when up to one hundred trades (sometimes even more) are executed during a day. However, a more quiet trading could be carried out with 5-10 trades a day.

- M15 and M30 are used for intraday trend trading strategies or reversal strategies. There are less trades here – 1-3 trades a day.

- H1 and H4 help to track tendencies of several day periods and look for entry points during a day. Trades are not necessarily executed every day.

Pros of short-term trading:

- Active intraday movements. The price could move rather strong on small time-frames, providing a trader with a possibility to trade every day.

- Gaining experience fast. Since every day provides opportunities, a trader may gain trading experience fast and test efficiency of the trading system.

- High profit potential. In view of high intraday volatility, short-term trading has a big profit potential. Profit may come from both up and down movements during a day.

- Absence of overnight rollover risks. Since a majority of trades in short-term trading are closed during one day, there is no overnight rollover risk. Sometimes, strong movements may take place in the low-liquid night market, which could endanger your account in the event you have open positions.

- Absence of weekend rollover risks. Some political or force-majeure events could occur during a weekend. This may result in the situation when markets open on Monday with a price gap. If you have open positions, your account may suffer a non-system loss.

- Time & Sales and Order Book. Short-term traders have a big set of instruments applied mainly in day trading. This allows analysing the market more accurately and finding entry points with a good profit potential.

- Small deposit. Since stop losses are relatively small, a small deposit is sufficient for trading, which could be attractive for beginner traders.

However, short-term trading also has cons:

- Quick and difficult to predict market movements. The market may reverse in one minute during short-term trading. Consequently, a trader always needs to be attentive and concentrated, which is rather difficult to maintain for a long period of time.

- It is necessary to monitor the market several hours a day. This type of trading is better suited for professional market participants, who can allocate 8 hours a day for trading. It could be difficult to combine this type of trading with another job or business.

- It is a very difficult type of trading, which requires experience. Profitable intraday trading requires big experience and is more affordable for advanced traders. This type of trading could be difficult for a beginner trader.

- A lot of false movements and market noise. Trend movements are not strong and are rare. There are many reversals and false breakouts of levels. You should be able to filter out false movements from true ones.

- Emotional and psychological load is high. In view of lengthy trading during a day and regular false movements, a trader could experience quite strong psychological load and emotional stress because of a big number of trades during a day and a necessity to compensate current losses.

- It is difficult to trade many instruments simultaneously. It is better to trade several instruments for a more stable profit. If there is no trend in one market, there could be a trend in another market. However, it is quite difficult to attentively monitor and trade many instruments during intraday trading.

- It is difficult to build up your portfolio of several trading strategies. The resulting capital curve of several strategies in the portfolio will always be smoother and more stable than the capital curve of one strategy. That is why it is good if a trader could trade several strategies simultaneously. However, it is difficult to implement this approach in short-term trading. As a rule, a trader may trade only one or two intraday strategies in parallel.

What can help a trader to trade successfully during a day?

Understanding actions of major market participants. The trading and analytical ATAS platform has a lot of volume analysis instruments, which could help in short-term trading.

Smart DOM. This module allows seeing pending limit orders of the market participants, dynamics of these orders’ movement and significant price levels for major players. How to trade using Smart DOM.

Smart Tape. It allows seeing Time & Sales, that is market orders. A user can conduct analysis of executed trades and traded volumes and receive extremely valuable information for active intraday trading. How to read the Time & Sales tape.

Middle-term trading Pros and cons

Middle-term trading focuses on making profit by means of movements during a week with holding a trade for several days. The main time-frame for middle-term trading is ‘daily’ (D).The task of a middle-term trader is to track emergence of strong trends, which have 3-5 day movement potential. Middle-term trading is, most often, the trend following trading.

Pros of middle-term trading:

- You need little time for trading. Since the daily time-frame is used for analysis, 1 hour a day could be enough for looking through several markets and finding good entry points.

- Middle-term trading could be combined with a job or business. When you start mastering the trader profession, you will need to combine learning with your job or business and middle-term trading is perfectly suited for this since it takes little time.

- Low psychological and emotional load. Since only a few trades are executed, this type of trading doesn’t produce a lot of psychological pressure. There is no need to monitor the market during a day and your brain could have a rest from trading.

- Strong trend movements. Middle-term trading allows tracking and taking strong trend movements. One or two such movements on one instrument may bring sufficient annual income.

- It is possible to trade several instruments simultaneously. In order to diversify trading, the parallel operation on several instruments helps to reduce risks and increase trading profitability.

- It is possible to trade several trading systems simultaneously. Since analysis takes little time and trades are not executed every day, it is possible to collect statistics and acquire trading experience by several trading systems. It is possible to build up a trading portfolio on various instruments from several trading systems.

- It is an excellent variant for beginner traders. Since it doesn’t take much time, it could be combined with the core activity and psychologically it is not difficult.

However, every coin has two sides and middle-term trading has its cons and you should clearly recognise them.

- Big deposit. You should post rather wide stop losses for trading on the daily time-frame. Consequently, you need to have a big deposit in order to meet risk management requirements.

- Relatively small profit. In view of a more quiet trading, a trading profit could be less than in short-term trading. Annual income starting from 20% could be considered good.

- Small number of trades. You will need much time for acquiring experience since the number of trades is small. You can solve this problem by trading a bigger number of instruments.

- Lengthy account drawdowns. A middle-term system may not produce a result until a strong trend starts on the instrument. If this happens, you just need to wait and continue system trading. In order to trade by middle-term systems, you need to control yourself and be patient to continue system trading despite the drawdown.

- Additional risk of overnight, weekend and holiday position rollover. There is always a risk of some unpredictable events when markets are closed: military conflicts, terrorist attacks, natural disasters, etc. In the event of such force-majeure events, the markets may open with a big price gap and the posted stop losses could be activated in completely different places increasing losses substantially.

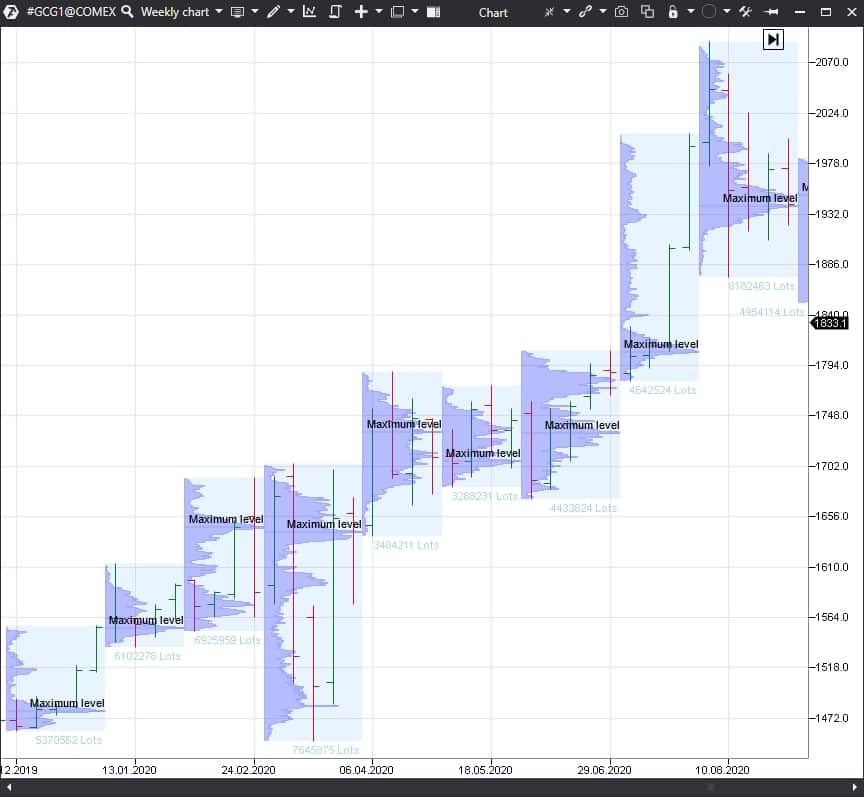

What instruments of the trading and analytical ATAS platform will help you in middle-term trading? It is important for a middle-term trader to know where the levels, at which the price may stop, are.

The Maximum Levels indicator is good in showing middle-term levels:

- Previous week.

- Previous month.

- Contract.

Then you will see the levels, at which the movement can stop.

Long-term trading Pros and cons

Long-term trading is something in between investing and trading. The time-frame you could use is a week or month. There could be several trades a year and not necessarily every month. Advantages of this approach:- It is good for busy people. You will need to allocate several minutes a week or a month for trading. You can conduct analysis on weekends and execute trades on the nearest Monday when the market opens.

- It is possible to trade various markets. Since you do not need to conduct analysis often, you could analyse the majority of main world markets: stocks, indices, commodities, currencies, cryptocurrencies, etc. Such a diversity allows seeing the general picture of the whole market and not to miss a single significant trend.

- Widely diversified portfolio. In long-term trading, you can build up a portfolio, which will trade with low risks and high Sharpe ratio.

What are the cons of long-term trading?

- An even bigger deposit. Trading could be carried out without leverage, which will require an even bigger deposit. A trader could gain knowledge and experience gradually and, while the deposit grows, allocate some funds for long-term strategies.

- You need big patience. You might wait for more than a year to see results of the long-term approach. There could be situations of lengthy drawdowns, during which you will need to trade. If it is a flat year in the majority of markets, the long-term system might not produce a result. However, a trend year may cover losses and bring profit.

What instrument of the trading and analytical ATAS platform could be useful in long-term trading?

The monthly TPO and Profile indicator could show levels of the maximum accumulated volumes.

Conclusions

What to do in practice

What trading type to select?Each trading type has its advantages and disadvantages, that is why you should reasonably approach the selection:

- Middle-term trading on the daily time-frame is the best variant for a beginner trader since it doesn’t require much time and psychologically is not difficult.

- While gaining experience, a trader could master short-term trading, which, potentially, could be highly profitable.

- While the deposit grows, some funds could be allocated for long-term trading as the safest one.

It is better to acquire experience in all three types of trading, then your total profit would be more stable and risks would be lower.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.