How Does Swing Trading Work?

In our article on the Six Types of Trading, we classified trading based on how long positions are held: High-frequency trading (holding positions for fractions of a second).

- swing long trade №1 was closed at the stop loss (minus 46 ticks) the day after opening;

- swing long trade №2 may still be active (+650 ticks) to date, for instance, utilizing a trailing stop.

What Tools Are Used in Swing Trading?

Reliable tools are a way to stay resilient in competitive markets, where your profit often comes at the expense of another trader’s loss.

Effective Tools:

- Market Profile. This tool enables traders to analyze trading volume distribution across different price levels, identifying key support and resistance levels. It helps determine major activity zones and market participants’ interest areas.

- Price Alerts. They ensure traders do not miss crucial entry or exit points, allowing them to focus on other tasks without constantly monitoring price movements.

- Vertical Volumes (Volume and Delta). They aid in assessing the market in terms of effort and result, helping to evaluate supply and demand balance.

- Footprint Charts. These charts offer detailed information about trades within each candle, including volume and direction at specific price levels. For example, daily timeframe footprints can be valuable for swing traders.

- Margin Levels. Margin zones often act as significant support and resistance levels.

- Non-standard chart types like range charts. They enable you to filter out market noise and focus on short-term trend changes.

- ZigZag Pro Indicator – it helps break down candle sequences into waves, including statistics for each wave.

- Wave Analysis. Elliott Wave principles and other wave analysis tools can be used on higher timeframes to determine the current market stage and potential direction of the next swing.

- Economic calendars.

Ineffective Tools:

Overly sensitive Order Flow Indicators For example, DOM (Depth of Market) – this indicator shows the market depth and the volumes of buy and sell orders at different price levels. While highly useful for scalpers, it is less effective for swing trading since it reflects immediate market activity that changes rapidly. Indicators reflecting activity in the DOM can help a swing trader find a more precise entry point (thus reducing risks), but they are unlikely to change the trader’s perspective on the market over several days or weeks. Moving averages (MA) for swing trading Tools such as moving averages and oscillators have questionable effectiveness and cannot be recommended as reliable aids for making trading decisions. Research shows that their predictive power is often limited. For example, a study published in the “Journal of Risk and Financial Management” concludes that trading rules based on MACD and RSI indicators do not always effectively predict price movements across various markets. This data confirms that technical indicators can be useful in certain market conditions, but they often provide false signals.Swing Trading: Types of Strategies

Let’s break down the strategies used by swing traders into two main categories:

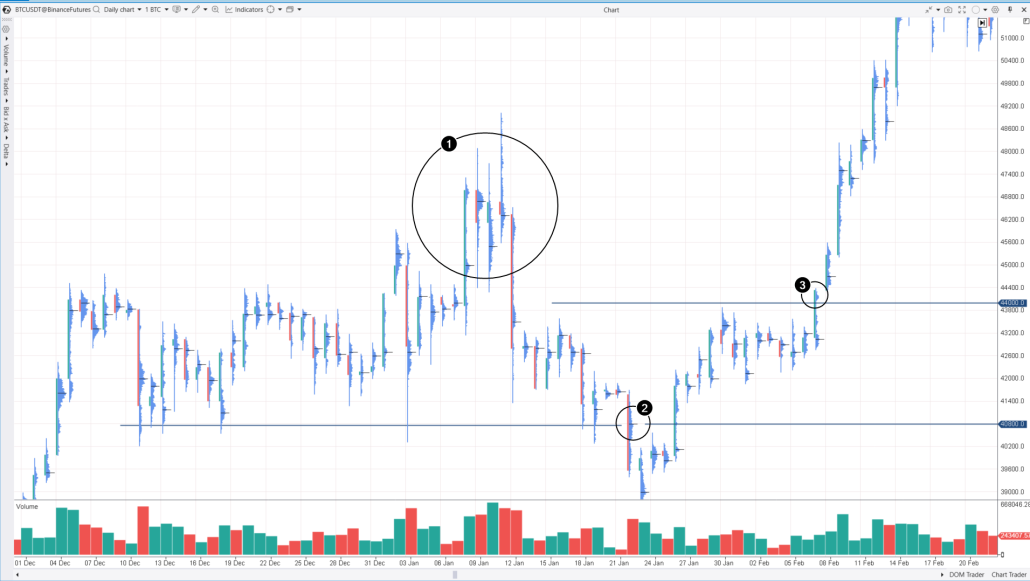

- the buy-stop order is slightly above 40,800 – this level can be seen as crucial, where bears had exerted significant effort to break through (indicated by volume on the footprint chart – number 2).

- the buy-stop order is slightly Above 44,000 – this level appeared as resistance, but on February 8, the balance between buyers and sellers settled above it (indicated by volume on the footprint chart – number 3), suggesting a shortage of sellers and the continuation of the uptrend.

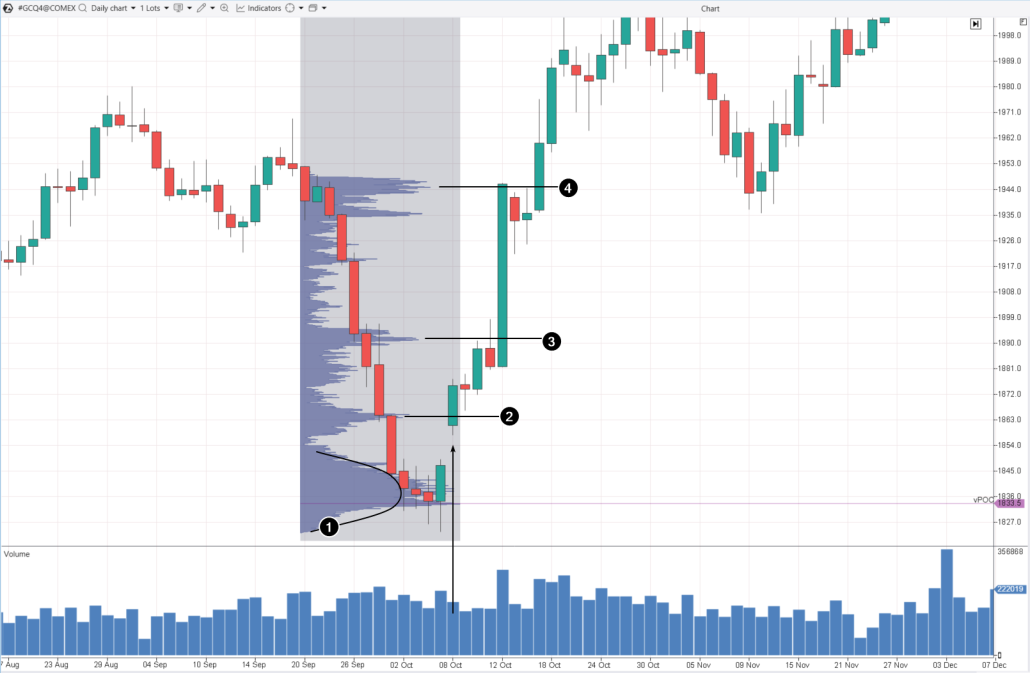

- high inflation prevalent in Western countries in 2023;

- demand for gold from central banks, particularly the People’s Bank of China.

- speculated that the increase in geopolitical tensions (in addition to the factors mentioned above) would act as a major driver;

- bought gold above the $1863 resistance, anticipating that the price would not drop below the gap area;

- continued purchasing on breakouts above resistance levels 3 and 4.

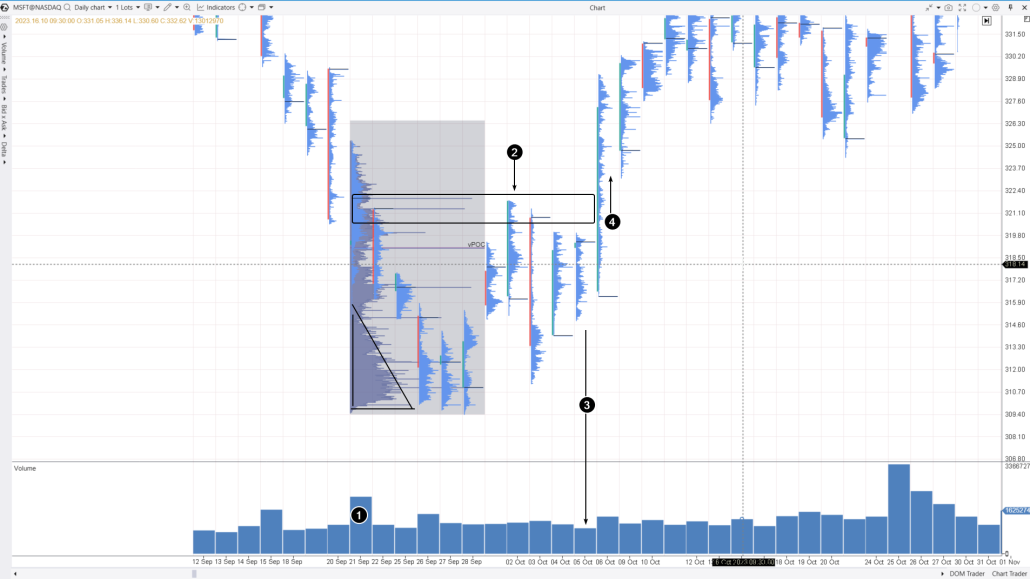

- A decline (1) on high volume. It occurred after the Federal Reserve’s September meeting, where they decided to keep interest rates unchanged and signaled that they would maintain high rates longer than Wall Street expected to combat inflation.

- The downward-expanding triangle (shown with black lines) indicates the presence of a limit buyer in the market, who preferred to accumulate fundamentally strong stocks from September 26-28, preventing them from falling below $310.

- The upward movement with a test (2) of high-volume levels from September 21-22 confirmed the buyer’s activity, and the subsequent decline on October 3 failed to establish a new low.

- (3) – an inside bar, indicating market indecision.

- (4) – a bullish breakout of the resistance zone (2), which a swing trader could use to enter a long position, expecting the balance of supply and demand to have shifted upwards and the price to stay above the inside bar. Footprint signals provided the confidence to buy on the breakout.

Pullback Trading

In this approach, a swing trader needs to consider the current trend and enter a trade after a pullback in the direction of that trend. We have already discussed two examples of buying on a pullback to a high-volume level. Now, let’s delve into another scenario involving opening a short position. Example. Silver market, daily timeframe. Cluster chart reflecting the events of the first half of 2024. During this period, a swing trader might have noticed the breakout of the psychological level of $30 per ounce of silver and the establishment of a multi-month high.

Swing Failure Pattern

The Swing Failure Pattern (SFP) trading method is commonly found online and can also be applied to trend-based swing trading. This method (credited to Tom Dante) involves:- Buying after a false bearish breakout below the previous swing low in an uptrend;

- Selling after a false bullish breakout above the previous swing high in a downtrend.

- this approach can be considered trading against the trend since many indicators pointed to a downtrend in the market since late March;

- the expectation would be that the price would not fall below the Monday gap and the POC level from Friday, April 19.

- “the price triggered the stop-losses of sellers who had short positions during the decline (2)”;

- “a professional is working on establishing a short position using the stop-loss orders of retail sellers”;

- “I am also opening a short position, anticipating that the peak breakout will prove to be false.”

Pros and Cons of Swing Trading

Swing trading attracts traders with the potential to profit from holding positions for several days, but not everyone finds success. Short-term trading has its nuances, and success often hinges on how adeptly traders combine fundamental types of analysis, their psychological attributes, and risk management skills. Personal preferences also play a significant role: some traders thrive on dynamic position changes, while others prefer longer-term investment strategies.Pros of Swing Trading

Reasonable time commitment. It requires less time for analysis and position monitoring compared to day trading. Traders can dedicate a few hours per week to the market, making it possible to combine swing trading with their primary job. Moderate volatility. Swing trading does not require reacting to every instant market change, unlike day trading. Potential for significant profits. Trends can persist longer than expected, allowing for substantial profits through short-term trends and market fluctuations. Flexibility in choosing instruments. It is suitable for trading various financial instruments, including stocks, currencies, futures, and cryptocurrencies. Diverse strategies. The ability to use different trading strategies such as breakout, pullback, and trend trading, allows for adaptation to different market conditions. Transaction costs. While transaction fees and costs do not heavily impact the final result in swing trading, they should still be considered when planning a strategy.Cons of Swing Trading

High starting capital requirements. They are related to wider stop losses that prevent the position from closing due to insignificant price movements in terms of swing trading. Additionally, the increased capital demands may necessitate holding positions overnight. Gap risk. Holding positions overnight or for several days (weeks) carries the risk of unexpected price gaps due to unforeseen news events. Forecasting requirement. Swing trading requires the ability to comprehensively analyze the market: taking into account fundamental background and technical analysis. Errors in judgment can lead to losses. Psychological pressure. Swing trading is considered to involve less emotional pressure than active day trading. However, stress can arise from holding a position for an extended period, especially during periods of high volatility and/or anxiety when holding positions overnight. Continuous learning requirement. It requires constant updating of knowledge and skills, as well as adaptation to market changes.Day Trading or Swing Trading?

You can combine both styles: for instance, swing trading in less volatile stock markets and active day trading in cryptocurrencies.| Day Trading | Swing Trading | |

| Profit Potential | Excessively high. Profiting from small fluctuations during the day | High. Profiting from swings |

| Duration of Trades | Trades close within one trading day | From several days to several weeks |

| Time Commitment | Requires full attention during the trading day | Allows for flexibility with other activities |

| Risk | High risk due to frequent trades and market volatility | Relatively lower risk due to comprehensive analysis |

| Psychological Pressure | High due to quick decision-making demands | Lower, allowing more time for thoughtful decisions |

| Chart Analysis | Swift response to sensitive indicators | In-depth analysis of trends and patterns |

FAQ

What does Swing mean in trading? Swing in trading refers to short-term movement (fluctuation, trend, wave) that lasts from several days to several weeks at most. As swing trading profitable? Yes. Like any strategy, swing trading can be profitable if risks are managed correctly and the market is analyzed. Is swing trading legal? Yes. Is swing trading suitable for beginners? Swing trading can be suitable for beginners if they are willing to invest time in learning analysis. It is important to develop a trading plan, start with a small capital or on a demo account to minimize potential losses. How much money is needed to become a swing trader? For swing trading with futures, it is recommended to have at least a few thousand dollars to cover margin requirements for overnight positions and risk management. For starting swing trading with cryptocurrencies, a couple of hundred dollars might suffice, although small positions are unlikely to yield significant profits. Is it possible to do swing trading without indicators? Indicator-free swing trading relies on analyzing price patterns and support/resistance levels without the use of technical indicators. In this approach, cluster charts can be highly beneficial if you know how to interpret them. What timeframe is best for swing trading? The most suitable timeframes for swing trading are typically daily charts (D1), although some traders also utilize 4-hour (H4) and weekly (W1) charts. It is advisable to consider non-standard chart types that do not consider time and offer better visibility of swing movements. Example:

How to Start Applying Swing Trading

To try your hand at swing trading, use the ATAS Market Replay simulator for traders. This module within the ATAS platform utilizes historical data to replicate real-time trading conditions. Beginner traders can hone their skills in completely real conditions, avoiding any financial risks. To try the simulator, download the ATAS platform for free, install, and launch it, and then:

- adjust the playback speed, and pause;

- use more than 400 indicators;

- of course, use Chart Trader and other features to trade on the built-in demo Replay account and then analyze your performance;

- use drawing objects, for example, mark support and resistance levels;

- use various chart types (e.g., non-standard Range XV);

- use exit strategies;

- do much more to learn how to spot swings.

Conclusions

Swing trading is between day trading and long-term investments. It is ideal for those willing to hold positions for a few days and remain calm during market swings. This style focuses not on small profits from a large number of trades, but on quality, emphasizing carefully chosen entry and exit points, which requires patience. Swing traders actively use technical analysis, complementing it with fundamental analysis for a deeper understanding of supply and demand balances. Despite the potential for profits from trends that last more than a day, it is important to remember the risks and costs associated with holding positions overnight, gaps after weekends, fluctuations that one can ignore on minute timeframes. All the things mentioned above highlight the importance of establishing clear trading rules based on identified patterns. Download ATAS. It is free. During the trial period, you will get full access to the platform’s tools to experiment with different strategies for swing trading. Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading, analyzing volumes and identifying potential swings. Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.