CME Micro Contracts or Forex CFD?

Nasdaq, S&P500, Dow Jones – futures (what futures are) on American stock indices are one of the most popular markets in the world.

E-mini futures are the most popular of them

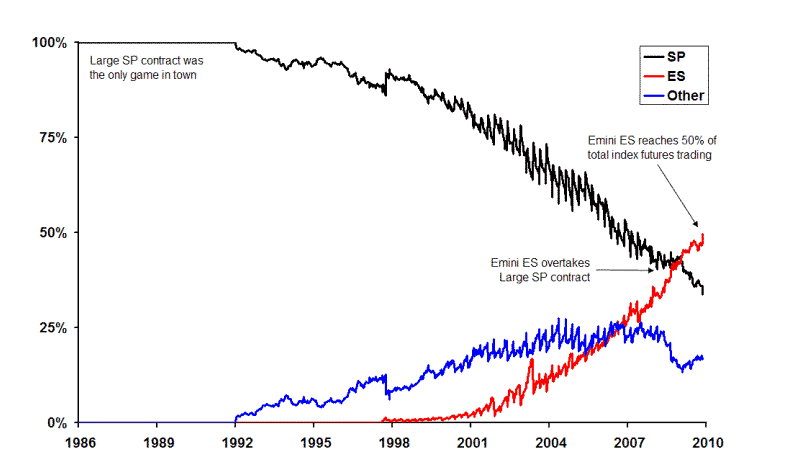

E-mini futures contracts on the leading S&P index were originally launched in September 1997 to attract non-professional investors to index futures trading. A full-weight S&P contract had been the only market before that. But it was too expensive for a ‘regular Joe’ to trade it. Thus, CME introduced an E-mini contract, which was one fifth of the size of a standard S&P 500 futures contract.

E-mini reached a huge success in 10 years. The chart above shows that the E-mini trading activity (red line) exceeded volumes of trading with the parent S&P contract. E-mini (its brief code is ES) is traded not only by beginners, but also by professional traders, mutual investment funds, pension funds, hedge funds, insurance companies, high-frequency trading (HFT) firms and trading syndicates.

Do you want to make money trading futures on the American stock indices? It’s real. Modern technology allow conducting overseas financial operations from anywhere in the world. Today we will compare instruments and exchanges and give an example of a strategy in a chart.

You will learn from this article about American stock market indices:

- What to trade?

- Where to trade?

- How to trade?

- How much to trade?

There is also a question when to trade, but the answer to it does not require a separate section, since futures are traded practically round the clock except for weekends and holidays. The active phase of the American session is from 8:30 until 15:00 New York time.

What to trade?

There are three main indices of the American markets and each one has its own futures:

- Standard & Poor’s is a subsidiary company of the American McGraw-Hill corporation, which is engaged in analytical research of the financial markets. The company is basically known as a developer and editor of various stock indices, the most famous of which is S&P 500. It is the number one index in the US. It is based on the value of stock of 500 leading companies from various sectors and reflects the overall state of things in the American economy.

- NASDAQ-100 – the index includes 100 companies with the biggest capitalization, the stocks of which are traded on NASDAQ. The index does not include the financial sector companies. It mainly reflects dynamics of stocks of technological companies, such as Google, Apple, Amazon, Microsoft, etc. The index is known from 1985.

- The Dow Jones index or Dow Jones-30. This index, which was born in the 19th (!) century, covers dynamics of stocks of 30 biggest companies.

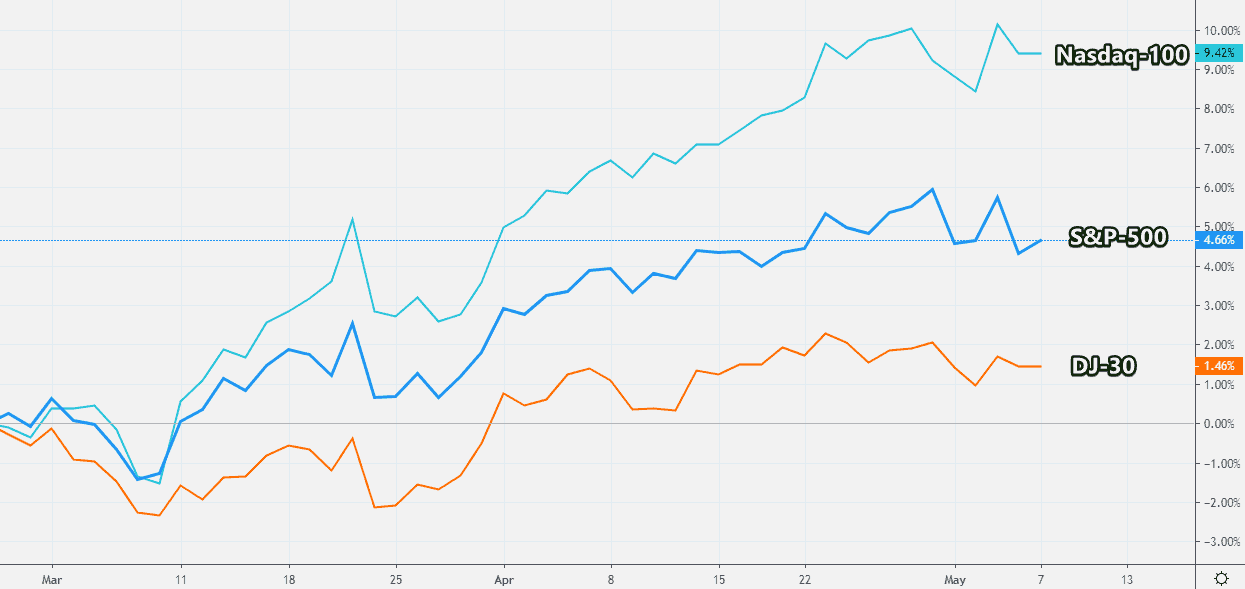

Each of these indices has subcategories. But, in general, they correlate between themselves rather strongly. Besides, sometimes one of them acts stronger than others.

- E-mini NASDAQ futures code is NQ;

- E-mini S&P futures code is ES;

- E-mini Dow Jones futures code is YM.

As you can see in the chart above, NASDAQ-100 grew more active than the other two during the recent (as of this writing) 2 months.

Consequently, it makes sense to pay attention namely to NASDAQ if you look for a setup for entering a long position. The Dow Jones index futures market would be more expedient if a trader is interested in a trade against the growing trend. Always act in such a way so that to increase your chances for a positive outcome.

Where to trade the American stock market index futures?

Conditionally, brokers could be divided into 2 big groups:

- Official. These are the companies, which really transfer your trade to a real exchange. The main platform for trading futures on the American stock indices is the CME Group – the biggest North-American market, which was formed through unification of the leading Chicago and New York exchanges. Note that, since recently, the S&P 500 futures is also traded on the Moscow Exchange. Official brokers have proper licenses and are regulated by strict regulatory authorities. If you trade through an official broker, your trade is entered into the exchange register. You can even see it on tape (we will show it to you in the example below).

- Not quite official. These companies, as a rule, are registered offshore and provide services to their clients using the MetaTrader trading terminal. And their trading instruments are called CFD (Contracts For Difference). It is impossible to track where your orders go and by whom, where and how they are executed – the story is absolutely non-transparent.

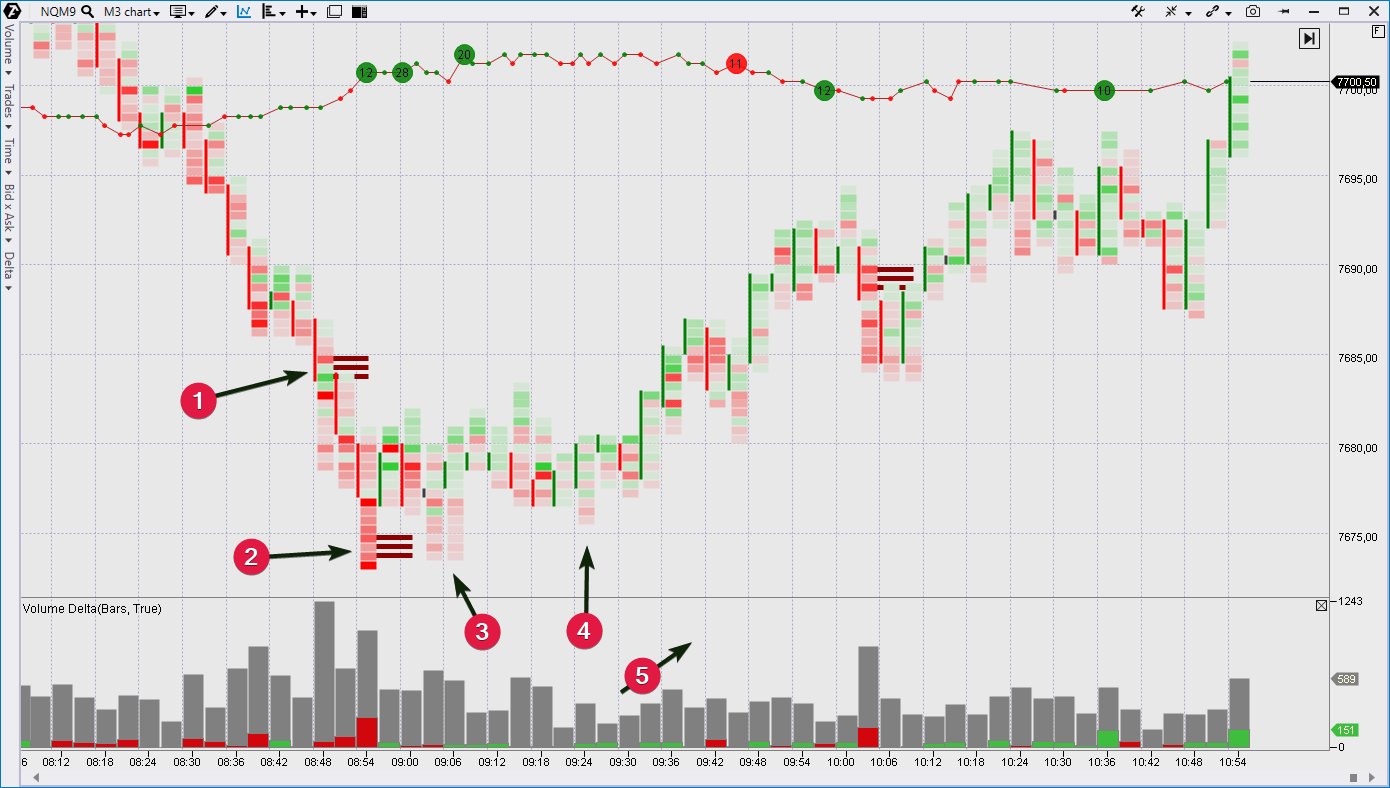

Let’s consider 2 charts in support of the above.

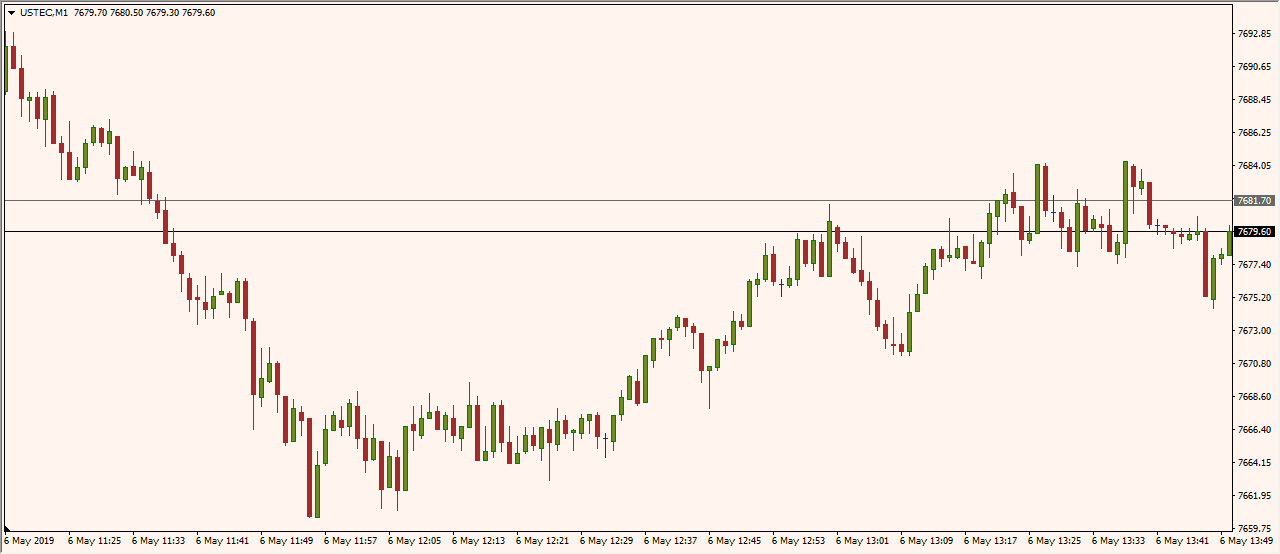

The first one is a screenshot from the MetaTrader terminal. It reflects a fragment of trading the NASDAQ index in the CFD market on May 6, 2019 (1-minute timeframe).

The second chart is a screenshot from the trading and analytical ATAS platform. This cluster chart (types of cluster charts) displays the same fragment of trading activity. The data are loaded directly from CME, where operations with stock index futures take place.

Note the fundamental differences between the two charts.

First, do you see the polygonal line on top? It is the Order Flow indicator or visualisation of the tape in the chart. It shows the trading progress in real time. For example, the green circle with the number 10 means that someone bought 10 contracts. Can it be done in MetaTrader? Ask the support service of the broker, who provides services through the MT terminal, about it. Interesting, what they would answer.

Second, the clusters contain the history of the trading progress with a maximum break-down. Standard candles hide this information. The picture of the reversal becomes readable due to the cluster chart (or footprint):

- Effort of sellers at breakout of lows of the previous three bars. The Imbalance indicator registers an inflow of sell orders to the exchange.

- Intraday panic or selling climax. Do not miss the red splash on the delta.

- Inflow of sell orders dries out and the panic goes down.

- No supply.

- Buyers take the market under control, since the price grows in proportion to the volume with a positive delta.

Can you read this story from the MetaTrader chart? The answer is quite obvious. We will remind you that our friend Michael, an ATAS user and professional trader, directly advises in his interview to forget about CFD and start trading futures.

How to trade the American stock market index futures?

Every trader should find his own answer. You can pick up many ideas for trading strategies on our official YouTube channel. Watch and do not forget to subscribe.

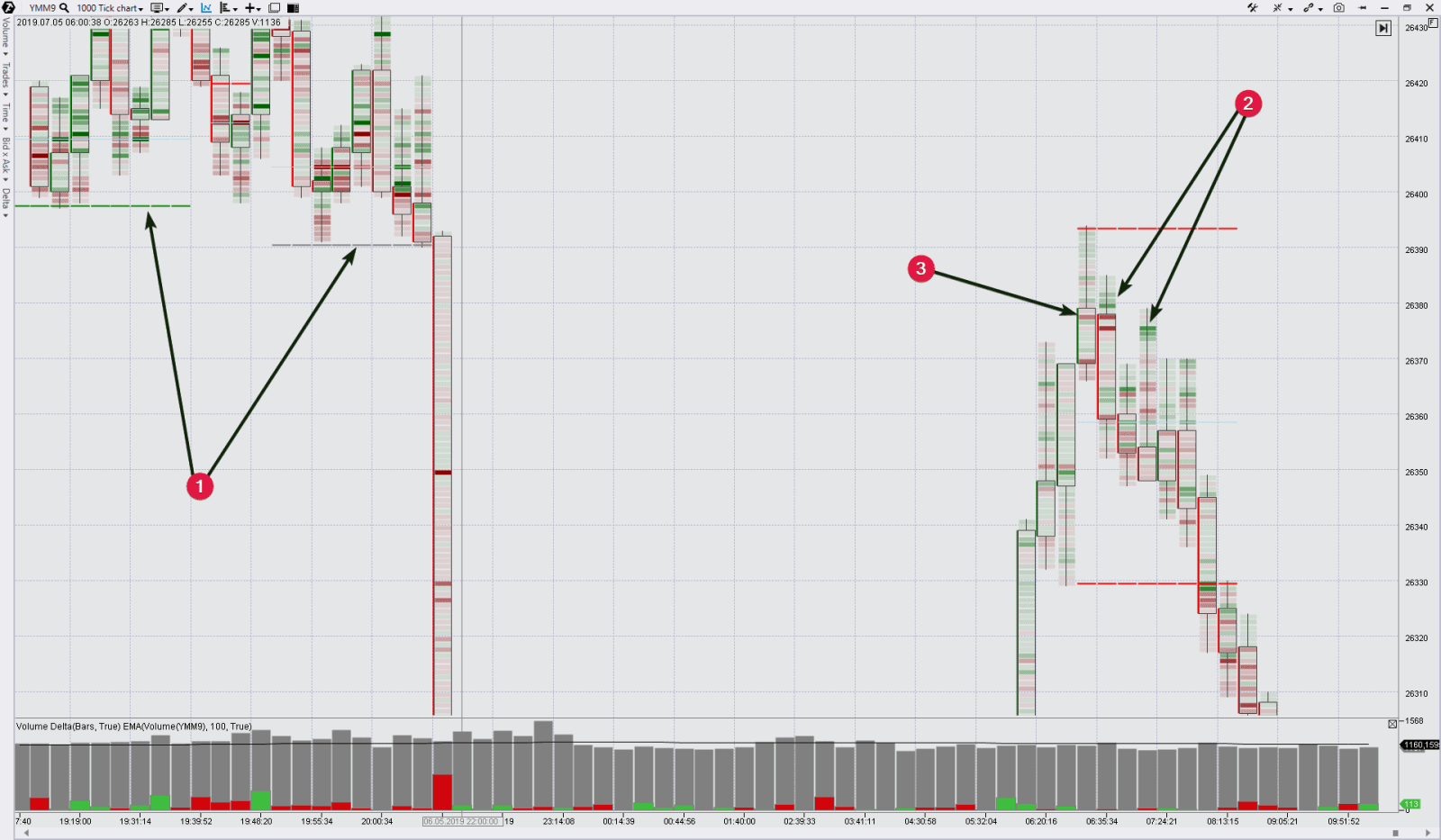

In order to add more practical value to the article, let’s consider the ‘bearish breakout test’ setup in the Dow Jones index futures (YM) tick chart. It was formed on May 7, 2019, when it was early in the morning in Moscow.

Number 1 points to the support, which the HRanges indicator reflects in the chart. This support level was formed during the previous session, but was broken downward. The price came back to the breakdown area the next day. What’s next? Downward reversal or rally continuation?

The chart gives a hint. The buyer efforts (2) produce no results and the appeared seller (3) holds back the growing impulse, in the result of which the candles form long tails from top. It tells us that the buys pretty much reflect activation of stop losses of sellers rather than a true demand. What is our conclusion? There are chances in favour of a downward reversal.

How much to trade?

The most beneficial answer is provided by those brokers that render the American stock index CFD trading services through MetaTrader. They reduce minimum deposit requirements down to 100, 50, 10 and 5 dollars in their race for customers. No doubt, a low market entering price is a pro. However, the reverse side of the coin promises a bunch of cons: non-transparent system of trade execution, absence of a possibility to analyze the order flow, doubtful reputation of offshore companies and many others.

Let’s look at the Moscow Exchange. As of the beginning of May 2019, you need to have a collateral in the amount of RUB 12.5 thousand on your account for trading one US 500 (S&P analog) American issuers stock index futures contract (contract specifications in more detail). It is quite affordable for entering into such a serious business as futures trading.

And now let’s look at the main citadel – CME. How much money do you need to trade futures on S&P 500, Dow Jones or Nasdaq in their native country?

The official CME web-page states that you need USD 6,300 for trading one E-mini S&P-500 contract with transfer of an open position overnight. Big money. A smaller amount (depends on a broker), but not much, is required for intraday trading.

If you want to close the American stock index futures trading topic as unaffordable, do not hurry. There are good news on the main web-page of the exchange.

CME starts Micro Contract trading! They are 10 times more affordable!

Judging by the name, micro contracts should be much less demanding to the trader’s capitalization. Very much so. We put the information about micro contracts in the table below:

Parent index ticker | Micro contract ticker | Required collateral | Cost of one tick | |

| Micro E-mini S&P 500 Futures | SPX | MES | USD 690 | USD 1.25 |

| Micro E-mini Nasdaq-100 Futures | NDX | MNQ | USD 836 | USD 0.5 |

| Micro E-mini Dow Jones Futures | DJIA | MYM | USD 649 | USD 0.5 |

CME makes advances to beginner traders with low capitalization. We believe that E-micro contracts would repeat the success of E-mini and soon become a similarly popular instrument in the world market.

Summary

Internet made it possible to trade on the American exchanges from any place in the world.

CME made the stock index trading more accessible after introducing E-micro contracts.

Orderflowtrading made the futures market analysis more efficient by constantly improving the trading and analytical ATAS platform. Download the free test version right now.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.