What you should know about liquidity

There is a rule in trading – to trade liquid securities only.

In this article we will:

- identify what securities are liquid and what are not;

- consider examples of liquid stocks of the American and Russian sectors;

- explain how to identify liquidity with the help of the Smart DOM and limit orders;

- speak about iceberg orders with the help of which liquidity is hidden in the market.

Liquidity definition

Securities liquidity means a possibility to be sold fast at the price, which is close to the market price. Liquidity also characterizes a high security demand and supply.

Stocks could be:

- highly liquid;

- low liquid;

- non-liquid.

Liquidity of a security in the financial market is identified by a number of executed trades (trading volume) and the size of the spread – difference between the maximum prices of buy orders and minimum prices of sell orders.

Liquid and non-liquid stocks

In order to identify the spread size it is necessary to work with the Smart DOM in the trading terminal.

Availability of a narrow spread in the Smart DOM doesn’t mean yet that the stock is liquid. It is important that counter demand and supply would have such a volume which could have held the price from strong slippages.

For example, the price spread could be quite narrow but if someone needs to buy or sell a big volume of stock, this could move the price significantly to one or the other side. In such a case a security cannot be considered highly liquid.

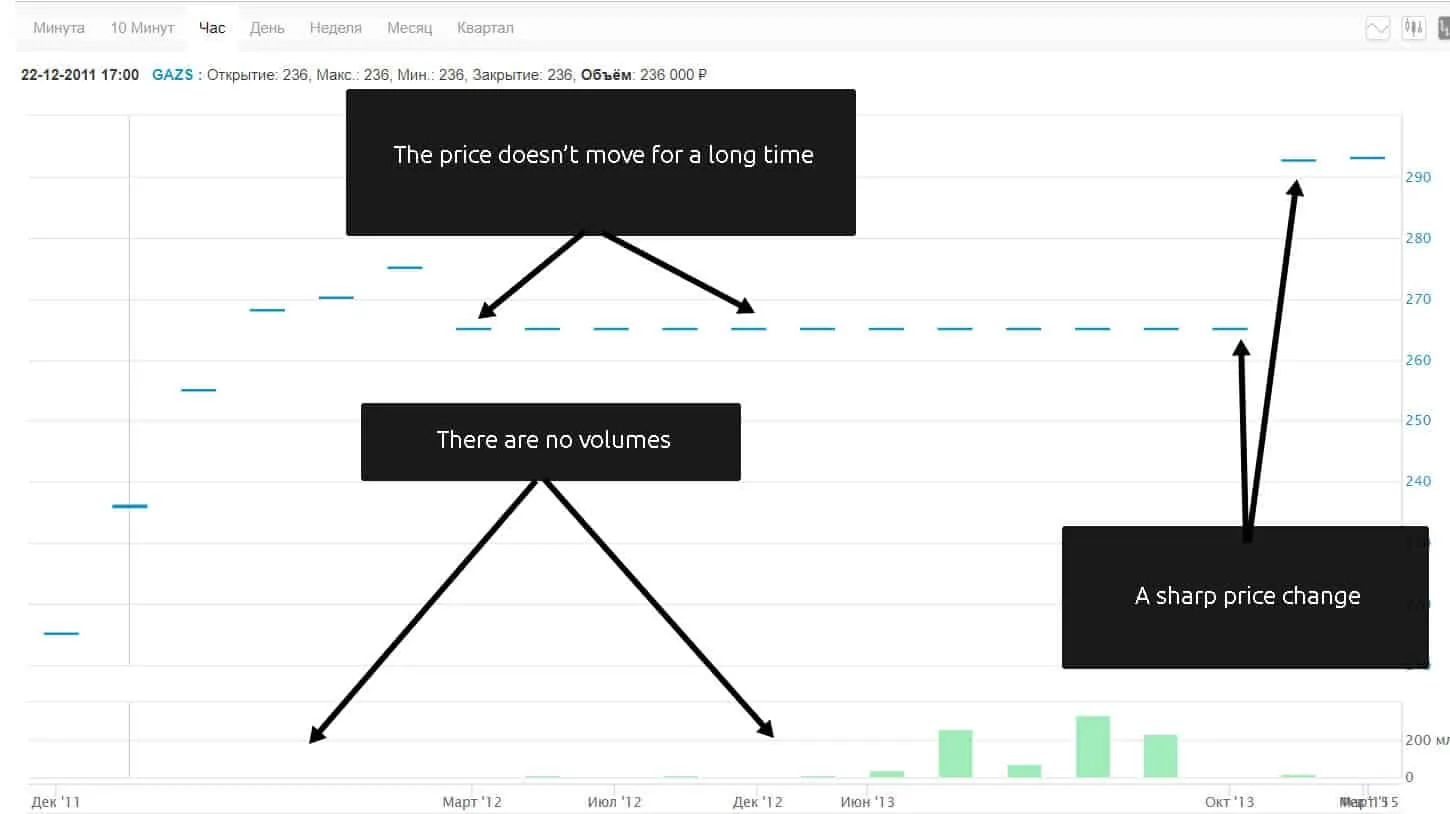

Non-liquid stocks are quite frequent in the market and it is easy to identify them by the chart which would have a lot of long-term flat movements and sharp breakouts in one direction or the other.

Example of the non-liquid Gaz-Servis PAO stock on the Moscow Exchange.

If there is a possibility to track the Smart DOM of limit orders for trading non-liquid stock, you will notice that there is no counter-will of one of the sides in the Smart DOM. The other side can wait for execution of their orders for a long time until some counteragent emerges.

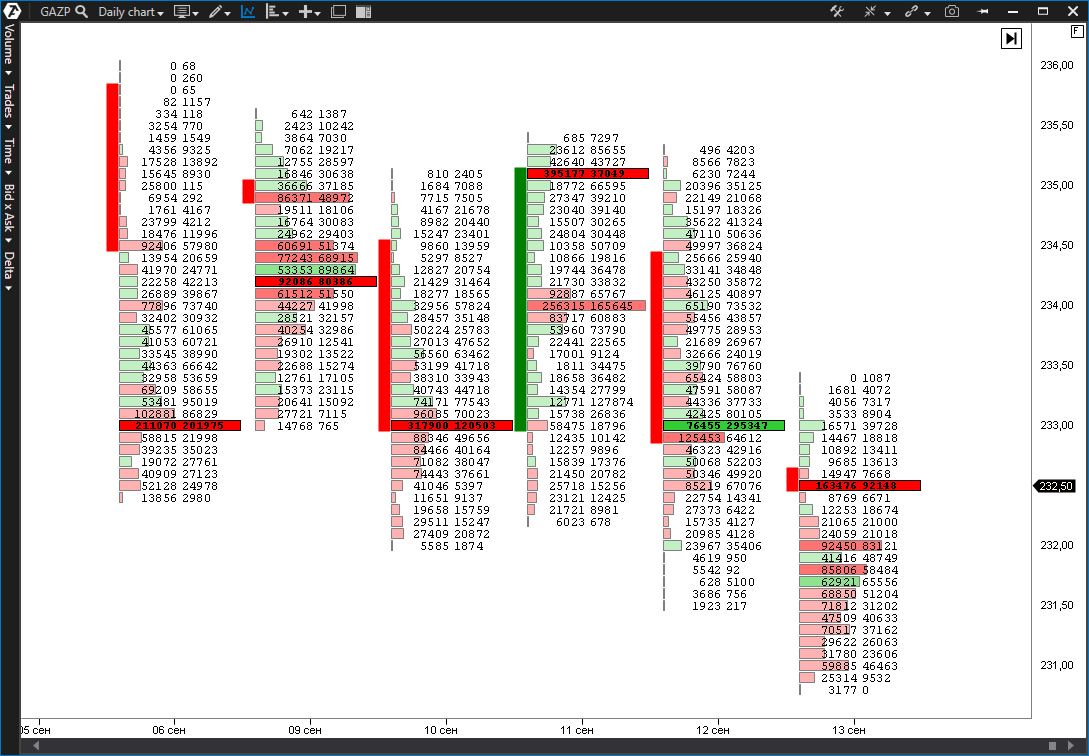

In order to understand what average liquidity the stock has, it is sufficient to open a cluster chart (what a cluster chart is) where you can see market buys and sells.

The above example shows a day cluster chart of the PJSC Gazprom stock. Major clusters are highlighted bright:

- red – if there are more sellers;

- green – if there are more buyers.

It can be seen in the cluster chart what average volume of stock is traded for a certain period of time and it can serve as a basis for making a decision regarding the working volume for each specific stock.

Quite often stocks are traded in lots. In order to specify a real money circulation it is necessary to find out from the exchange websites how many shares there are in one lot. For example, 1 lot of GAZP contains 10 shares. In order to specify the actual money circulation in a cluster it is necessary to multiply the traded volume first by price and then by 10.

The bigger volume is observed in clusters at a smaller time period, the bigger the stock liquidity is.

Set a smaller timeframe in the chart and compare liquidity of different securities. You should also remember that the maximum volume in stock may ‘wander’ from one hour to another.

Add the vertical volume indicator (Volume) in the ATAS platform (how to trade by volumes) in order to find the maximum accumulation of volume. This way you will see the most active trading period during a day.

How explicit and hidden liquidities are formed

The market liquidity is formed by:

- market orders;

- limit orders which expect their execution.

Quite often there is a direct relation between the market orders and limit orders which manifests itself in the following phenomenon.

As soon as a major volume of limit orders emerges in the Smart DOM, the market orders, which can work both along the major volume and against it, are activated. The matter is that investors often wait for a moment when they have a possibility to ‘infuse’ their volumes into stocks. However, this infusion may result in a shift of the price spread and unprofitable trade in the event of absence of the counter-supply. That is why professional traders wait for appearance of a major supply and actively start buying or selling as soon as such a supply or demand emerges in the market.

Namely that is why the stock liquidity will have a nonuniform character: the volume would increase at some price levels and decrease at others.

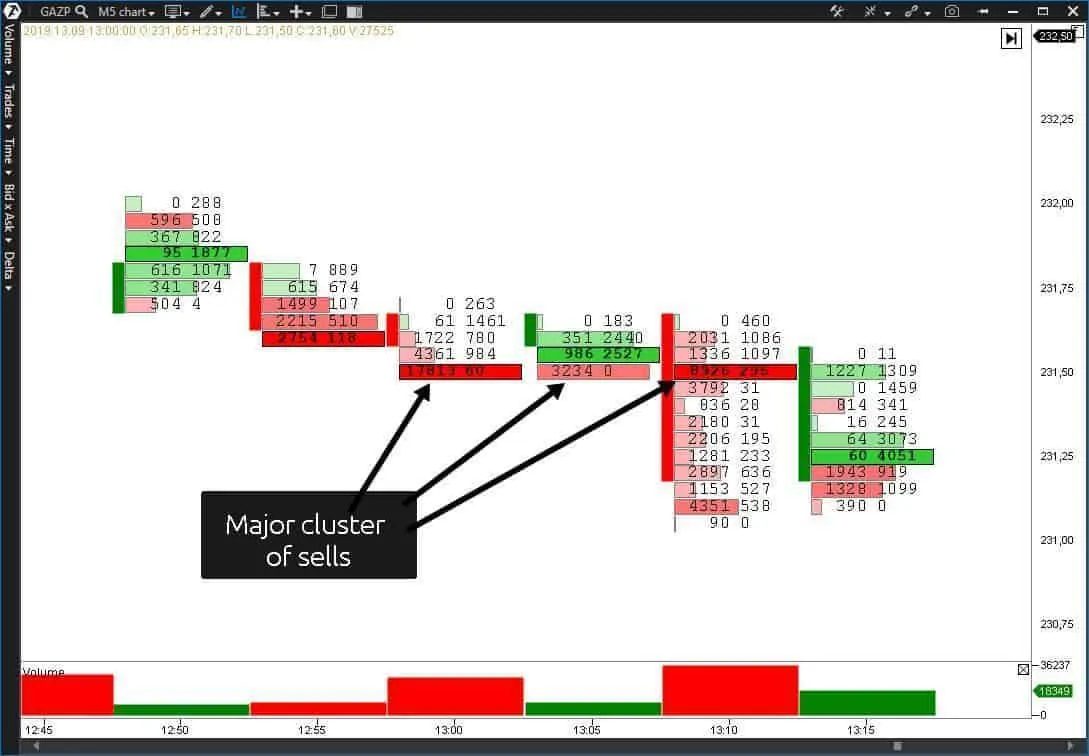

So, pay attention to what price levels contain the increased volume when you identify the stock liquidity. Such levels form important clusters. Moreover, the activity of investors rises again when the price tests a major cluster (how to trade by horizontal volumes).

The example shows a major cluster in the PJSC Gazprom stock which held the price from falling for some time. However, the price continued to decrease after the volume was exhausted.

Change of a security liquidity character

As a rule, the security liquidity character doesn’t change in time. Of course, the publication of important news results in a splash of interest of traders to the stock and the consequent growth of liquidity.

For example:

- the company issuer shows unprecedented growth of profit;

- a major investment fund buys a share of the company;

- the company’s stock is listed in S&P 500 index.

However, when the reaction to the news calms down, the security liquidity comes back to the level, which is close to the previous one.

However, qualitative structural changes of the issuer are required for the stock (or other security) to change its status from low liquid to highly liquid. For example, Amazon has passed a 20-year way from an average company to a world giant.

Liquidity indicator

The most true liquidity indicator is the traded volume. Namely this indicator shows what the real turnover of the security in the market is on a daily, hourly and minute basis. If you observe only one Smart DOM, you may have a wrong understanding of the real liquidity of a security. For example, you may be confused by spoofing orders or hidden iceberg orders.

If:

- a major volume emerges in the Smart DOM;

- it is picked up when the price approaches it.

… it shows that there is a spoofer who creates an illusion of liquidity in the Smart DOM. The spoofer’s goal is to manipulate the opinion of traders making them push the price in the required direction.

Liquidity and iceberg orders

Iceberg orders are different. Unlike a spoofer they do not show their whole volume. A very small volume could be presented in the visible part of the order, but when the market absorbs liquidity at the iceberg level, it, as if, ‘gets stuck’ in it while liquidity in the Smart DOM is constantly replenished. Thus, we can see that the iceberg as if constantly ‘floats up’ when the visible part is analyzed.

However, if there is an iceberg, its size, as a rule, is bigger (otherwise there is no sense to hide it). When investors run into an iceberg, they understand that they’ve met a massive counter-supply and will actively infuse liquidity until the iceberg ‘floats up’ completely.

There are such big icebergs that the counteragents exhaust while the iceberg is still not liquidated. In such a case the price goes into correction. However, the volume accumulation place creates a cluster, which can pull up the price to itself again, in the chart.

Summary

In this article we:

- considered what securities are liquid and what not;

- found out how to identify liquid stocks by clusters and Smart DOM;

- learnt how spoofing orders and iceberg orders behave.

If you got interested in the topic of trading liquid securities in the Smart DOM, read the following articles: