Using Stop-Loss and Take-Profit in ATAS

In this article, we will explain in simple terms what stop-loss and take-profit are and how to use them in ATAS.

Read more:

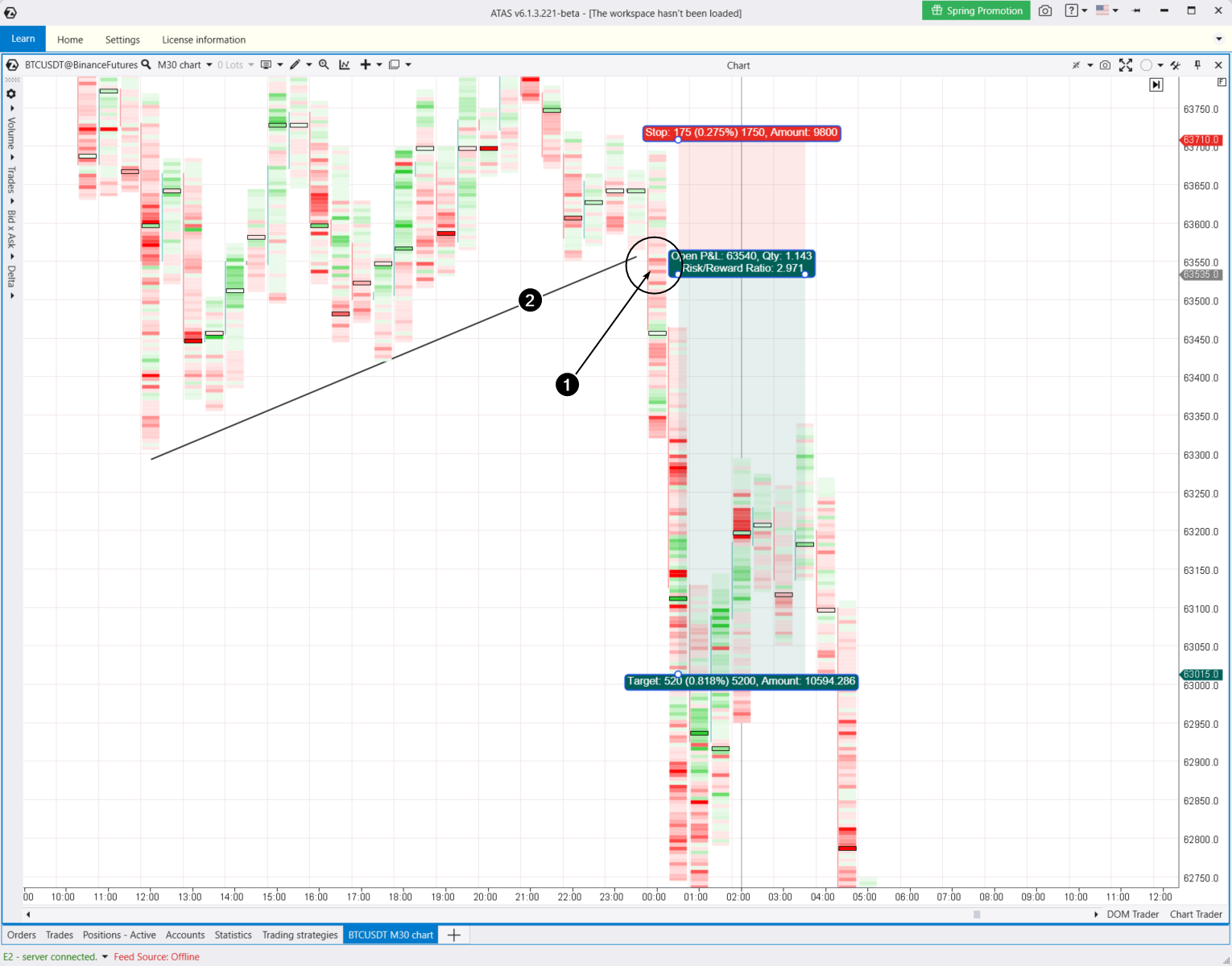

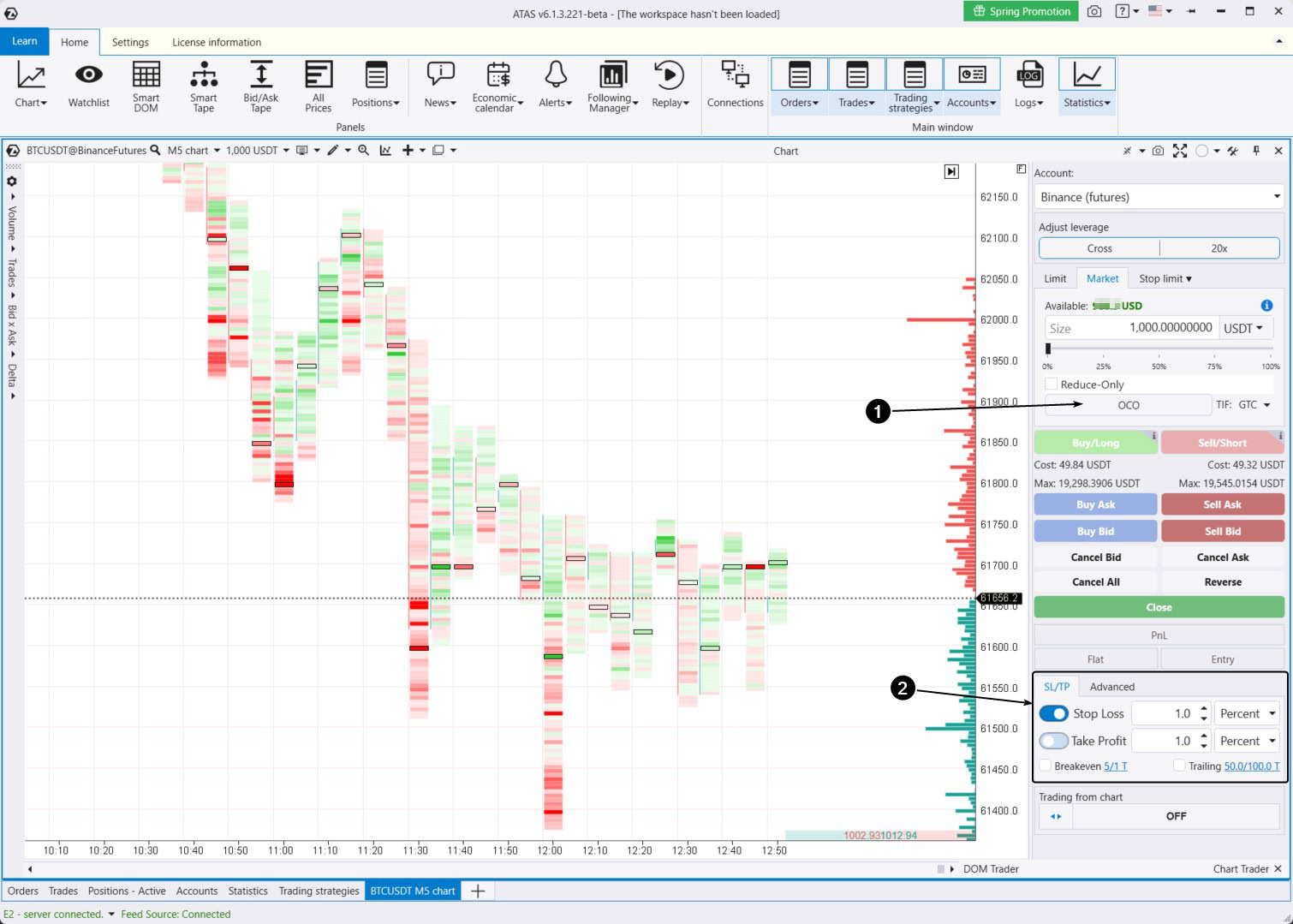

Stop-loss (SL) and take-profit (TP) are types of trading orders. Traders use these orders to minimize losses and secure profits. They are often referred to as “stop” and “take.”

In the simplest terms:

- Stop-loss closes losing trades;

- Take-profit closes profitable trades.

Both stop and take orders allow traders to set predetermined prices at which the system will automatically execute the orders on the exchange. Therefore, both stop-loss and take-profit are pending orders.

Depending on the situation, these can be either market orders or limit orders. To understand the difference between market and limit orders, check out the article about how orders are matched on the exchange.

ARE STOP-LOSSES AND TAKE-PROFITS NECESSARY?

There is no consensus among traders about the use of stop-losses and take-profits.

Proprietary traders always use short stops in their trading. Setting stop-losses is typically a requirement for working with proprietary trading firms, although increased competition among these firms may lead some to allow traders to use less strict risk control measures. It is common practice for the size of a stop to be less than half of the average daily earnings.

Some traders use mental stops, allowing losses to grow. Paradoxically, this can include both professionals, who close a position once they are convinced they are wrong, and beginners, who struggle to admit mistakes and hope the price will soon turn in their favor.

Famous traders like Alexander Elder and Larry Williams strongly recommend using stops.

Meanwhile, long-term investors, like those in stock indexes, might not use stop-losses because their strategy focuses on long-term asset growth. They often see temporary declines as opportunities to invest more, rather than as risks of losses.

Every trading strategy should have not only entry rules but also exit ones. Therefore, besides stops, traders use take-profits or a trailing stop, which will be discussed later.