Cumulative Delta indicator for recognising traps on the chart

When traders get into traps, they hope for the better but, as a rule, they get out of them only by a stop loss. We will show you what it looks like in the chart, so that you would understand the market structure better and even could use somebody else’s pain for your own benefit.

Read in this article:

- How financial markets work.

- The Cumulative Trades chart and Cumulative Delta indicator.

- Traps for sellers and buyers.

- Conclusions. What to do in practice?

How financial markets work

Financial market is a complex mechanism, consisting of millions of participants. There are major and minor players and there are speculators and hedgers, but all of them have the same goal – profit.

One of the sources of profit, especially for market makers and major players, are losses of other market participants. That is why, the following situations occur in the market:

- False level breakouts. It is important for traders to use something as reference in the market and the levels serve as a well-known reference for trading. Stop losses of those, who have positions, and pending orders of those, who wish to enter the market, are accumulated beyond the levels. False level breakouts, after which the price moves beyond the level, take place especially for activating these orders.

- Short trends. Sometimes, the price may steadily move in a certain direction for one or two days. The trend stops when a majority of small and medium market participants believe that a new big trend started and try to join it. After that, the price might move back again to the range where it had been. In such a situation, traders, who entered in the direction of a new trend, are forced to close their positions with losses.

- Expanding triangles. The price could move one way or the other with an increasing amplitude. Thus, more new and new participants are involved in the market, while the expanding amplitude of the market movement results in activating stop losses of both sellers and buyers.

So, there are always traps in the market both for sellers and buyers.

How to avoid such traps? How to use such situations for making profit? Let’s discuss it.

The Cumulative Trades chart and Cumulative Delta indicator

In order to avoid traps, private traders need to track activity of major market participants. The trading and analytical ATAS platform functionality provides an excellent opportunity to do it.

Let’s consider the Cumulative Trades chart. This chart displays in the form of clusters only those trades, which match the set filters. For example, only those clusters may be displayed, in which more than 20 contracts were traded.

This chart type displays information from the Time & Sales in a convenient form. The information, which is difficult to see in the Time & Sales, is clearly displayed in the Cumulative Trades chart.

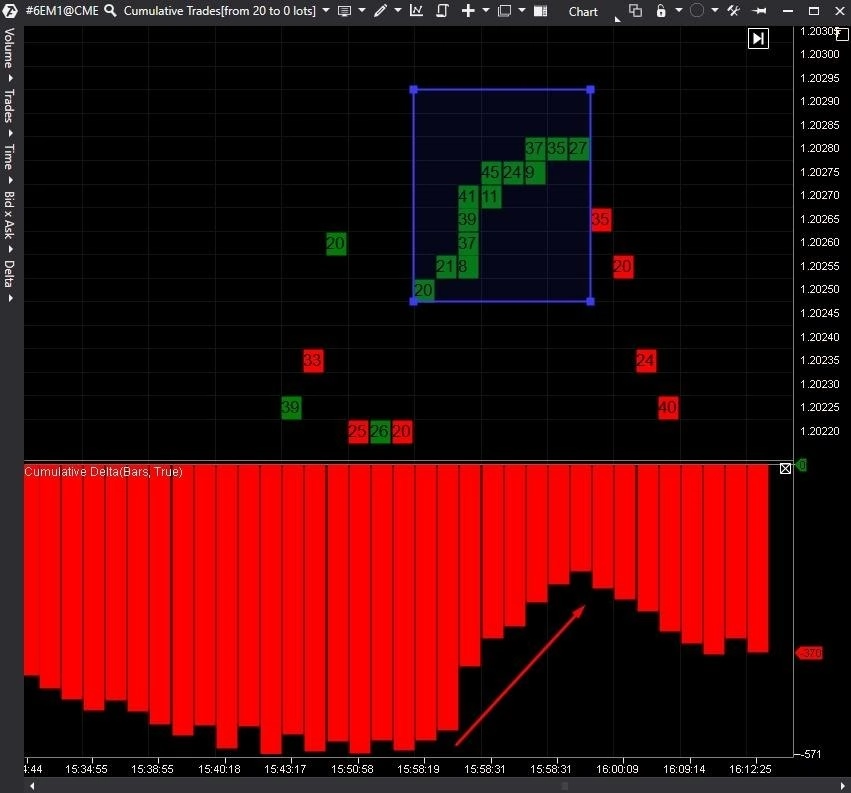

The screenshot above shows the Cumulative Trades chart. It helps to see the prices, which are especially important to major market participants and at which the biggest number of trades were executed. If a trader understands actions of major players, it may protect him from executing spontaneous trades and getting into market traps.

The second instrument, which helps to understand the market better, is the Cumulative Delta indicator. It sums up the Delta for a certain period of time in order to show the dynamics of predominance of aggressive buys or sells.

If you combine this indicator with the Cumulative Trades chart, you may successfully analyse actions of major participants in the market and avoid their traps.

The picture above shows an example of market analysis with the help of the Cumulative Trades chart and Cumulative Delta indicator. If the Cumulative Delta indicator direction changes (arrows) when big clusters emerge (rectangle), the trend change in the market is quite possible.

Let’s consider some examples to see how we could use these two instruments.

Traps for buyers

How are they set up?

First, the buyers enter the market with accumulation of big prints. The limit seller should absorb all these buys and reverse the market down. The buyers make losses but hold their positions for some time.

The buyers exit from the market when the price is taken to the levels, which are unacceptable for the buyers:

- The buyers may exit by stop losses, which are often posted beyond the levels.

- The buyers may also exit from their positions with the help of market sells.

The price often reverses and starts to increase after a major buyer exits from the market.

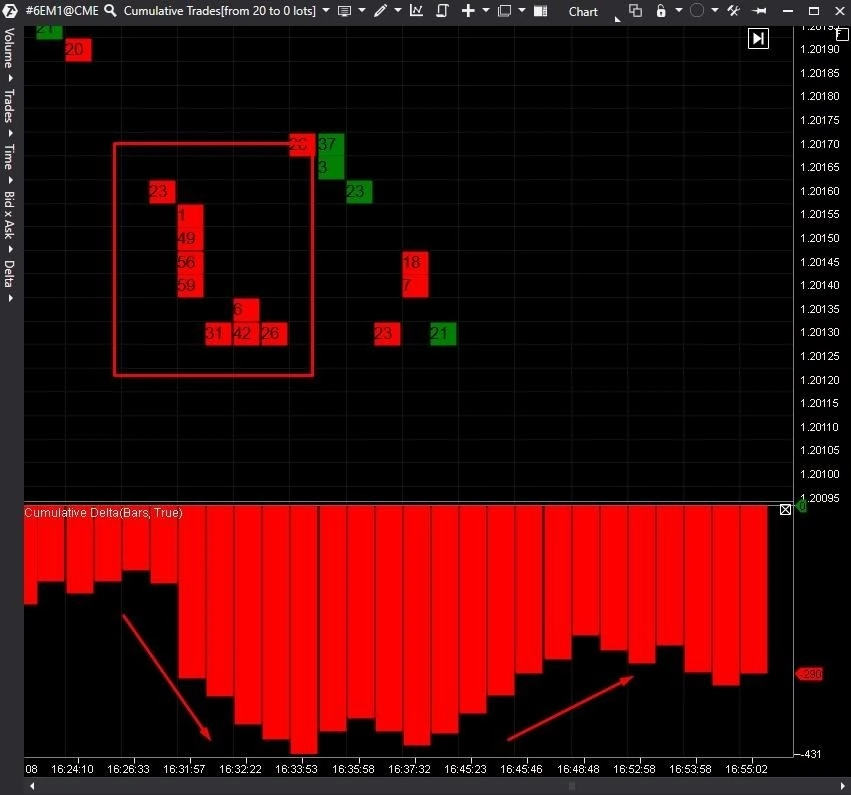

Let’s consider such a situation using the following example:

The Cumulative Trades chart above shows many big buy prints (blue rectangle). It could be interpreted as the appearance of a major buyer. Such an ‘inflow’ of the buy volume also influenced the Cumulative Delta indicator and the histogram started to grow. However, the limit seller absorbed all these buys and the price started to fall.

Let’s see how the situation developed further:

Consolidated sells entered the market after half an hour of the price fall (red rectangle). Perhaps, the buyers, who got into the trap, decided to register losses.

The price reversed up after that and the Cumulative Delta indicator also changed its direction.

Traps for sellers

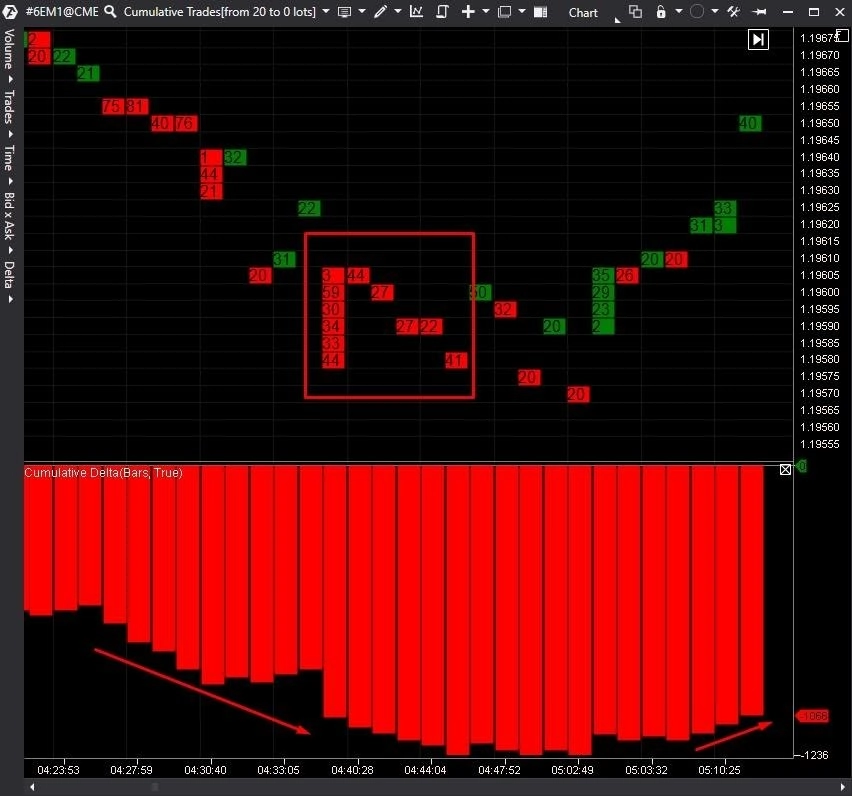

Let’s consider such a trap. Everything is mirror-like in such a trap:

- emergence of big sells → the price reverses up;

- emergence of big buys → the price reverses down.

The chart above shows an example of big prints from the seller (red square), which were absorbed by the limit buyer. The price started to increase after that.

Big buy prints emerged after several hours of the price growth (red rectangle). Perhaps, the seller registered losses.

How to use this information in trading?

You can track big accumulations of prints in the Cumulative Trades chart. Then look at the price reaction. The Cumulative Delta indicator may confirm the trend reversal points. If the price moved against big prints, then, perhaps, the seller or buyer got into a trap. Most probably, they will continue to move the market in the direction of loss-making by those traders who got into a trap. That is why, this direction could have good prospects for opening trades.

You can register profit and exit from the market when there are big prints in the Cumulative Trades chart again. It means that those traders, who got into a trap, exit from the market and the price may reverse.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.