The world financial markets shudder again. Wednesday was the crash peak, when the S&P 500 index lost the record-breaking for several months 3.5%. The crash was caused by a combination of unfavourable events. Meanwhile, the largest corporations, led by Microsoft, Apple and Amazon, published their quarterly reports. Is it time to buy cheap stocks?

Topics

- Calendar of economic statistics

- Retracement shuddered the markets: main reasons

- Quarterly reports of Apple, Amazon and Microsoft

- JP Morgan investment bank introduces its own crypto

| Date, Time (GMT+3:00) | Event | Impact, forecast |

| Monday, November 2 11:55 | Germany. Industrial PMI in October. | DAX, EUR. Forecast – 56.6, previous value – 58. |

| 18:00 | United States. Industrial PMI in October. | S&P 500, USD. Forecast – 55.6, previous value – 55.4. |

| Tuesday, November 3 and until the end of the week | Presidential election in the United States. | All markets. |

| Tuesday, November 3 6:30 | Australia. Decision about the RBA interest rate. | AUD. Forecast – 0.1%, previous value – 0.25%. |

| 17:00 | United States. PMI in non-production sphere in October. | S&P 500, USD. Previous value – 57.8. |

| Wednesday, November 4 12:30 | Great Britain. PMI in the service sphere in October. United States. Employment in the non-agricultural sector. | FTSE. GBP. Previous value – 52.3.

S&P 500, USD. Previous value – 749K. |

| 18:30 | United States. Crude oil reserves. | Brent. WTI Crude oil. Previous value – 4.320M. |

| Thursday, November 5 14:00 | Great Britain. Decision about the interest rate. Statement of the Bank of England on monetary policy. | FTSE. GBP. Forecast – 0.1%, previous value – 0.1%. |

| 22:00, 22:30 | United States. Decision about the interest rate. Statement of the FRS on monetary policy. | S&P 500, USD. Forecast – 0.25%, previous value – 0.25%. |

| Friday, November 6 16:30 | United States. Change of employment in the US non-agricultural sector. | S&P 500, USD. Forecast – 850K, previous value – 661K. |

| 16:30 | Canada. Employment level. | CAD. Previous value – 334K. |

| Monday, November 2 11:55 |

| Germany. Industrial PMI in October. |

| DAX, EUR. Forecast – 56.6, previous value – 58. |

| 18:00 |

| United States. Industrial PMI in October. |

| S&P 500, USD. Forecast – 55.6, previous value – 55.4. |

| Tuesday, November 3 and until the end of the week |

| Presidential election in the United States. |

| All markets. |

| Tuesday, November 3 6:30 |

| Australia. Decision about the RBA interest rate. |

| AUD. Forecast – 0.1%, previous value – 0.25%. |

| 17:00 |

| United States. PMI in non-production sphere in October. |

| S&P 500, USD. Previous value – 57.8. |

| Wednesday, November 4 12:30 |

| Great Britain. PMI in the service sphere in October. |

| FTSE. GBP. Previous value – 52.3. |

| 16:15 |

| United States. Employment in the non-agricultural sector. |

| S&P 500, USD. Previous value – 749K. |

| 18:30 |

| United States. Crude oil reserves. |

| Brent. WTI Crude oil. Previous value – 4.320M. |

| Thursday, November 5 14:00 |

| Great Britain. Decision about the interest rate. Statement of the Bank of England on monetary policy. |

| FTSE. GBP. Forecast – 0.1%, previous value – 0.1%. |

| 22:00, 22:30 |

| United States. Decision about the interest rate. Statement of the FRS on monetary policy. |

| S&P 500, USD. Forecast – 0.25%, previous value – 0.25%. |

| Friday, November 6 16:30 |

| United States. Change of employment in the US non-agricultural sector. |

| S&P 500, USD. Forecast – 850K, previous value – 661K. |

| 16:30 |

| Canada. Employment level. |

| CAD. Previous value – 334K. |

The coming trading week is expected to be extremely volatile. The Presidential election in the United States would set the pace in the markets. Traders should be very careful and observe risk management rules. As regards economic events, it makes sense to monitor the PMI data and decisions of central banks (first of all, FRS) on their monetary policy.

Retracement shuddered the markets: main reasons

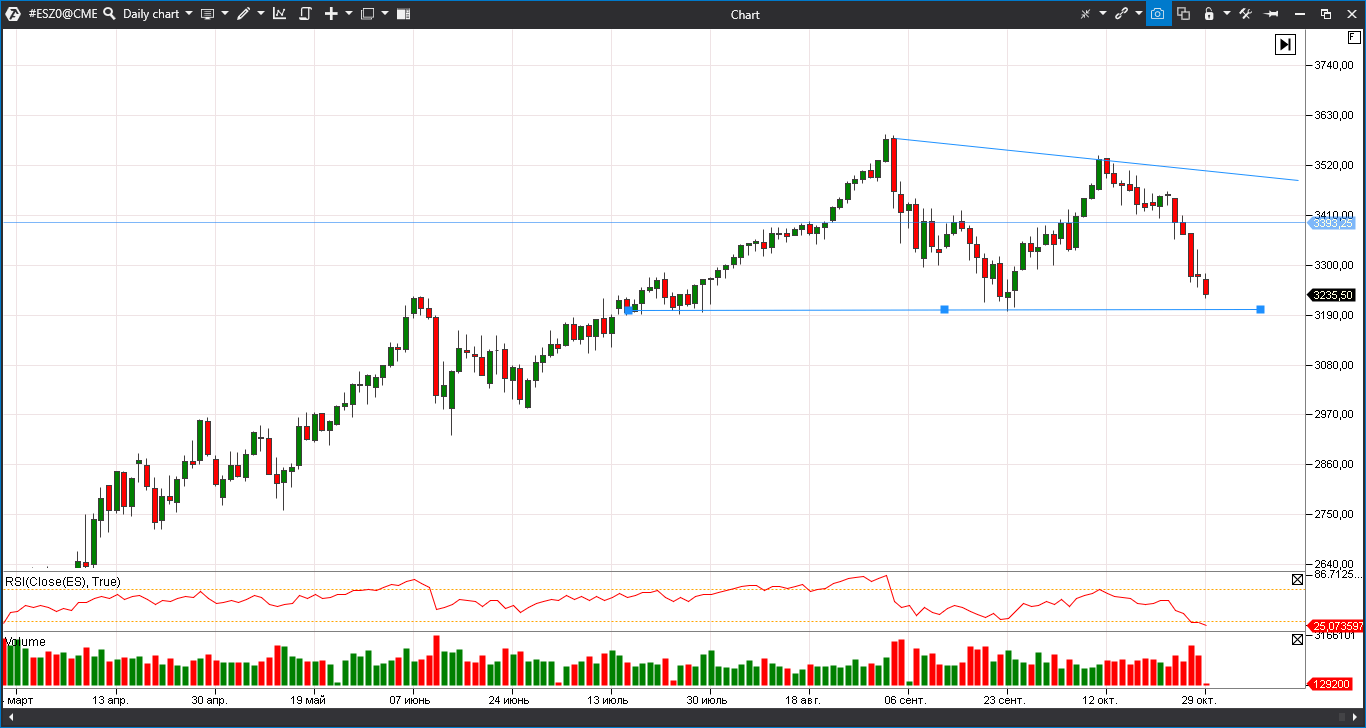

The previous week was unfavourable for the majority of financial markets. Bears were up to their games on Monday, crashing S&P 500 by nearly 1.86%. However, the peak was on Wednesday, October 28, which entered the top of the worst days for the stock market in 2020. The index futures (ESZ0) lost 3.53% during one day. The down movement continued on Friday after ‘a day off’ on Thursday.

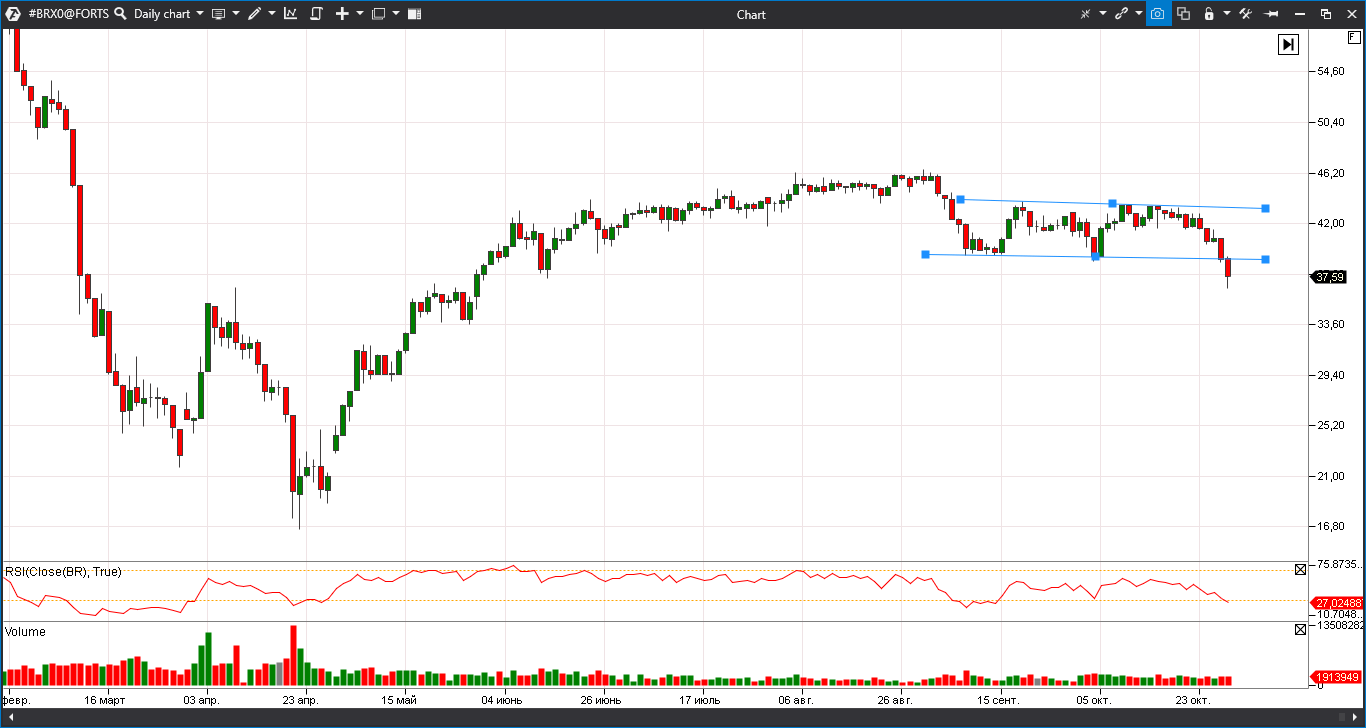

The key currency pair EUR/USD symbolizes the exit from risk, confidently moving down during the whole week. Following it, the Brent oil (BRX0) prices fell for the first time since May significantly lower than USD 39 per barrel.

Something similar took place only in March. However, as opposed to March, we do not speak about the liquidity crisis – central banks ‘printed’ a huge volume of money. We rather speak about the confidence crisis.

Players were strongly impressed by the news about a sharp deterioration of the situation with coronavirus, due to which a number of European countries already announced a significant tightening of the quarantine. The leader of the presidential race Joe Biden didn’t rule out such a scenario for the United States.

All these events take place in the background of the pre-election political clinch. Democrats and Republicans failed to agree on the economic assistance package of USD 2 trillion and the issue has been suspended for, at least, a couple of weeks.

Although, the unstated consensus on Wall Street shows that politicians have no chances to kill this program and they would manage to avoid the complete economic lockdown according to the spring scenario. It means that the current retracement, probably, is a temporary phenomenon.

Quarterly reports of Apple, Amazon and Microsoft

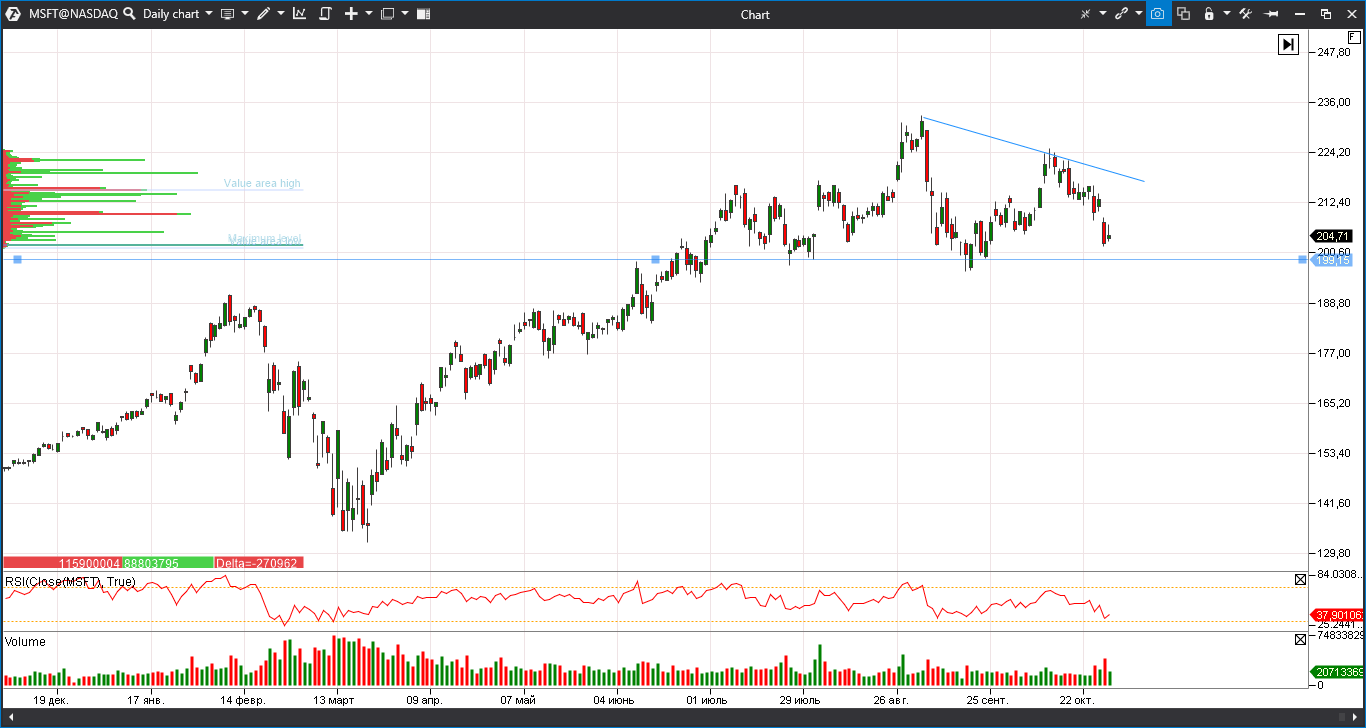

Meanwhile, the third quarter reporting season has passed its culmination stage in the US. The big five – Microsoft, Apple, Amazon, Google and Facebook published their reports. The largest, by capitalization, US companies significantly surpassed forecasts of analysts.

However, it doesn’t seem yet that good quarterly reports outweigh other fears. Thus, the Microsoft stock continued to fall even after an excellent report, published on Tuesday. Investors didn’t like that the company made the Xbox sales forecast worse.

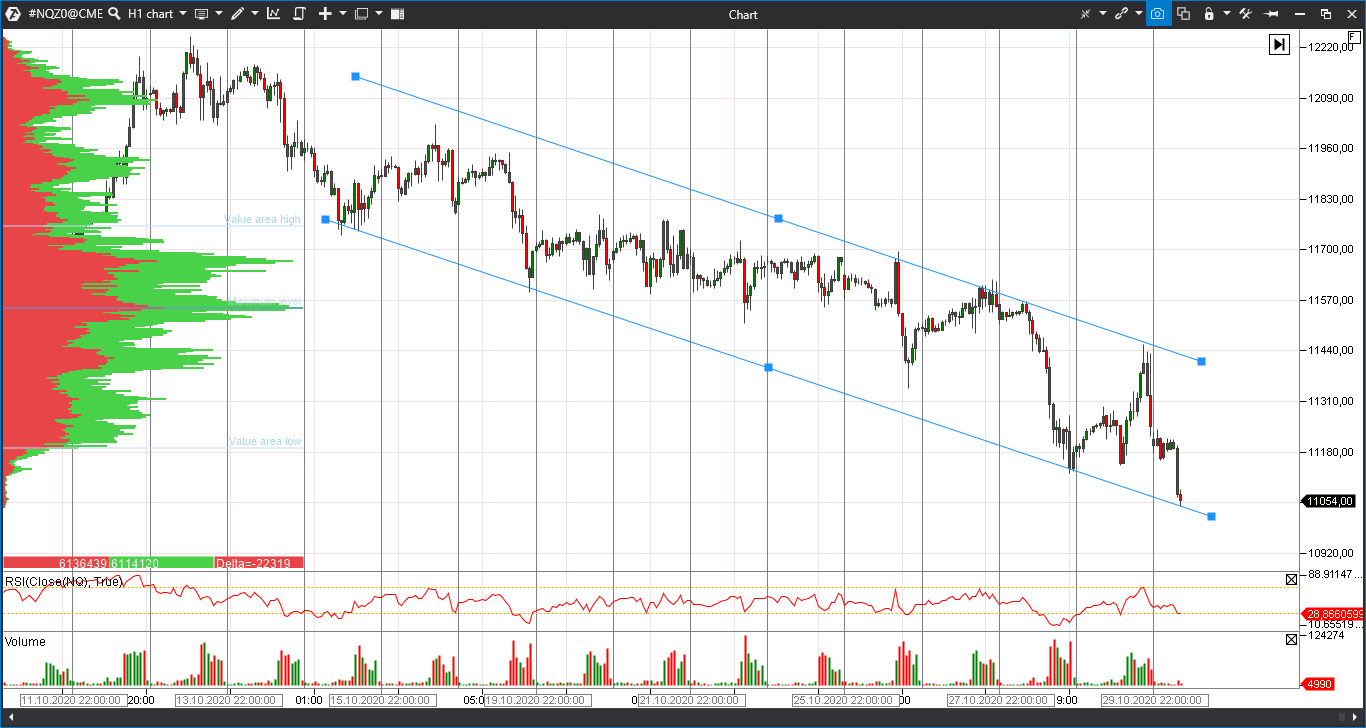

The Nasdaq futures (NQZ0) lost more than 2% on Friday morning. It means that the Apple, Amazon, Google and Facebook reports, published on Thursday after the market had been closed, didn’t improve the investors’ mood. This alerts, since all four companies declared historic records of quarterly earnings. Amazon, which annual yield increased by 37%, is especially prominent.

Uncertainty of players is supported not only by political and epidemiologic determinacy, but also by their specific consequences. Due to deterioration of macroeconomic prospects, a number of major US companies reconsidered their financial forecasts for the future towards deterioration. However, the situation might quickly change after the Presidential election and then stock would quickly win back their losses.

JP Morgan investment bank introduces its own crypto

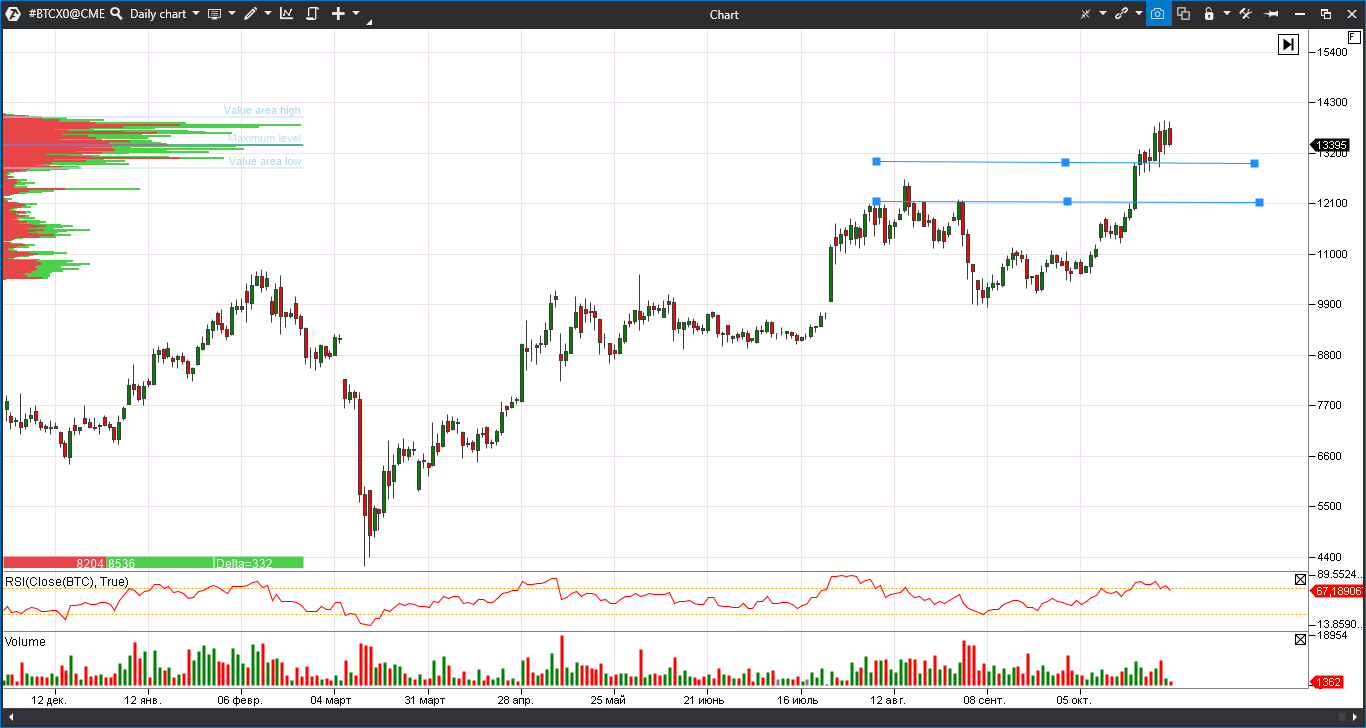

Bitcoin feels itself unexpectedly well on the general background of total sell-outs. The BTC futures (BTCXO) consolidated above the USD 13,000 level and managed to hold it even during peak sell-outs of risk assets. We wrote that the growth of cryptocurrencies was supported during the past week by their inclusion into the list of settlement means of the PayPal wallet.

We should also note some fresh news from the US largest investment bank – JP Morgan Chase. First, the bank analysts stated that bitcoin becomes gold of the generation of millennials that is why we may expect ten-fold growth of its capitalization. Thus, as the years go by, it may approach the physical gold value.

This week, the bank announced the introduction of its own coin. The blockchain technology would allow JP Morgan to sharply increase the rate of conducting transactions and reduce expenditures on their execution.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.