How to buy Apple stock and will it make a profit now?

Apple company (AAPL) is one of the world’s technology flagships, the stock of which is rather popular among investors. The biggest world’s financiers, including legendary Warren Buffett, hold big shares of Apple in their portfolios. Let’s see how to buy Apple stock and does it make sense to do it now? In order to find it out, we will get acquainted with the main variants of acquiring Apple stock and also analyse company prospects.

The following topics are discussed in the article:

- How to buy Apple stock directly

- Buying Apple stock in ETF

- Why you should consider buying Apple stock

- Apple stock in portfolios of famous investors

- Risks of buying Apple stock

Apple company (AAPL) profile

| Exchange | Nasdaq |

| Stock price* | USD 133.11 |

| Market capitalization | USD 2.22 trillion |

| Major stockholders | Vanguard Group Inc., BlackRock Inc., Berkshire Hathaway, Arthur Levinson, Tim Cook |

| Price to earnings ratio | 29.87 |

| Business margin | 23.45% |

| Dividend yield | 0.66% |

| Earnings per share | USD 4.56 |

* all data as of June 28, 2021

Option 1. How to buy Apple stock directly

The main option to buy Apple stock by a physical person is to buy through an online broker. Since documents are processed through the Internet nowadays, it is not necessary to look for a brokerage office in your town or even country.

Three important broker qualities you should take into account when selecting a broker:

- A broker should provide access to trading on the exchange, which trades Apple stock. The main volume of AAPL trades is accounted for by Nasdaq. A part of the company stock was listed and is quoted at other platforms, such as London Stock Exchange, Berlin Stock Exchange and Borsa Italia.

- A broker should be licenced. Availability of a high-profile regulatory authority will provide protection of ownership rights and availability of a fair judge in the event of disputable situations. Such regulators as the US Securities and Exchange Commission (SEC), UK Financial Conduct Authority (FCA) and also stock regulators of Western Europe, Switzerland and Australia have the highest authority in the world.

- Availability of Apple stock options in the list of broker’s trading instruments, with the help of which risks could be managed more efficiently, is also important for some investors.

Major US-based international brokers that meet the above-mentioned criteria are Interactive Brokers, TD Ameritrade, TradeStation and Fidelity. European companies of this sort are Saxo Bank and Degiro. In general, there are 2-3 dozens of decent variants.

You will need to make some more steps, after you have selected a broker, for buying Apple stock:

- Submit an application for opening a trading account on the broker’s web-site. Be prepared to fill in a rather detailed profile with personal data. A majority of serious brokers are interested in citizenship, investment experience, income source and general financial state. If the investment amount is rather big, a broker can ask to confirm the income source.

- Send scanned copies of the identity card and other required documents. As a rule, it takes 1-5 days for data verification.

- After the data have been verified and the account has been opened, you just need to deposit the account and start to invest.

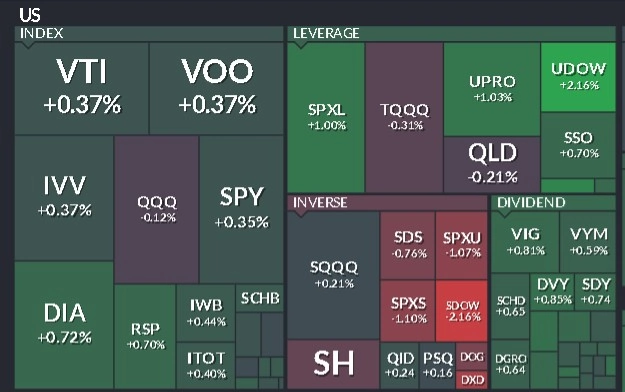

Option 2. Buying Apple stock in ETF

Buying Apple stock could be a good idea, but professional investors recommend diversifying your stock portfolio. It is connected with the fact that even the most successful companies in the world have bad times. One of the most simple ways to compose a balanced stock portfolio with minor management expenditures is ETF.

A shortcoming of index ETF is that the Apple stock share in them is proportional to the share in those indices, which they model themselves on. You will buy 100-500 companies along with Apple in the ETF. A pro is a wider diversification. As a rule, in the long run, indices outrun portfolios of a majority of funds.

If you are aimed at availability of a bigger Apple stock share in your portfolio, you can consider a more narrow-focused ETF. The largest Apple stock share is in the following funds:

| ETF/ticker | % of Apple stock in ETF |

| Technology Select Sector SPDR Fund (XLK) | 21% |

| Fidelity MSCI Information Technology Index (FTEC) | 20.2% |

| Vanguard Information Technology ETF (VGT) | 19.68% |

| iShares U.S. Technology ETF (IYW) | 18.49% |

Why it makes sense to consider buying Apple stock

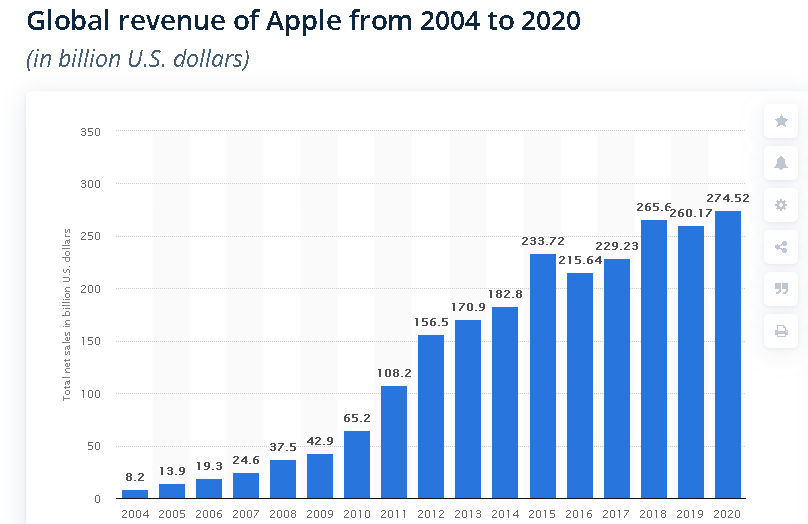

Apple is one of the most successful companies in the beginning of the 21st century, whose revolutionary innovations completely turned around our idea of gadgets. By selling expensive high-class products, the company has a possibility to include a high margin in the price, which keeps its profitability at a high level.

The company’s success can be traced by the annual revenue dynamics during the past 16 years. It grew from USD 8.2 billion in 2004 to impressive USD 274.52 billion in 2020.

Growth of earnings and profit is a good basis for the growth of the stock value and, consequently, company capitalization.

If you trace the price dynamics, on the average, the prices have been increasing rather actively in recent years. The following table gives you an idea of that.

Apple stock dynamics in 2012-2021

| Year | Opening price | Closing price | Annual price change |

| 2012 | 12.4379 | 16.4886 | 32.24% |

| 2013 | 16.4886 | 17.819 | 8.07% |

| 2014 | 17.819 | 25.0576 | 40.62% |

| 2015 | 25.0576 | 24.3024 | -3.01% |

| 2016 | 24.3024 | 27.3355 | 12.48% |

| 2017 | 27.3355 | 40.5834 | 48.46% |

| 2018 | 40.5834 | 38.3959 | -5.34% |

| 2019 | 38.3959 | 72.5521 | 88.96% |

| 2020 | 72.5521 | 132.267 | 82.31% |

| 2021 (as of June 3, 2021) | 132.267 | 123.54 | -15.64% |

Those investors, who bought Apple stock at the beginning of 2012, have already increased their capitals by 10 times. However, the powerful price increase in 2019-2020 was followed by consolidation in the flat in 2021, exit from which will set the further movement direction.

Apple stock in portfolios of famous investors

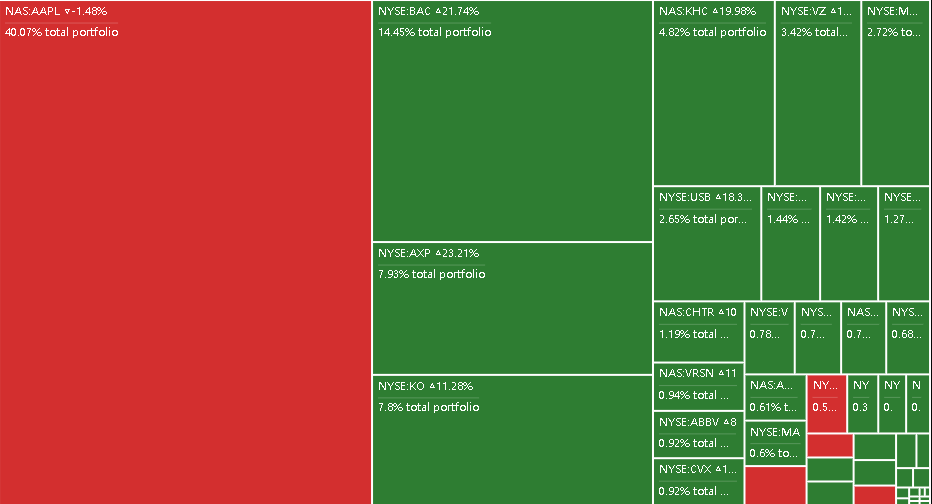

Growth of financial indicators and excellent liquidity support high interest in Apple stock among investors. Co-owners of the company include major hedge funds, pension funds, investment companies and private investors.

One of the biggest Apple stockholders is the Berkshire Hathaway company (BKK) of legendary investment guru Warren Buffett. Apple took the key place in the Buffett portfolio as of the beginning of June 2021 – more than 40% of the total value.

Other major Apple stockholders are the world investment conglomerates Vanguard (7.83%) and BlackRock (6.6%) and also former top managers of the company, such as Tim Cook.

Risks of buying Apple stock

The main risk of buying Apple stock are historically very high investment estimates, which the market puts in it in 2021. The stock price to earnings ratio (p/e) reaches 30 at the moment, which is very high even for technology companies. For example, the Apple p/e was about 15 from 2009 until 2018. Nowadays, the company estimate is 2 times higher.

If US monetary authorities start to increase the key interest rate and reduce quantitative easing programs, the stock might come back to regular estimates, which threatens with a very strong retracement. If you are a long-term investor, as Buffett is, and plan to hold Apple stock for decades, such risk might be insignificant. However, investors with a 2-5 year horizon should take into account the retracement danger.

You shouldn’t also exclude variants of other unpredictable negative events – black swans. So, it is optimal to buy Apple stock as a part of a wider investment strategy. As we have already mentioned before, portfolio diversification is one of the possible answers to risks of individual companies.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.