Everything you need to know about Chicago exchanges

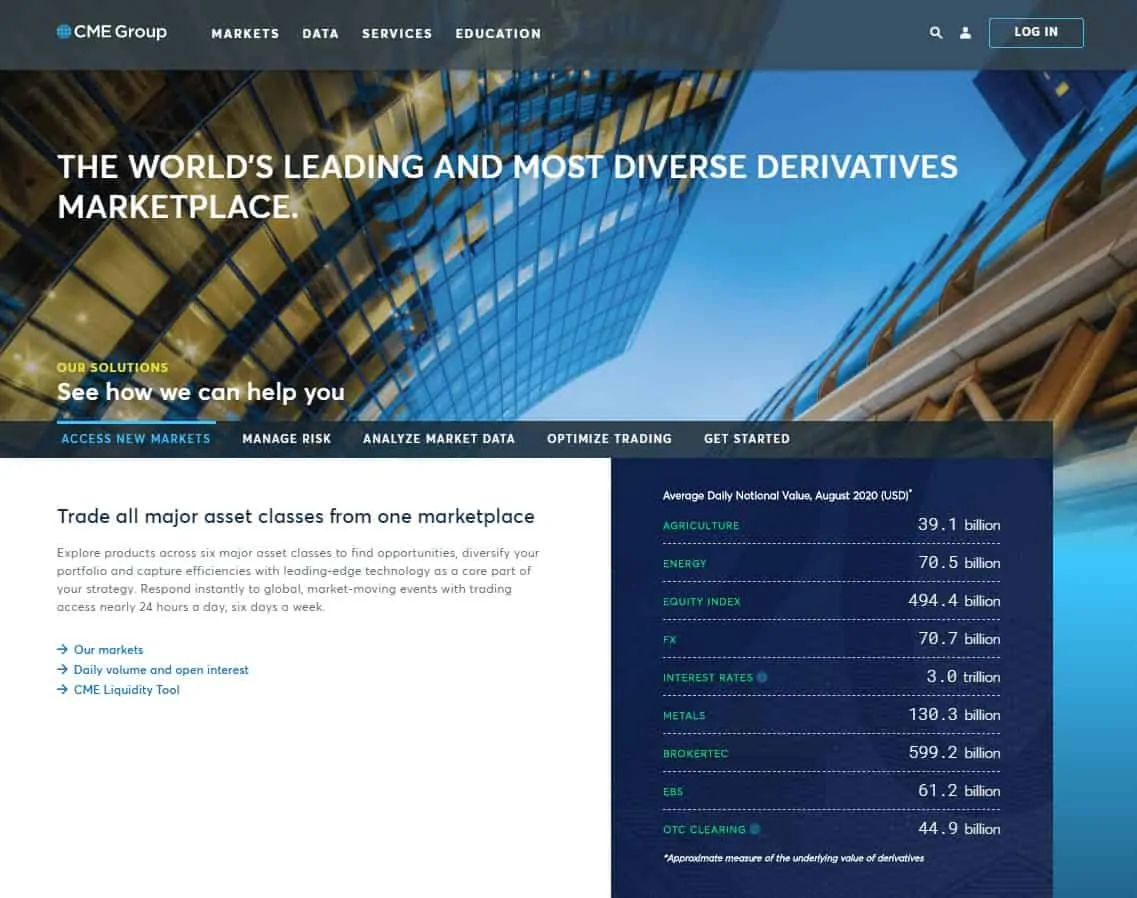

The CME Group is the biggest and most influential organisation in the world of exchange futures. This platform, the central office of which is in Chicago, represents the highest level. The best professionals from all over the world trade here and if you set the maximum goals – welcome to the CME.

First of all, you need to understand what the Chicago futures exchange or CME is. The matter is that historically there are several major exchanges in Chicago:

- Chicago Board Of Trade (CBOT) was founded in 1848.

- Chicago Mercantile Exchange (CME) was founded in 1874.

- Chicago Stock Exchange (CHX) was founded in 1882. It trades stocks of 3,500 companies. It was taken over by the Intercontinental Exchange (ICE) in 2018.

CBOT and CME united in 2007 and formed the CME Group, which was joined by the New York Mercantile Exchange (NYMEX) one year later.

Thus, the CME Group became the leading platform for derivative trading and today the trading volume accounts for billions of dollars a month in each sector.

Read in this article: