Excessive trading (overtrading) is a trader’s problem from the area of exchange psychology. Experienced exchange dealers know it too well.

You can read in different sources that overtrading is an excessively frequent execution of trades. They often recommend you to move to longer time-frames, for example, H4 or daily, in order to ‘cure this disease’.

However, it is not a very correct statement in our opinion. We will share our view in this article on:

- what in fact overtrading is;

- what its real reasons are;

- how it could (and should) be fought out.

Overtrading - what is it?

First, we will start with a definition.

We assume that you are not a gambler on the exchange and have a clear trading plan, tested on the historic data. In such a case, overtrading could be defined as:

- execution of a trade, which is outside your trading plan;

OR

- execution of any number trades, in the result of which you exceed the maximum allowable risk limits (we wrote about risk limits in the article about risk management).

If you allow execution of, at least, one of the above conditions, alas, you are subject to overtrading.

In other words, your measure is your trading plan. Trades outside the plan mean excessive trading.

Please, note that we didn’t mention:

- the number of trades;

- time-frames.

It might sound unusual, since you can come across the following thought in many books on trading, on web-sites and in forums on exchange trading:

“Higher time periods are better than speedy time-frames. Fast periods are just a market noise, while higher time-frames give better signals”.

But wait a second. Professional market participants, traders from prop trading firms, actively open and close dozens of trades during the day, trading on minute time-frames. Does it mean that all of them trade excessively? Yes, the intraday trading increases the cognitive load but doesn’t transform professionals into looneys.

Could it be that the advice to avoid low time-frames is based on fear? Fear to take responsibility for the decisions, which you need to make more actively and fear to make losses more often.

Do you understand us? You may trade excessively on any timeframe. Time periods are not the primary reason for excessive trading.

Example

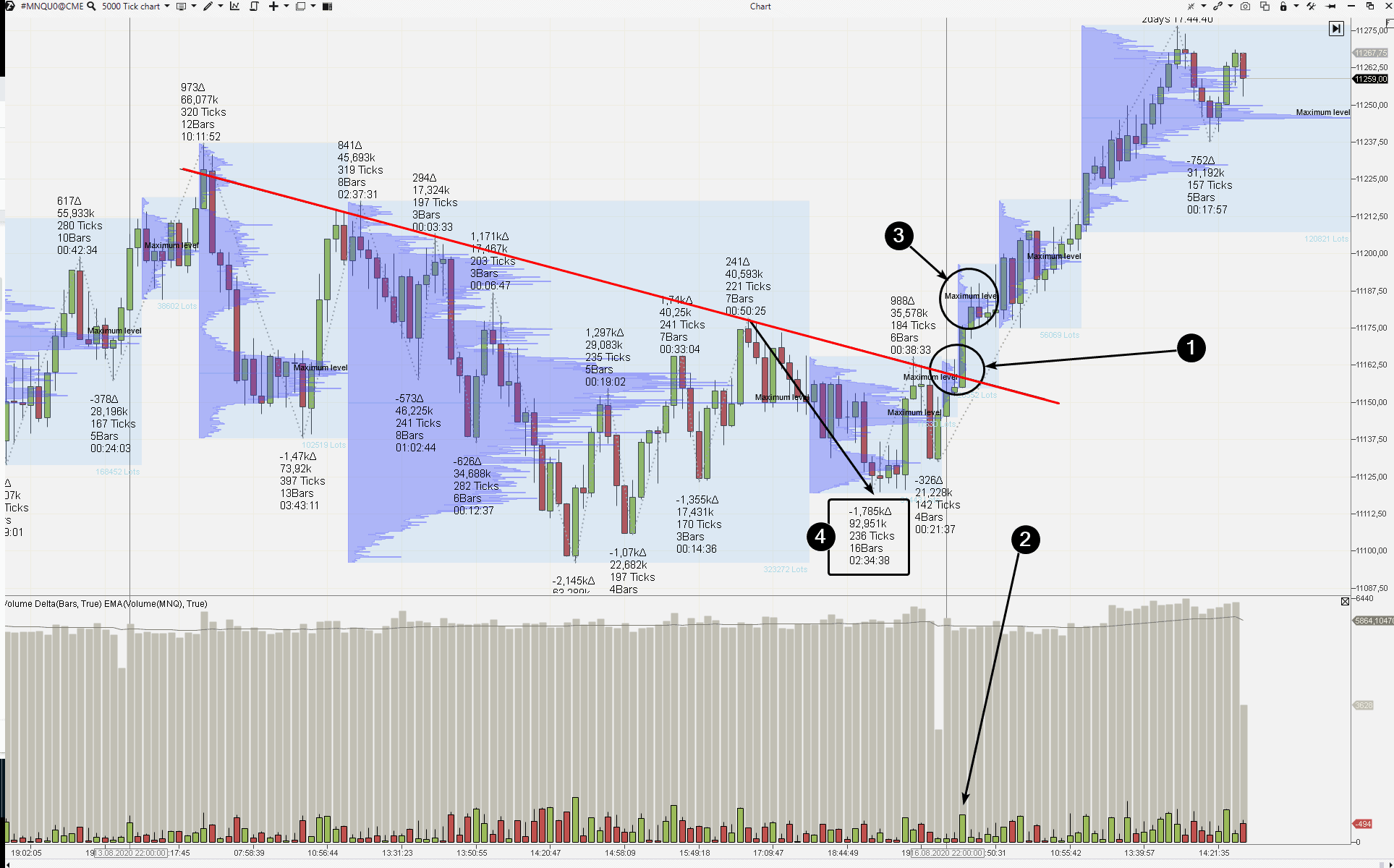

The picture below shows the Nasdaq 100 stock index futures chart. Note that the volume bar chart is so ‘brushed-up’ because the 5000-tick chart is used here (what chart types are available in ATAS).

Let’s assume that a trader, who operates in this market, identified that:

- the price broke the downtrend from bottom to top (shown in red colour);

- it was accompanied with a splash of positive Delta;

- the next balance (a bulge on the Market Profile) was formed above the trend line, which means that the price remained above the breakout level;

- a downwave with an extremely high volume stayed at the bottom. If the market doesn’t reach a new low in the result of such an active wave, it means that it ‘refuses’ to move down (the sign of a hidden strength of buyers).

These conditions, stated in the trader’s trading plan, are sufficient for making a statement that the price enters the uptrend. And, following his policy, he should open long positions only.

In view of this, any of his short positions (even one a day) would be interpreted as overtrading, since it doesn’t correspond with his plan, unlike dozens of long trades (for example, by the CCI indicator signal or scalping trades in the Smart DOM), which were executed in accordance with the plan.

Real overtrading reason

In fact, there are two reasons why overtrading may happen:

- Absence of a trading plan.

- Absence of discipline in its execution.

If you didn’t bother to formulate your plan and didn’t set up your brain to perform it, the time-frame selection and everything else will not have crucial importance.

This is like a habit to eat too many sweets. You will wish to eat sweets independent from where you are and what time it is.

The same is true about overtrading – you walk around the markets and periods, you build whatever strategies – if the plan is not followed (or you don’t have it), you are in the risk area.

How to get rid of the overtrading reasons

It is evident that you need to make 2 steps.

First step. Write a trading plan.

Here are some articles from our blog, which will help you to do it:

- 10 steps of developing a trading plan (an article in 2 parts).

- How to become an intraday trader.

- Trading as business.

- How to develop a trading strategy.

Pay due attention to testing on historic data (we have an article on this subject about strategy programming in the ATAS environment). You will see that your strategy sometimes gives growth and sometimes – a drawdown. And this is normal. Drawdowns could be:

- within the framework of one strategy, but the ‘white stripe’ will outweigh the ‘black stripe’ in the long run;

- within the framework of one portfolio, but one (or more) strong security will outweigh ordinary ones and will ‘drag out’ the portfolio yield curve.

It is used in sports. If a basketball player is in the ‘white stripe’, the team attacks through him, since his series of successful shots is crucially important for the general victory. Professional poker players also know it – if you have good cards you should use it to cover losses from a series of unlucky hands.

Sometimes professional traders start trading days with 3 or 4 or even 7 loss-making trades in a row. But they do not stop if they do not reach the daily risk limit, which is calculated and stated in their trading plans.

They continue to attack the markets, working out their setups, because they know that one or two major profits would either bring them back to the break-even or would help to make profit by the end of the day.

If they would follow the ‘overtrading = more than X trades’ policy, such days could have become loss-making instead of being profitable. In addition, losses would have left negative traces in their heads.

That is why, the goal is to win every day, sticking to your trading plan, observing risk limits and being in the right mood.

Well, you wrote a plan. It contains everything you need – strategy, entry points and capital management methods. What’s next?

Second step. Stick to your plan.

It seems easy if the instructions are maximally clear. It would seem so…

However, it’s not quite so.

It will not be easy to fight against temptation, change yourself, go against your will and make your brain act contrary to your emotions, prejudices and habits.

For example. You read a good (yes, we tried to do our best) article about false breakouts. You liked the idea and you:

- tested it on historic data;

- got confirmation;

- developed a detailed trading plan;

- registered a demo account;

- and started to practise.

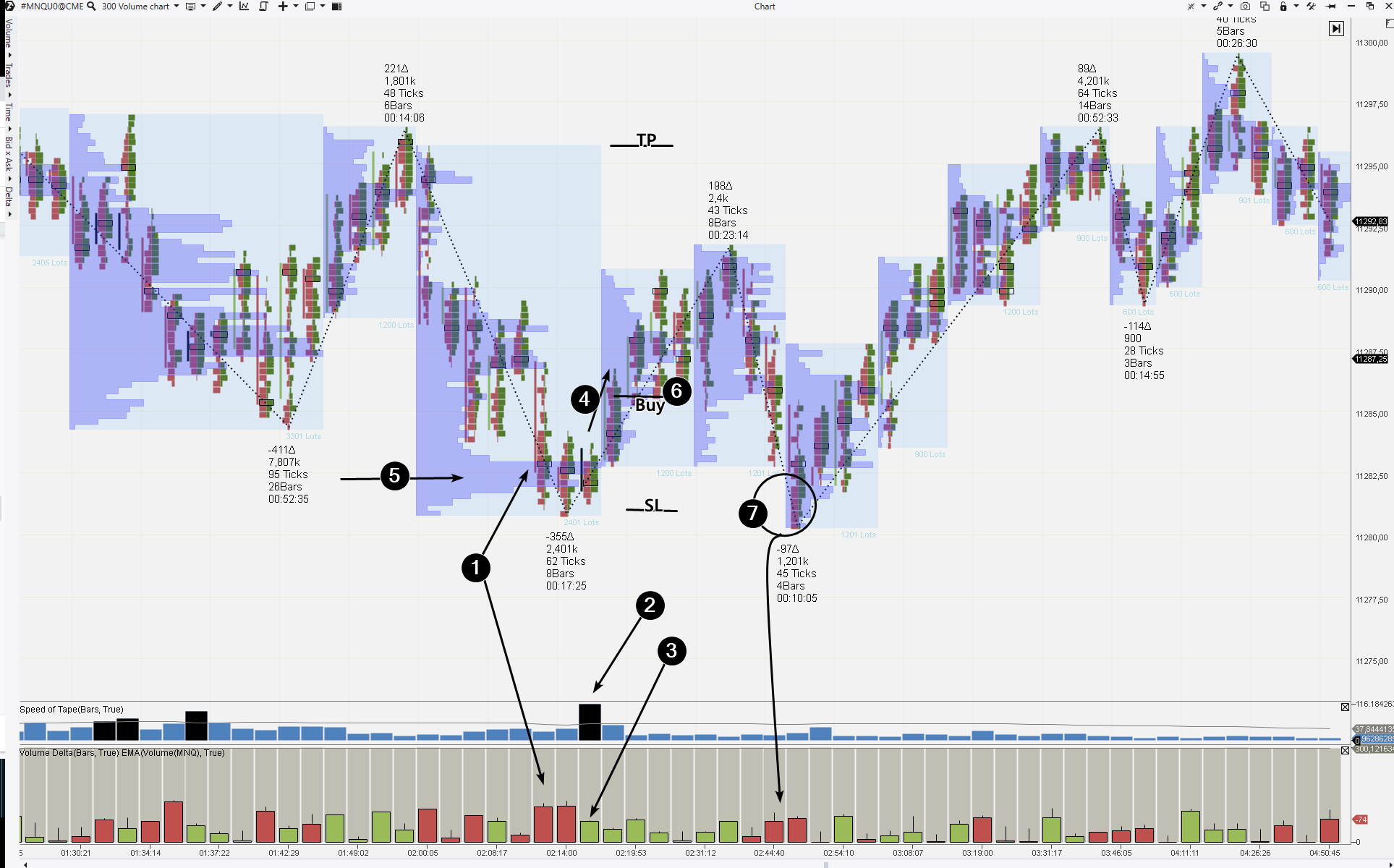

You open the Footprint (what the Footprint is) of the Nasdaq E-mini futures (what a futures is) and add the Market Profile, Delta and Speed of Tape indicator to it.

And you analyse the situation:

- Big sells come to the market and the price moves down. The market becomes more active.

- Then somebody starts to act very fast. What does he do?

- Most probably, he buys.

- And this somebody is rather strong, since the price responded with growth on the next bar.

- As a result, a big bulge was formed in the lower part of the profile. It is a sign of the fact that some major player is taking on the position buying out a sell wave with offsetting limit orders. You understand that the market found support and the price could move up.

- You try to find excuses that the price cannot form a false breakdown and buy at 11,285, post the stop at 11,281 (under the bulge) and the take at 11,296. The ratio is 11:4. Is everything good? No. The plan has been violated.

- After some time you are knocked out by the stop. You find yourself among those traders ‘against’ whom the initial strategy was built. A big splash of sells and closing far from the low on that candle – everything testifies to the ‘knockout from the market’ of those buyers, who posted stops below the previous low.

You make a loss in a situation when you should have made a profit. What should you do to avoid such a scenario?

You should understand why your plan was violated. You should analyse your actions. Neural networks are clusters of neurons in your brain. They determine your motives to action. They need time to change.

Think how familiar the following thoughts are to you:

- I am tired of waiting for a setup.

- It’s boring, I want action.

- Everybody is trading and I am not.

- I missed a setup, I need to catch up with it.

- I am absolutely sure I see the market strength, I have to buy immediately.

- I will regret it if I do not buy right now.

- Intuition tells me that…

How do traders justify their weaknesses when they back out of their plans? They find arguments.

The same is true for a sweet tooth: ‘One biscuit at night will not hurt’. Such a weakling has low chances to become a tough muscled guy who has a strict dietary and training regime.

It is the same in trading. If you want to achieve some progress you need to undertake systematic efforts.

Conclusions

Overtrading is dangerous and may result in your account blowing up.

We think that you shouldn’t trade on the exchange without a clear strategy and plan. Your trading plan should maximally accurately determine your actions every time you start trading.

However, all your plans make no sense if you do not perform them. Read books on trading psychology. And do not forget to read the article about tilt in trading.

Analyse your current results, detect errors, eliminate their reasons and achieve progress. ATAS will help you to do it.