- opening and closing prices and the price extreme points;

- character of the trading volume;

- and fundamental data,

… experts identify price levels, where, according to them, it makes sense to buy or sell.

Levels are those price levels, which matter

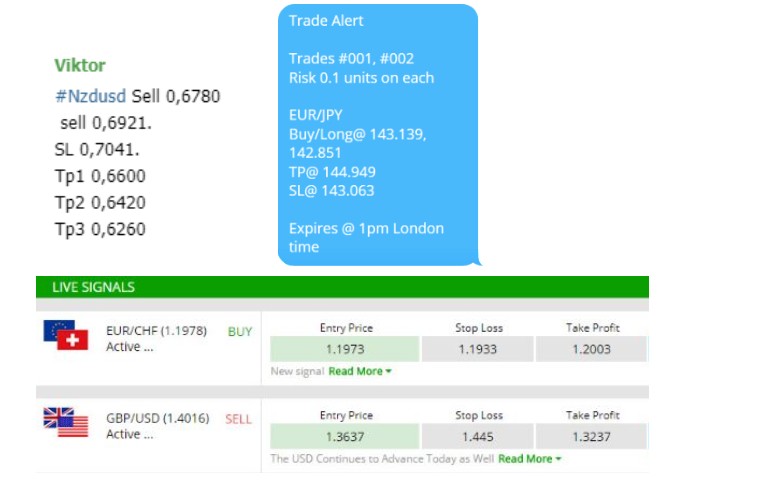

Those market participants who have no experience, skills or time for the market analysis can subscribe to various recommendations or signals. They would usually arrive in the form of simple instructions – what to do at what level.

We will speak in this article about how to achieve this goal using such indicators as:

If you can accurately identify levels for entering and exiting the market, you will be able to:

- minimize subjectiveness in making decisions;

- build and optimize profitable strategies;

- manage the capital efficiently;

- send signals to other traders.

Trading by levels with the Market Profile indicator

The Market Profile indicator is also known as horizontal volumes. This indicator shows activity of traders at each price level during a certain period of time.Instruments of the ATAS trading platform allow to:

- build the market profile for different time periods;

- combine several profiles;

- analyze data of each profile both totally and separately by each price level.

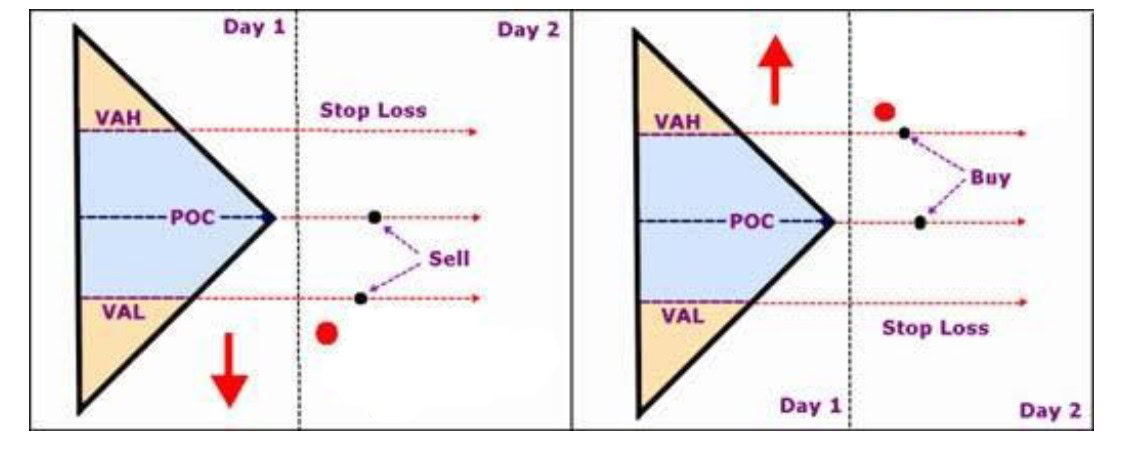

The classical idea of trading by levels (built with the help of the Market Profile indicator) is a bounce from the previous level of the maximum volume (or a test of POC – Point Of Control).

Let’s start from a simple strategy:

- we do not trade at the session opening (first candle) – we just build a plan for a day;

- we buy/sell from the POC level of the previous day (test of the maximum volume level);

- we post a stop behind the previous value area;

- we close the trade at the session closing.

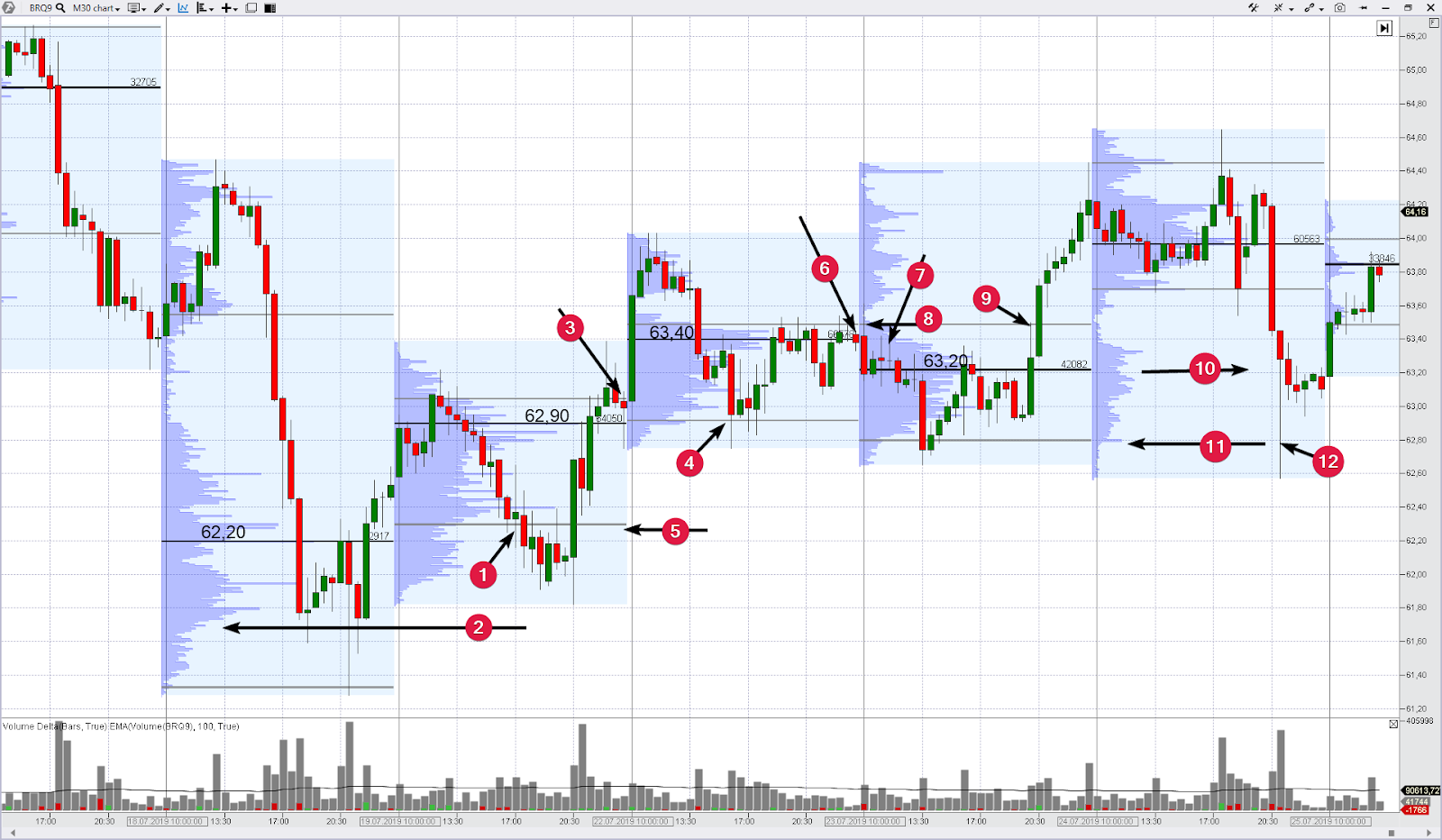

Let’s test the strategy in the market of oil futures.

Trading by profile levels in the oil market

The chart below shows the most recent (as of this writing) data from the Brent forward market. The 30-minute candle chart has the Market Profile indicator with 1 day period. The indicator black lines reflect the POC level for each day while the grey lines reflect the value area.

July 18. There were no trades because the trading opened significantly below the POC level of July 17 and there was no test.

July 19. The market opened higher than the previous day’s POC, that is why we start to wait for a buy signal.

1 – buy at 62.20.

2 – according to our strategy, we should have posted a stop below the automatically calculated value area low and it ‘emerged’ practically at the day’s lows. Quite wide. We could post a stop at 61.70, where the profile clearly ‘deflated’.

3 – no matter where the stop was posted, we close with a profit at the level of 63.00 (+80 ticks).

July 22. The market again opened above the previous day’s POC, that is why we started waiting for a buy signal.

4 – buy at 62.90.

5 – stop at 62.30.

6 – close at 63.40 (+50 ticks).

July 23. The market moved below the previous day’s POC level and we started to wait for a test and sell signal.

7 – sell at 63.40.

8 – stop at 63.50. A very narrow stop.

9 – we were kicked out by the stop here. There was a reversal after the trade reached profitability of more than 80 ticks (could have posted a breakeven). The loss is 10 ticks.

July 24. The market opened above the POC of July 23. Waiting for a test and bounce.

10 – buy at 63.20.

11 – stop at 62.80.

12 – we were kicked out by the stop here. We should note that this candle with a long ‘downward tail’ is a clear manipulation with the aim to ‘get hold’ of protective orders of buyers, which were posted under the previous day’s low. Assuming that the manipulation pivot points to the forthcoming growth, we can enter again into a long position believing that the oil price goes up on July 25 (which proved true) but we acknowledge the loss of -40 ticks.

The result of 5 working days is 0+80+50-10-40=+80 ticks. The positive result (excluding fees and other expenses) points to perspectivity of this strategy of trading by profile levels.

Can we improve it? Yes. How? For example, to:

- introduce the rule of moving to the breakeven;

- build profiles manually (not automatically). Building time-independent profiles allows more accurate identification of the balance boundaries and calculation of levels for trading.

- add an element of judgement, which is, perhaps, the most difficult thing. Judgement, as well as intuition, develops with experience. But it allows to adjust levels, select/feel a better moment for exiting a trade.

Let’s try. We will use the same strategy but we will build profiles ‘manually’ using the ‘profile’ drawing tool, which you can launch pressing the F3 button. The main principle of a balanced market is a bell-shaped profile. That is why a bell profile is a confirmation of a correctly built balance.

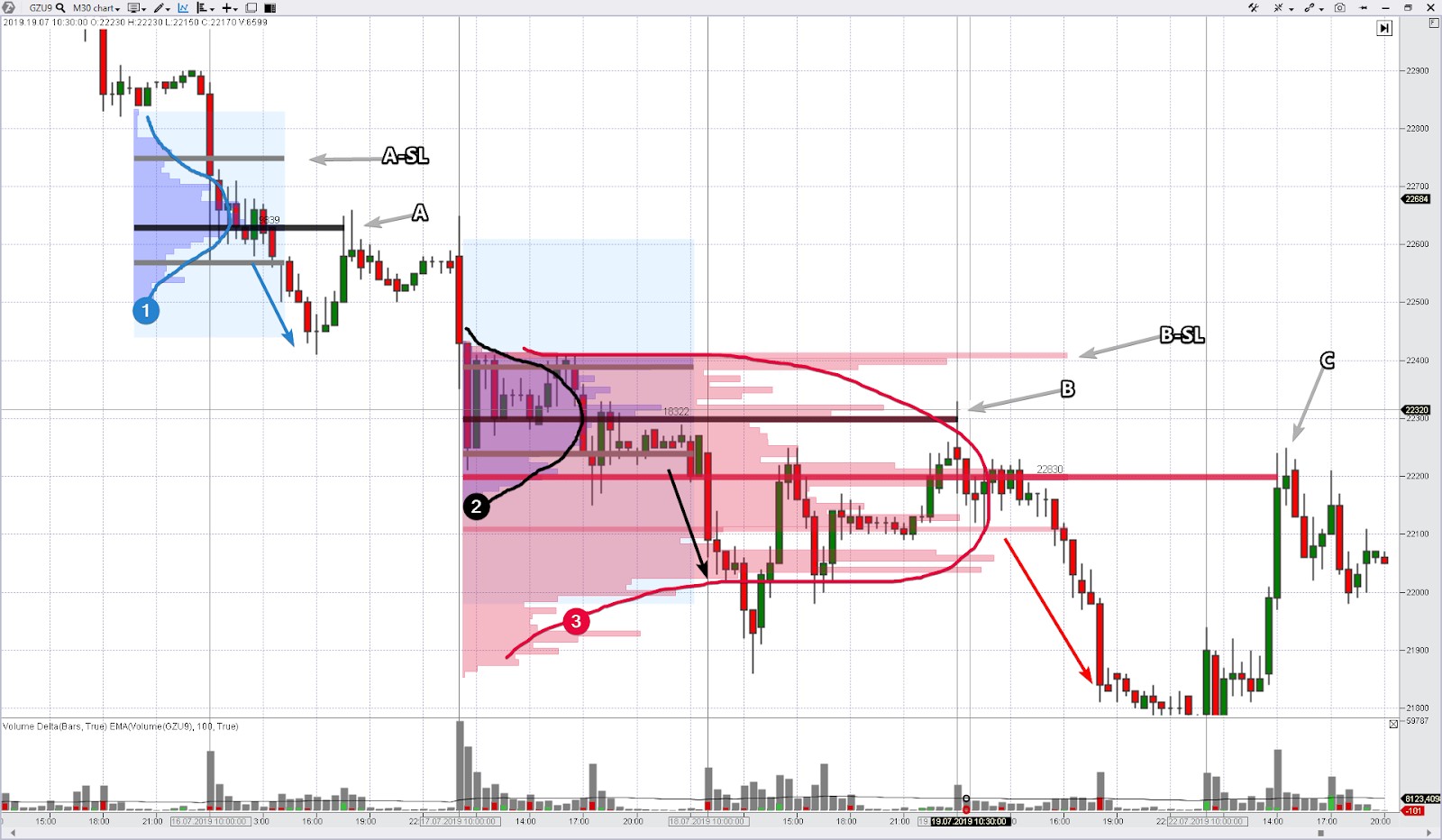

Trading by profile levels in the stock futures market

Let’s consider an example from the Gazprom stock futures market. The data is from the middle of July 2019. The market was in the descending tendency at that time and the example below shows how the ATAS platform indicators allow:- to be flexible combining several profiles;

- to join the trend finding the best points for entering the market.

- The balance, which was formed soon after the market opening on July 16. The blue arrow shows that the price goes below the balance (traders agree that the futures is too expensive). ‘A’ point is a POC level test. Entry into a short with a stop is over the grey line at the A-SL level.

- One more short-term intraday balance was formed soon after the market opening on July 17. It was broken the next day on July 18 (marked with the black arrow). The opening of trades on July 19 sent a signal for entering into a short position (‘B’ point and a stop behind the B-SL level).

- We can consider all these movements on July 17-19 as formation of a more long-term balance. We marked it as a big red bell. After this balance was broken (red arrow) its maximum level was tested (‘C’ point. Entry into a short position. The stop coincides with the B-SL level).

Where to post takes? If our goal is to renew local lows without trailing of stops, then all goals were achieved on July 25 when the price went down under the psychological level of 21,000 (what you should know about round numbers).

Are there ways to further improve the described strategy? Of course, there is always room for improvement. We can add the delta and monitor the open interest. But what for? The best is the enemy of the good. More indicators make the picture more complicated and confusing. ATAS provides a multitude of indicators and solutions so that each trader can find his unique combination of indicators and state of comfort. Don’t forget that 80% of the effects come from 20% of the causes.

Download ATAS and play around with finding balances, their breakouts and further tests. Make a comment – do you see a potential in the strategy of trading by profile levels?

And we continue and discuss the next strategy of trading by levels.

Trading by levels with the Dynamic Levels indicator

In two previous examples we considered the strategy of trading by a bounce from the maximum level using two profile types:- profiles of equal periods. The classical Market Profile indicator builds horizontal levels after equal periods of time (1 hour, 2 hours, several days, several weeks and so on);

- profiles of arbitrary periods. Manual building of a profile with monitoring the dynamics of horizontal volumes for any time period.

The Dynamic Levels indicator is a certain cross-breed. It builds in the chart a change in time of the POC line and value area high and low. You can find a description and instructions on how to set the Dynamic Levels indicator here.

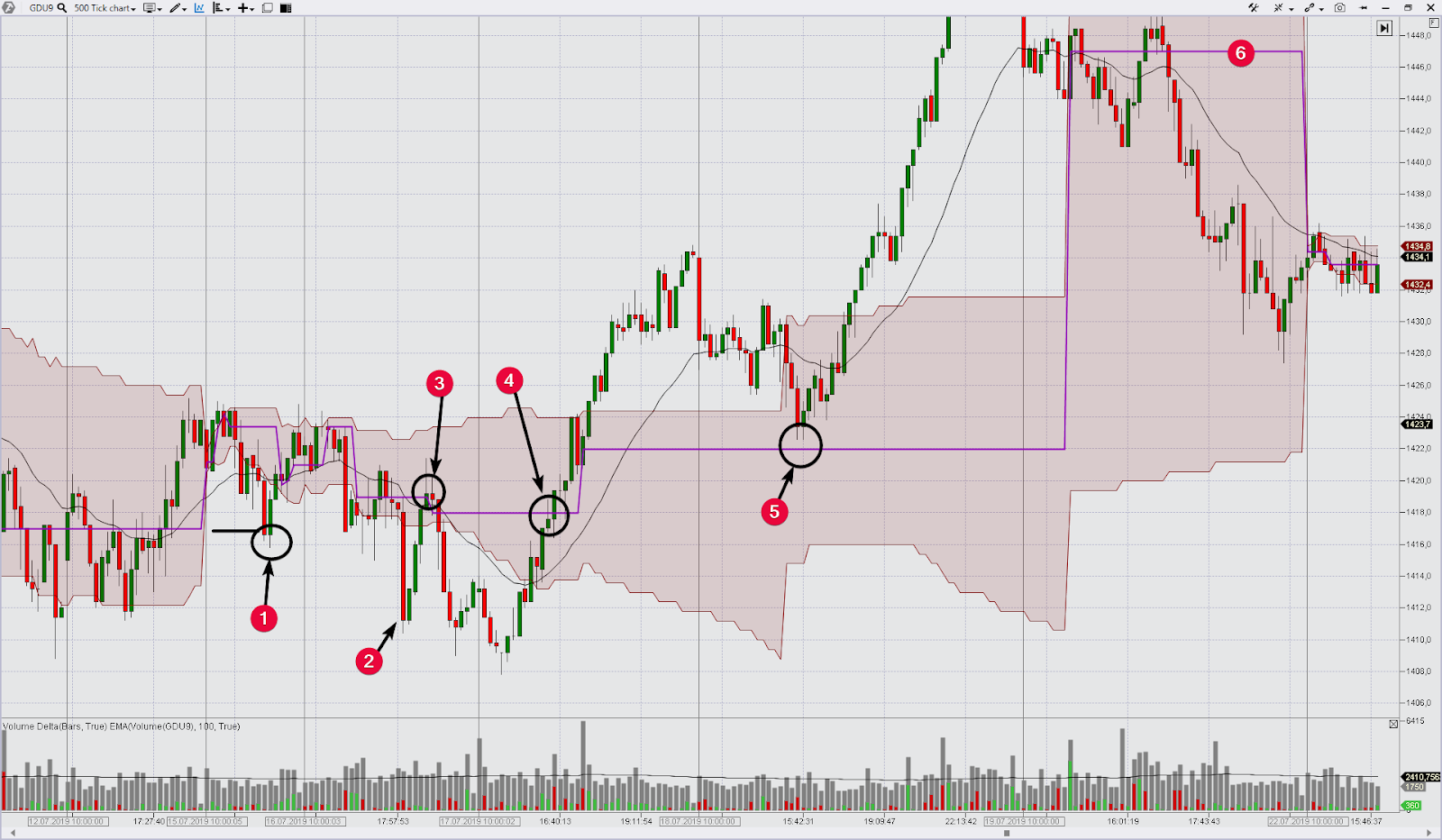

Example of using the indicator in the 500-tick gold futures chart. The data is from the Moscow Exchange and it covers the middle of July 2019.

- value area (light brown colour);

- POC line (violet colour).

In this example, the indicator resets its values on Monday (period=week in settings). Let’s see what explicit signals for trading by levels were sent by Dynamic Levels during a week (July 15-19, 2019).

- Monday, July 15. Since the week has just started it makes sense to pay attention to the POC of the previous week. So, we get a buy signal 1 – a test of the high volume level which was formed on Thursday-Friday.

- The wide red candle moved the price down on Tuesday and we focus on a sell setup.

- A POC test and entry into a short.

- According to our strategy, this sell setup produced a loss. Wednesday was very successful for bulls and the price of gold increased with confidence. That is why we focus on buys on Thursday after a powerful breakout of the POC from bottom to top. There is an important moment here: if the price confidently breaks the POC line, it is a sign of a trend change and you should behave respectively.

- To be accurate, there was no POC test at that moment actually, since the candle lows didn’t touch the violet line. But if we allow ourselves several ticks of freedom for entering into longs (it is justified after a powerful growth the day before), a small deviation from the rules would bring a big profit.

- Friday didn’t produce clear setups. It just formed a level for selling in the future.

Thus far, we considered quiet trading – 1 trade a day on average. However, ATAS has powerful instruments for working with such ultra-fast periods as 1 minute or 15 seconds.

Can scalpers and short-term intraday traders use Dynamic Levels for trading by levels?

Yes. One can use Dynamic Levels as a trend indicator and open only:- shorts, if the price is traded below the Dynamic POC;

- longs, if the price is traded below the Dynamic POC.

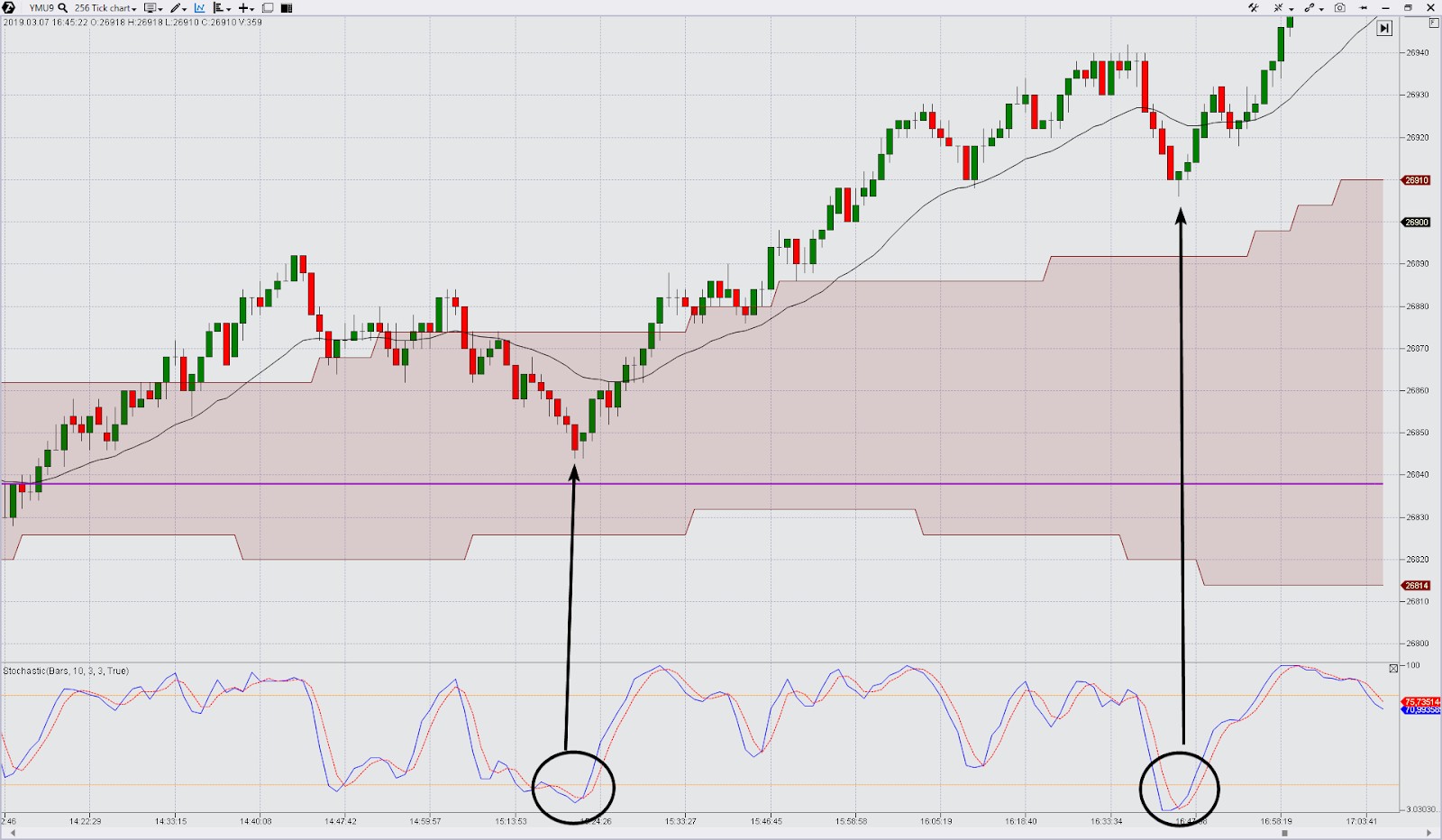

Example in the E-mini Dow index futures (YMU9) chart.

The price is below POC, so we trade shorts only. We use a simple stochastics as a signal.

The price is above the POC level, so we trade longs only. You can use another signal indicator instead of the stochastics – ATAS has a wide range of them.

And we will speak about one more indicator, which works with volume levels – Maximum Levels.

Trading by levels with the Maximum Levels indicator

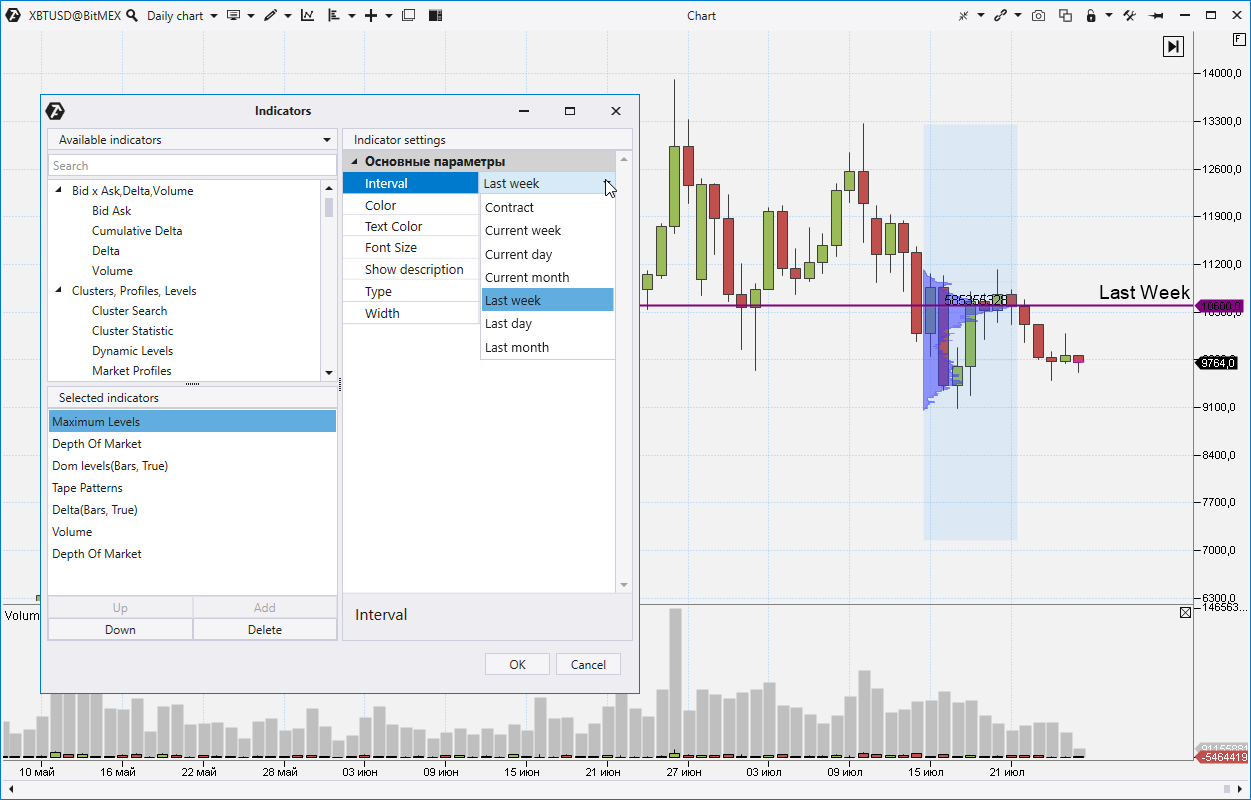

The Maximum Levels indicator is, in fact, a light version of the Market Profiles and shows only a few of important POCs.

If you do not need all the details and nuances of working with profiles but need a light and simple instrument, try Maximum Levels. This indicator looks for the level, at which the maximum volume for the current/previous day/week/month was traded and draws it in the chart as a simple line. Several indicators could be drawn in the chart.

For example, we drew the market profile for the previous week and added the Maximum Levels indicator with the Last Week setting in the chart of XBTUSD cryptocurrency from BitMEX (how to make money on cryptocurrencies). As you can see, a splash on the profile coincides with the Last Week level.

- we trade shorts only;

- pay attention to the Last Week level test as a setup for entering into sells;

- in the event of a bottom to top breakout of the Last Week level, this level becomes the support and implicates a change to the ascending trend.

Trading by levels with a maximum volume

Putting it all together, we will show 2 setups for trading by levels – entry into sells and buys. The logic is universal and may be used in any market with any period.Example 1. Selling an oil futures

- The balance area. It often forms a triangle since the demand and supply balance each other and fluctuations subside. We take the profile drawing tool, mark this balance area and get POC = 63.83. And the value area low-high is 63.71-63.92.

- The descending downward fluctuation reflects the pressure of sellers. The balance area is broken downward on a splash of the negative delta. It means that the current character of the market is bearish.

- A POC test. Our attention is highest when the price comes back to the previous value. We can see the pressure of buyers (green clusters) but the price doesn’t grow. Most probably, a major player meets all buys and accumulates his short position. A splash of the volume with the positive delta points to the culmination of buys.

- The delta changes. The price action changes. Trading goes on below the previous 5 bars. This is a sign of downward reversal and a signal for opening a short in harmony with the bearish character of the market. A stop is posted behind the value area high at 63.92. Practically for the next 15 minutes the position made a profit of 20 ticks.

Note that there was no touching of the previous balance POC level actually, but the delta change and cluster analysis gave us confidence for opening sells.

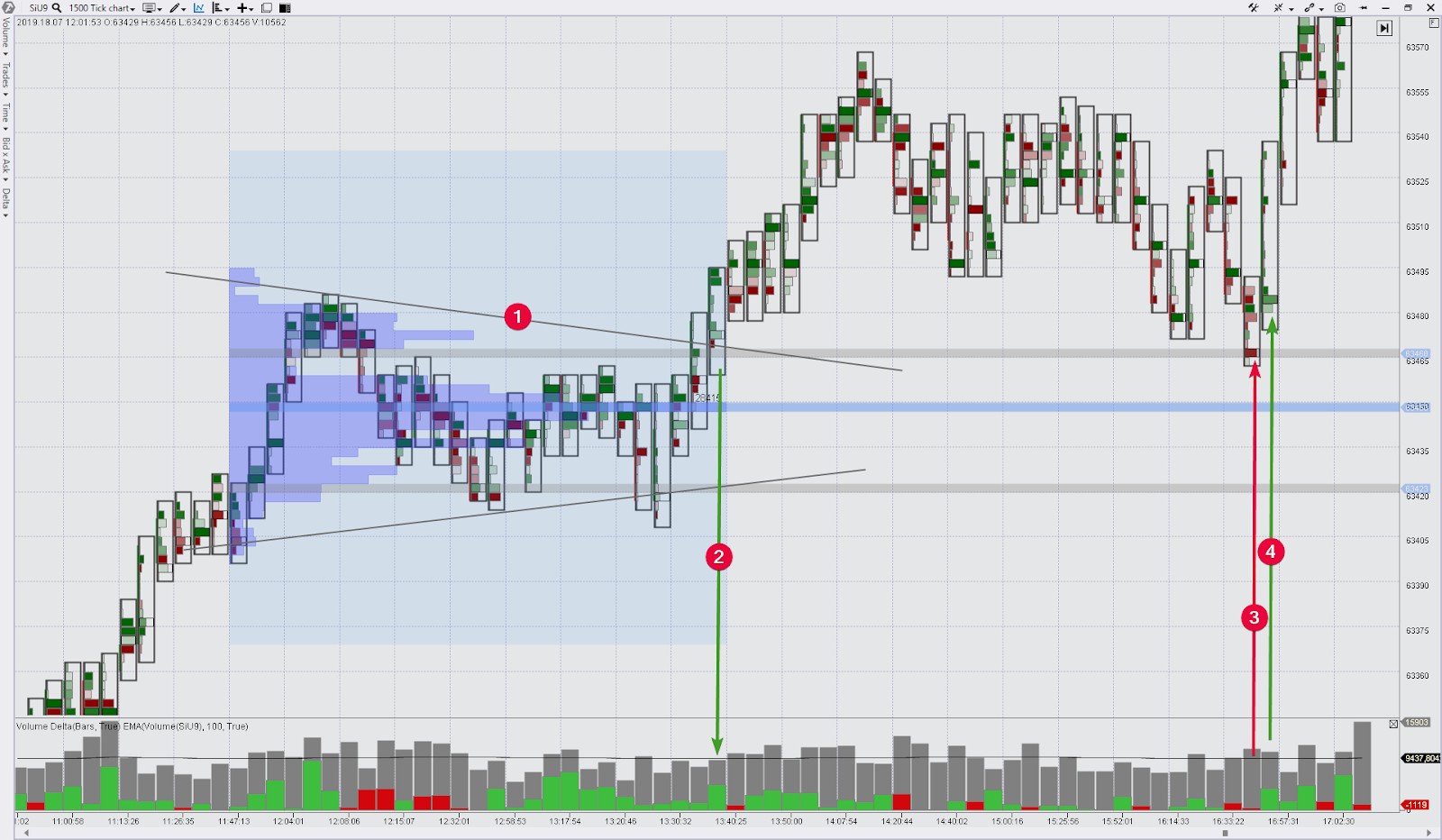

Example 2. Buying a RUB futures

- The balance area is in the form of a triangle. We get POC = 63,450 with the help of the profile instrument. And the value area low-high is 63,423-63,468. A small downward thrust at about 13:25 means a trap for bears and confirms the genuineness of the future upward breakout.

- The ascending fluctuation reflects the pressure of buyers. The balance area breaks up on the positive delta splash. It means that the current market character is bullish.

- A POC test. Our attention is highest when the price comes back to the previous value. We can see a splash of sells (red cluster at the candle low). Most probably, this is either an iceberg (read setup No. 2) or kick out of the stops of buyers who entered into longs at the triangle breakout.

- A delta change. It is a sign of an upward reversal and a signal for opening a long in harmony with the bullish character of the market. A stop is posted behind the value area low of 63,423. The position produced a good profit practically for the next 5 minutes.

Note that there were no touching of the previous balance POC level actually. Those who were waiting for this moment experienced negative emotions after seeing how the price grows. However, the delta change and cluster analysis in ATAS provided us with a way not to miss a profitable opportunity.

Summary

It is easy to open a trade. Anyone who can press a button can do it. It is much more difficult to learn at what price to open/close a trade. That is why, the chart analysis with the aim to find entry/exit levels is pretty much the most responsible task in the market. ATAS and its indicators, such as Market Profile, Dynamic Levels and others, will help you to cope with it.There is no such an indicator which would produce 100% of accuracy and this kind of magic is just impossible. There could be ‘undershots’ or ‘overshots’. The most important thing is to hold chances in your favour and maintain discipline.

- Pay more attention to those levels where maximum volumes took place;

- analyze how the price reacts to them;

- keep trading by a trend;

- and protect your capital.

The rules of trading by levels are clear. And we try to show how ATAS can add to the increase of the level of your results in trading on the exchange. You saw in this article how ATAS helps you to:

- find ranges where the market is balanced (a bell-shaped profile);

- assess the balance breakout;

- give instructions for entering into a trade. A delta change on a high volume is a more evident, actual and clear signal for opening a position. As compared to it, posting a buy limit at the old POC level has its disadvantages.

Did you like this article? Press the like button! Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.