Earlier, we published articles about indicators: Big Trades, Speed of Tape, Cluster Search, CCI, RSI, MACD, Imbalances and Fibonacci Levels. Articles about trading strategies: How to trade by VSA, Top 5 strategies of trading by volume, Forex strategies against ATAS instruments, Strategies for scalping and Strategies of trading along the trend and against the trend.

We also wrote about discipline in trading, risk management, trading psychology, what cluster analysis is, what bid and ask are and how to read the Footprint.

However, we missed such an important topic as trading on news.

Indeed, news has a special impact on financial markets. President Trump tweets deserve a special notice.

We will fill the gap in this article and will:

- tell you how to get ready for the news publication;

- give you 4 recommendations for trading on news;

- study the connection between news and price movement;

- assess advantages and disadvantages;

- discuss strategies of trading on news;

- provide illustrative examples;

- remind you about safety measures.

We tried to make this material useful both for beginner and experienced traders.

Why financial news releases are important

We will not ‘waffle on’ the importance of fundamental analysis and macroeconomic processes. Instead, we will present you one practical storyline.

A landmark event took place at the beginning of the second half of July 2020. Leaders of the EU countries gathered in Brussels in order to adopt an action plan for supporting the European economy under conditions of the coronavirus pandemic.

- Rumors surfaced on July 20 that EU officials nearly reached an agreement after several days and nights of heated discussions.

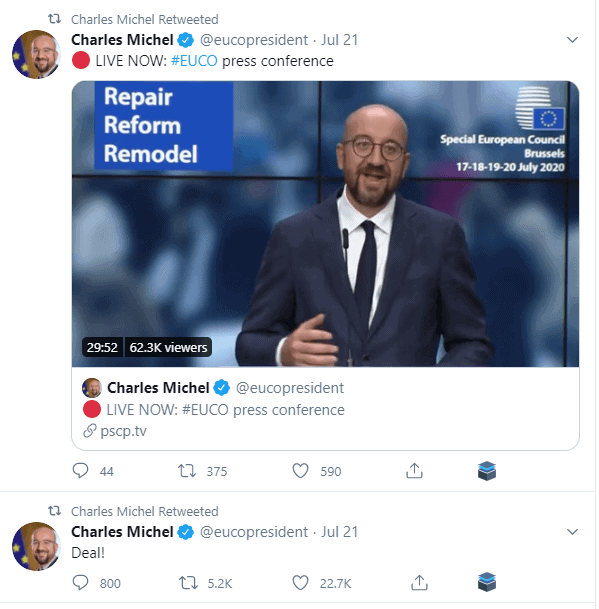

- The rumors were confirmed early in the morning on July 21. The European Council Head Charles Michel published a tweet, from which it was clear that the EU leaders reached a consensus. As it turned out later at a press conference, they adopted the largest package of financial assistance in history in the amount of around EUR 2 trillion.

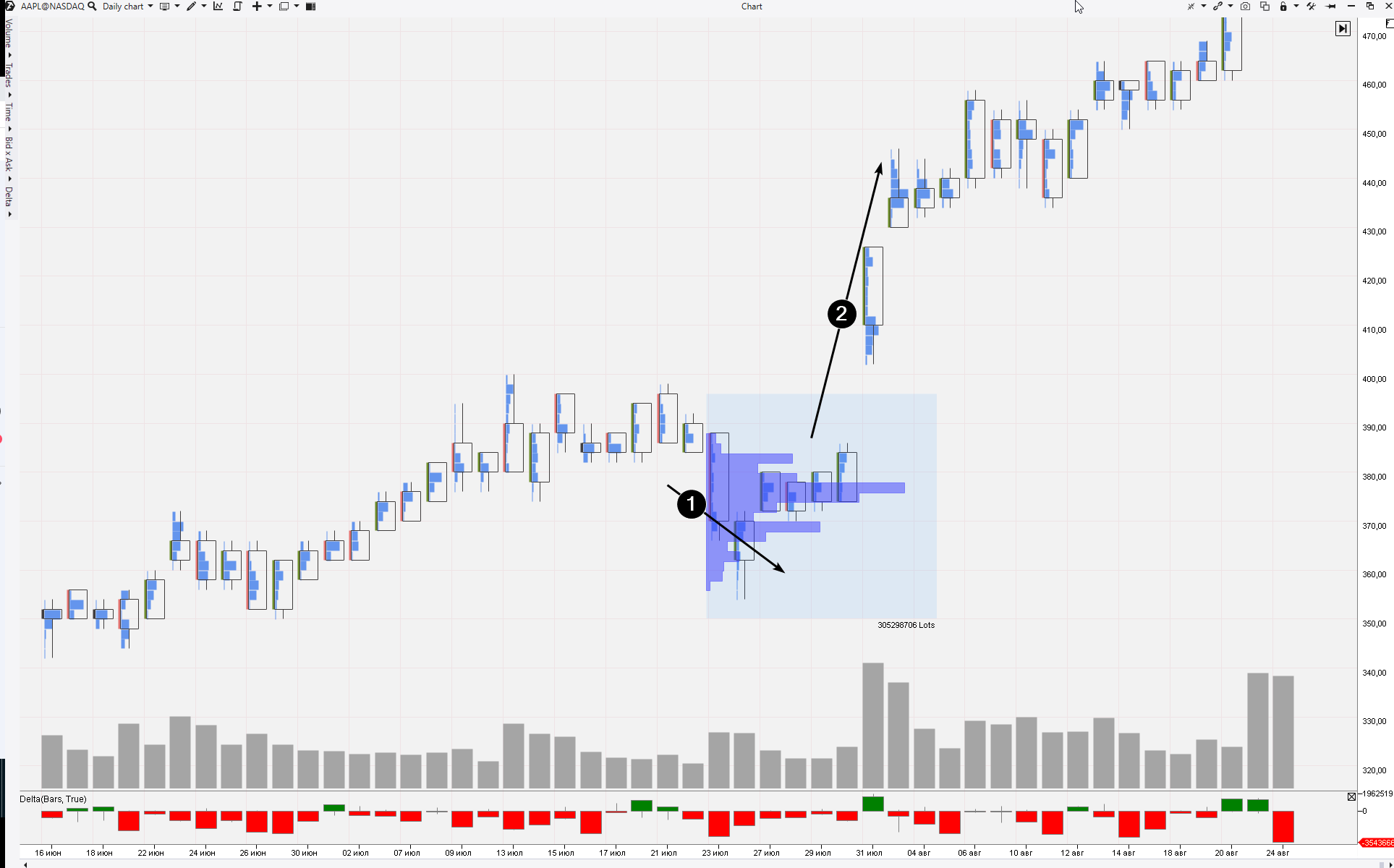

It goes without saying that such a global decision couldn’t pass without a trace for EUR futures. As we can see in the chart below, the eurocurrency quotations rocketed after the decision was made (2).

It’s interesting that the price formed a bullish breakout the day before (1). Most likely, professionals took advantage of insider information in order to enter the very beginning of the trend, which developed during several subsequent weeks and which is still of relevance at the moment of writing this article.

You should admit that traders cannot ignore such influence factors as economic and political news releases and speeches of high-ranking officials.

How to take news into account in trading?

Globally, there are 3 approaches:

- To trade only during an important news release. Let’s assume that a trader develops a plan for the next week on the weekend and notes down the time of an important news release. Then, at the proper time on a working day, he turns on his terminal, assesses the current situation and acts according to the plan in order to: a) open a position on the basis of the report data, or b) get benefit from volatility, which increases at the time of the release.

- Completely cut out trading during a news release. For example, a trader closes his positions (or reduces them) before a news release. Or he doesn’t open new positions XX minutes before the release. The goal is to preserve the capital from wide ‘news-related’ price movements.

- Adapt your trading style to news releases. A trader can act differently in this case. As a variant, he can:

- expand stops to avoid their activation;

- change the time-frame and apply a faster period;

- decrease indicator sensitivity;

- be extremely attentive.

There is the fourth approach – to exclude news. Actually, such an approach could be applied as an exception if a trader trades in quiet markets (when ‘America is closed’). Or if he is completely focused on the cluster analysis patterns and the stable deposit growth confirms that it is better not to be distracted by ‘the fundamental’.

One more opinion speaks in favour of the fourth approach. Many traders, including professional ones, believe that the news impact is already taken into account before its release. In other words, professional traders, insiders and market makers are already prepared for news-related events and use them as manipulations with the public.

Nevertheless, knowledge of the news-related background would help to better understand what happens in the market, what the emotional state of its participants is and why the price moves as much as that. Example – the oil price crash in spring 2020.

Advantages and disadvantages of trading on news

Let’s assume that you decided to trade during an important economic data publication. What are the pros and cons in this case?Advantages of trading during the news release:

- There’s less time for trading and more time for other things. You can plan your day, since the news release is scheduled by the economic calendar.

- There’re faster and wider movements and higher profit potential.

Disadvantages could be described briefly – high risks. Namely:

- frequent activation of stop losses (what stop losses are);

- expanding spreads;

- trade execution by your broker takes more time.

One more con should be underlined separately – it is necessary to know and understand specific features of fundamental analysis and macroeconomic and political processes. Which is quite difficult.

Trading on news. 4 recommendations

The list below is not sorted by the degree of importance. Each of the recommendations has an unquestionable significance.Recommendation 1. Plan your trading with consideration of the economic calendar

Fortunately for traders, release of the majority of news that has some impact on the currency quotations is clearly planned in time and specified in the calendar.

There are many economic calendars online, which help to get prepared for a starting trading session. Forexfactory, Investing, MQL5, etc. Most probably, there is an economic calendar on the web-site of your broker. You can find more variants in Google. Choose whatever you like.

Calendar advantages. They allow:

- learning the exact time of the news release. An important moment – do not make a mess of time zones;

- assessing the news significance. The more significant the news, the higher the probability of a strong movement in the sensitive currency market is. Some of the most significant news are: Non Farm Payroll, GDP, Central Bank Rates, Fed Chair speeches and others. Usually, the calendars mark the degree of significance of every piece of news by the scale from 1 (less significant) to 3 (more significant). Consequently, the more significant the news, the more attention a trader should pay to the market during the moments of this news release;

- assessing the news impact on a specific market. For example, news-related data from Japan would have the biggest impact on 6J futures, while the oil futures will not notice them at all (which is quite probable);

- looking into the past. Good calendars provide a possibility to learn the data about previous news releases.

Calendar disadvantages:

- economic calendars are placed separately from trading terminals, since they are independent products. That is why, there is some risk here to forget about the calendar data and miss some news. It is also inconvenient to relate the price movements in the chart with the calendar, since they are in different windows;

- popular economic calendars do not contain all necessary and comprehensive information. For example, if you trade the Russian Surgutneft company stock, the majority of calendars would not remind you about the date of dividend payment. That is why, you should collect news announcements with consideration of those markets, which you trade – for example, stock market calendars. Study the price reaction to the news release and compare analyst versions in order to ‘dig in the direction of the truth’.

Trading on news. Recommendation 2. Take additional safety measures

Let’s assume that you formed your strategy. It brought profit by the results of testing. Wonderful. You started to work by it. And at some moment significant news is approaching. What to do?

Let’s reason upon it. The minutes of the economic news release are short periods when the market moves outside the boundaries of its standard behaviour, which could be observed in the annual perspective. The price movements become more aggressive, spreads (what a spread is) expand and the chart behaves a little bit (or too much) unusually.

That is why, it would be logical to adapt the strategy parameters for the period, when the market would, at least slightly, ‘digest’ the influence factor of the just published news. These are additional safety measures, which you should take during publications.

Specific steps you should make:

- expand your stop losses a little bit;

- do the same with takes;

- if your strategy sends you a signal to enter the market soon after the news release – enter with a smaller than usual volume. For example, 50% of a standard trade;

- select a more sensitive time-frame. By the way, ATAS has, apart from standard time frames, more than 10 nonstandard frame types.

Recommendation 3. Study the news

There are many pieces of news, all of them are different and every piece of news influences the price differently.

If you are still a beginner trader, you have no experience of trading on some specific news and you hardly know what should be expected from its next release.

Let’s assume that the Great Britain GDP (Gross Domestic Product) publication is approaching. Open the calendar and find out what it means, what the previous GDP publications were and how the difference between the forecast and actual value influences the market.

Let’s see it through the Forexfactory calendar example:

- The calendar shows when exactly the GDP news publication would be. The red colour warns that this event would exert a serious influence on the English currency exchange rate.

- It is a forecasted value, prepared by analysts and economists.

- Click here and you will get information about the news.

- Specifications state who publishes the news, what it means and how it influences the currency exchange rate. For example, if the actual GDP value is higher than the forecasted -0.1%, this should increase the pound exchange rate.

- These are historic data. As you can see, GDP is published once a month and forecasts by no means always coincide with actual values.

Open the chart with the historic data. Look how 6B futures reacted during previous GDP publications. You will be better prepared for the forthcoming event.

Recommendation 4. Sell the rumours, buy the facts

Publication of news-related events is often connected with the mass media attention and activity of outstanding market experts and analysts. That is why, if you visit web-sites about trading, most probably, you will be sensitive to the header influence. This distorts your own opinion about the market.

Try to focus on the price and important details in the cluster charts. These are facts. Namely the price difference forms the result of your activity rather than what is discussed in the news and comments on popular trading web-sites.

How to build trading on news

Well, we considered introductory information about trading, so, let’s discuss a more practical subject – how to trade during a news release.

Usually, the following logical plan is promoted in the trading literature:

- You analyse the approaching news, say, unemployment data. You look at the previous value and at the forecasted value.

- You try to learn as soon as possible about the new value at the moment of the news release and quickly buy the asset if the value is better than expected and sell if the value is worse.

However, this plan has 3 significant shortcomings:

- First, a speed play. You should not only learn about the news faster than the majority, but also react faster. And (let’s be honest) you hardly have a competitive advantage to do it.

- Second, a worse order execution. This plan envisages posting orders as fast as possible after the report publication. However, namely at this point you will face, with a high degree of probability, the execution delay and slippage, which are quite capable of influencing the final result.

- Third, there is no guarantee that the logic will work. Let’s assume good news was released and you opened a long position fast, but … the price doesn’t grow (although it should). The later news will say something like ‘traders coldly reacted to the good news because they had expected more optimistic news’.

By no means always strong price movements could be explained from the point of view of economic news. While it is easy to understand and accept the market fall against the background of the coronavirus pandemic, in some cases fundamental motives could be somewhat incredible.

There was very little information in the news about the reasons for the crash during the first days after it. Experts proposed different versions.

- Fat-finger theory: it was discussed immediately after the crash that the event could have been caused by a too big unintended ‘sell order’ on Procter & Gamble stock, which made robots intensively sell the assets. An assumption was made that the trader pressed more zeros than he planned. However, this theory turned out to be false since it was later established that the fall of the Procter & Gamble stock took place after a major fall of the E-Mini S&P 500 futures contracts. Also, the fat-finger trading is refuted by the fact that the existing safety measures of the CME Group and ICE prevent such an error.

- Influence of HFT (High-Frequency Trading) algorithms. Regulatory bodies identified that HFT robots posted sell orders aggressively in order to liquidate their positions in the event of the fall. However, the CME Group officials stated that the investigation didn’t detect any evidence that HFT played the main role and, in fact, they arrived at the conclusion that automatic trading supported the market stability during the Flash Crash.

- Trades of major players. Regulatory bodies stated that the chain of events, which caused the Flash Crash, was initiated by a major player in the E-Mini S&P 500 market, but they didn’t announce the name of this player. Earlier, some investigators assumed that a big options trade on the S&P 500 index, which was carried out by the Universa Investments hedge fund shortly before the event, could be among the main reasons of the crash. There were also opinions that the crash could have been provoked by selling 75 thousand E-Mini S&P 500 contracts for the amount of about USD 4 billion, which was done by the Waddell & Reed company.

Whatever it was, nearly five months later, on September 30, 2010, a team of investigators headed by Gregg Berman, the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) published a joint report named ‘Findings Regarding the Market Events of May 6, 2010’ with a description of the sequence of events, which led to the Flash Crash.

The report stated: ‘the market is so fragmented and fragile that only one big trade may cause a sudden spiral turn’.

It was described officially how a major hedge fund, while selling an unusually big number of E-Mini S&P 500 contracts, first exhausted all available buy orders and then HFT algorithms enhanced the effect from the hedge fund sells and promoted a sharp price fall on that day.

It turns out that the strongest movement had no news-related background but was completely formed by actions of the market participants (major players and HFT robots) and had no relation to whatever news releases.

Consequently, we can formulate 2 rules:

- Rule 1. Special trades in the market are a driver of significant movements. Traders need to detect them (ATAS indicators will help you in it) in order to focus on the reasons rather than consequences;

- Rule 2. When you develop a strategy (including the one for trading on news) – see Rule 1.

The ‘false move’ strategy of trading on news

Let’s assume that insiders and professional traders have trustworthy information about what the news release would be. How should they get ready? What are their motives and intentions?

- If the news is negative – to take on preliminarily a short position at the maximally high prices.

- If the news is positive – to take on preliminarily a long position at the minimum prices available.

Namely that is why you may often (more than in 50% cases) observe the ‘false move’ (the move, which is opposite to the further news-related impulse) before the news release.

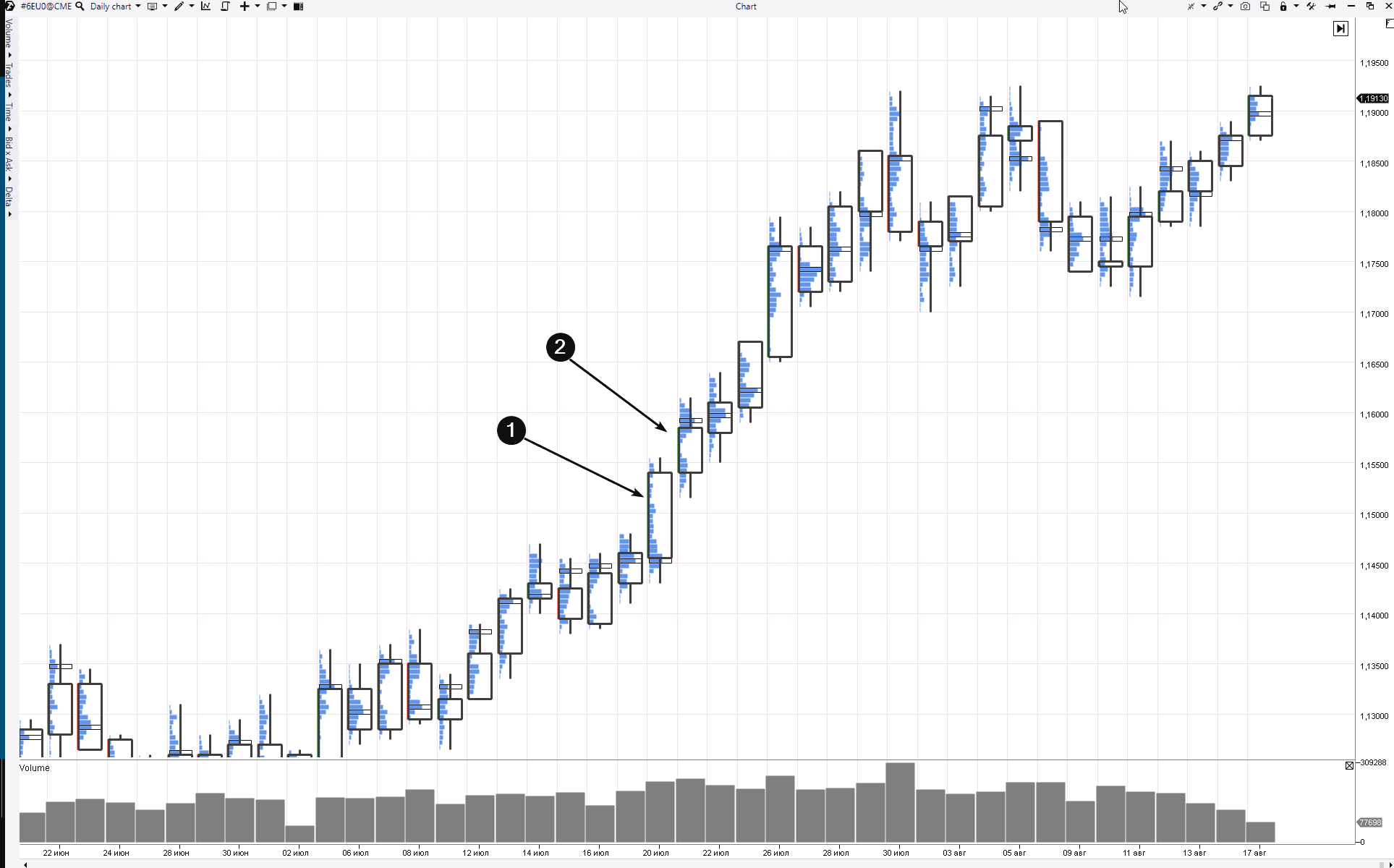

Example from the EUR futures market. Hourly period.

- False move up in the Asian session on August 21, 2020. Note the bulge formation on the Market Profile.

- A shoot down, caused by a series of negative news for euro (Purchasing Managers’ Index in the manufacturing sphere of France and Germany).

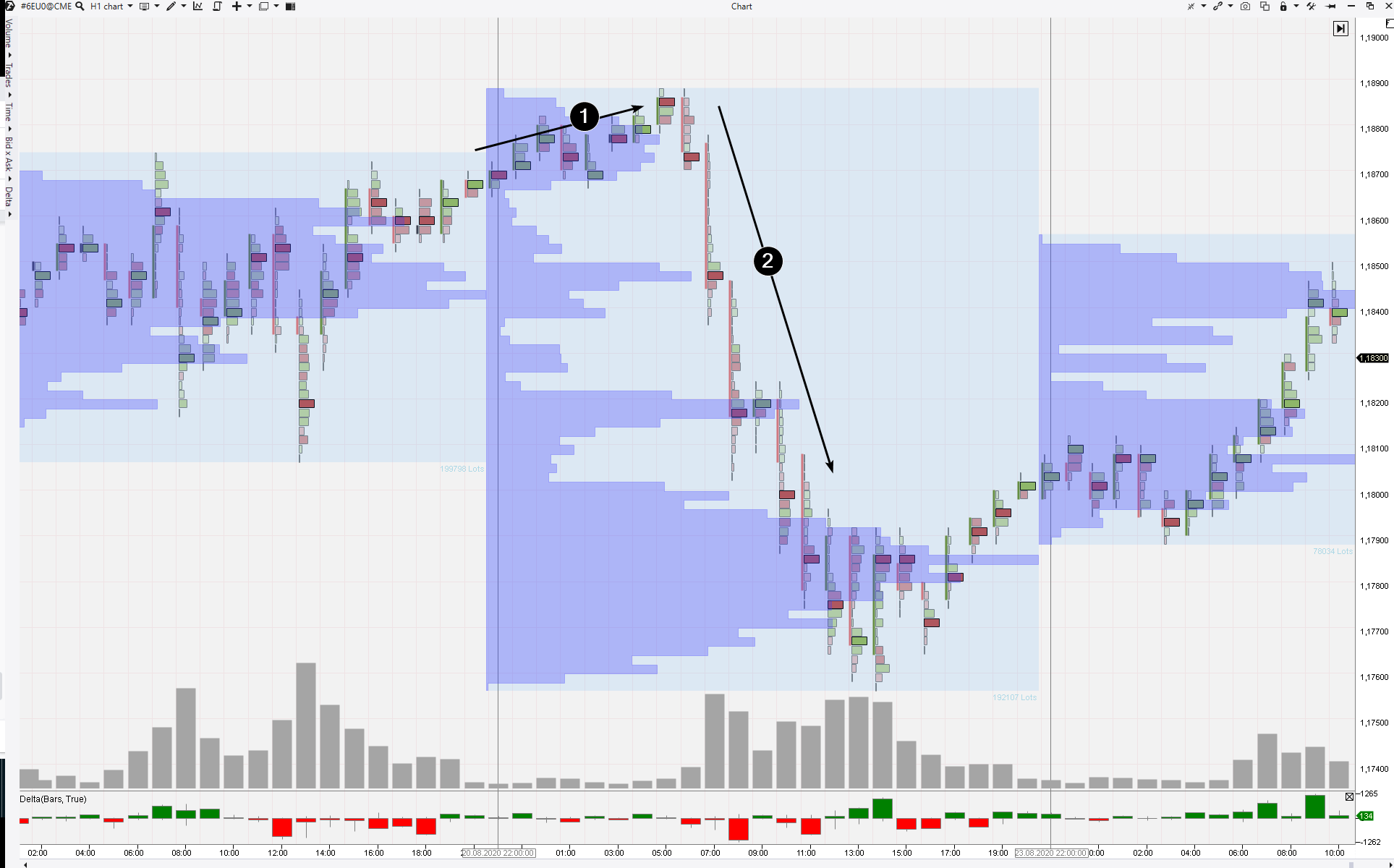

Example from the WTI oil futures market. Hourly period.

- False move up on August 5, 2020. Note the bulge formation on the Market Profile.

- A shoot down, caused by the news about the crude oil reserves.

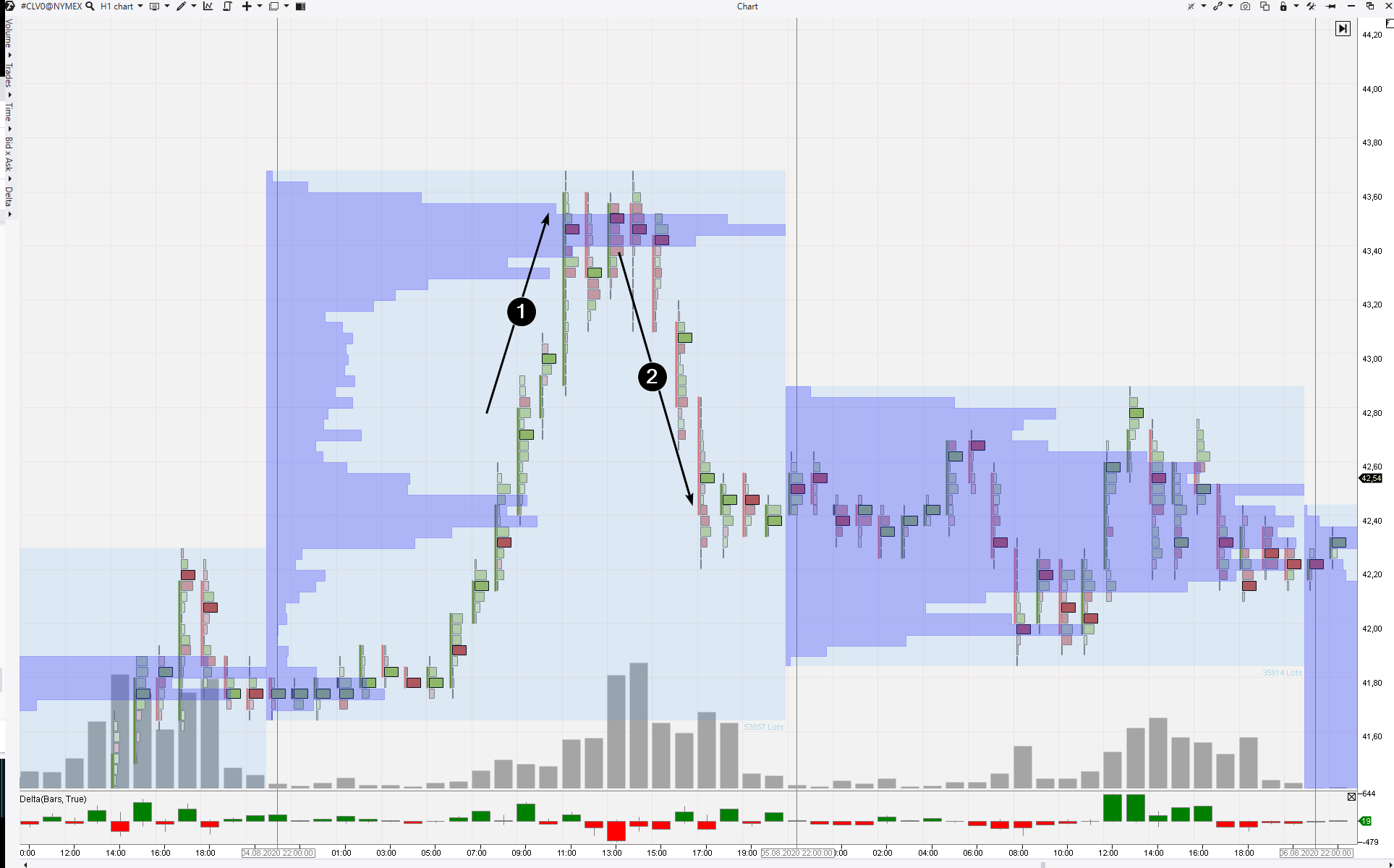

Example from the AAPL stock market. Daily period.

- False move down, which started on July 23, 2020. Note the bulge formation on the Market Profile.

- A shoot up, caused by good news about the Apple company revenues (20% better than expected despite the pandemic).

You might be wary of the false move subject. Say, we deliberately selected such charts, which confirm the idea rather than refute it.

You can check it by yourself. Download ATAS, track the price behaviour on the eve of the news release on the Footprint. You will find so many false moves that it hardly could be an accidental coincidence.

Search of the strategies for trading on news

While searching for strategies for trading on news (in Forex or with futures) you may get acquainted with the idea about two pending orders. The point is to post (before the significant news release) two orders ‘on breakout’ – a buy stop above the current price and sell stop below it. The idea in this case is that the news-related impulse would activate the right order and make the position profitable.We believe that this approach is similar to guessing. Although the idea might work, there are much more scenarios than just ‘strictly up’ and ‘strictly down’. That is why a more rational solution would be to develop a strategy on the basis of cluster analysis and to focus on major player actions – just what we write so much about in our ATAS blog.

The rational strategy would work both on news and without any connection to news. Perhaps, the only thing you should avoid is the strategy of trading in a flat.

Example. A news release is accompanied with a splash of volatility. This might be used for the so-called stop loss knockout. We already wrote about this phenomenon and its nature in the following articles:

That is why you may use this strategy at the moments of news releases. Conduct an assessment where ‘stop losses may hide’. Monitor how the price ‘tries to reach’ these areas and get confirmation from indicators. Open positions only when the majority is forced to close them.

Summary

It’s quite possible that trading on news personally fits your way of thinking and character. In the event you:

- prefer to act fast;

- inclined to take risks;

- are stress-resistant and become despondent when you need to wait;

- do not have much time for financial markets, …

… than trading during the significant news releases could be namely your style.

But, first of all, train for a while on the demo account. Later, when your results show a stable growth, start trading on the real account with small positions in order to preserve confidence when you start trading on a bigger scale.

Do not be in a hurry to catch every piece of news. Preservation of your capital is the most important thing.