Pros and cons of volume trading

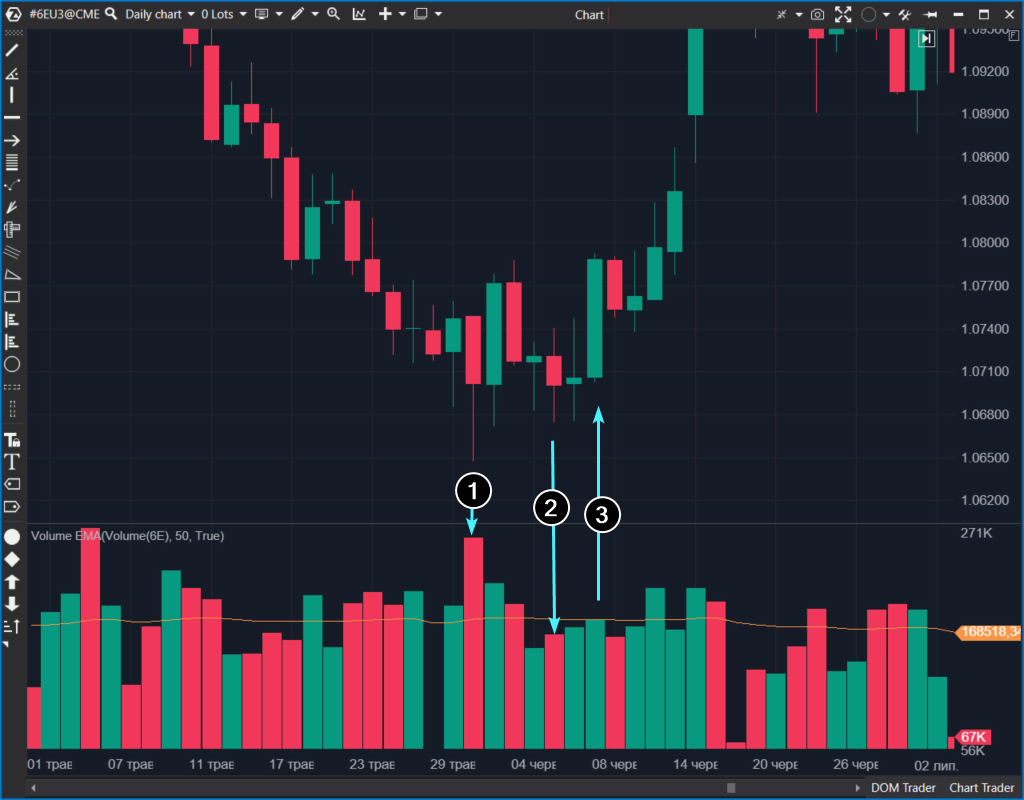

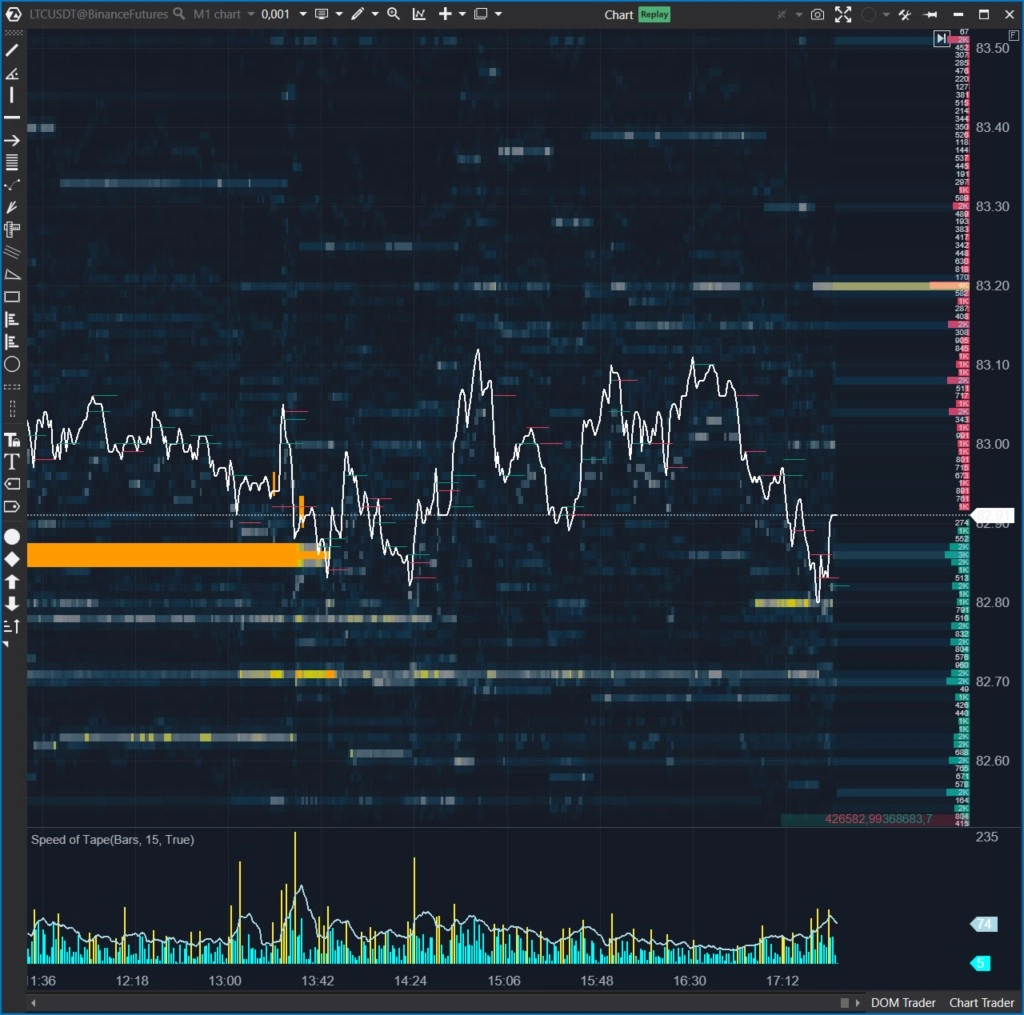

Volume analysis is an important tool in a trader’s arsenal, but it requires a deep understanding of how to interpret volume dynamics in relation to price.

If you are a beginner trader and have not yet tried volume analysis, this article will help you decide whether you should study it (spoiler: definitely yes).